This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

US Inflation Comes-in Softer Than Expectations

April 11, 2025

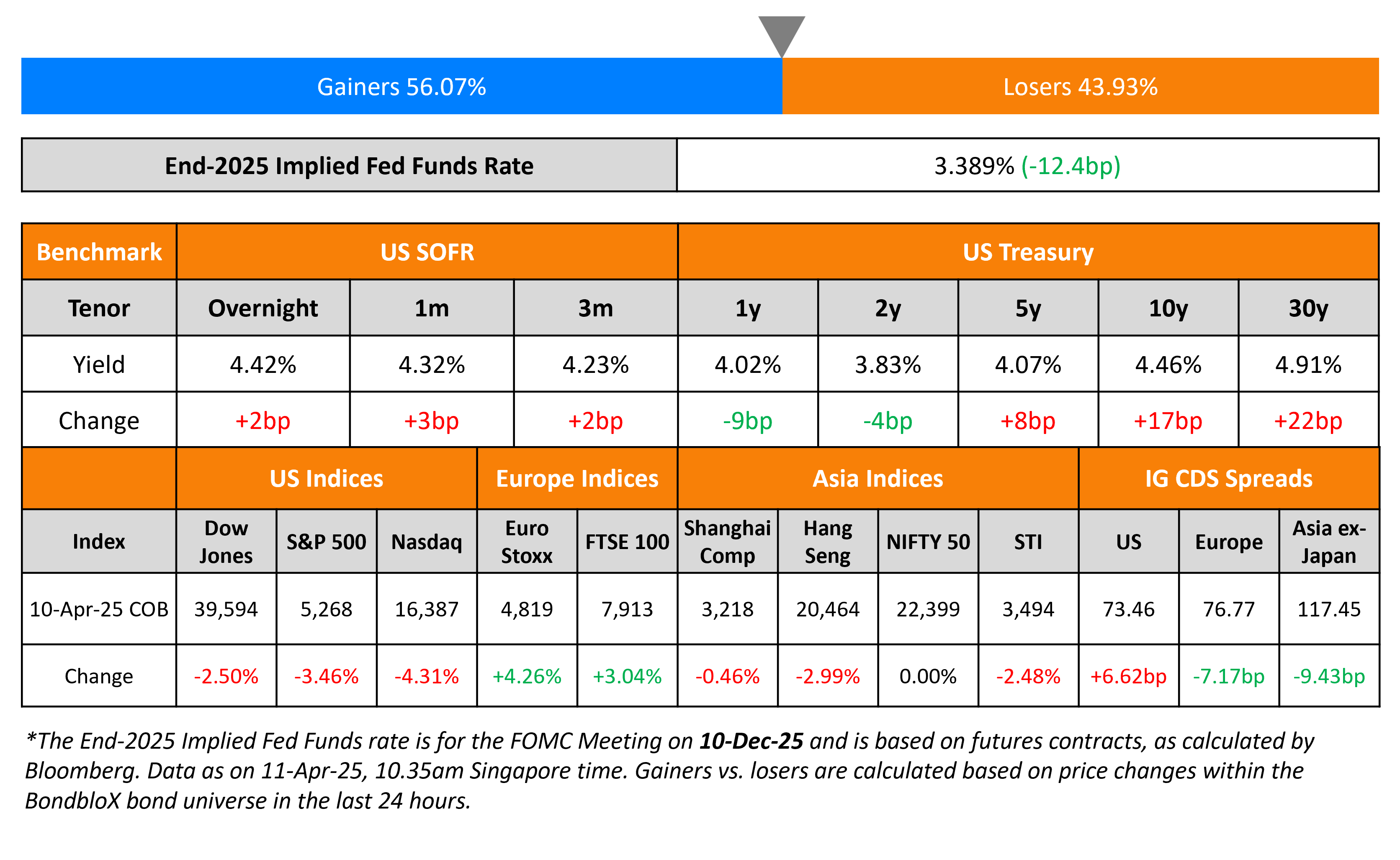

The US Treasury curve saw another volatile session on Thursday, with the 2Y yield easing by 4bp while the 10Y yield shot higher by 17bp. US March CPI rose by 2.4% YoY, softer than expectations of 2.5% and the prior month’s 2.8% print. Similarly, Core CPI rose by 2.8%, also softer than expectations of 3.0% and the prior month’s 3.1% print.

Looking at US equity markets, the S&P and Nasdaq dropped, closing 3.5% and 4.3% lower. Looking at credit markets, US IG and HY CDS spreads widened by 6.6bp and 37bp respectively. European equity markets ended lower. The iTraxx Main and Crossover CDS spreads tightened by 7.2bp and 35bp respectively. Asian equity markets have opened mixed this morning. Asia ex-Japan CDS spreads were tighter by 9.4bp.

New Bond Issues

Rating Changes

-

Moody’s Ratings upgrades Swedbank’s long-term deposit and senior unsecured debt ratings to Aa2; outlook changed to stable from positive

-

Fitch Upgrades Vallourec to ‘BBB-‘; Outlook Stable

-

Moody’s Ratings upgrades Bank Millennium S.A.’s long-term deposit ratings to Baa2, maintains positive outlook

-

Fitch Downgrades Ratings on 38 China Central-Government Owned Corporates and Subsidiaries

-

Caleres Inc. Downgraded To ‘BB-‘ On Elevated Leverage And Weak Operating Performance, Outlook Stable

-

Fitch Revises Volkswagen Financial Services AG’s Outlook to Negative; Affirms IDR at ‘A-‘

-

LG Parent Holdco Inc. Outlook Revised To Negative From Stable On Expected Sales Decline Due To Macroeconomic Uncertainty

Term of the Day: Technical Recession

A technical recession for economic purposes is defined as one where a country witnessed two consecutive quarters of negative GDP growth/decline in GDP. However in reality, it might not necessarily indicate an actual recession and could be influenced by temporary factors. A actual recession may sustain for a considerable period of time and covers a wide range of declines in economic activity.

Talking Heads

On Tariffs Present Stagflationary Shock for Fed – Fed’s Austan Goolsbee

“A tariff is like a negative supply shock. That’s a stagflationary shock, which is to say it makes both sides of the Fed’s dual mandate worse at the same time… the bar for action, in the near term, to me is a little higher”

On investors should cut down exposure to stocks as recession looms – Janus Henderson

“We don’t think this is the environment that clients want to buy the dip quite yet, because there could still be more downside… “We’ve gone to an equity underweight in the portfolios… headed towards a tariff-induced global slowdown right now in the very short term. Europe and China could have potentially more downside than the US… When we’re looking to de-risk… we’re looking at investment grade sovereigns, and less so credit”

On Treasuries Suddenly Trading Like Risky Assets in Warning to Trump

Padhraic Garvey, ING strategist

“Treasuries are not behaving as a safe haven… If we were to slip into recession there is a path there for yields to revert lower. But the here and now is painting Treasuries as a tainted product”

Benson Durham, Piper Sandler

“People are right to kind of worry about this general economic management… not clear to me, at least not yet, that this is an episode where people are particularly penalizing US assets.”

Top Gainers and Losers- 11-April-25*

Go back to Latest bond Market News

Related Posts: