This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

Treasuries Hold Steady; Fed’s Miran Calls for More Cuts in 2026

December 23, 2025

US Treasury yields were broadly steady across the curve. Dovish Fed Governor Stephen Miran said that the central bank risks sparking a recession unless it continues lowering rates next year. He added that while he does not see an economic downturn in the near-term, he believes that rising unemployment should push Fed officials to continue cutting rates.

Looking at US equity markets, the S&P and Nasdaq ended 0.6% and 0.5% higher respectively. US IG CDS spreads tightened by 0.7bp while HY CDS spreads tightened by 2.7bp. European equity indices ended lower. The iTraxx Main CDS spreads tightened by 0.4bp while the Crossover CDS spreads were 1.7bp tighter. Asian equity markets have opened mixed this morning. Asia ex-Japan CDS spreads tightened 0.3bp.

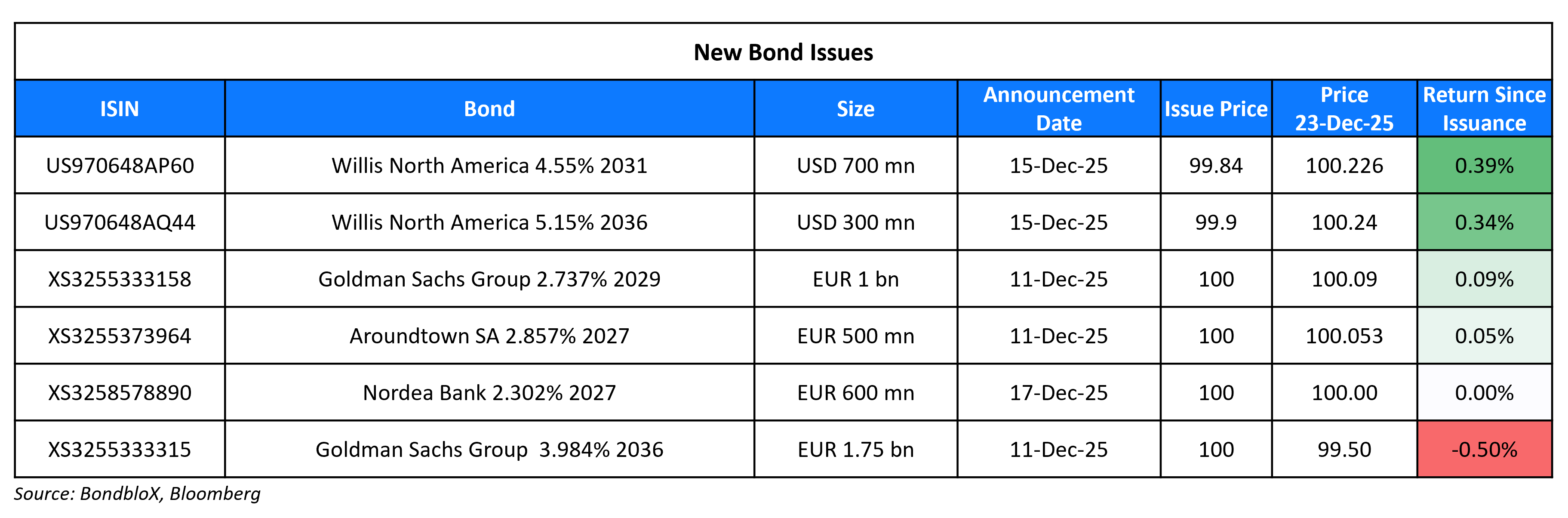

New Bond Issues

Rating Changes

- Teva Pharmaceutical Industries Ltd. Upgraded To ‘BB+’ On Continued Deleveraging, Improved Visibility; Outlook Stable

- Fitch Upgrades Ukraine to ‘CCC’

- Fitch Upgrades United Airlines to ‘BB+’/Stable; Takes Various Actions on EETCs

- AES Argentina Generacion S.A. Upgraded To ‘CCC+’ On Similar Rating Action On Sovereign; Outlook Stable

- Fitch Upgrades Amgen to ‘BBB+’; Outlook Stable

- Trane Technologies PLC Ratings Raised To ‘A-‘ On Sustained Low Leverage; Outlook Stable

- Moody’s Ratings upgrades NXP’s senior unsecured ratings to Baa2; outlook stable

- Moody’s Ratings upgrades Freeport LNG Investments to B2; outlook positive

- Petroperu Ratings Lowered To ‘B-‘ From ‘B’ On Lower Likelihood Of Government Support; Placed On CreditWatch Negative

- Fitch Downgrades Empresa de Telecomunicaciones de Bogota, S.A. to ‘BB’; Outlook Stable

- Fitch Takes Actions on Colombian and Central American Banks Following Colombia’s Sovereign Downgrade

- Fitch Downgrades Colombian Corporates After Sovereign Downgrade; Assigns Outlooks

Term of the Day: Revolving Credit

Revolving credit is a form of borrowing where the credit line has a maximum limit but the borrower can access it in any quantum based on their funding needs. In a normal borrowing, once the loan has been repaid, the borrower must take a new loan to borrow more. In revolving debt, the borrower can re-access any funds that have been paid back too. Revolving debt generally comes with a higher interest rate and does not necessarily have a fixed coupon.

Talking Heads

On Inflation and Bonds and Stocks Correlation

Russ Koesterich – BlackRock

“For the better part of 20 years bonds offered little yield but effective diversification. From the aftermath of the internet bubble through the pandemic, stock/bond correlations were consistently negative, making a Treasury bond an effective portfolio hedge. Unfortunately, starting in 2021 that relationship abruptly shifted. A sharp and abrupt rise in inflation turned bonds from a risk mitigant to a risk accelerator. However, that dynamic may be in the process of changing.”

On Gold and Silver Prices Hitting All-time Highs

Dilin Wu – Pepperstone Group Ltd.

“Today’s rally is largely driven by early positioning around Fed rate-cut expectations, amplified by thin year-end liquidity.”

Nicholas Frappell – ABC Refinery

“The main factors affecting the market were the prospect of more rate cuts and “geopolitical concerns, particularly around Ukraine and the Trump administration’s recent national security strategy.”

On ECB Rate Hikes in Forseeable Future

Isabel Schnabel – ECB

“At the moment, no interest-rate increase is to be expected in the foreseeable future. Rates will probably remain stable for quite some time, barring any unforeseen events.”

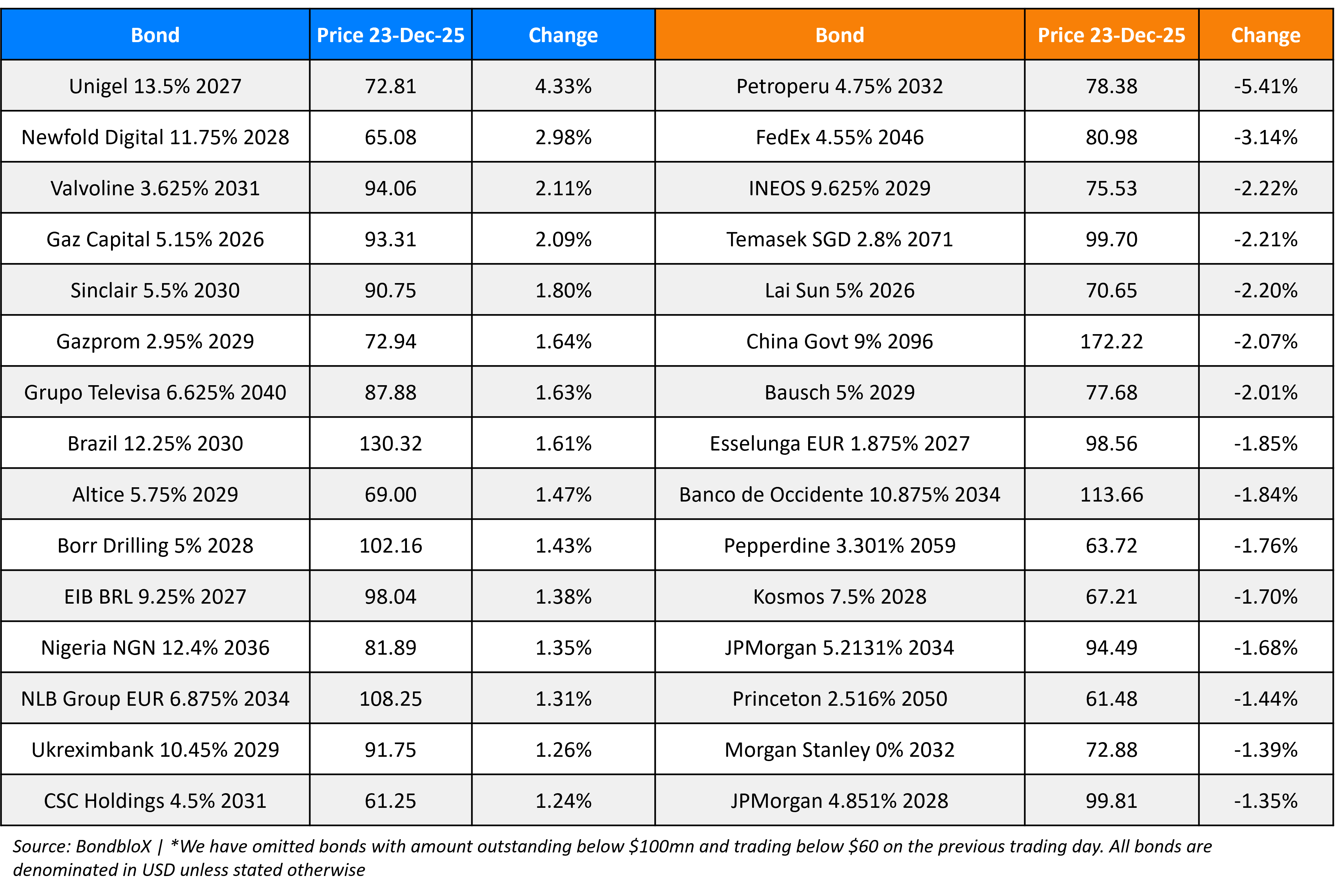

Top Gainers and Losers- 23-Dec-25*

Go back to Latest bond Market News

Related Posts: