This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

SIA, Philippines, Woori Bank and others Launch Bonds

January 20, 2026

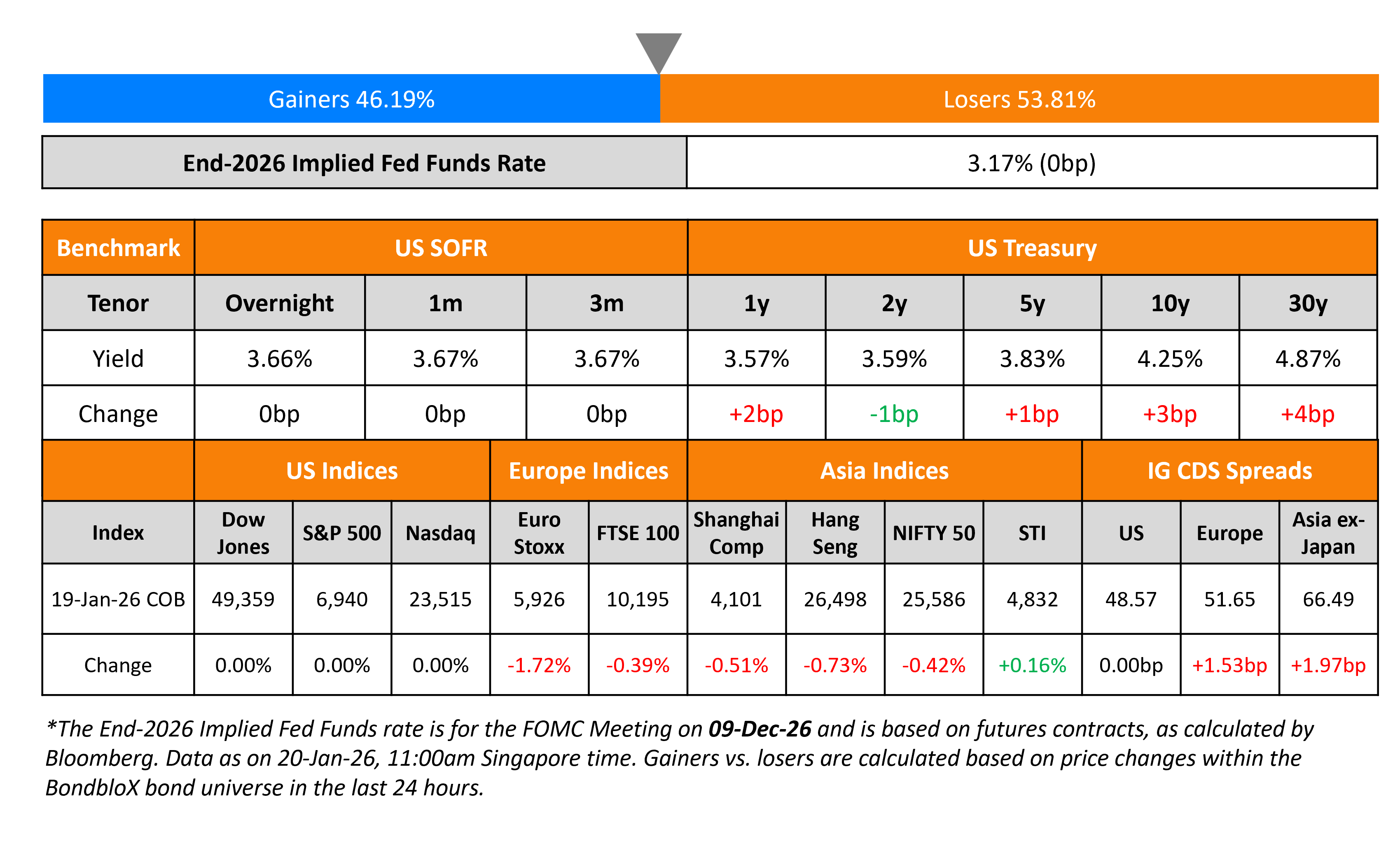

The US Treasury yield curve continues to steepen, with the 10Y higher by 3bp and the 2Y yield down by 1bp this morning. There were no major data points yesterday due to a US holiday on account of Martin Luther King Jr Day. Both US equity and credit markets were closed yesterday. European equity indices ended lower across the board amid geopolitical risks concerning Greenland — the US is set to deploy military aircrafts while Denmark has boosted the presence of troops in the region. Over the weekend, US President Donald Trump announced a 10% tariff on eight European countries, set to increase to 25% in June unless a deal for Greenland is reached. The iTraxx Main CDS spreads were 1.5bp wider and the Crossover CDS spreads were 7.1bp wider. Asian equity markets have opened with a negative bias this morning. Asia ex-Japan CDS spreads were wider by 2bp.

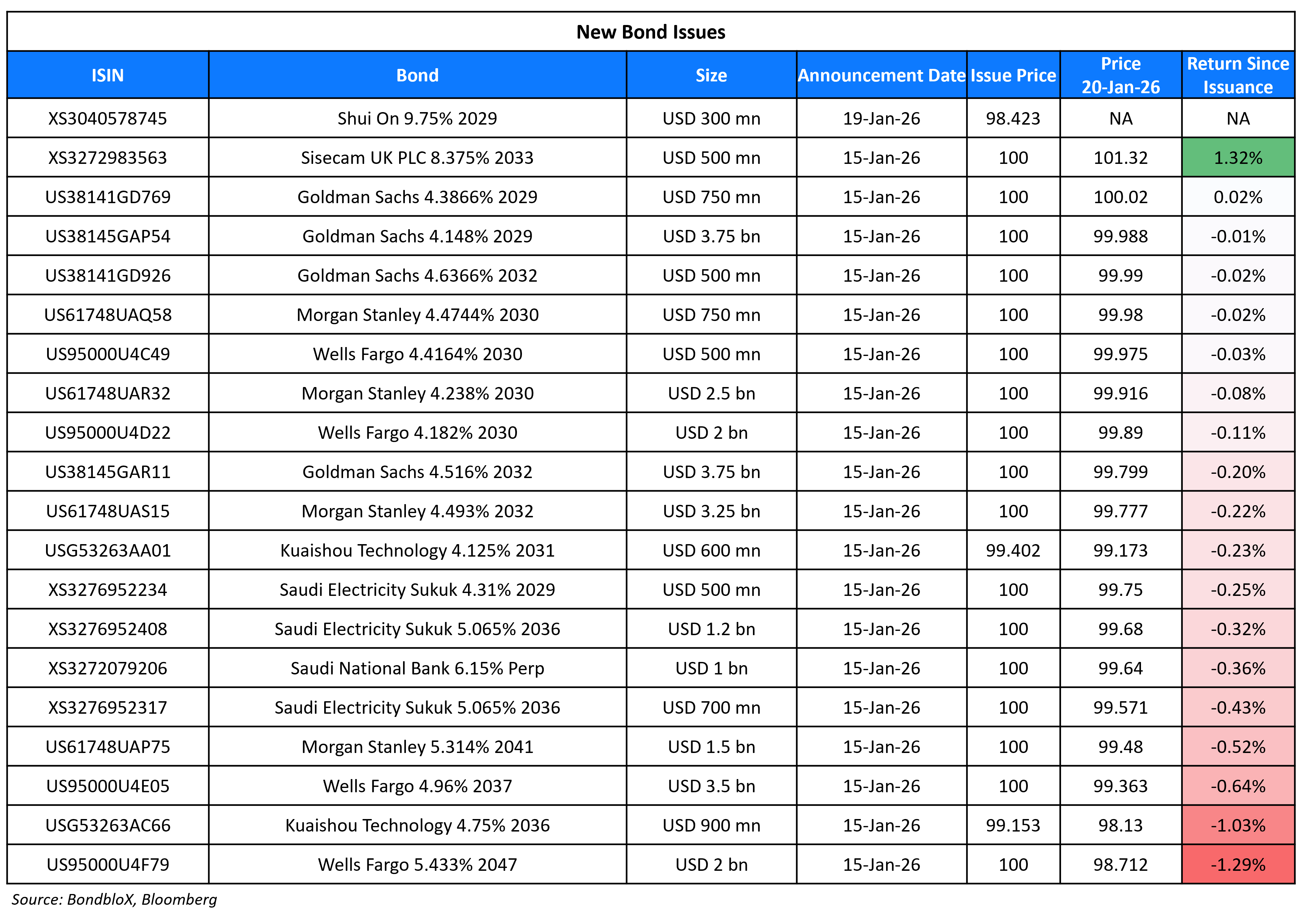

New Bond Issues

- Singapore Airlines S$ 10Y at 2.95% area

- Philippines $ 5.5Y/10Y/25Y at T+70bp/T+100bp/5.9% areas

- Woori Bank $ 3Y FRN/5Y at SOFR+85bp/T+70bp areas

- Toyota Finance Australia $ 3.25Y FRN/5Y at SOFR+90bp/T+85bp areas

- China Oil & Gas $ 3NC2 at 7.25% area

Shui On Land raised $300mn via a 3NC1.5 bond at a yield of 10.375%, 25bp inside initial guidance of 10.625% area. The senior unsecured note is unrated. Proceeds will be used for its concurrent tender offer and any remaining balance to refinance other existing debt and for general corporate purposes.

New Bonds Pipeline

-

ReNew Treasury IFSC $ green bond

Rating Changes

- Companhia Siderurgica Nacional Downgraded To ‘B+’ On Timing And Execution Risks To Leverage Reduction; Outlook Negative

- Ukrainian Railways JSC Downgraded To ‘SD’ On Missed Coupon Payment

- Moody’s Ratings downgrades DWCM’s and Wanda HK’s ratings, outlook remains negative

Term of the Day: Floater/FRN

Floating Rate Bonds are also known as floaters or FRNs (floating rate notes). These are bonds with a variable interest rate unlike fixed rate bonds. Floaters are considered attractive for investors in a rising interest rate environment since the interest rate/coupon gets re-adjusted periodically (semi-annually/quarterly etc.), linked to benchmark rates such as SOFR.

Talking Heads

On Markets Will Punish a Fed That Bows to Trump – Picton Investments

“There is a relationship between the amount of Truth Social that gets posted and what’s happening in the debasement trade — that is, gold, silver and these commodity-based hedges… bond vigilantes out there may have something to say about this”

On cutting EM FX view on overcrowding worries – JP Morgan Strategists

“There are times to reduce risk in the short term due to overcrowding and this is one of those times in our view… flagged the build-up of positioning in EM currencies and this is now enough for us to take profits in the short term”

“We find that global growth remains quite resilient… in a sense, the global economy is shaking off the trade and tariff disruptions of 2025 and is coming out ahead of what we were expecting before it all started”

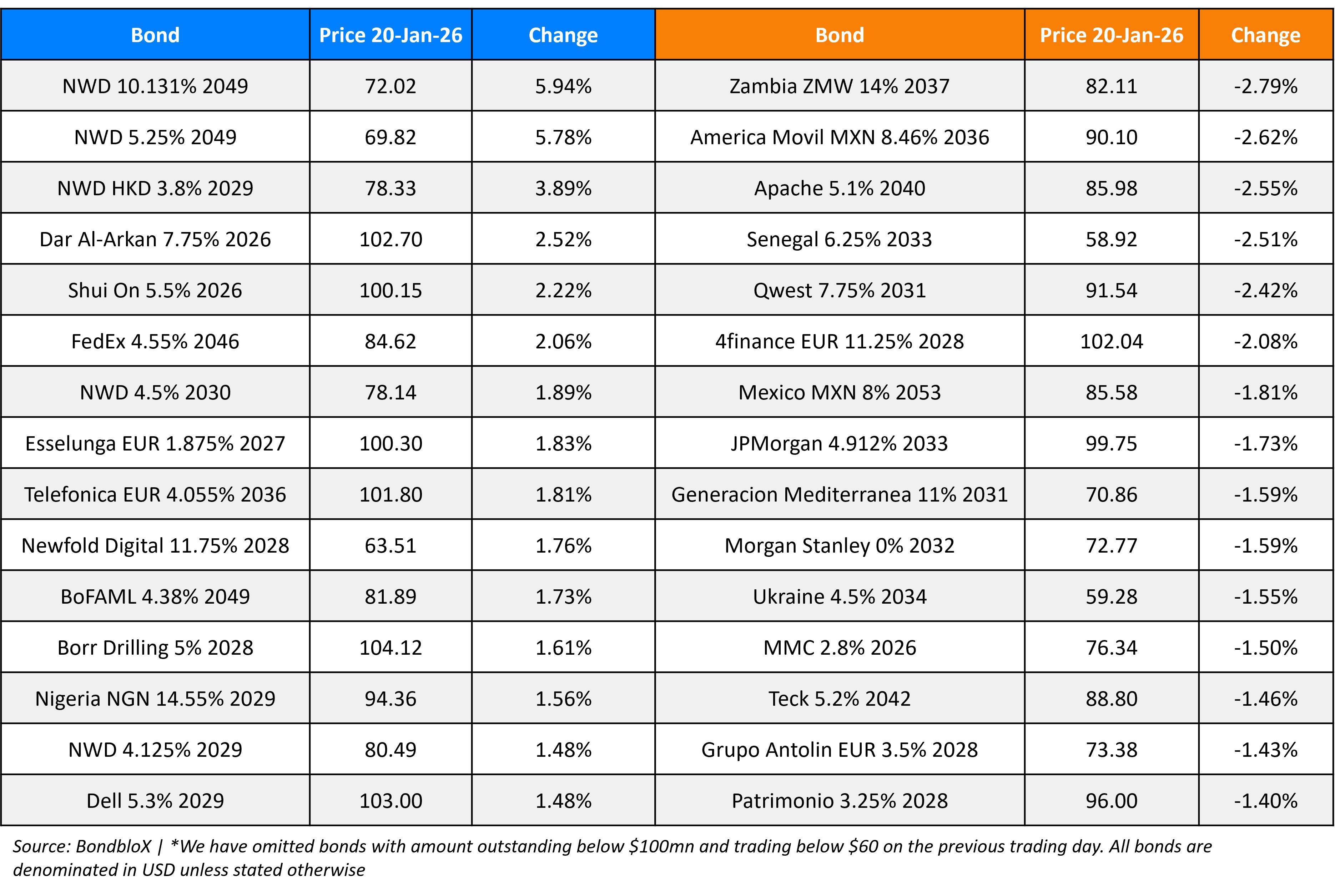

Top Gainers and Losers- 20-Jan-26*

Go back to Latest bond Market News

Related Posts: