This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

Sun Hung Kai Launches $ 3Y Bond; Colombia, Jefferies, SocGen, BNP and others Price Bonds

January 14, 2026

US Treasury yields were stable on Tuesday. US CPI YoY for December came in at 2.7%, inline with expectations and the prior reading. Core CPI YoY came in at 2.6%, lower than the surveyed 2.7% and inline with the prior month’s 2.6% reading. Following the data release, St. Louis Fed President Alberto Musalem said that the latest inflation reading was encouraging and that he expects it to resume converging towards the 2% target over the course of this year. On the other hand, US President Donald Trump said that the inflation reading supported the case for the Fed to cut interest rates.

Looking at US equity markets, the S&P and Nasdaq ended lower by 0.1-0.2%. US IG CDS spreads widened by 0.2bp and HY CDS spreads were wider by 0.1bp. European equity indices ended mixed. The iTraxx Main CDS spreads were 0.4bp wider while the Crossover CDS spreads were 0.6bp wider. Asian equity markets have opened with a positive bias this morning. Asia ex-Japan CDS spreads were tighter by 0.7bp.

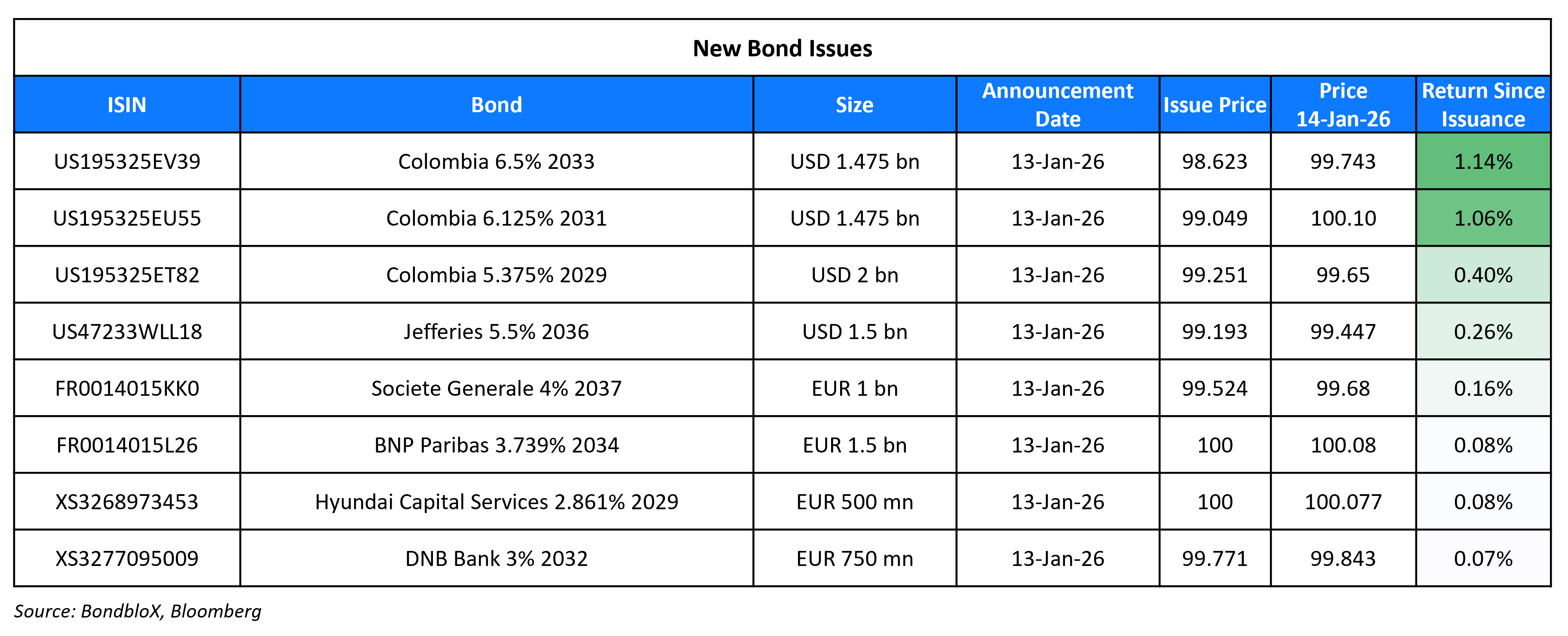

New Bond Issues

- Sun Hung Kai $ 3Y at 6.75% area

- ANZ New Zealand $ 3Y/3Y FRN/5Y FRN at T+75bp/SOFR eq./SOFR+105bp areas

Colombia raised $4.95bn via a three-tranche offering. It raised:

- $2bn via a 3Y bond at a yield of 5.65%, 35bp inside initial guidance of 6% area. The new bond is priced at a new issue premium of 30bp over its existing 4.5% 2029s that currently yield 5.35%.

- $1.475bn via a 5Y bond at a yield of 6.35%, 40bp inside initial guidance of 6.75% area. The new bond is priced at a new issue premium of 20bp over its existing 3.125% 2031s that currently yield 6.15%.

- $1.475bn via a 7Y bond at a yield of 6.75%, 35bp inside initial guidance of 7.1% area. The new bond is priced at a new issue premium of 37bp over its existing 10.375% 2033s that currently yield 6.38%.

The senior unsecured notes are rated Baa3/BB/BB. Proceeds will be used for general budgetary purposes.

Jefferies Financial Group raised $1.5bn via a 10Y bond at a yield of 5.605%, 27bp inside initial guidance of T+170bp area. The senior unsecured note is rated Baa2/BBB/BBB+. Proceeds will be used for general corporate purposes. The new bond is priced at a new issue premium of 13.5bp over its existing 6.25% 2036s that currently yield 5.47%.

Societe Generale raised €1bn via an 11NC10 bond at a yield of 4.059%, 30bp inside initial guidance of MS+150bp area. The senior non-preferred bond is rated Baa2/BBB/A- and received orders of over €3bn, 3x issue size.

DNB Bank ASA raised €750mn via a 6NC5 green bond at a yield of 3.05%, 27bp inside initial guidance of MS+80bp area. The senior preferred note is rated Aa2/AA- and received orders of over €2.1bn, ~2.8x issue size. Proceeds will be used to finance or refinance, in whole or in part, a portfolio of eligible green loans under the issuer’s green finance framework.

BNP Paribas raised €1.5bn via an 8.25NC7.25 green senior non-preferred bond at a yield of 3.741%, 25bp inside initial guidance of MS+130bp area. The notes are expected to be rated Baa1/A-/A+ and received orders of over €3.3bn, ~.2x the issue size. Proceeds will be used to finance or refinance eligible green assets as defined in its green framework.

Hyundai Capital Services raised €500mn via a 3Y bond at a yield of 2.861%, 38bp inside initial guidance of MS+90bp area. The senior unsecured note is rated A3/A- (Moody’s/Fitch) and received orders of over €2.2bn, ~4.4x the issue size. Proceeds will be used for general corporate purposes.

New Bonds Pipeline

- Toyota Finance Australia $ 3.25Y FRN/5Y bond

- Kuaishou $ bond offering

- Woori Bank $ 3Y/5Y sustainability bond

Rating Changes

- Kinder Morgan Inc., Operating Subsidiaries Upgraded To ‘BBB+’ On Solid Metrics And Track Record; Outlook Stable

- Green Bidco S.A.U. Downgraded To ‘CCC-‘ And Placed On Watch Negative; Ratings Then Withdrawn At Issuer’s Request

Term of the Day: Acceleration Notice

An acceleration notice is a bond clause which allows lenders to demand a borrower to immediately repay a bond if specific requirements are not met. Thus, the borrower must immediately pay unpaid principal and accumulated interest prior to the invocation of the notice. These notices are generally given when a borrower materially breaches the loan/debt agreement.

Talking Heads

On Chipping Away at Fed Independence ‘Not a Great Idea’ – Jamie Dimon, JPMorgan

“Everyone we know believes in Fed independence… anything that chips away at that is probably not a great idea. And in my view, will have the reverse consequences. It’ll raise inflation expectations and probably increase rates over time”

On Hedge Funds Turning Chaos Into Cash for Best Gains in 16 Years

Alexis Maubourguet, ADAPT Investment Managers

“2025 was the year when everybody won… There was something for everyone, which is quite rare”

Mike Pyle, deputy head of BlackRock

“Hedge funds are an area where we have seen a sizable resurgence in client interest”

Marlin Naidoo, BNP Paribas

“We know people want to add more into their portfolio, but many of the managers they want are closed to new capital”

On India’s Interest Rate in Neutral Zone – Sanjay Malhotra, RBI Governor

“We are in a neutral stage on rates… Inflation is at a level we are comfortable with… primarily because of supply side reasons, but a lot of it is because of base effect”

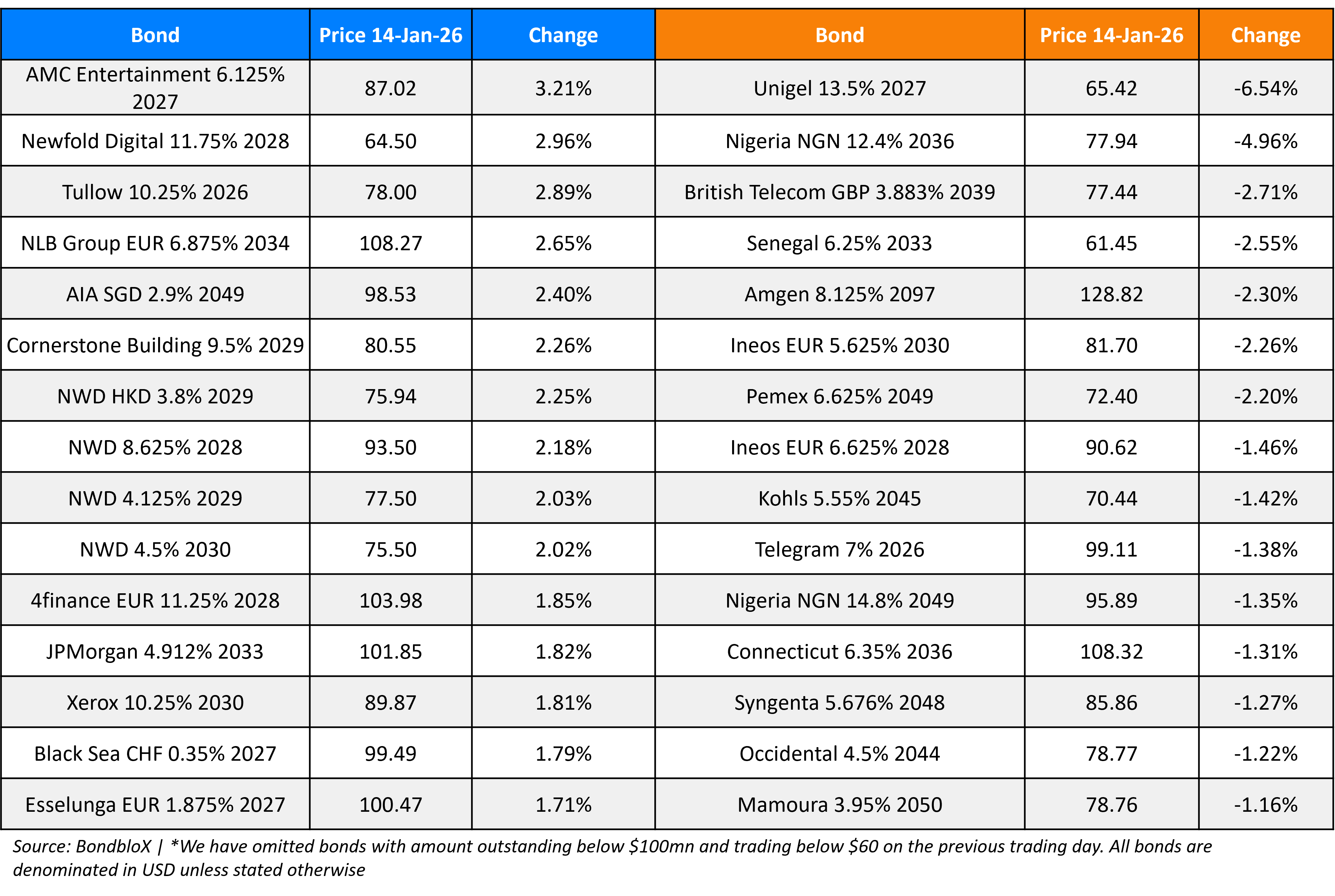

Top Gainers and Losers- 14-Jan-26*

Go back to Latest bond Market News

Related Posts: