This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

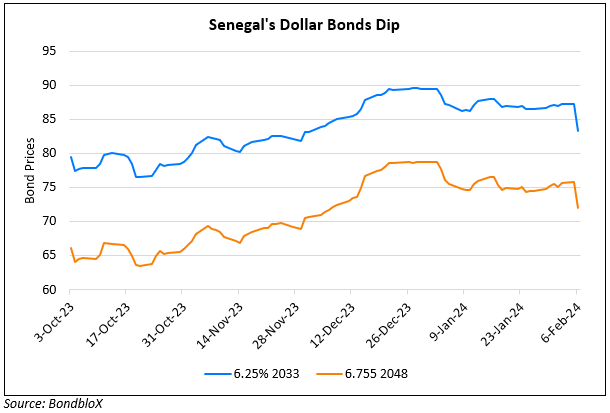

Senegal’s Dollar Bonds Tick Higher as Prime Minister Rules Out Debt Restructuring Again

January 12, 2026

Senegal’s dollar bonds inched higher after Prime Minister Ousmane Sonko reiterated that the government will not pursue a debt restructuring and instead rely on domestic markets to finance its budget and service its debt. Sonko said Senegal has continued servicing its debt for the past 18 months without external support and highlighted a XOF 560bn ($1bn) oversubscribed regional bond sale as evidence of funding access, despite limited entry to global markets. While markets welcomed the firm stance, analysts cautioned that heavier dependence on local borrowing offers only temporary relief and could worsen refinancing risks. Economists warn domestic issuance may crowd out private credit and strain sustainability over time, noting that some fiscal adjustment will likely be required to secure a new IMF program, even as President Bassirou Diomaye Faye backs the government’s opposition to restructuring.

Senegal’s dollar bonds touched their November highs with its 6.25% 2033s at 63.8, yielding 14.4%.

For more details, click here

Go back to Latest bond Market News

Related Posts:

Senegal’s Dollar Bonds Drop 4 Points on Election Postponement

February 6, 2024

Senegal’s Dollar Bonds Trend Higher on Political Developments

September 11, 2024