This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

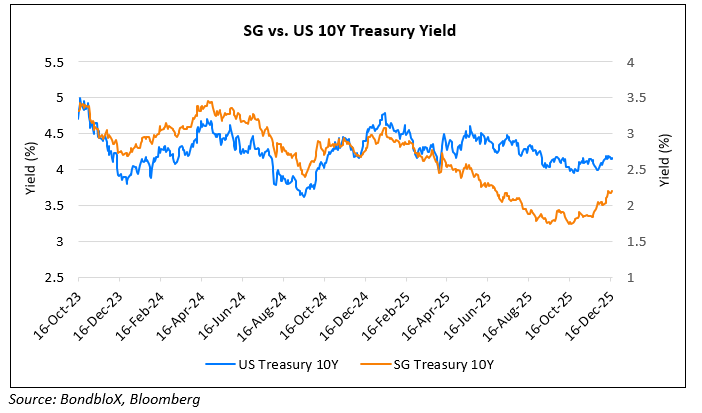

Singapore Bonds Decoupling from US Treasuries

December 18, 2025

Singapore government bonds are increasingly decoupling from US Treasuries, signaling that investors are seeking alternatives to dollar assets. According to Bloomberg, the correlation between the two markets has fallen to near zero, reflecting strong demand for Singapore’s AAA-rated bonds amid concerns over US fiscal health and renewed volatility risks surrounding Federal Reserve independence. Singapore’s fiscal discipline and safe-haven appeal have helped its bonds outperform, even as yields rise across other developed markets such as Japan and Germany. Haven inflows have boosted domestic liquidity, lowering interbank borrowing costs and supporting bond performance. As per Bloomberg Singapore Total Return Unhedged USD Index, Singapore bonds have delivered strong returns of nearly 14% to dollar-based investors this year, marking their best performance in decades. Market participants say rising interest in high-quality Asian local-currency bonds, driven by de-dollarization trends, should continue to underpin foreign demand for Singapore government bonds. The chart above shows how the US and SG 10-year Treasuries have moved over the last two years.

For more details, click here

Go back to Latest bond Market News

Related Posts:

Pimco calls for Indian Sovereign Bond

May 26, 2017

China to Issue First Sovereign Bond since 2004

June 15, 2017