This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

US 2s10s Steepens to 4Y Highs

February 9, 2026

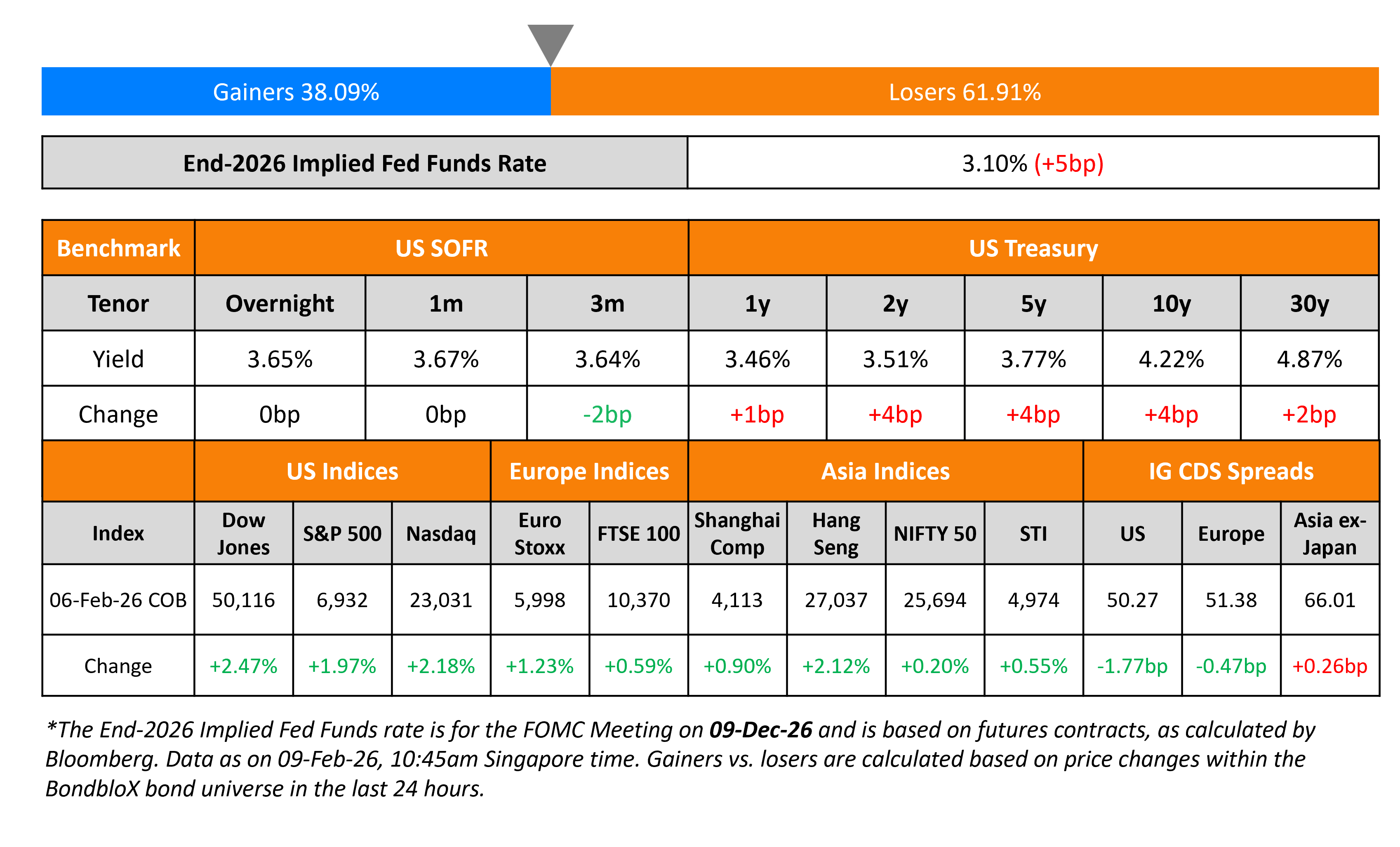

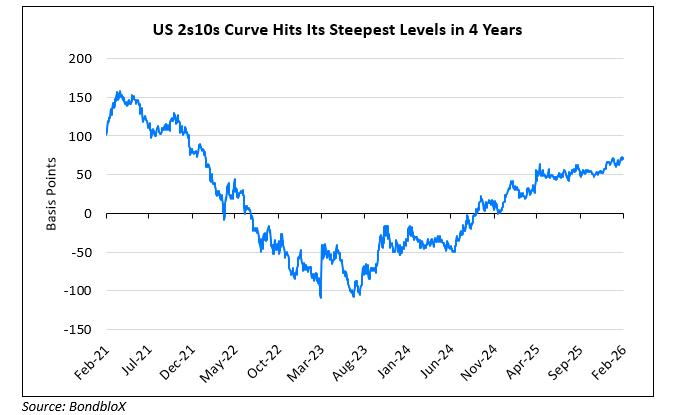

Risk-on sentiment hit the markets on Friday with US Treasury yields jumping higher by ~4bp, partly unwinding the move seen on Thursday. The US 2s10s curve marked its steepest levels since January 2022 as seen in the chart below. This came on the back of a recovery in the equity markets after a sharp sell-off during the two prior trading sessions amid AI related capital expenditure concerns. On the data front, the Michigan Consumer Sentiment Index came in at 57.3, beating expectations of 55.0.

Looking at US equity markets, the S&P and Nasdaq closed 2.0-2.2% higher. US IG CDS spreads tightened by 1.8bp and HY CDS spreads were 10bp tighter. European equity indices ended higher too. The iTraxx Main CDS spreads were 0.5bp tighter and the Crossover CDS spreads were 3.8bp tighter. Asian equity markets have opened strongly in the green this morning. Asia ex-Japan CDS spreads were wider by 0.3bp. Japanese Prime Minister Sanae Takaichi’s party and its coalition partner secured a landslide victory in the snap election. Analysts highlight that the victory has increased expectations for higher fiscal spending. The JGB 10Y yield moved higher by 5bp with the USDJPY touching the 157 handle.

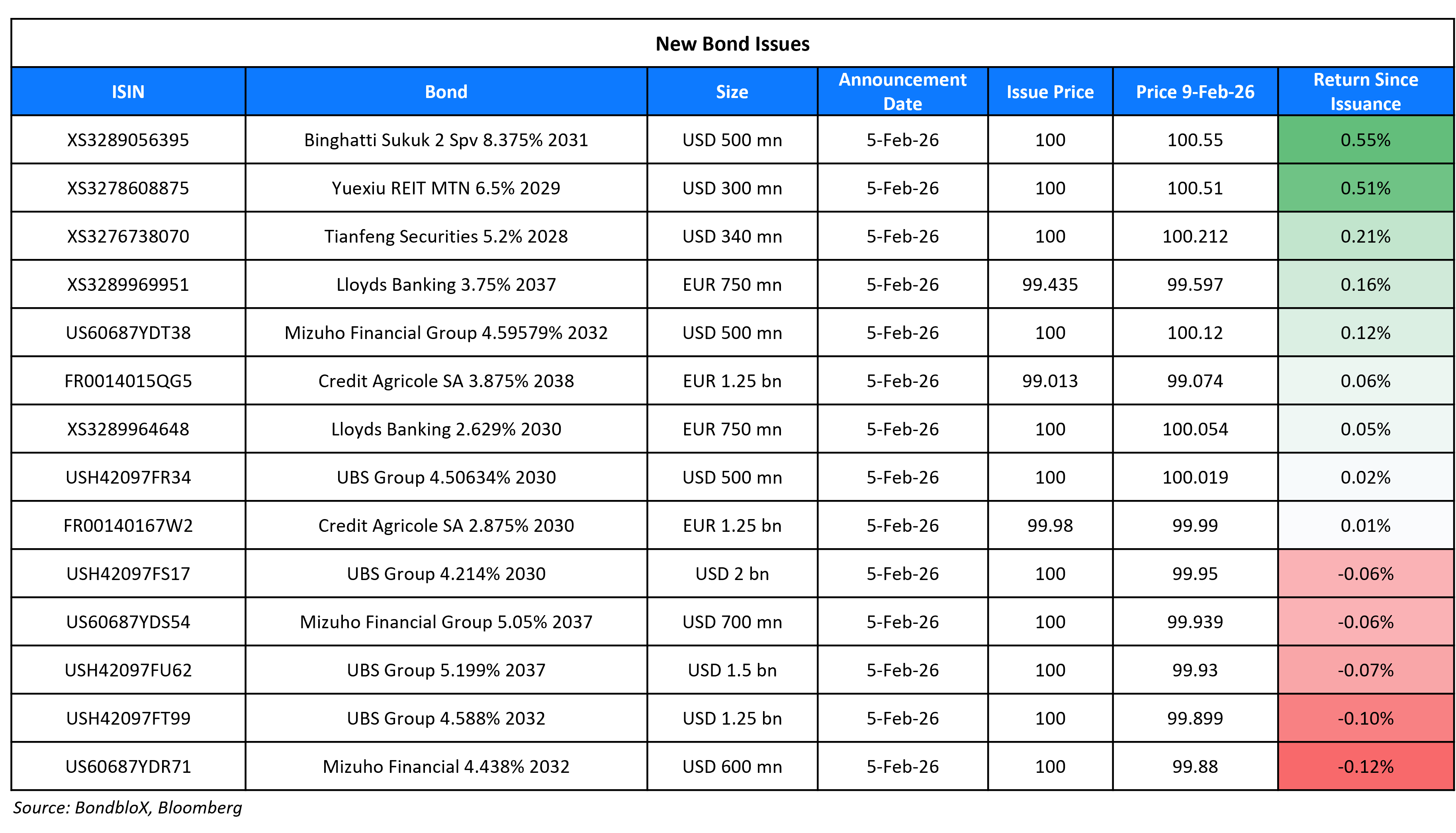

New Bond Issues

- DBS Bank Australia A$ 3Y FRN and/or 5Y at 3m BBSW+62bp/SQASW+74bp

Rating Changes

- Moody’s Ratings upgrades AbbVie to A2; outlook is stable

- Fitch Upgrades Las Vegas Sands’ IDR to ‘BBB’; Outlook Stable

- Fitch Upgrades Iceland to ‘A+’; Outlook Stable; Withdraws Ratings

- Lumen Technologies Inc.’s Senior Unsecured Debt Rating Raised To ‘B’ From ‘CCC’ Following Paydown Of Senior Debt

- Fitch Revises Outlook on Biocon Biologics to Positive; Affirms IDR at ‘BB-‘

- Moody’s Ratings changes El Salvador’s outlook to positive from stable; affirms B3 rating

- Moody’s Ratings revises PLN’s outlook to negative following change in sovereign outlook

- Moody’s Ratings revises outlooks to negative for seven Indonesian corporates following change in sovereign outlook

- Moody’s Ratings changes outlooks on five Indonesian banks to negative following change in sovereign outlook; affirms ratings

Term of the Day: Samurai Bonds

Samurai bonds are yen-denominated bonds issued by foreign entities in Japan. These bonds, which are subject to bond market regulations in Japan, are issued by foreign countries and corporations to attract Japanese investors. Another reason to issue Samurai bonds is to capitalize on lower interest rates in Japan compared to the issuer’s local market. Poland priced a four-tranche Samurai bond deal totaling JPY 211.6bn ($1.4bn) on Friday.

Talking Heads

On Dumping US Credit in Favor of Emerging Markets – Rick Rieder, BlackRock

“We’ve been moving around a fair amount to keep it dynamic and where we think the best opportunity is… We like EM a lot… yield differential between EM and high yield is as good as it has ever been”

On Certain Emerging Corporates Looking Like a Safer Bet than Governments

Manuel Mondia, Aquila Asset Management

“Companies can survive even when governments fall. If you buy the sovereign in Argentina, the political risk can kill you, but their corporations will keep existing and people are willing to pay a premium for that.”

Arnaud Boué, Bank Julius Baer

“EM countries remain in a high‑debt equilibrium, with debt ratios elevated relative to pre‑Covid norms and unlikely to fall materially in the near term”

On Growing Cohort of Emerging Debt Paying Less Than Treasuries

Andrew Chorlton, M&G Investments

“Emerging markets and developed markets are somewhat old-fashioned phrases because it’s the so-called emerging markets that behave themselves”

Yong Zhu, DuPont Capital Management

“Spreads are very tight everywhere… takes only a small portion of the allocation from global investors to drive EM spreads tighter”

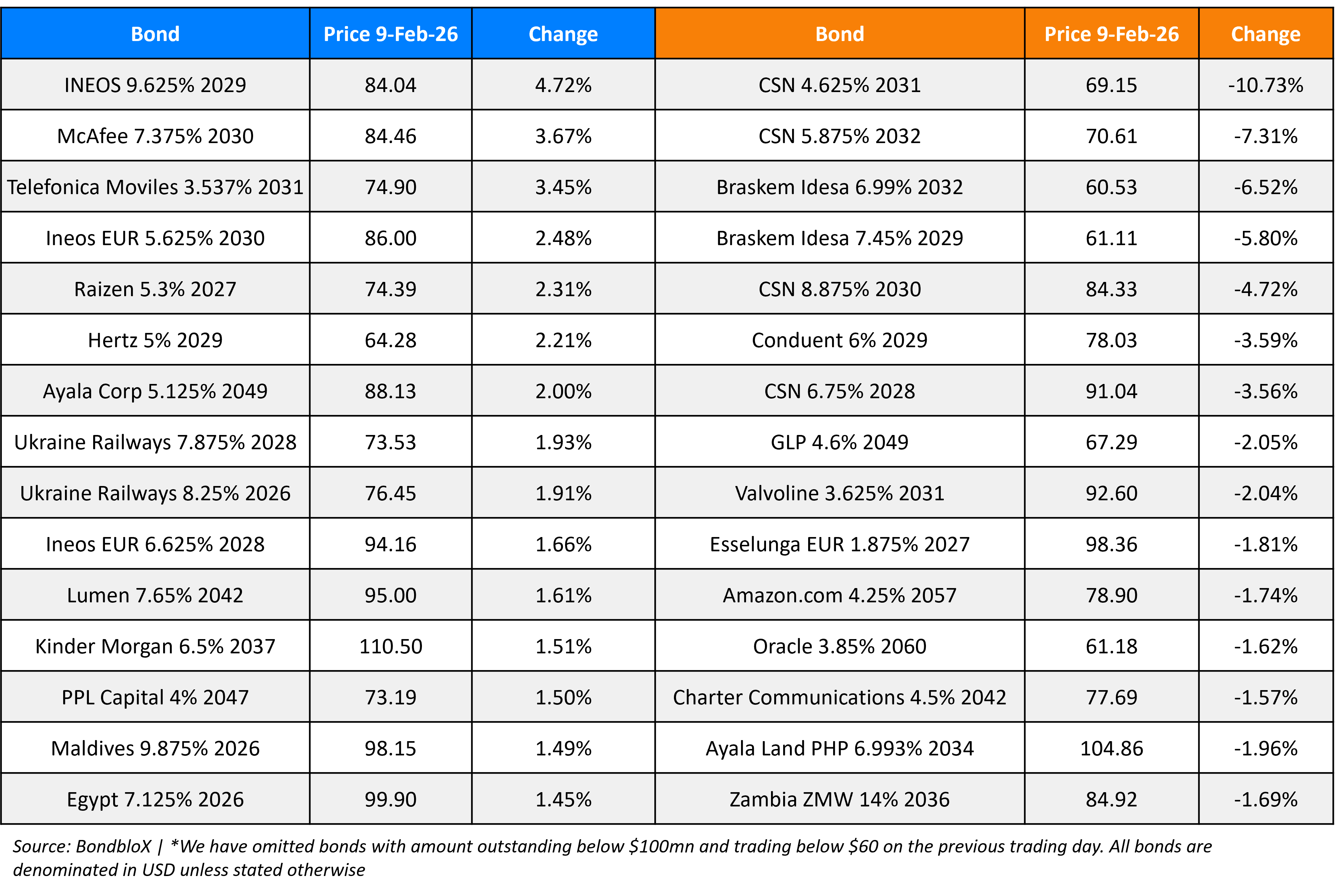

Top Gainers and Losers- 09-Feb-26*

Go back to Latest bond Market News

Related Posts: