This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

Senegal Turns to Local Currency Borrowing for Refinancing

December 15, 2025

Senegal’s finance minister Cheikh Diba told lawmakers that the country’s debt metrics are beginning to improve, as the government increasingly relies on local-currency borrowing and better refinancing terms. Despite debt rising to 132% of GDP at end-2024, Diba said Senegal is consistently securing more advantageous refinancing conditions and expects continued fiscal adjustments to bring debt down to more acceptable levels. With access to international markets constrained after the discovery of $7bn in previously unreported liabilities, Senegal has leaned heavily on the West African regional debt market, where it now accounts for 31% of net issuance, and plans to fund most of its 2026 budget gap through CFA franc and euro-denominated borrowing, diaspora bonds, sukuk and multilateral partnerships. Despite this, financing pressures remain acute. This comes after the IMF suspended an $1.8bn program, S&P downgraded the sovereign deeper into junk, and some banks warned that restructuring may become unavoidable by 2026. The government, however, insists it will not pursue a restructuring and expects reforms to support stronger revenue growth, moderating inflation and 5% GDP growth in 2026, even as debt-service costs climb 12% next year.

Senegal’s 6.25% 2033s were trading lower by 0.6 points at 59.6, yielding 15.85%.

For more details, click here

Go back to Latest bond Market News

Related Posts:

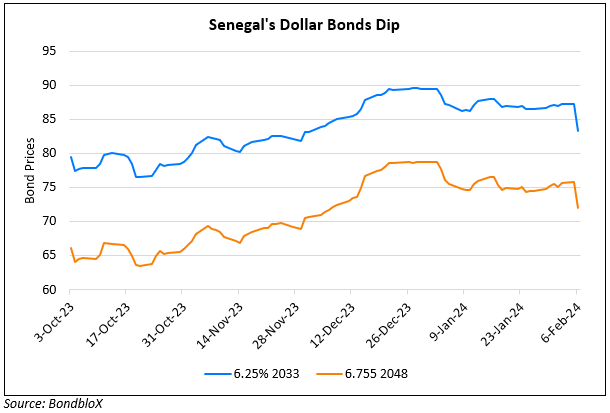

Senegal’s Dollar Bonds Drop 4 Points on Election Postponement

February 6, 2024

Senegal’s Dollar Bonds Trend Higher on Political Developments

September 11, 2024