This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

US Inflation Slightly Higher Than Expectations

October 11, 2024

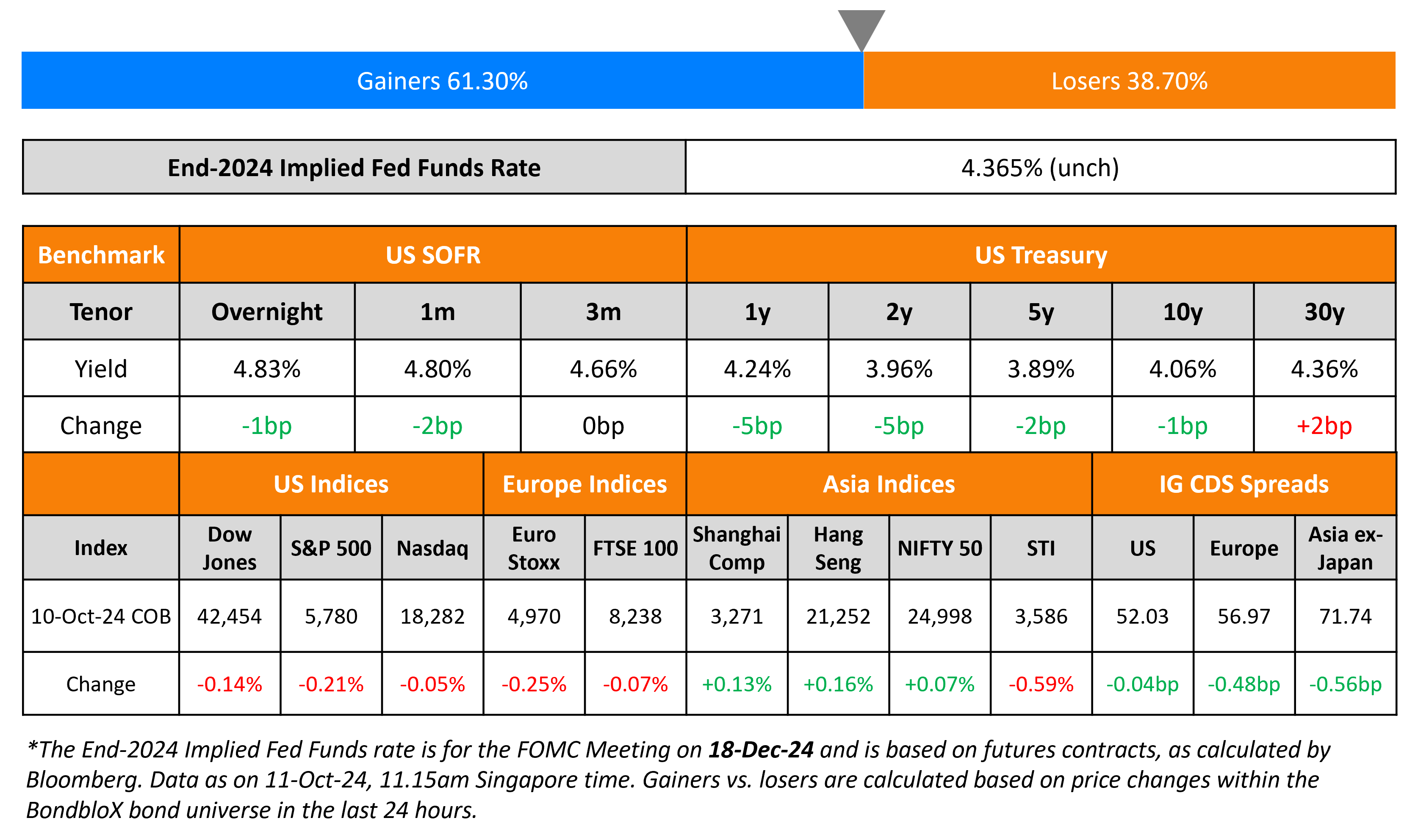

US Treasuries bull steepened, with short-end yields falling by about 5bp and long-term yields remaining largely stable. Key inflation figures for September were released yesterday. US Headline CPI decelerated to 2.4% YoY from the prior 2.5% print, but was higher than expectations of 2.3%. Core CPI came in higher than both initial expectations and the prior reading, at 3.3%. Following this, a few Fed officials offered their views – John Williams, Austan Goolsbee and Thomas Barkin, the Federal Reserve Presidents of New York, Chicago and Richmond respectively, all commented that inflation had continued to head in the right direction. Thus they beleive that the Fed can continue to lower rates. Atlanta Fed’s Bostic added that he might favor a pause at the next FOMC meeting. Separately, the US Treasury saw a solid 30Y auction with a strong indirect acceptance of 80.5% and a bid-to-cover ratio at 2.5x, stronger than the prior auction’s 2.38x. US IG CDS spread were flat while the HY CDS spread widened by 0.8bp. Looking at US equity markets, S&P and Nasdaq both closed lower by 0.2% and 0.1% respectively.

European equities followed suit and closed lower across the board too. In terms of Europe’s CDS spreads, the iTraxx Main and Crossover spreads tightened by 0.5bp and 1.2bp respectively. Asian equities opened mixed this morning. Separately, Bloomberg reports that investors are expecting a probable $283bn stimulus package by China that could be announced on Saturday. This package is likely to be funded by the sale of more sovereign debt and is expected to be targeted towards households, instead of to restimulate real estate investment-led growth.

New Bond Issues

New Bonds Pipeline

- Adani Hybrids Renewables hires for $ 20Y bond

Rating Changes

-

Moody’s Ratings upgrades to Ba2 ratings of ICE and Reventazon; changes outlook to stable

-

Moody’s Ratings affirms Syngenta AG’s Baa3 issuer rating; revises outlook to negative

-

Moody’s Ratings affirms Teva’s Ba2 ratings; revises outlook to positive

-

Fitch Places Zorlu Renewables on Rating Watch Positive

Term of the Day

Zero Coupon Bonds (ZCBs)

As the name suggests, these are bonds that do not pay coupons. Given the lack of coupons, the price changes in the bond due to a change in interest rates (duration) can be sharper than coupon-paying bonds. But the lack of coupon means that there are no reinvestment risks and therefore unless a default occurs, the bondholder will get the stated yield at the time of buying. For example, if a 5Y zero coupon bond that has a yield to maturity of 3% is bought, the investor will get a 3% return if held to maturity since he/she doesn’t have to reinvest any cashflows. Whereas, in a 5Y 3% coupon-paying bond that has a yield to maturity of 3%, the investor must be able to reinvest the coupons at 3% consistently over the 5Y period to get a return of 3% – if interest rates fall, he/she would end up with a lower return since the coupons are reinvested at a lower rate. These bonds are generally issued at a discount to par value and get redeemed at par.

Talking Heads

On Trump’s Bid to Weaken Dollar Would Face Hurdles – Michael Feroli, chief US economist, JPMorgan

“The mainstream of the economics profession has considerable reservations about the effectiveness, or even harmlessness, of unilateral intervention aimed at weakening the dollar… Even so, that’s no reason to rule it out as an option the administration might consider… The elephant in the room is China”

On Big Banks Preparing for Billions More in Bond Issuance After Earnings

Nicholas Elfner, Breckinridge Capital

“It is reasonable to expect bank new issuance post-earnings and pre-election. With tight spreads and the prospect for Fed cuts, we think supply should normalize ..”

Arnold Kakuda, Bloomberg Intelligence

“The lenders may be strategic and issue above these levels to quench the voracious thirst of bond investors for corporate debt”

On Boeing Risking Becoming the Biggest-Ever US ‘Fallen Angel’ If Cut to Junk

Bill Zox, Brandywine Global

“Boeing has worn out its welcome in the investment-grade index… high-yield index would be honored to welcome Boeing and its many coupon step-ups.”

JPMorgan analysts

“This is an idiosyncratic credit situation, should a downgrade occur. No other large fallen angel has ever transitioned at such tight spreads.”

Scott Kimball, Loop Capital Asset Management

“Expect a fair amount of index-related selling as the debt changes hands”

Top Gainers & Losers 11-October-24*

Go back to Latest bond Market News

Related Posts: