This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

Turkey, FAB, Al Rajhi, BNP and Others Price Bonds

January 8, 2026

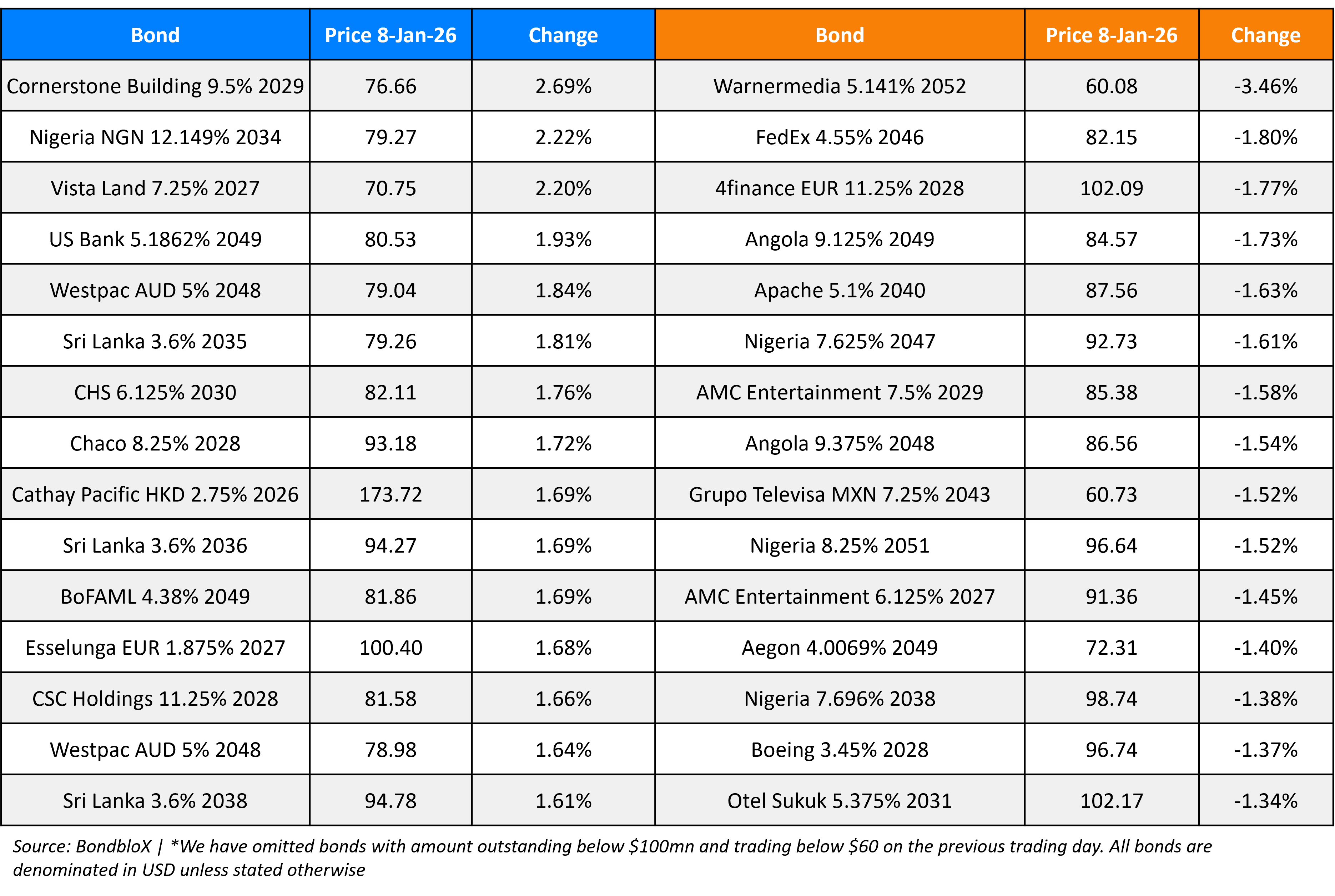

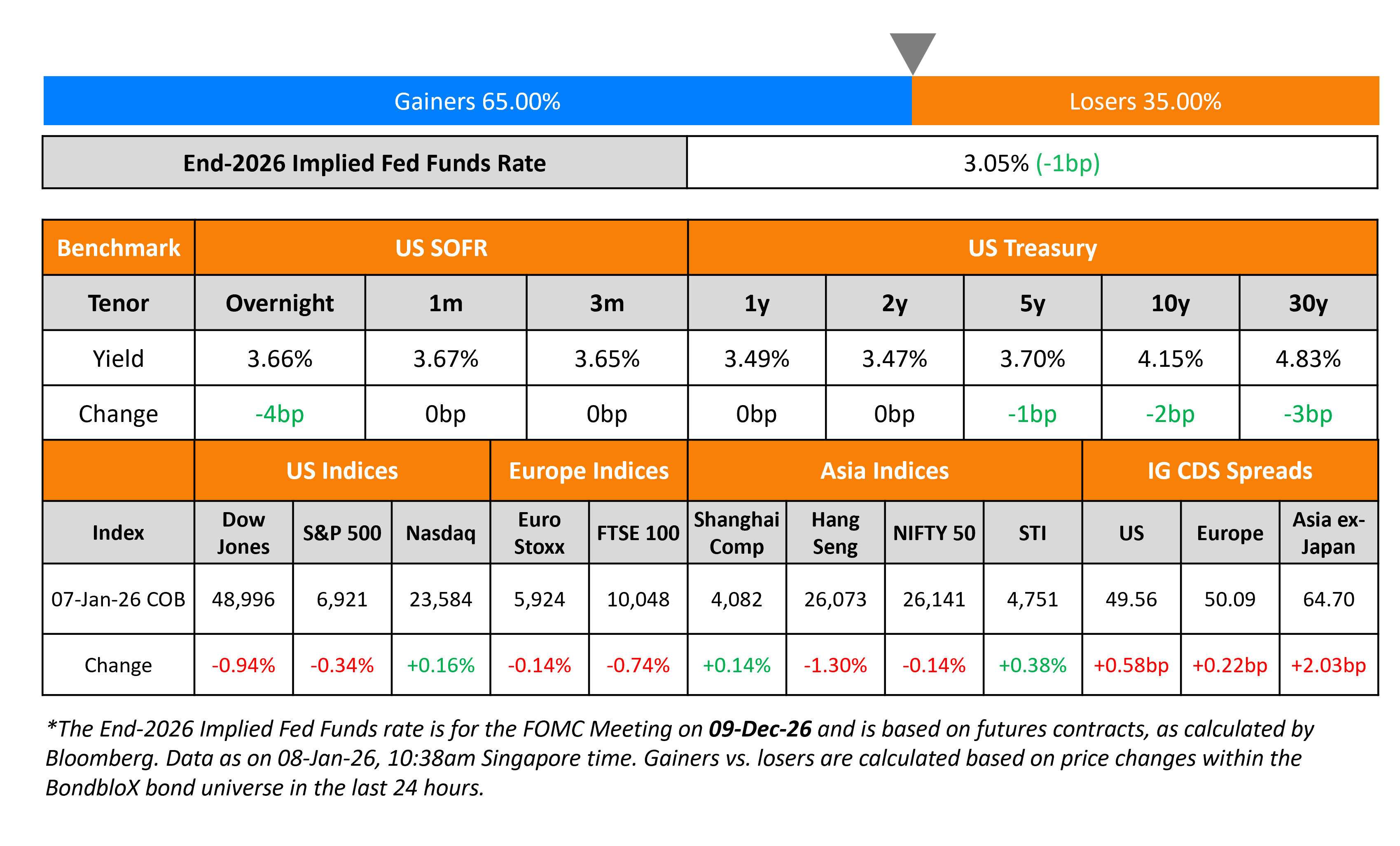

US Treasury yields were broadly stable across the curve on Wednesday. The ISM Services PMI for December came in at 54.4, stronger than expectations of 52.2 and the prior month’s 52.6 reading. This was the highest reading on the index in more than a year, led by a surge in the new orders and employment sub-indices. The ADP employment report for December saw private payrolls come in at 41k, softer than the surveyed 50k, but rebounding from the 29k drop seen in November.

Looking at US equity markets, the S&P closed 0.3% lower while the Nasdaq ended higher by 0.2%. US IG CDS spreads widened by 0.6bp and HY CDS spreads widened by 2.9bp. European equity indices ended lower. The iTraxx Main CDS spreads were 0.2bp wider and the Crossover CDS spreads were 0.3bp wider. Asian equity markets have opened weaker this morning. Asia ex-Japan CDS spreads were wider by 2bp.

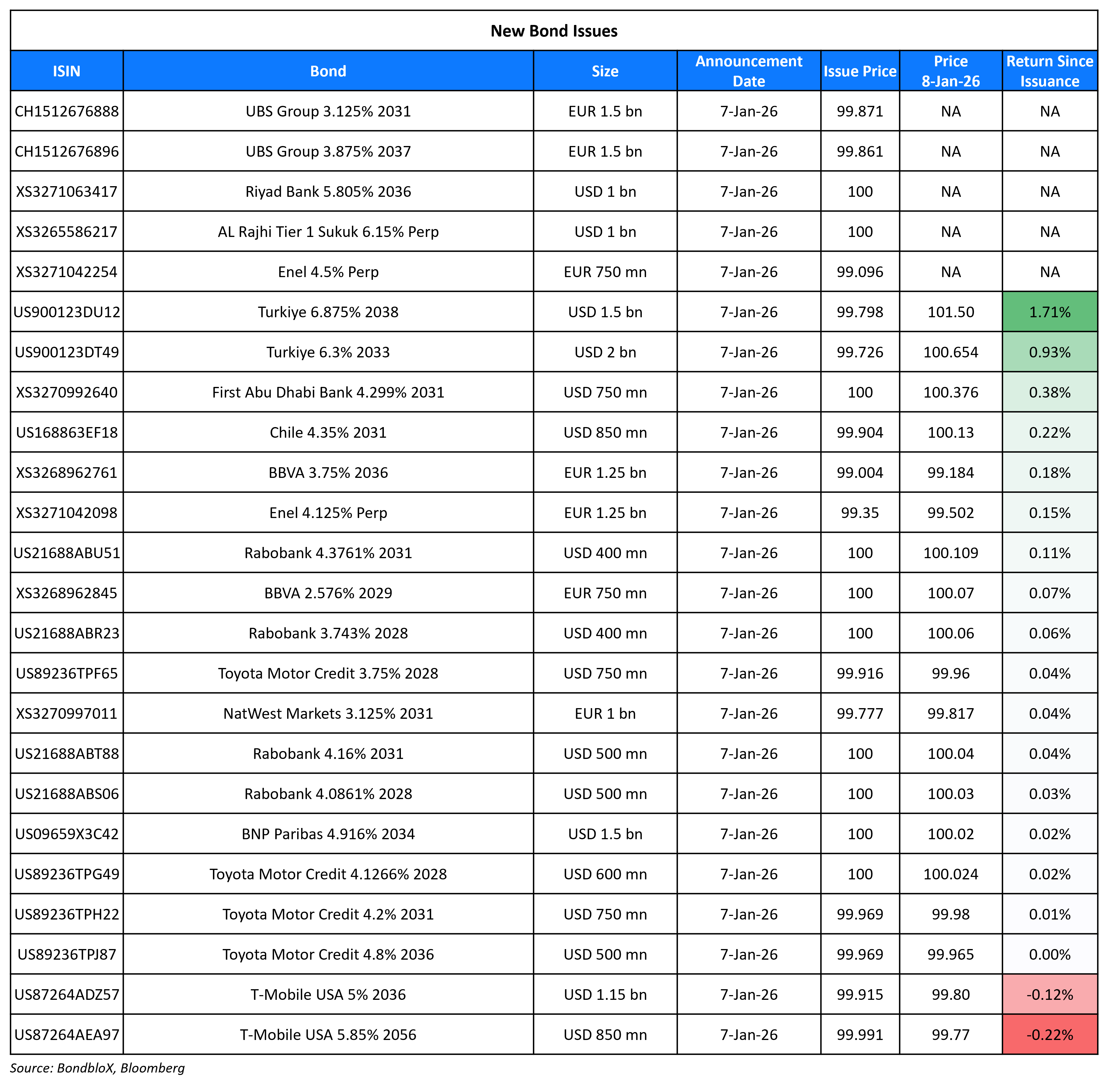

New Bond Issues

- KHFC $ 3Y FRN/5Y at SOFR+77bp/T+67bp areas

- SJM Holdings $ 5NC2 at 6.875% area

- Credit Agricole S$ 6NC5 at 3.05% area

- Thai Oil $ PerpNC5.25 at 6.625% area

Turkey raised $3.5bn via a two-tranche offering. It raised $2bn via a long 7Y bond at a yield of 6.35%, 30bp inside initial guidance of 6.65% area. It also raised $1.5bn via a 12Y bond at a yield of 6.90%, 30bp inside initial guidance of 7.20% area. Proceeds will be used for general budgetary purposes. The new 7Y bond was priced at a new issue premium of 11bp over its existing 9.375% 2033s that currently yields 6.24%. The new 12Y bond was priced at a new issue premium of 45bp over its existing 7.25% 2038s that currently yields 6.45%.

BNP Paribas raised $1.5bn via an 8NC7 bond at a yield of 4.916%, 28bp inside initial guidance of T+130bp area. The senior non-preferred note is rated Baa1/A-/A+. Proceeds will be used for general corporate purposes.

Riyad Bank raised $1bn via a 10NC5 Tier-2 sustainability bond at a yield of 5.805%, 25bp inside initial guidance of T+235bp area. The subordinated note is rated BBB-/BBB (S&P/Fitch) and received orders of $2.6bn, 2.6x issue size. Proceeds will be used to finance and/or refinance eligible green and social projects in line with its sustainability framework.

The Republic of Chile raised $850mn via a long 5Y bond at a yield of 4.372%, 27bp inside initial guidance of T+95bp area. The senior unsecured note is rated A2/A/A-. Proceeds will be used for general governmental purposes. The new bond was priced at a new issue premium of ~5bp over its existing 2.45% 2031s that currently yield 4.32%.

UBS Group raised €3bn via a two-tranche offering. It raised €1.5bn via a 5NC4 bond at a yield of 3.158%, 32bp inside initial guidance of MS+105bp area. It also raised €1.5bn via an 11NC10 bond at a yield of 3.892%, 32bp inside initial guidance of MS+135bp area. The senior unsecured notes are rated A2/A-/A, and received orders of over €5.5bn, 1.8x issue size.

BBVA raised €2bn via a two-tranche offering. It raised €750mn via a 3Y FRN at 3m Euribor+55bp, 30bp inside initial guidance of 3m Euribor+85bp area. It also raised €1.25bn via a 10Y bond at a yield of 3.872%, 25bp inside initial guidance of MS+125bp area. The senior non-preferred notes are rated Baa1/A-/A-, and received orders of over €5.5bn, ~2.8x issue size. Proceeds will be used for general corporate purposes.

T-Mobile USA raised $2bn via a two-tranche offering. It raised $1.15bn via a 10Y bond at a yield of 5.01%, 23bp inside initial guidance of T+110bp area. It also raised $850mn via a 30Y bond at a yield of 5.85%, 22bp inside initial guidance of T+125bp area. The senior unsecured notes are rated Baa1/BBB/BBB+. Proceeds will be used for refinancing existing debt on an ongoing basis and for general corporate purposes.

NatWest Markets raised €1bn via a 5Y bond at a yield of 3.174%, 28bp inside initial guidance of MS+95bp area, and received orders of over €3.3bn, 3.3x issue size. The senior unsecured note is rated A1/A/AA-.

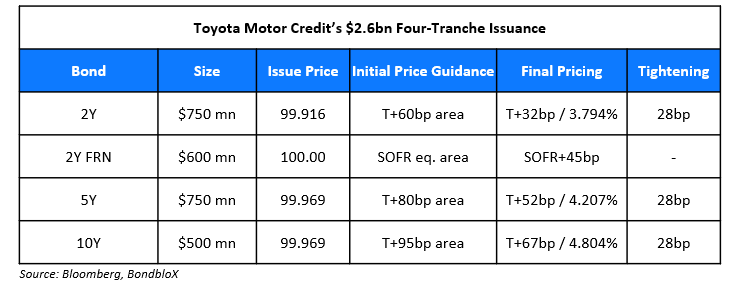

Toyota Motor Credit raised $2.6bn via a four-trancher.

The senior unsecured notes are rated A1/A+/A+. Proceeds will be used for for general corporate purposes.

Rating Changes

- Fitch Upgrades Dana’s IDR to ‘BB+’; Removes Positive Rating Watch; Outlook Stable

- Murphy Oil Corp. Downgraded To ‘BB’ From ‘BB+’ On Continued Weak Credit Metrics; Outlook Stable

- Fitch Affirms Conga IDR at ‘B+’; Downgrades First Lien Term Loan to ‘BB’/’RR2’; Outlook Stable

Term of the Day: Blue Bonds

Blue bonds are a type of sustainable debt wherein the proceeds from such issuance are earmarked for marine/water projects related to ocean conservation (hence the name blue bonds). These are similar to green bonds, which are earmarked for green or environmentally-friendly projects. Blue bonds became popular in late 2018 when Seychelles issued the world’s first sovereign blue bond.

Yesterday, Emirates NBD raised $300mn via a 3Y blue bond at a yield of 4.195%.

Talking Heads

“The supervisory operating principles emphasize that examination findings and reports must focus on material financial risk… A simple solution would be to adjust thresholds by nominal GDP, which includes both economic growth and inflation… Supervision delivers clear benefits”

On BEA saying it will use US September, November CPI averages to calculate October PCE inflation

“For those CPIs that are not available for October, BEA will use an average of BLS’ September and November CPI data for its estimates included in the personal income and outlays report for October.

On Japan’s Bond Market Facing Another Big Supply Shock

Akio Kato, MUFJ Asset Management

“Supply-demand conditions in Japan’s bond market have deteriorated to the point that the government may eventually need to adjust issuance each quarter”

Miki Den, SMBC Nikko Securities

“Fair value for the 10-year yield is around 2.2–2.3% for now in our view. Yields could reach that level fairly easily”

Top Gainers and Losers- 08-Jan-26*

Go back to Latest bond Market News

Related Posts: