This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

The Week That Was (05 – 11 Jan, 2026)

January 12, 2026

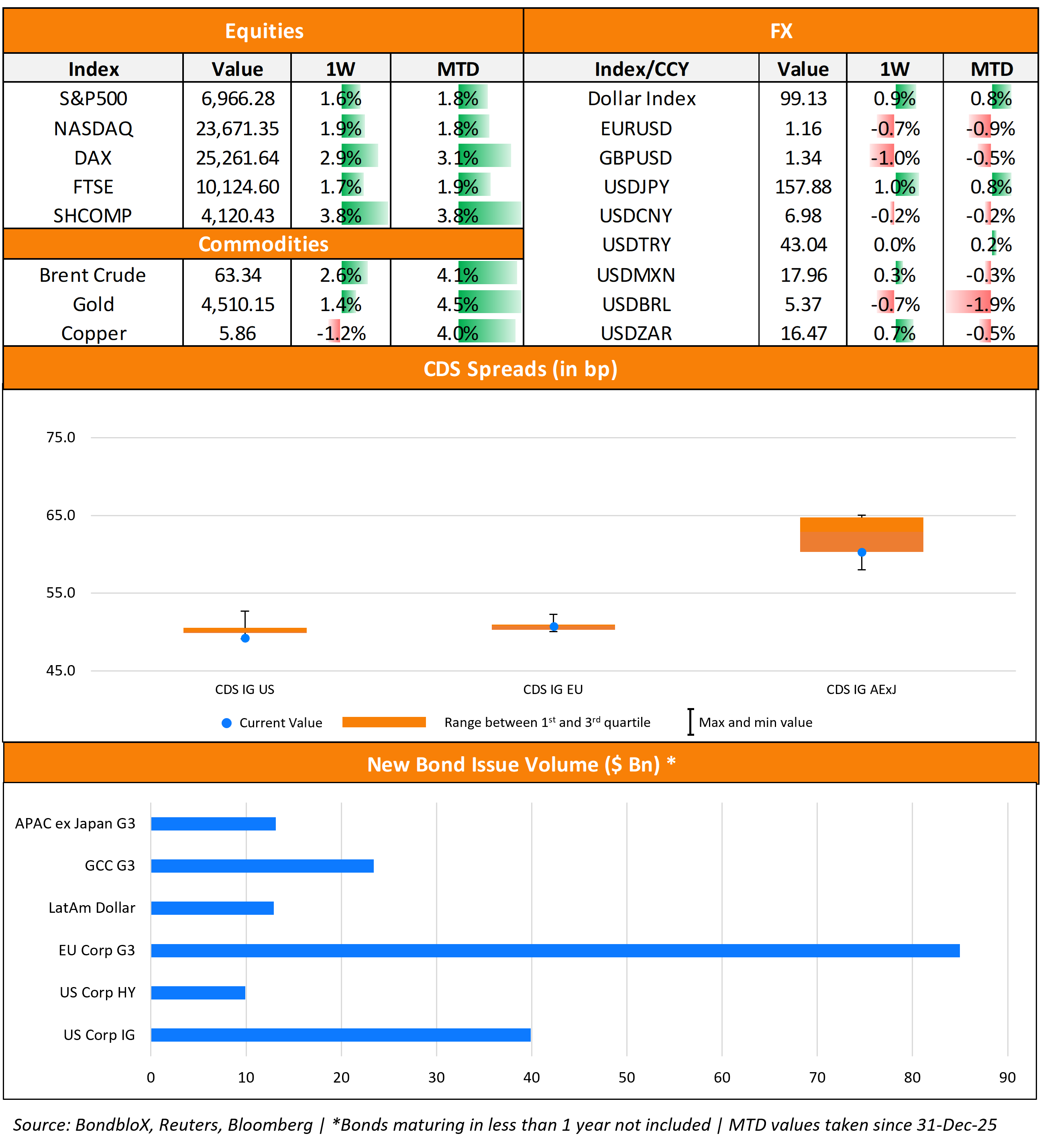

US primary market issuances stood at a massive $50bn in new deals to begin the year. IG issuers took up $39.9bn of the total, led by Broadcom’s $4.5bn deal, followed by Constellation Energy, Hyundai Motor and Williams Cos raising $2.75bn via multi-tranchers each. HY deals stood at $9.9bn, with volumes led by Charter Communications’ $3bn two-trancher and Artemis Holdings’ $1.65bn four-part deal. In North America, there were a total of 17 upgrades and 24 downgrades, across the three major rating agencies last week. US IG funds saw $4.1bn in inflows during the week ended January 7, adding to the $1bn inflows seen during the week before that. US HY bond funds saw $278mn in inflows, adding to the $542mn inflows seen in the prior week.

EU Corporate G3 issuances stood at nearly $85bn with volumes led by Orange’s $6bn multi-trancher, followed by Credit Agricole and UBS raising an overall $6.5bn and ~$4.1bn respectively. The region saw 7 upgrades and 10 downgrades across the three major rating agencies. Last week, the GCC dollar primary bond market saw $23.4bn in new deals with Saudi Arabia raising $11.5bn followed by Riyad Bank and Saudi Telecom Company’s $2bn two-tranchers each. In the Middle East/Africa region, there was 1 upgrade and downgrade each across the major rating agencies. LatAm saw $12.9bn in new deals led by Mexico’s $9bn three-part offering and Chile’s $850mn issuance. The South American region saw 2 upgrades and 1 downgrade, across the three major rating agencies last week.

G3 issuances from the APAC ex-Japan region last week stood at $13.1bn led by Korea raising $4.5bn via a six-trancher, NAB’s $2.5bn four-trancher and Clifford Capital’s $1bn two-trancher. In the APAC region, there was 1 upgrade and downgrade each across the three rating agencies.

Go back to Latest bond Market News

Related Posts: