This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

US GDP Expands 4.3% in Q3 Led by Consumer Spending

December 24, 2025

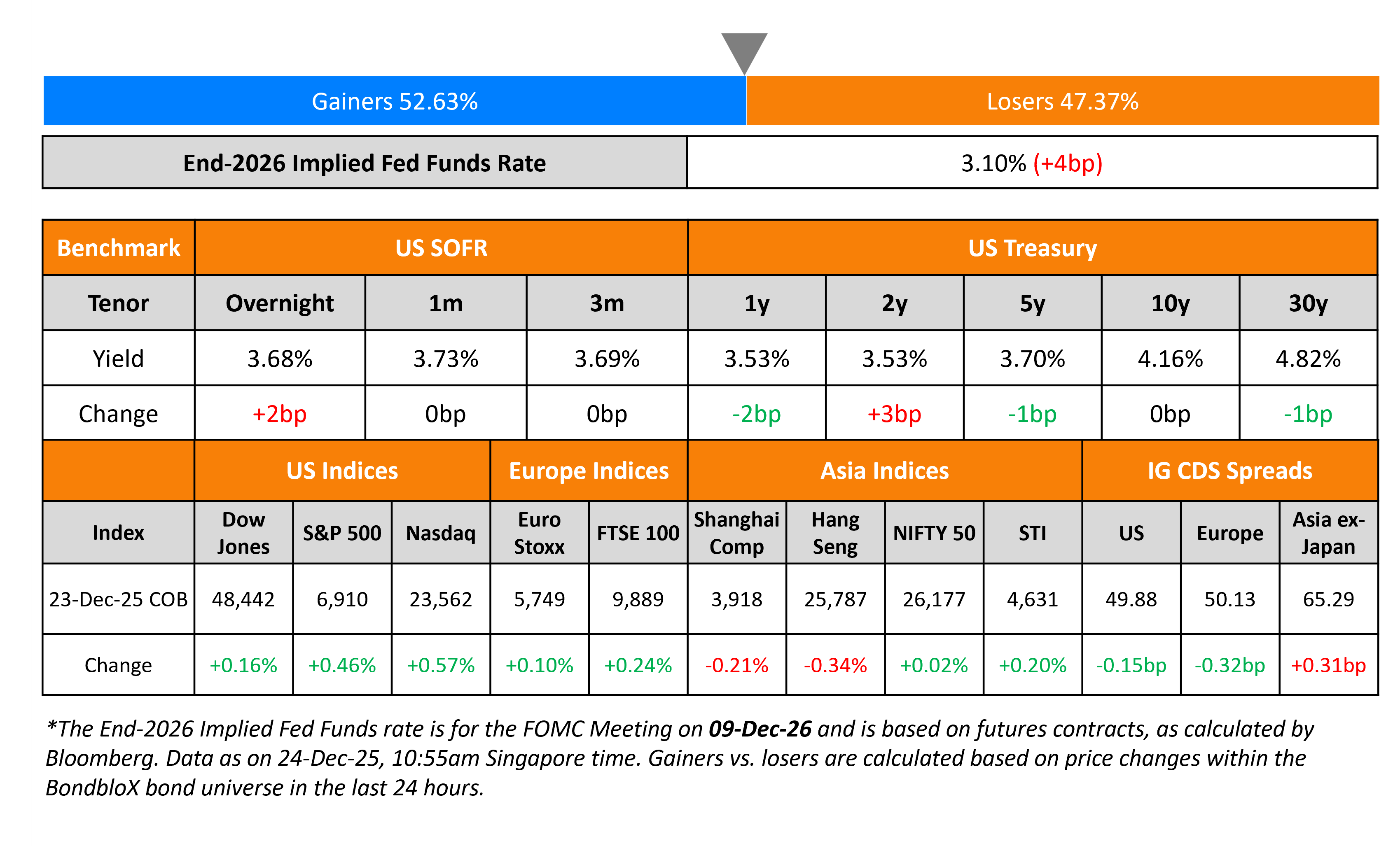

US Treasury yields were broadly stable across the curve. The delayed second reading of US Q3 GDP saw an increase of 4.3%, significantly better than expectations of 3.3%. This was also the fastest pace of growth since 3Q2023, led by consumer spending that increased at 3.5%, the strongest pace since 4Q2024. On the other hand, the Conference Board Consumer Confidence Index for December fell to 89.1, lower than expectations of 91.0. The delayed preliminary Durable Goods Orders reading for October came in at -2.2%, worse than expectations of -1.5%. Capital Goods Orders came in at 0.5%, better than expectations of 0.3%.

Looking at US equity markets, the S&P and Nasdaq ended 0.5% and 0.6% higher respectively. US IG CDS spreads tightened by 0.2bp while HY CDS spreads widened by 0.6bp. European equity indices ended higher too. The iTraxx Main CDS spreads tightened by 0.3bp while the Crossover CDS spreads were 0.6bp wider. Asian equity markets have opened higher this morning. Asia ex-Japan CDS spreads widened by 0.3bp.

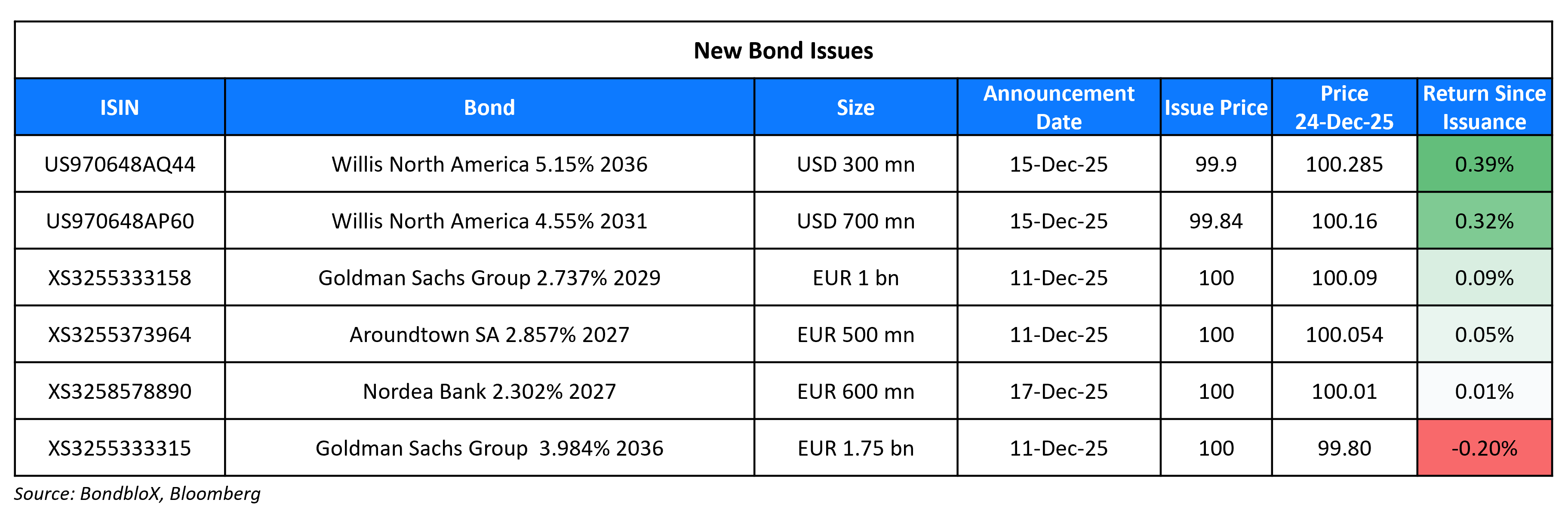

New Bond Issues

Rating Changes

- Moody’s Corp. Upgraded To ‘A-‘ On Strong Market Position And Performance; Outlook Stable

- FirstEnergy Corp. Upgraded To ‘BBB+’ On Improved Governance; Outlook Stable; Multiple Actions Taken On Subsidiaries

- Moody’s Ratings raises Bulgaria’s local and foreign currency ceilings to Aa1 from Aa2

- Swedish Real Estate Company SBB Ratings Raised To ‘CCC’ On Completion Of Tender Offer; Outlook Negative

- China Vanke Downgraded To ‘SD’ On Completed Distressed Debt Restructuring; Removed From CreditWatch

- Moody’s Ratings downgrades Adecoagro to B2; stable outlook

- New Fortress Energy Inc. Downgraded To ‘SD’ On Forbearance Agreement Extension; Affected Term Loan Rating Lowered To ‘D’

- Coty Inc. Outlook Revised To Stable on Sale of Wella Stake and Debt Reduction; ‘BB+’ Issuer Credit Rating Affirmed

Term of the Day: Selective Default

A Selective Default (SD) credit rating is assigned by S&P when the rating agency believes that the obligor/issuer has selectively defaulted on a specific issue or class of obligations but it will continue to meet its payment obligations on other issues or classes of obligations in a timely manner. A rating on an obligor/issuer is also lowered to D or SD if it is conducting a distressed debt restructuring.

Vanke and New Fortress Energy were downgraded to Selective Default (SD) by S&P.

Talking Heads

On Fed Should Lower Rates If the Market Does Well

US President Donald Trump

“I want my new Fed Chairman to lower interest rates if the market is doing well, not destroy the market for no reason whatsoever. Anybody that disagrees with me will never be the Fed Chairman”

Marshall Front, Front Barnett

“Wall Street is focused on economic fundamentals. The economy is on strong footing, and that will support corporate profits, and that’s what matters”

On White House adviser Hassett saying GDP ‘fantastic,’ job gains to jump

“It’s really a fantastic number and it’s a great Christmas present for the American people… recovery is really taking off and there’s a heck of a lot of people coming off the sidelines and entering the labor force… we’re going to see (monthly payrolls) back to the 100,000-150,000 range if we stay in the 4% GDP growth range as we head into the New Year.”

“The moves were clearly not in line with fundamentals but rather speculative. Against such movements, we have made clear that we will take bold action, as stated in the Japan–US finance ministers’ joint statement”

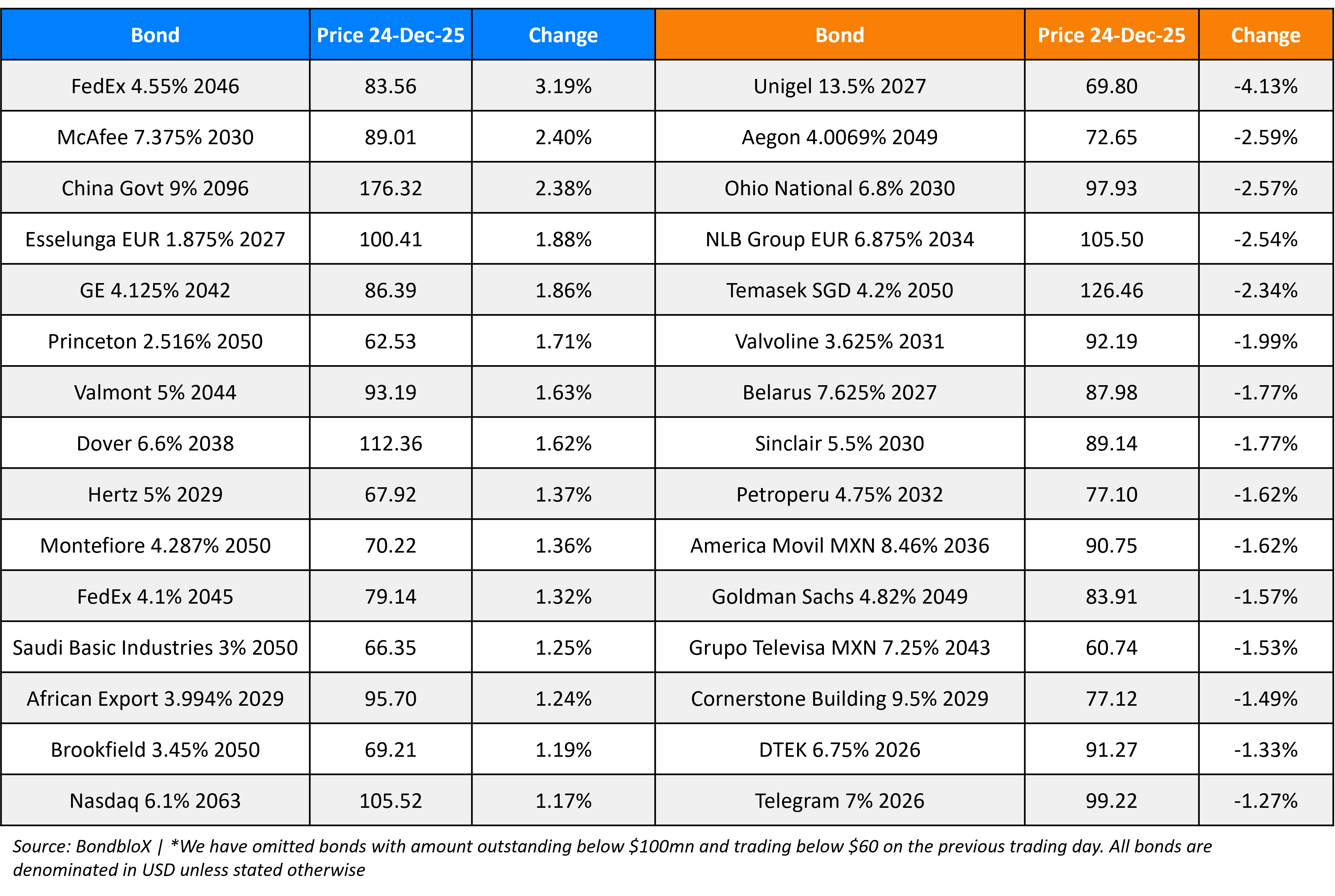

Top Gainers and Losers- 24-Dec-25*

Go back to Latest bond Market News

Related Posts: