This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

US Equity Markets Slide on AI Valuation Concerns; Markets Await Nov CPI Data

December 18, 2025

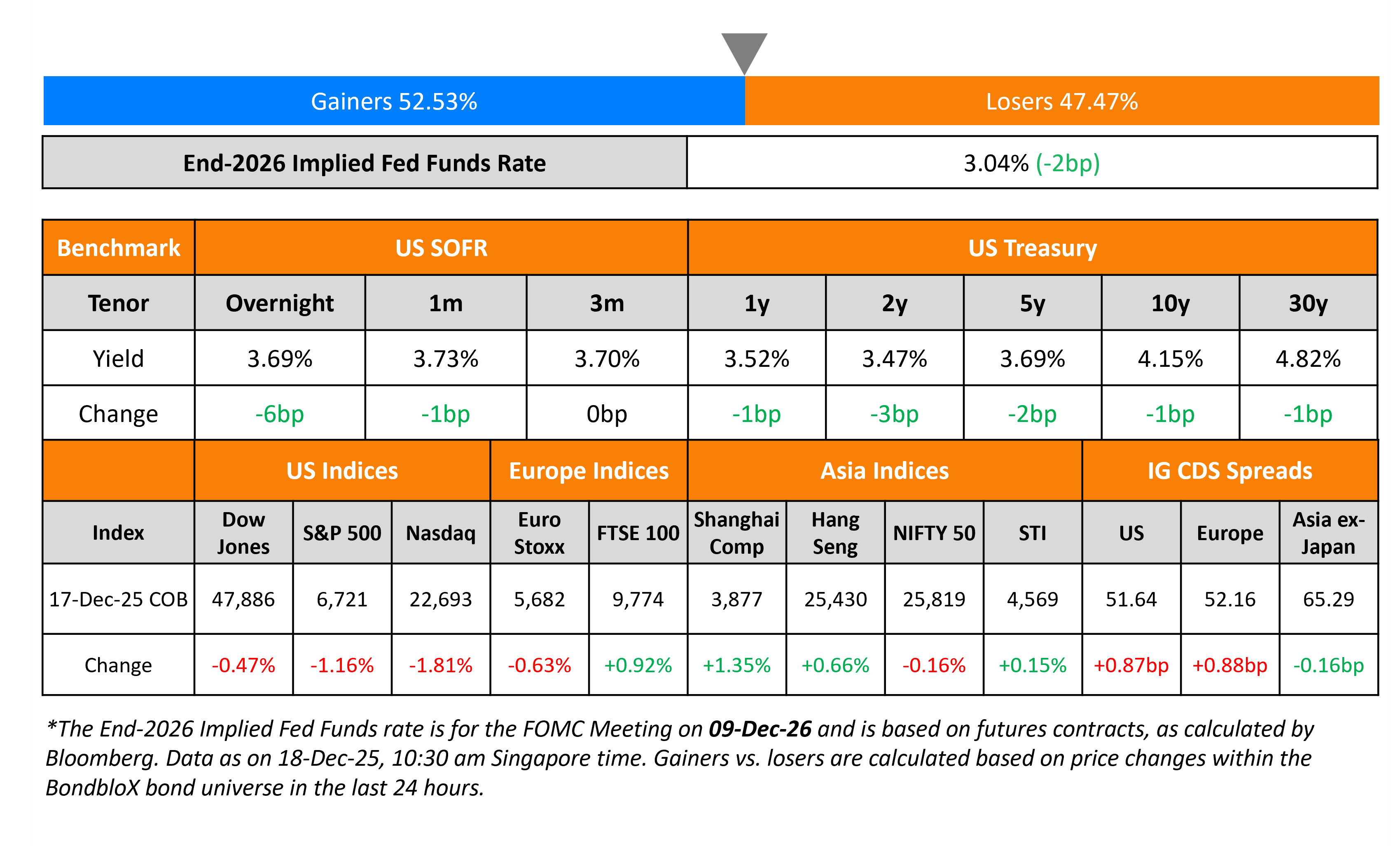

US Treasury yields eased by 1-2bp across the curve. There were no major data points released yesterday. Federal Reserve Governor Christopher Waller said that the current monetary policy was up to 100bp above the neutral policy rate but the Fed need not rush to bring the policy rate down since inflation was still up.

Looking at US equity markets, the S&P and Nasdaq ended 1.2% and 1.8% lower, respectively. US IG CDS spreads widened by 0.9bp while HY CDS spreads widened by 4.4bp. European equity indices ended mixed. The iTraxx Main CDS spreads widened by 0.9bp while the Crossover CDS spreads were 1.6bp wider. Asian equity markets have opened broadly lower this morning. Asia ex-Japan CDS spreads tightened by 0.2bp. The Bank of Japan is widely expected to raise its benchmark rate by 25bp to 0.75% at the end of its two-day meeting tomorrow.

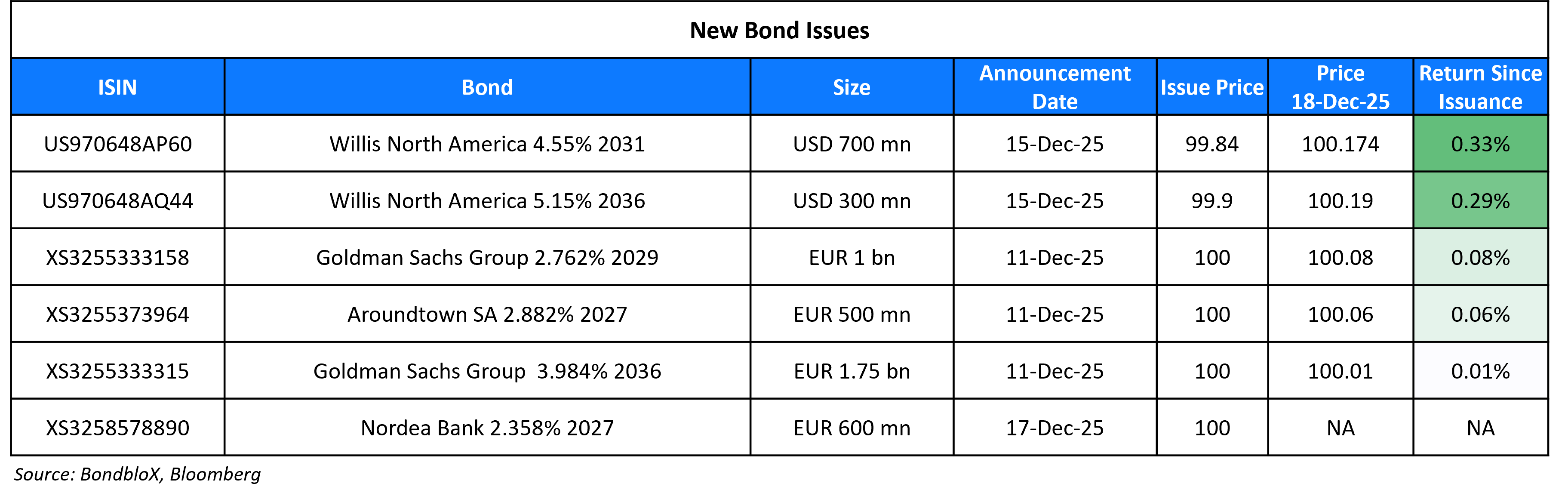

New Bond Issues

Rating Changes

- Fitch Upgrades Omantel to ‘BBB-‘, Outlook Stable

- Argentina Long-Term Ratings Raised To ‘CCC+’ On Improved Access To Liquidity; Outlook Stable

- Fitch Upgrades Total Play to ‘B’; Outlook Stable

- Lancashire Holdings’ Re/Insurance Subsidiaries Upgraded To ‘A’ On Improved Competitive Position; Outlook Stable

- Republic of Paraguay Upgraded To ‘BBB-/A-3’ On Policy Effectiveness And Stronger Economic Resilience; Outlook Stable

- Moody’s Ratings upgrades Siemens Energy to Baa1 from Baa2, outlook stable

- Fitch Downgrades China Vanke to ‘C’ and Vanke HK to ‘CC’

- Moody’s Ratings downgrades SES rating to Ba1 from Baa3; outlook changed to stable

- Fitch Downgrades Kosmos to ‘CCC+’

- Volkswagen Outlook Revised To Negative On Slower-Than-Anticipated Recovery In Credit Metrics; Affirmed At ‘BBB+/A-2’

- Genting Group Companies Outlook Revised To Negative On Higher Spending, Growth Appetite; Ratings Affirmed

- Moody’s Ratings changes outlook on Energean Israel Finance to stable; affirms Ba3 ratings

Term of the Day

Haven Assets

Haven assets aka ‘safe havens’ refer to those class of assets/securities which are in demand when market conditions deteriorate. Examples of haven assets include US Treasury bonds, German Bunds, UK Gilts, Japanese Government Bonds (JGBs) and gold. These are in contrast to ‘risk assets’ which are generally those assets/securities that are in demand when market conditions are buoyant, like equities, real estate and high yield bonds.

Talking Heads

On China’s Growing Pile of Long-Term Debt

Wang Yifeng – Everbright Securities Co.

“Rate risks for some lenders have increased, limiting their ability to absorb ultra-long bonds. The emphasis on longer-tenor bonds has raised investment duration for banks.”

Lv Pin, chief fixed-income analyst at Zhongtai Securities.

“If demand for China’s long bonds keeps declining, officials may have to make a similar pivot to shorter debt. Looking ahead, authorities may need to allow more flexibility in regard to certain risk management restrictions for banks.”

On Record $184bn Bond Issuance in LATAM

Adrian Guzzoni – Citigroup Inc.

“I don’t think anybody would say that it doesn’t surprise them. Given how tight the spreads were in investment grade market, we have seen some of the traditional investment grade funds essentially cross and buy emerging-market credits.”

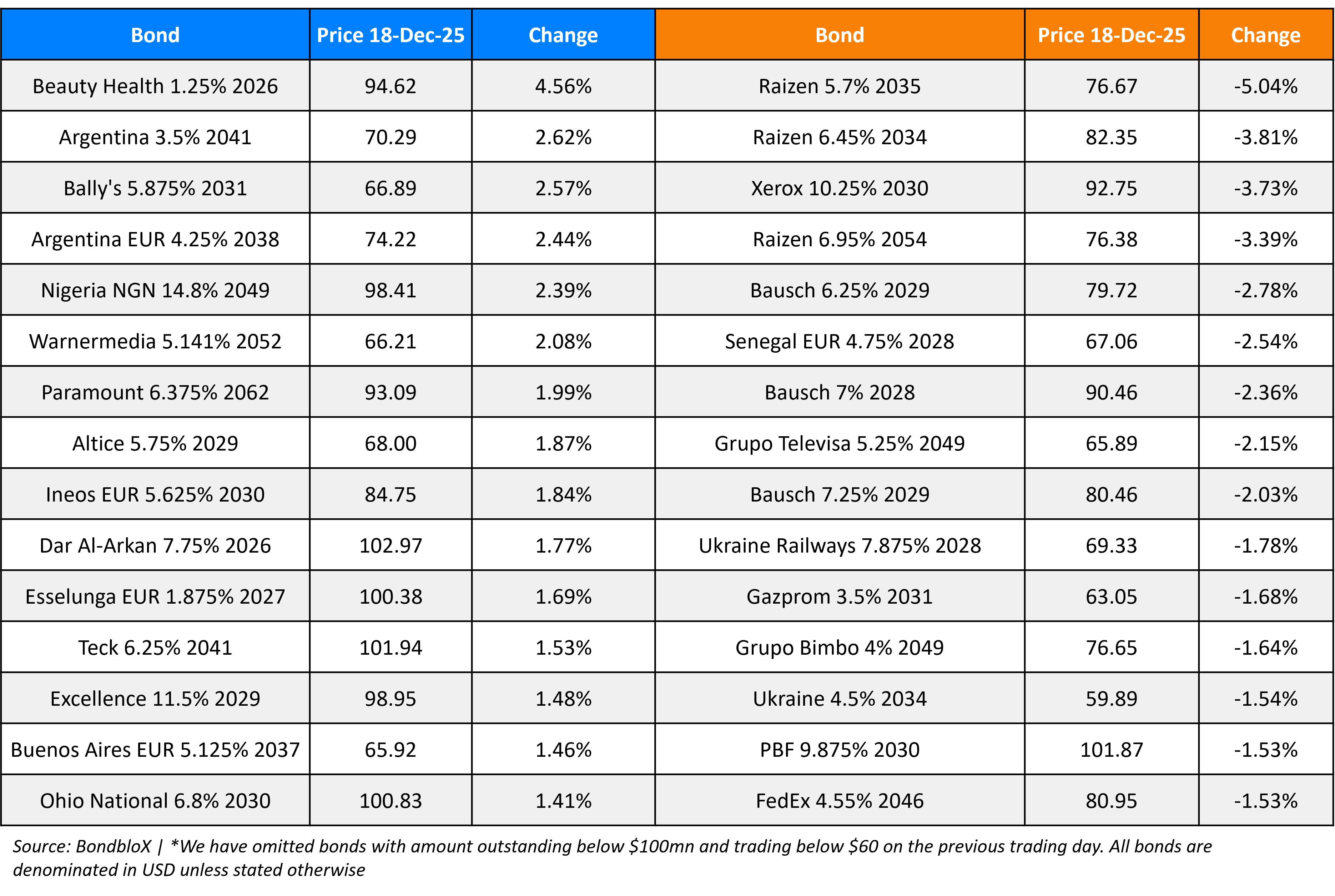

Top Gainers and Losers- 18-Dec-25*

Go back to Latest bond Market News

Related Posts: