This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

The Week That Was (02 – 08 February, 2026)

February 9, 2026

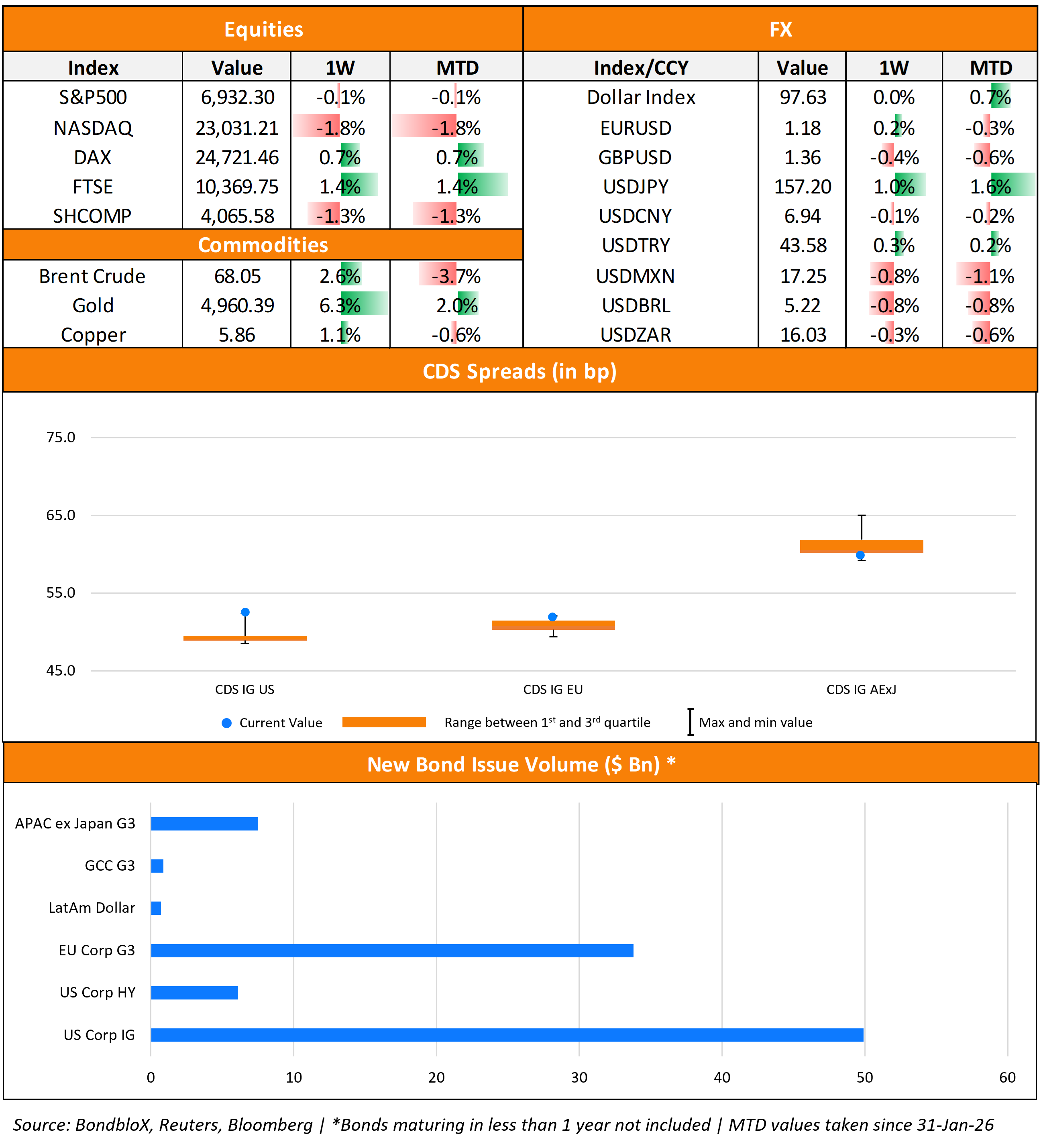

US primary market issuances jumped to $56.1bn vs. $40bn in the week prior to it. IG issuers took up $49.9bn of the total, led by Oracle’s $25bn eight-part deal, followed by BofA’s $7bn three-trancher and American Express’ $3.5bn four-tranche deal. HY deals stood at $6.1bn, with volumes led by Cipher Mining’s $2bn deal and Howard Hughes and United Airlines’ $1bn issuances each. In North America, there were a total of 41 upgrades and 26 downgrades, across the three major rating agencies last week. US IG funds saw $6.4bn in inflows during the week ended February 4, adding to the $5.4bn inflows seen during the week before that. This marked the highest weekly inflows into IG funds in over five years. US HY bond funds saw $421mn in inflows, adding to the $215mn inflows seen in the prior week.

EU Corporate G3 issuances stood at $33.8bn vs. $35.6bn a week earlier. UBS Group’s $5.25bn four-trancher led the tables, followed by Lloyds’ ~$4bn and ING Groep’s €3.8bn multi-currency issuances. The region saw 43 upgrades and 31 downgrades across the three major rating agencies. Last week, the GCC dollar primary bond market saw $860mn vs. $7.6bn in new deals in the prior week. Volumes were led by Binghatti’s $500mn issuance and Mubadala Investment’s $300mn deal. In the Middle East/Africa region, there was 1 upgrade and no downgrades across the major rating agencies. LatAm issuance dropped sharply to only $697mn compared to $12bn in new deals in the week prior. El Puerto de Liverpool SAB’s $500mn issuance and Abra Group’s $150mn deal led the tables. The South American region saw 2 upgrades and 3 downgrades, across the three major rating agencies last week.

G3 issuances from the APAC ex-Japan region last week stood at $7.5bn vs. $6.8bn with volumes led by Korea’s $3bn and CICC’s $1.4bn two-part deals each, followed by CDBL’s $700mn two-trancher and GLP Holdings’ $500mn issuance. In the APAC region, there were 13 upgrades and 27 downgrades each across the three rating agencies, with several Indonesian companies being downgraded after Moody’s revised the nation’s outlook to negative from stable.

Go back to Latest bond Market News

Related Posts: