This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

Treasuries Rally as US Inflation Eases

February 16, 2026

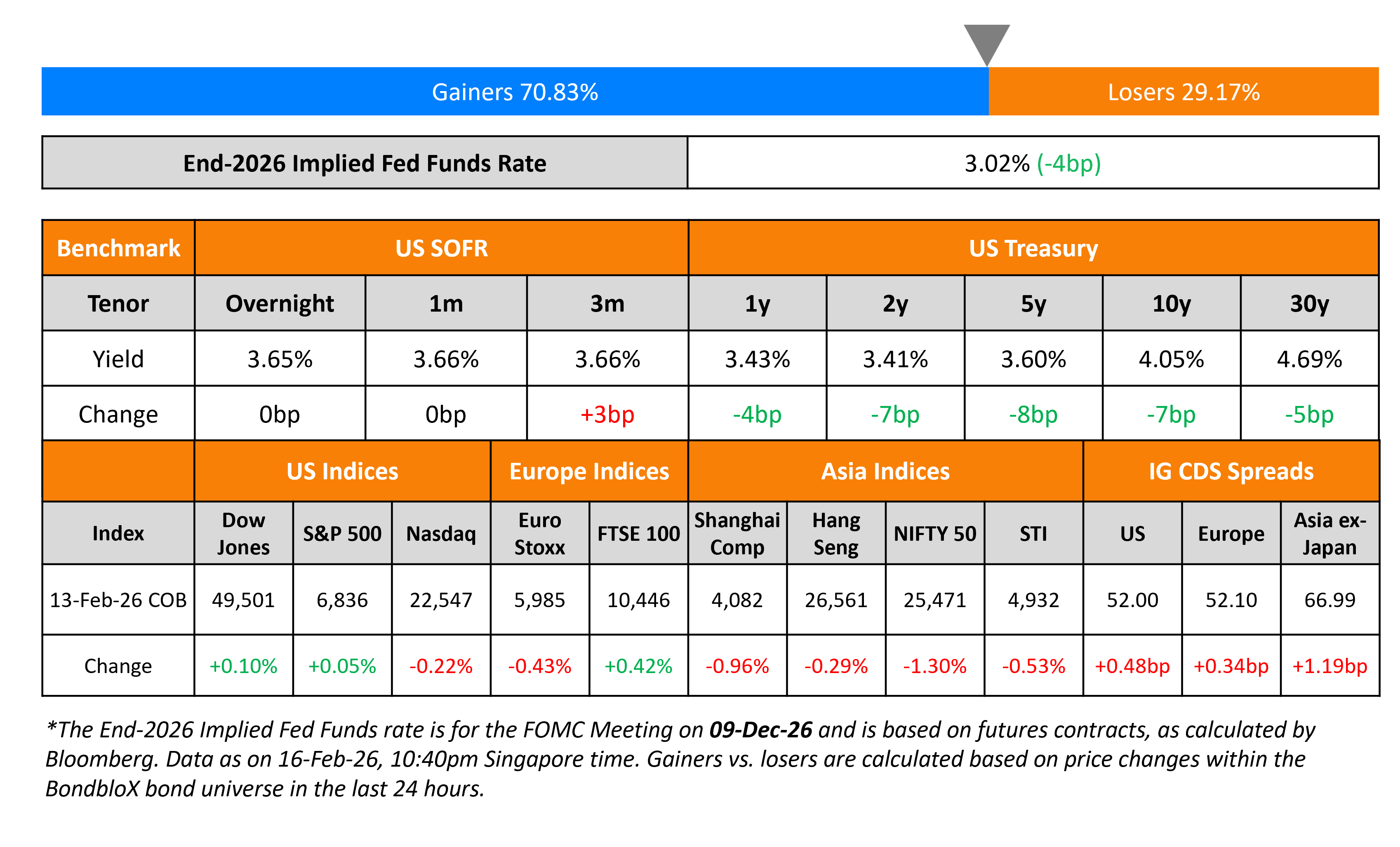

US Treasury yields dropped across the curve by 7-8bp on Friday after a soft inflation report. US CPI in January rose by 2.4% YoY vs. expectations of 2.5% and the prior month’s 2.7% print. The Core CPI rose by 2.5% YoY, inline with expectations, but lower than the prior month’s 2.6% print. This was the core inflation’s lowest reading since March 2021. Following this, markets are currently pricing-in about 65bp in rate cuts by the end of the year as compared to 55bp prior to the data release.

Looking at US equity markets, the S&P ended flat while the Nasdaq closed 0.2% lower. US IG CDS spreads widened by 0.5bp and HY CDS spreads were 3bp wider. European equity indices ended mixed. The iTraxx Main CDS spreads were 0.3bp wider and the Crossover CDS spreads were 1.5bp wider. Asian equity markets have opened mixed this morning. Asia ex-Japan CDS spreads were wider by 1.2bp.

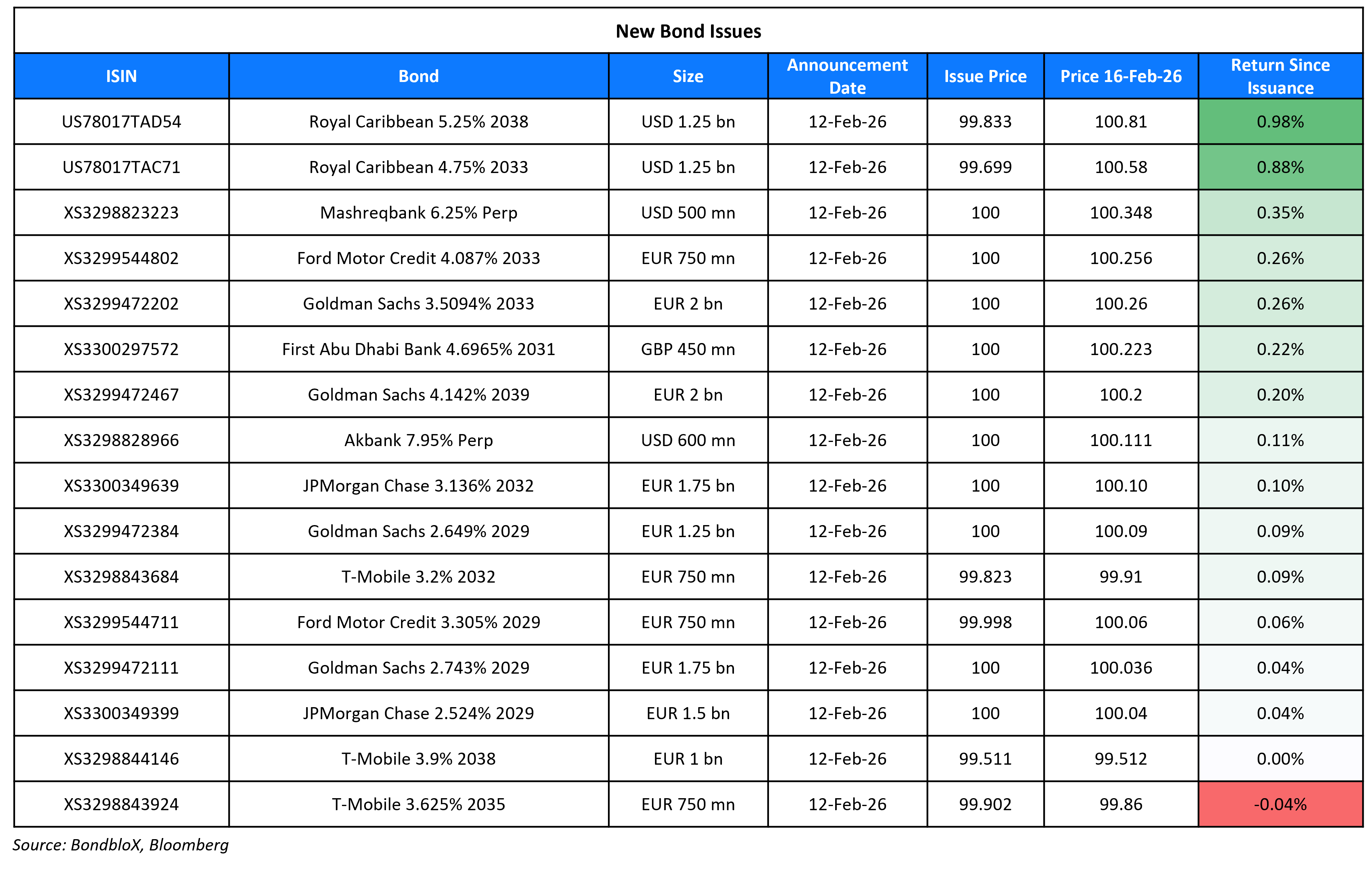

New Bond Issues

Rating Changes

- Fitch Upgrades Altria to ‘BBB+’; Outlook Stable; Removes UCO

- Fitch Upgrades Howmet Aerospace’s IDR to ‘A-‘; Outlook Stable

- Lebanon Long-Term Local Currency Rating Raised To ‘CCC+’; Outlook Stable; Foreign Currency Rating Unchanged At ‘SD’

- Fitch Upgrades Huatai Property & Casualty’s IFS to ‘AA-‘; Outlook Stable

- Moody’s Ratings changes PG&E Corporation and Pacific Gas & Electric’s outlooks to positive; Affirms ratings

- Telefonica Moviles Chile ‘BB’ Ratings Placed On CreditWatch Developing On Acquisition By Millicom And NJJ Holding

- Telecom Operator Coltel ‘B+’ Rating Placed On CreditWatch Developing Due To Acquisition By Millicom

- WE Soda Ltd. Outlook Revised To Negative On Higher Leverage Amid Weak Market Conditions; ‘BB-‘ Rating Affirmed

- Fitch Revises Coty Inc.’s Outlook to Negative; Affirms IDRs at ‘BB+’

- Enstar Group Ltd. Outlook Revised To Negative From Stable On Acquisition Of Accident Fund; Ratings Affirmed

Term of the Day: Hostile Takeover

A hostile takeover is an M&A strategy used by the potential buyer to directly go to the target company’s shareholders by making a tender offer or through a proxy vote. This is in contrast to a friendly takeover wherein, the target company’s board approves of the takeover and recommend shareholders vote in favor of it. Target companies can use anti-takeover strategies like poison pills, golden parachutes etc.

Talking Heads

On US rate futures lifting June Fed cut bets after soft inflation print

Chris Zaccarelli, Northlight Asset Management

“As long as CPI remains in check – which so far it has – then the rates discussion will revert back to the labor market, and under the current economic conditions the Fed is likely to proceed cautiously lowering rates a couple of times later this year”

On AI Bubble Fears Creating New Derivatives

Gregory Peters, PGIM Fixed Income

“This hyperscaler thing is just so ginormous and there’s so much more to come that it really begs the question of ‘do you want to really be nakedly exposed here?”

Matt McQueen, BofA

“Expected distribution periods of three months could grow to nine to 12 months… likely to see banks hedge some of that distribution risk in the CDS market”

Paul Mutter, Toronto-Dominion Bank

“Appetite for newer basket hedges can be expected to grow. More active trading of private credit will create additional demand for targeted hedges.”

On Pushing Back Against Taxes to Stop Capital Outflows – Christine Lagarde, ECB President

“I’m more in favor of incentives than taxes”…overall sentiment is currently positive for Europe as “the money is coming in”… Trump’s disruptive trade policy is “a kick in the butt” to speed up economic reforms. But “it also brings European leaders closer together”.

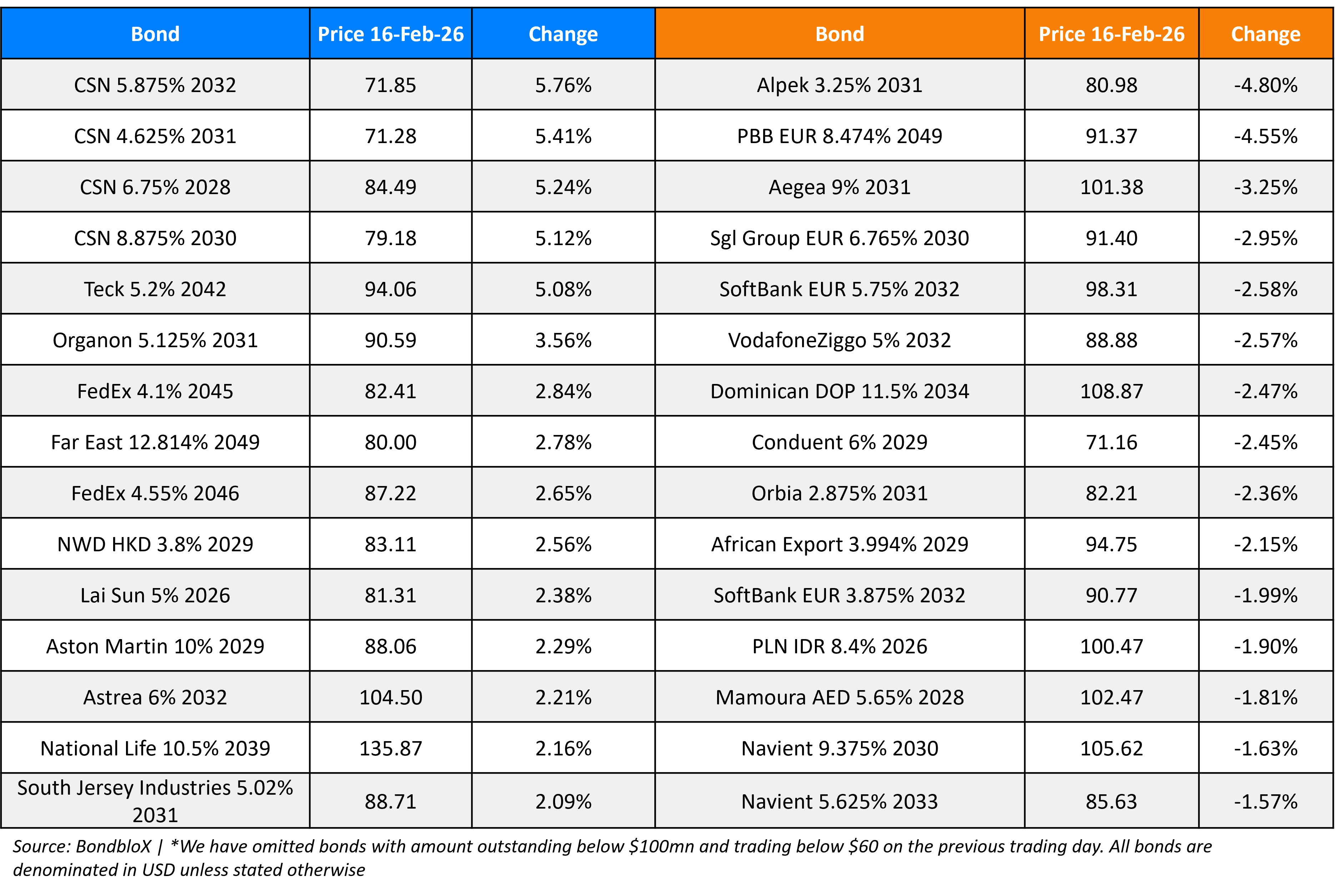

Top Gainers and Losers- 16-Feb-26*

Go back to Latest bond Market News

Related Posts: