This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

UBS Prices $1.5bn PerpNC5 and PerpNC10 AT1

January 6, 2026

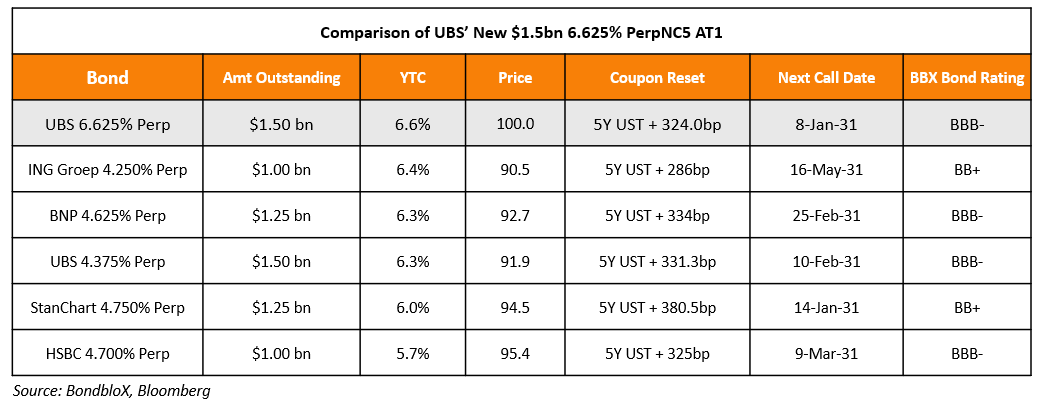

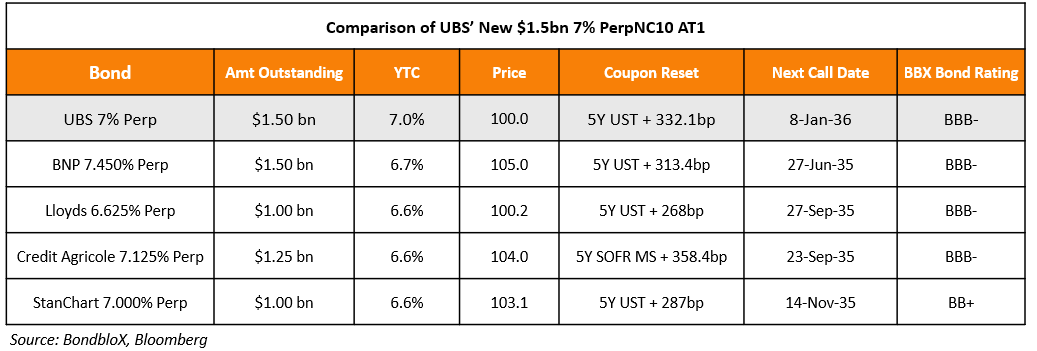

UBS raised $3bn via a two-trancher. It raised $1.5bn via a PerpNC5 AT1 at a yield of 6.625%, 50bp inside initial guidance of 7.125% area. It also raised $1.5bn via a PerpNC10 AT1 at a yield of 7.0%, 50bp inside initial guidance of 7.5% area. The junior subordinated notes are rated Baa3/BBB-/BBB-. The tables give a comparison of UBS’ new AT1 issuances with its peers.

Go back to Latest bond Market News

Related Posts: