This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

US Inflation Softens – CPI Rises by 2.7%, Core CPI Rises by 2.6%

December 19, 2025

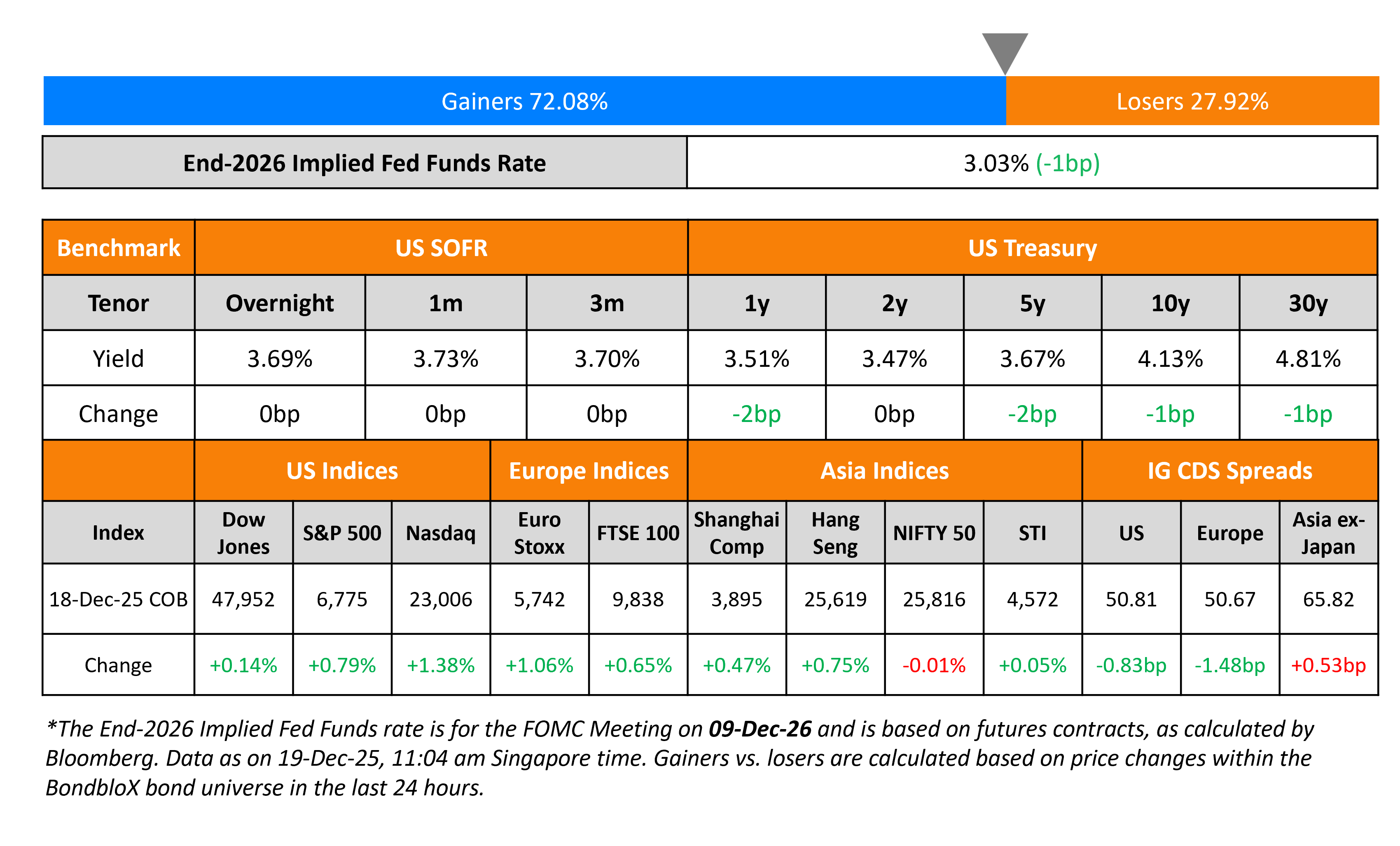

US Treasury yields eased by 1-2bp across the curve. US Headline CPI for November rose by 2.7% YoY, softer than expectations of 3.1%, marking its softest reading in four months. The Core CPI reading rose by 2.6% vs. expectations of 3.0%, marking its lowest reading in nearly four years. Some economists were skeptical of the latest inflation numbers due to certain missing data points amid the government shutdown. The October CPI numbers were not published due to the government shutdown. Separately, initial jobless claims for the previous week came-in at 224k, better than the survyed 225k print and the prior week’s 237k reading.

Looking at US equity markets, the S&P and Nasdaq ended 0.8% and 1.4% higher respectively. US IG CDS spreads tightened by 0.8bp while HY CDS spreads tightened by 4.6bp. European equity indices ended higher too. The iTraxx Main CDS spreads tightened by 1.5bp while the Crossover CDS spreads were 6.4bp tighter. Asian equity markets have opened higher this morning. Asia ex-Japan CDS spreads widened 0.5bp. The BOJ hiked its policy rates by 25bp to 0.75%, a 30-year high. The central bank added that real interest rates were at “significantly low levels” and that they “will continue to raise interest rates” if its economic and price forecasts materialise.

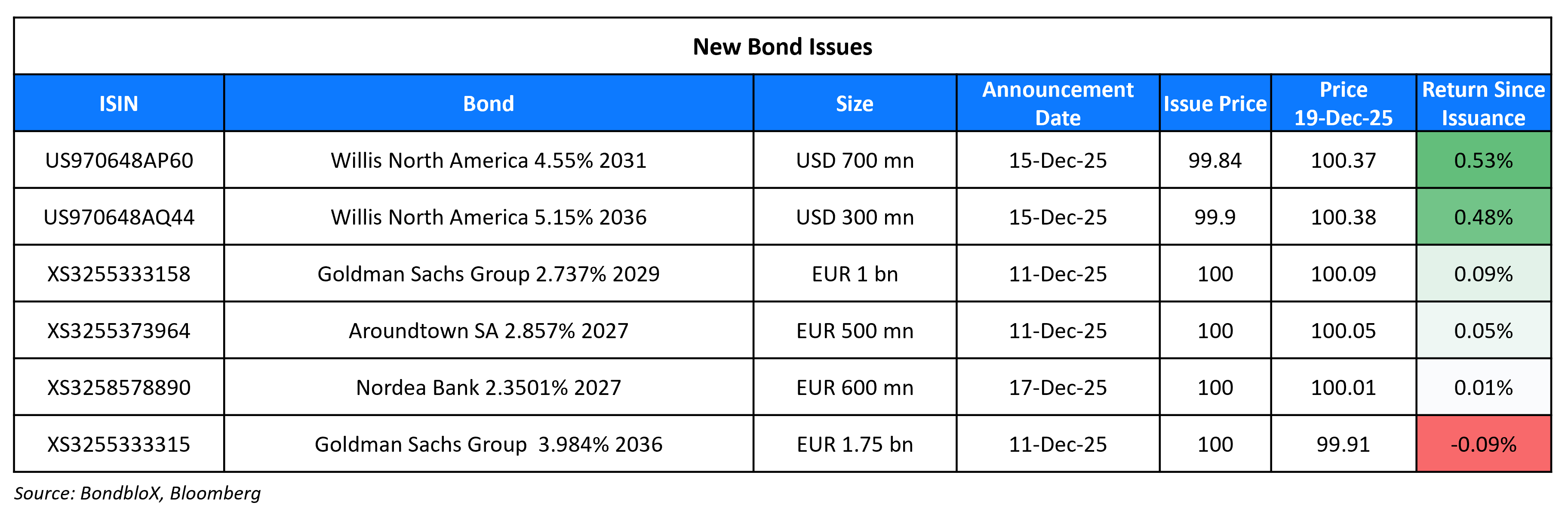

New Bond Issues

Rating Changes

- Moody’s Ratings upgrades MercadoLibre’s ratings to Baa3, stable outlook

- French Car Manufacturer Renault Upgraded To ‘BBB-‘ On Resilient Free Cash Flow Prospects; Outlook Stable

- Fitch Downgrades Vestel to ‘CCC+’

- Fitch Upgrades Pershing Square Holdings, Ltd. to ‘BBB+’; Outlook Stable

- Fitch Upgrades Silknet to ‘BB-‘ on Strong Parental Ties, Outlook Stable

- Fitch Upgrades GE Vernova to ‘BBB+’; Rating Outlook Positive

- Adecoagro S.A. Downgraded To ‘BB-‘ From ‘BB’ On Expectations For Sustained Higher Leverage; Outlook Negative

- Reno De Medici Downgraded To ‘CCC+’ On Weak Cash Generation; Outlook Negative

- Airbus Outlook Revised To Positive On Steady Free Cash Flow Generation; ‘A’ Rating Affirmed

- Moody’s Ratings places Asahi’s Baa1 ratings on review for downgrade upon acquisition announcement of East African business

- Bank of Cyprus Outlook Revised To Positive On Resilient Earnings And Supportive Environment; ‘BBB-/A-3’ Ratings Affirmed

- Italian Utility Giant Enel SpA Outlook Revised To Positive; ‘BBB/A-2’ Ratings Affirmed On European Network Growth

- Jamaica Outlook Revised To Stable From Positive; ‘BB’ Long-Term Rating Affirmed

Term of the Day: CET1 Ratio

Common Equity Tier 1 (CET1) Ratio is a financial ratio applicable to banks to measure its core capital as against its Risk Weighted Assets (RWA). Core Capital (CET1 Capital) includes common equity and stock surplus (share premium), retained earnings, statutory reserves, other disclosed free reserves, capital reserves representing surplus arising out of sale proceeds of assets and balance in income statement at the end of the previous financial year. RWAs are calculated to measure the minimum regulatory capital required to be held by banks to maintain solvency. The calculation methodology is such that the riskier the asset, the higher the RWAs and the greater the amount of regulatory capital required. CET1 capital must be at least 4.5% of RWAs according to Basel III. Contingent Convertible (CoCos) bonds/AT1s commonly have triggers based on CET1 ratios – if the bank’s CET1 ratio falls below a certain threshold, the bonds would convert into equity.

Talking Heads

On Seeing Further EM Gains, Risk of Dollar Rebound – Bob Michele, JPMorgan

“I don’t know that we’re going to match the returns of this year”… opportunity in EM local debt “is still very much there”… “recognize that the momentum has shifted again from de-dollarization to ‘well, it’s still the best place to go’ and not get caught shorting the dollar… There is a path to get to a flat yield curve at 3% or lower”

On ECB Officials Saying Cycle of Rate Cuts Is Most Likely Over

Christine Lagarde, ECB President

“There was unanimous agreement around the table about the fact that all optionalities should be on the table and that we should stick to the meeting-by-meeting approach, to the data dependency”

On UK, German Bonds Underperforming After Hawkish Central Bank Signals

Elias Haddad, Brown Brothers Harriman

“The updated macroeconomic projections reinforce the case that the ECB is in good place to keep rates on hold for some time, and that the next move is a hike”

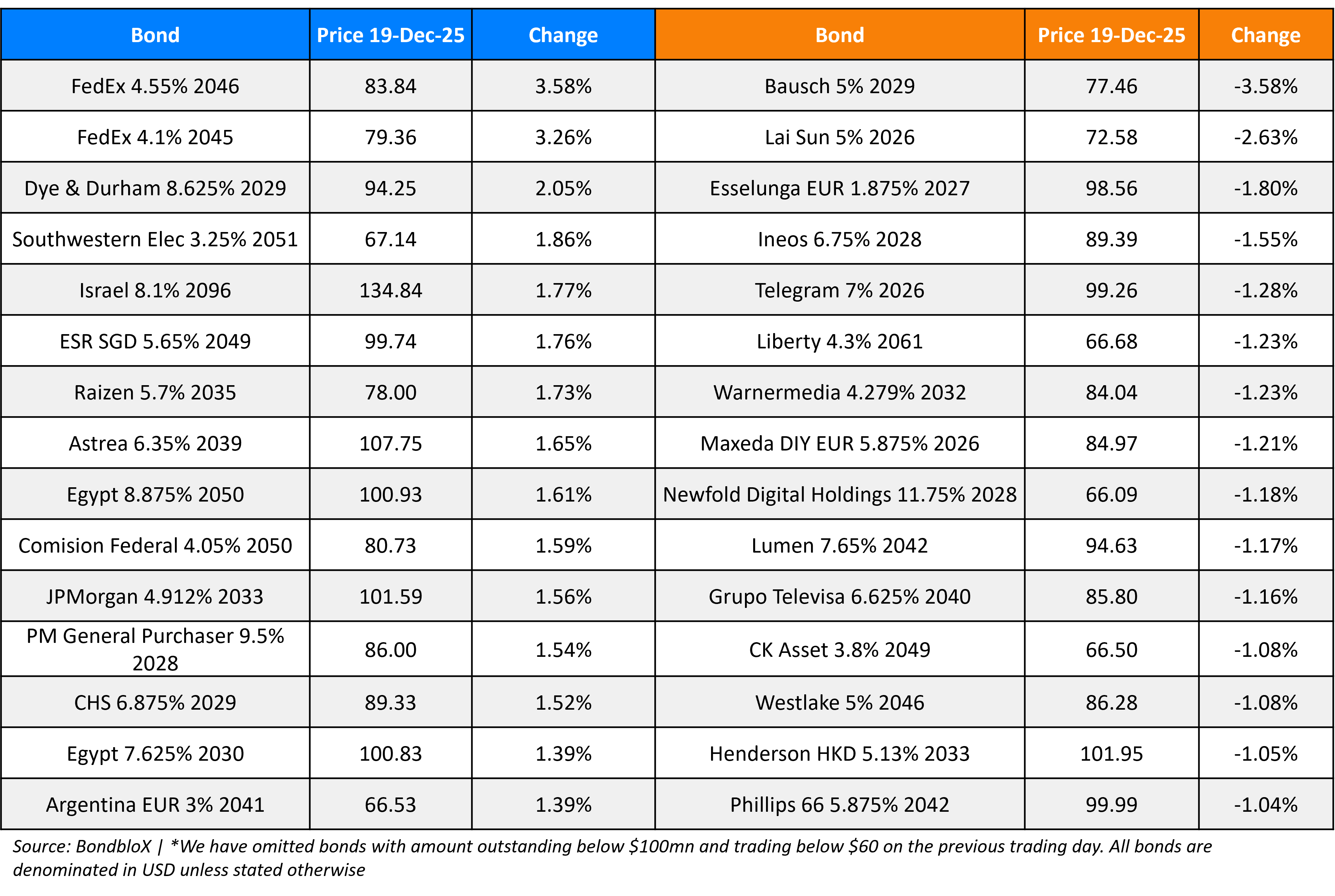

Top Gainers and Losers- 19-Dec-25*

Go back to Latest bond Market News

Related Posts: