This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

StanChart, NAB, Emirates NBD and Others Price Bonds

January 7, 2026

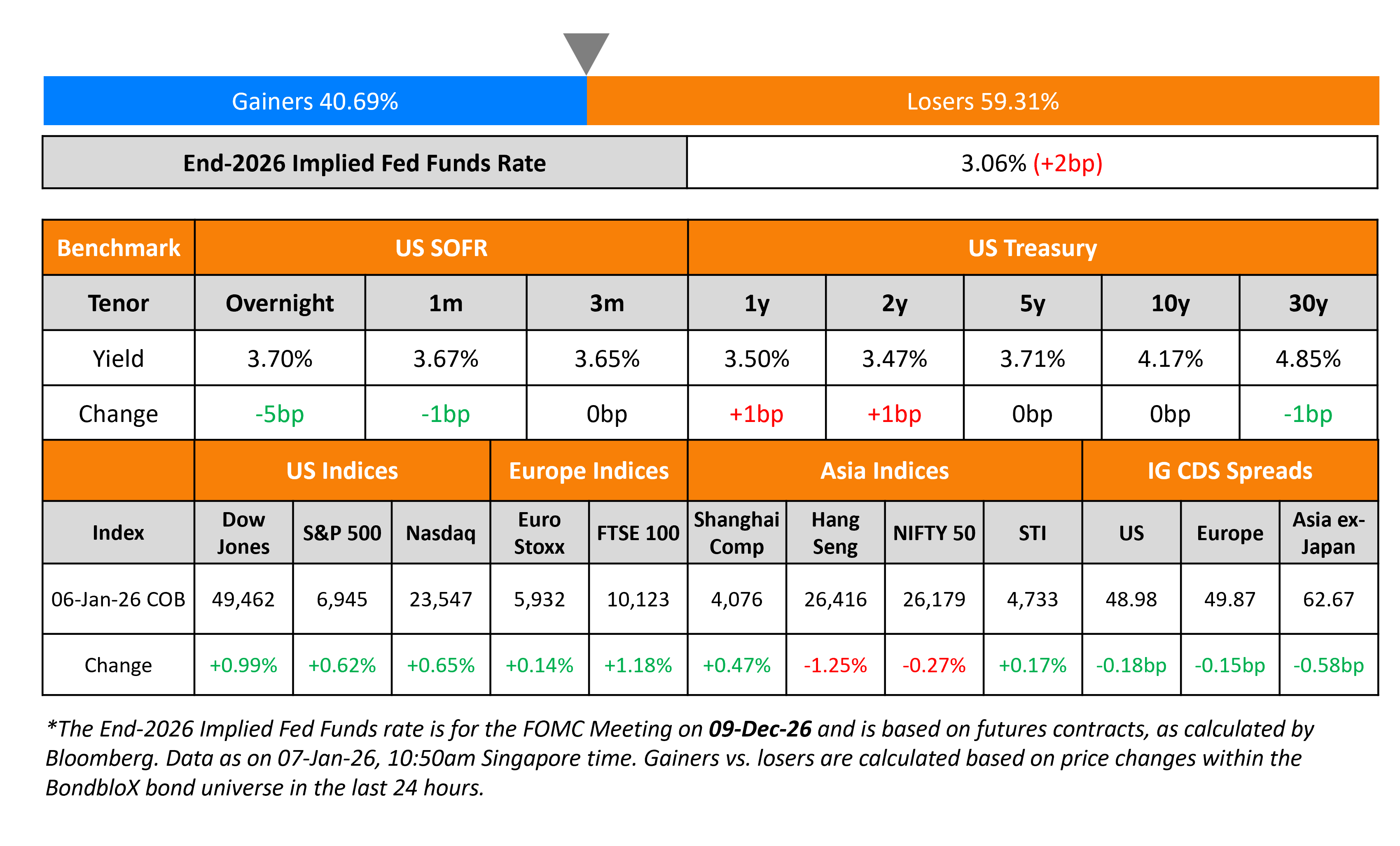

US Treasury yields were broadly steady across the curve. The final reading of the S&P Services PMI for December came in at 52.5, softer than expectations of 52.9. Markets await the ISM Services PMI and ADP Employment Change reports later today. Fed Governor Stephen Miran said that aggressive rate cuts are needed this year to keep the economy moving forward, adding that “well over 100 basis points of cuts are going to be justified this year”. Miran’s term as a Fed governor ends on January 31.

Looking at US equity markets, the S&P and Nasdaq again rallied by 0.6-0.7%. US IG CDS spreads tightened by 0.2bp while HY CDS spreads were tighter by 0.4bp. European equity indices ended higher too. The iTraxx Main CDS spreads were 0.2bp tighter while the Crossover CDS spreads were 0.1bp wider. Asian equity markets have opened weaker this morning. Asia ex-Japan CDS spreads were tighter by 0.6bp.

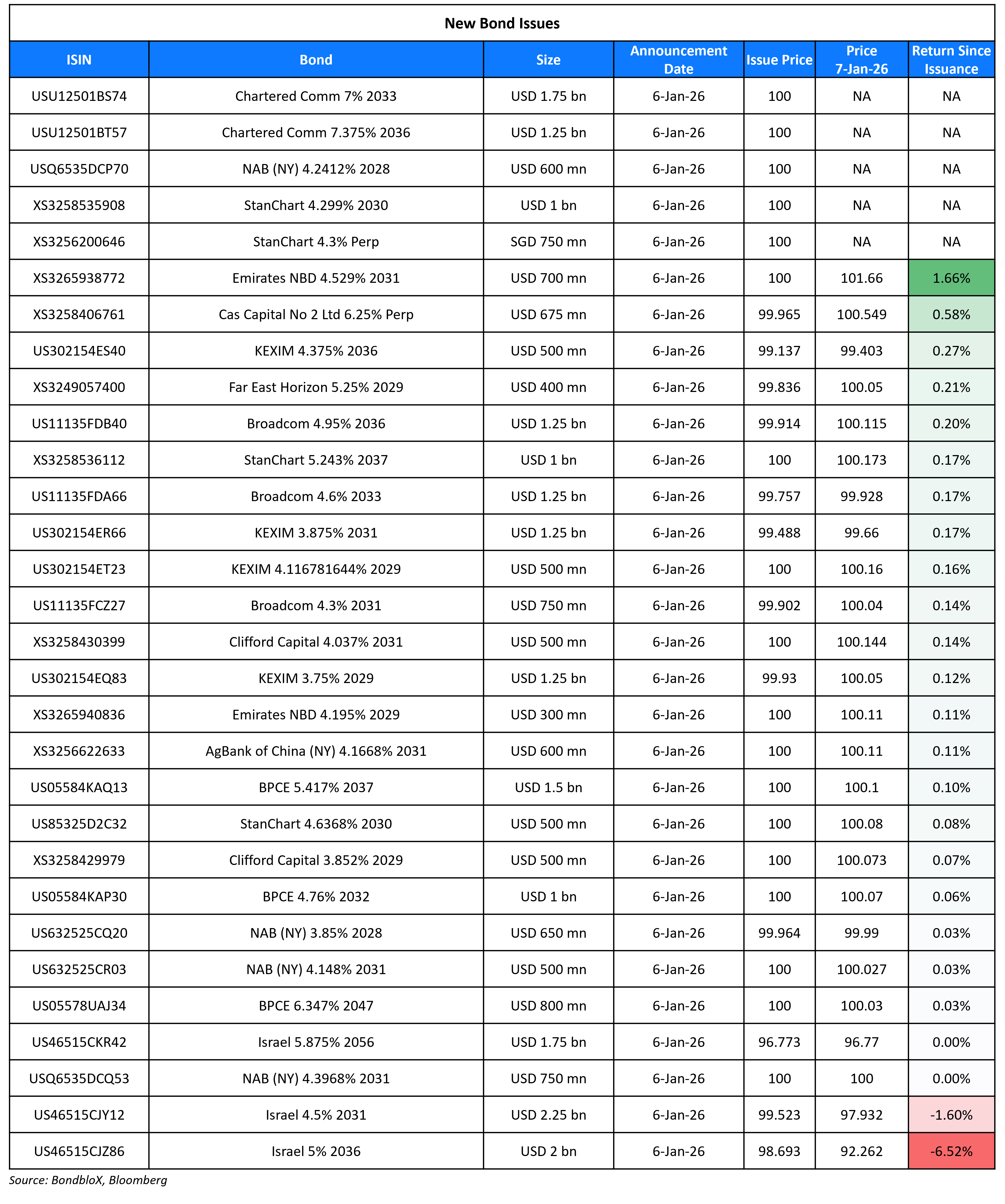

New Bond Issues

Standard Chartered raised S$ 750mn via a PerpNC5.5 AT1 at a yield of 4.3%, 40bp inside initial guidance of 4.7% area. The junior subordinated note is rated Ba1/BB+/BBB- (Moody’s/S&P/Fitch). If not called before 15 January 2032, the coupon will reset to the SGD 5Y OIS Swap + 226.3bp. Proceeds will be used for general business purposes of the Group and to strengthen further the regulatory capital base of the Group. The bond was priced 10bp tighter compared to SGD Barclays 4.65% Perp (reset in Mar 2032 and rated Ba1/BBB-) that currently yields 4.4%. Separately, Standard Chartered also raised $2.5bn via a three-trancher. It raised:

- $1bn via a 4NC3 bond at a yield of 4.299%, 28bp inside initial guidance of T+105bp area

- $500mn via a 4NC3 FRN at SOFR+92bp vs. initial guidance of SOFR equivalent area

- $1bn via an 11NC10 bond at a yield of 5.243%, 28bp inside initial guidance of T+135bp area

The senior unsecured notes are rated A3/BBB+/A. Proceeds will be used for general corporate purposes.

Emirates NBD raised $1bn via a two-tranche offering. It raised $300mn via a 3Y blue bond at a yield of 4.195%, 30bp inside initial guidance of T+95bp area. It also raised $700mn via a 5Y green bond at a yield of 4.529%, 30bp inside initial guidance of T+110bp area. The senior unsecured notes are rated A1/A+, and received orders of ~$2.2bn, 2.2x issue size. Proceeds will be used to finance or refinance eligible green and Shariah-compliant assets in line with the bank’s Sustainable Finance Framework.

Israel raised $6bn via a three-trancher. It raised:

- $2.25bn via a 5Y bond at a yield of 4.608%, 30bp inside initial guidance of T+120bp area

- $2bn via a 10Y bond at a yield of 5.169%, 30bp inside initial guidance of T+130bp area

- $1.75bn via a 30Y bond at a yield of 6.111%, 25bp inside initial guidance of T+150bp area

The senior unsecured notes are rated Baa1/A/A. Proceeds will be used for general corporate purposes.

Clifford Capital raised $1bn via a two-tranche offering. It raised $500mn via a 3Y bond at a yield of 3.852%, 30bp inside initial guidance of T+62bp area. It also raised $500mn via a 5Y bond at a yield of 4.037%, 33bp inside initial guidance of T+65bp area. The senior unsecured notes are guaranteed by the Government of Singapore. Proceeds will be used for general corporate purposes.

CAS Capital raised $675mn via a PerpNC5.25 bond at a yield of 6.25%, 37.5bp inside initial guidance of 6.625% area. The subordinated note is rated Ba2/BB/BB and is issued by CAS Capital No. 2 Limited and guaranteed by CAS Holding No. 1 Ltd. If not called by 13 April 2031, the coupon will reset to the prevailing 5Y UST + 253.3bp. The note has a coupon step-up of 25bp on 13 April 2036 and an additional 75bp on 13 April 2051 if not redeemed by then. Proceeds will be on-lent to the PCCW Group to redeem its outstanding $750m Perp, including amounts tendered under its concurrent tender offer.

Far East Horizon raised $400mn via a 3Y bond at a yield of 5.31%, 37bp inside initial guidance of T+215bp area. The senior unsecured note is rated BBB- by S&P. Proceeds will be used for working capital and general corporate purposes, with a portion potentially on-lent to PRC subsidiaries subject to the relevant approvals.

BPCE raised $3.3bn via a three-trancher. It raised:

- $1bn via a 6NC5 bond at a yield of 4.76%, 25–30bp inside initial guidance of T+130/135bp area

- $1.5bn via an 11NC10 bond at a yield of 5.417%, 25–30bp inside initial guidance of T+150/155bp area

- $800mn via a 21NC20 Tier-2 bond at a yield of 6.347%, 30bp inside initial guidance of T+185bp area

The senior non-preferred notes are rated Baa1/BBB+/A, while the Tier 2 note is rated Baa2/BBB/BB+. Proceeds will be used for general corporate purposes.

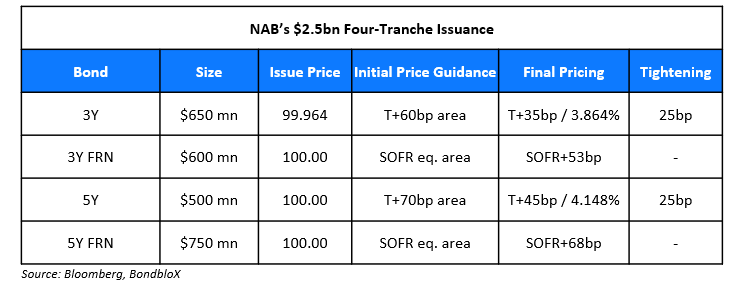

NAB raised $2.5bn via a four-part deal.

The senior unsecured notes are rated Aa2/AA- (Moody’s/S&P). Proceeds will be used for general corporate purposes.

Agricultural Bank of China raised $600mn via a 5Y FRN at SOFR+45bp, 60bp inside initial guidance of SOFR+105bp area. The note is rated A1/A/A. Proceeds will be used for general corporate purposes.

Charter Communications raised $3bn via a two-tranche offering. It raised $1.75bn via a 7NC3 bond at a yield of 7.0%, 12.5bp inside initial guidance of 7.125% area. It also raised $1.25bn via a 10NC5 bond at a yield of 7.375%, 12.5bp inside initial guidance of 7.5% area. The senior unsecured notes are rated B1/BB-/BB+. Proceeds will be used for general corporate purposes, including refinancing existing indebtedness and funding potential share buybacks.

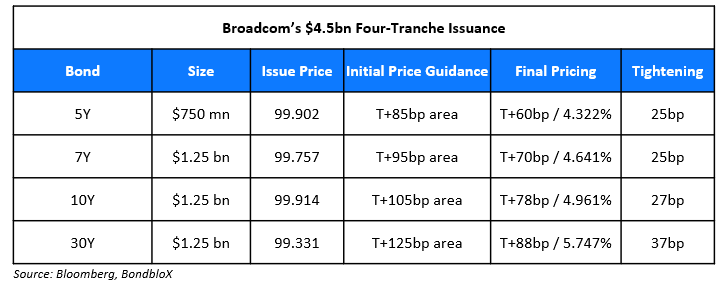

Broadcom raised $4.5bn via a four-part issuance.

The senior unsecured notes are rated A3/A-/BBB+. Proceeds will be used for general corporate purposes and for debt repayment.

Rating Changes

- Moody’s Ratings downgrades Baytex’s CFR to B1, senior unsecured notes to B3; outlook stable

- Moody’s Ratings downgrades Murphy’s senior unsecured notes to Ba3; affirms Ba2 CFR

- Fitch Places JSW Steel’s ‘BB’ Rating on Rating Watch Positive

- Moody’s Ratings changes Vistra’s outlook to stable from positive; ratings affirmed

New Bonds Pipeline

- Thai Oil $ Perp

- Riyad Bank $ 10NC5 Tier-2 bond

- Saudi Telecom $ 5Y/10Y bond

- Al Rajhi $ PerpNC6 AT1 sukuk

Term of the Day: Special Purpose Vehicle (SPV)

An SPV is a separate legal entity with its own assets and liabilities created by an organization (parent). SPVs are typically setup for a specific purpose such as issuing debt. SPVs can be in the form of limited partnerships, trusts, corporations or limited liability companies. Some benefits of setting up SPVs include:

- Isolating financial risk for the parent that is setting up the SPV

- Securitization of assets

- Tax savings if the SPV is domiciled in a tax haven such as the Cayman Islands

Some SPVs can also be referred to as ‘bankruptcy-remote entities’ in that its operations are limited to the acquisition and financing of specific assets in order to isolate financial risk.

Talking Heads

On Venezuela debt rally belying complex creditor web, political quagmire

Graham Stock, RBC BlueBay Asset Management

“I can’t really see anything happening inside a couple of years… complexity of the situation, the uncertainty on the politics, the uncertainty on the economic numbers, it’s just hard to imagine it being an easy thing to achieve”

Robert Koenigsberger, Gramercy

“Before we figure out the sequencing of a debt restructuring, there has to be a complete change in the sanctions regime… still very high risk and very unpredictable “

On EM Bond-Risk Premium Over Treasuries at its Lowest in 13 Years

Anders Faergemann, PineBridge

“Fundamentals in emerging markets are generally stronger and we view technical factors as conducive to risk, offsetting historically tight spreads”

Luis Olguin, a money manager at William Blair

“Even though spreads are tight, if the Fed continues cutting rates, long-duration EM assets could still see capital gains as yields move lower”

On Oracle’s Debt ‘Unlikely’ to Trigger Cut to Junk Grade – UBS

Investors have already priced in much of the credit risk and credit-rating companies will likely be “somewhat patient… A downgrade to junk in the first-quarter is not our baseline and in fact is probably quite unlikely”

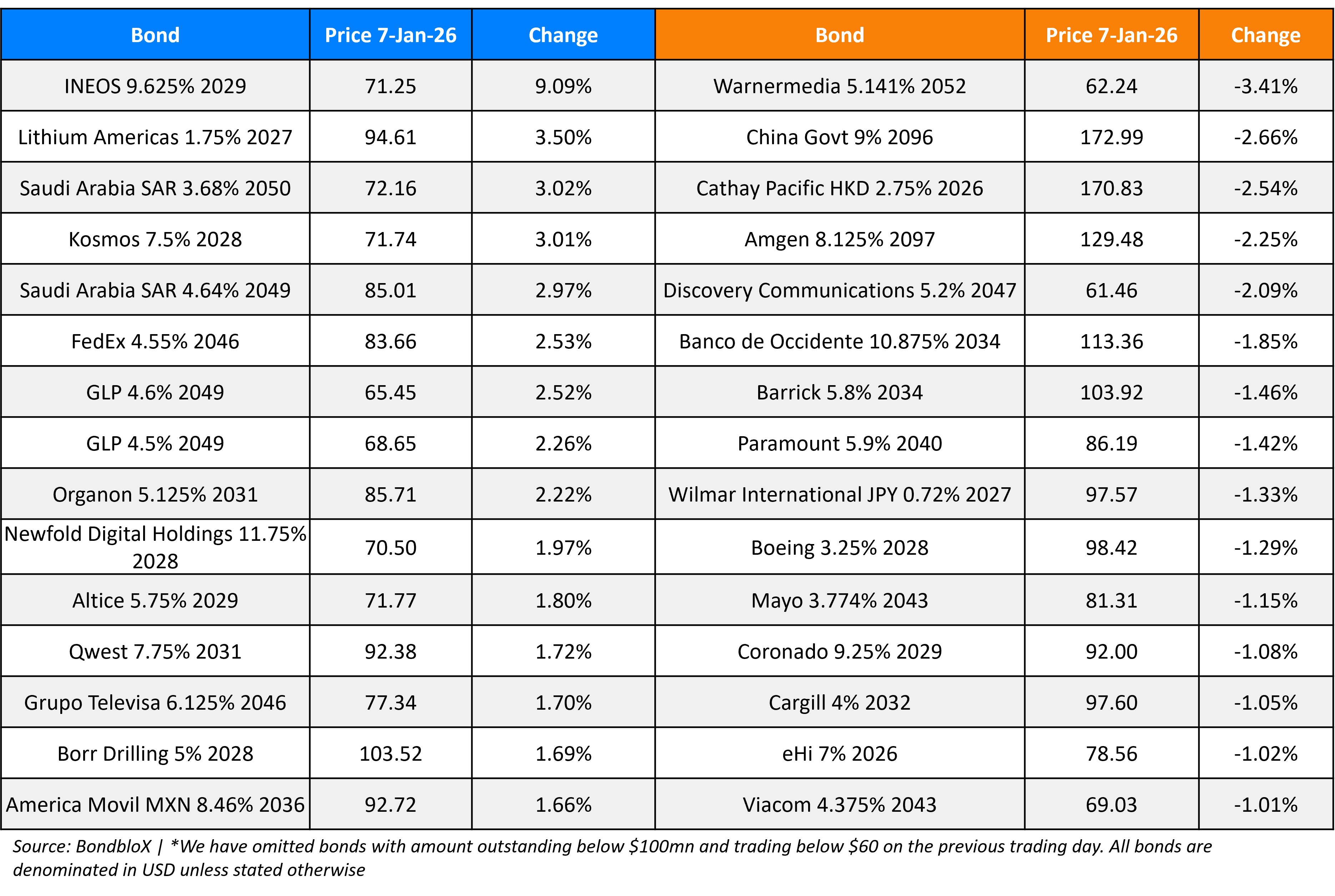

Top Gainers and Losers- 07-Jan-26*

Go back to Latest bond Market News

Related Posts: