This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

US Government Avoids Shutdown

December 23, 2024

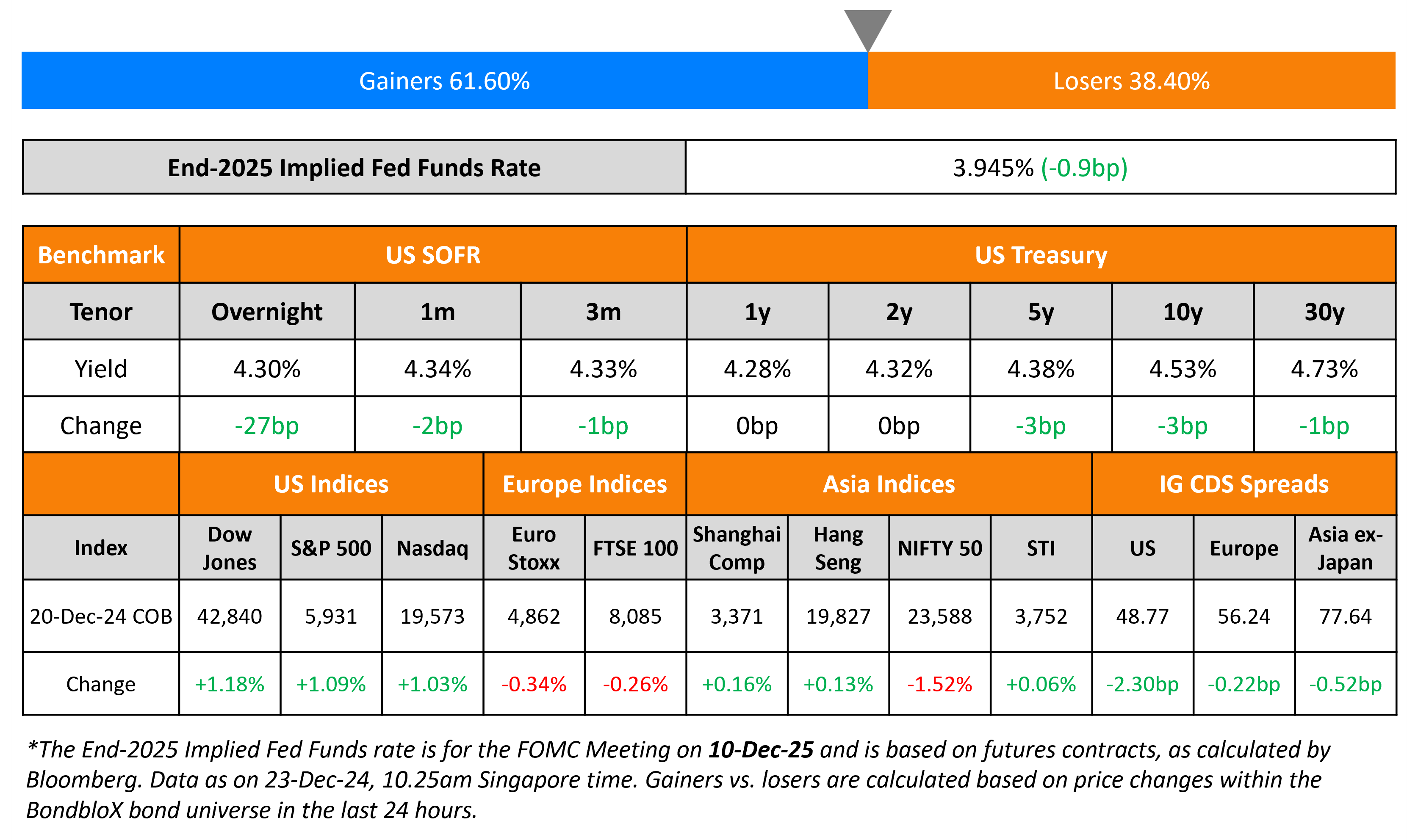

The US Treasury curve bull flattened on Friday, with the 10Y yield down ~3bp. The US government avoided a shutdown by signing a spending bill into law shortly after a midnight deadline. Going into year end, no major data points are due. US IG and HY CDS spreads tightened by 2.3bp and 11.5bp respectively. Looking at US equity markets, both the S&P and Nasdaq closed 1-1.1% higher on Friday. However, European equities ended lower. In terms of Europe’s CDS spreads, the iTraxx Main and Crossover spreads tightened by 2.5bp and 0.2bp respectively. Asian equities have opened higher this morning. Asia ex-Japan CDS spreads were 0.5bp tighter.

New Bond Issues

Rating Changes

-

Vedanta Resources Upgraded To ‘B’ On Diminished Refinancing Risk; Outlook Stable

-

Fitch Upgrades Sri Lanka to ‘CCC+’

-

Moody’s Ratings upgrades Brixmor’s senior unsecured debt ratings to Baa2, stable outlook

-

Heimstaden AB’s Euro Subordinated Perpetual Notes Downgraded To ‘D’ On Coupon Deferral Announcement.

-

Ukrainian Railways JSC Downgraded To ‘CC’ On Proposed Coupon Deferral; Outlook Negative

-

South Africa-Based Petra Diamonds Ltd. Downgraded To ‘B-‘ From ‘B’ Due to Shortening Debt Maturity; Outlook Negative

-

Suncor Energy Inc. Ratings Lowered To ‘BBB-‘ On Weak Midcycle Credit Ratios; Outlook Stable; ST Ratings Revised To ‘A-3’

-

Standard Profil Automotive GmbH Downgraded To ‘CCC-‘ As Restructuring Risk Rises; Outlook Negative

-

Utility Company SSE Outlook Revised To Stable On Intense Investment Program Absorbing Metric Headroom; Ratings Affirmed

Term of the Day: Springing Covenant

A springing covenant is a covenant that becomes effective upon the occurrence of a certain event. While these are more common in revolving and leveraged loan facilities, they can also be seen in bonds. Springing covenants are generally a feature of some covenant-lite agreements, Reuters notes. These covenants are based on leverage ratios but differ wherein, they do not apply unless a revolving facility is drawn above a specific threshold at the relevant date.

Talking Heads

On ‘Better Luck Next Year’ Hard to Believe For EMs

Sarah Ponczek, UBS Private Wealth

“It’s no surprise investors want to throw in the towel on emerging markets or quit trying altogether”

Luis Oganes, JPMorgan

“We were hoping that 2025 would be the return of capital flows into emerging markets, but given this uncertainty, even if the Fed starts to cut, it is unlikely… we are expecting outflows from EM-dedicated funds”

On Bond Traders Turn to 2025 Amid Most Agonizing Easing in Decades

Sean Simko, SEI Investments

“Treasuries repriced to the notion of higher for longer and a more hawkish Fed”

Jack McIntyre, Brandywine Global

“The Fed has entered a new phase of monetary policy — the pause phase. The longer it persists, the more likely the markets will have to equally price a rate hike versus a rate cut”

Michael de Pass, Citadel

“The market views bonds as cheap, certainly relative to stocks, and see them as representing insurance against an economic slowdown”

On Credit Quality Showing Signs of Having Peaked

Barclays strategists

“Although no signs of duress are imminent, it does appear the fundamental picture is likely past the peak for this credit cycle”

Seamus Ryan, GW&K Investment Management

“To see a valuation reset from here, I think we really need a catalyst”

Top Gainers and Losers- 23-December-24*

Go back to Latest bond Market News

Related Posts: