This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

Trump Calls for Pre-Emptive Rate Cuts

April 22, 2025

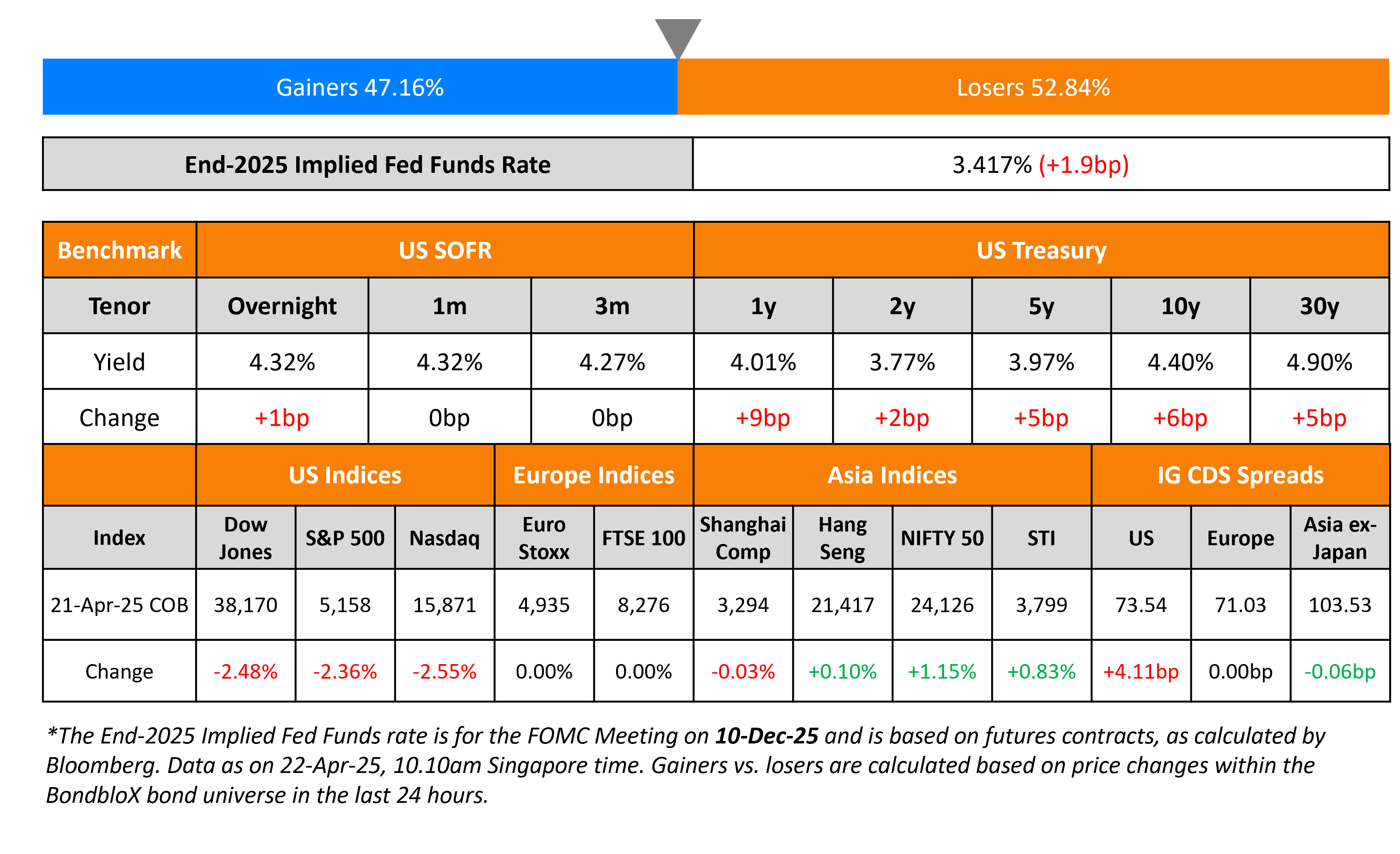

US Treasury yields continued to steepen with long-term yields higher by 5-6bp while short-end yields were marginally higher. US President Donald Trump added further pressure on Fed Chairman Jerome Powell, calling for pre-emptive rate cuts, noting that “there can almost be no inflation, but there can be a slowing of the economy”.

The S&P and Nasdaq ended sharply lower on Monday, down by 2.4-2.6%. Looking at credit markets, US IG and HY CDS spreads widened by 4.1bp and 17.7bp respectively. European equity and debt markets were closed on account of Easter holidays. Asian equity markets have opened mixed this morning. Asia ex-Japan CDS spreads were tighter by 0.1bp.

New Bond Issues

Rating Changes

-

Moody’s Ratings upgrades Earthstone’s notes to Ba2; stable outlook

-

Quincy Health LLC Upgraded To ‘CCC’ From ‘CCC-‘ On Extended Debt Maturities; Outlook Negative; Raises Debt Ratings

-

Huntsman Corp. Downgraded To ‘BB+’ From ‘BBB-‘; Outlook Stable

-

Moody’s Ratings downgrades Restoration Hardware’s CFR to B3

-

Moody’s Ratings downgrades Union Bank of the Philippines’ ratings to Baa3 from Baa2; Outlook changed to stable

Term of the Day: Offtake Financing

Offtake financing is a method of securing financing by the producer, typically via a loan based on a long-term business arrangement with a buyer to purchase portions of its potential future production. Offtake agreements tend to provide fixed or contractually adjusted prices for as long as ten years or more. Such agreements are often used in projects for energy production and distribution that require a high capex, wherein the project sponsor, owner, and lender all want a guarantee that some of the production is already sold.

Talking Heads

On Japanese Super-Long Bonds Drawing Record Foreign Inflow

Shoki Omori, Mizuho Securities

“The scarcity of buyers and the rise in long-term and long-end US interest rates likely discouraged active investment… March coincides with the Japanese fiscal year-end, during which investors typically adjust their balance sheets”

On Threat to US Exceptionalism Spurs Rush for EM Local Bonds

Jon Harrison, GlobalData TS

“We have a strong preference for EM local debt… The slowing US economy, with a growing chance of recession, is bad for global growth, which is likely to further incentivize EM central banks to cut rates

Philip McNicholas, Robeco

“Among the larger markets, we prefer the local-currency side… heightened volatility in Treasuries and US policy should be imbuing a higher term premium”

On Trump’s Push Against Powell Adds to Doubts of US’s Haven Status

Ian Lyngen, BMO Capital Markets

“Any attempt to remove Powell will add to the downward pressure on US assets”

Helen Given, Monex

“Should the US fall into a recession with a central bank that either does not or cannot act independently, there’s a chance such a downturn could be exacerbated”

Top Gainers and Losers- 22-April-25*

Go back to Latest bond Market News

Related Posts: