This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

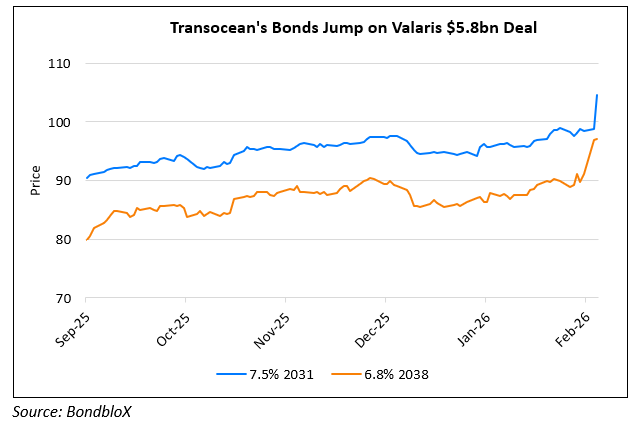

Transocean to Acquire Valaris for $5.8bn

February 10, 2026

Transocean has agreed to acquire rival Valaris Ltd. in an all-stock transaction valued at $5.8bn. Valaris shareholders will receive 15.2 Transocean shares per share owned, representing a 32% premium to the closing price of Valaris’ shares on Friday. The merger is set to create the world’s largest offshore rig contractor by market value, with a fleet of 73 rigs, including 33 ultra-deepwater drillships and 31 jackup vessels. The acquisition is expected to help Transocean reduce its significant debt load, analysts note. While Transocean previously exited the shallow-water market in 2017, it plans to retain Valaris’s fleet to generate incremental cash flow.

Transocean’s 7.5% 2031s jumped higher by 5 points to trade at 104.5, yielding 6.5%.

Go back to Latest bond Market News

Related Posts:

Sinopec Returns to the Dollar Bond Market for a Second Time in 2017

September 13, 2017

S&P Upgrades Yanlord by One Notch to ‘BB’

March 16, 2018