This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

Scotiabank, CFE, ReNew and others Price $ Bonds

January 23, 2026

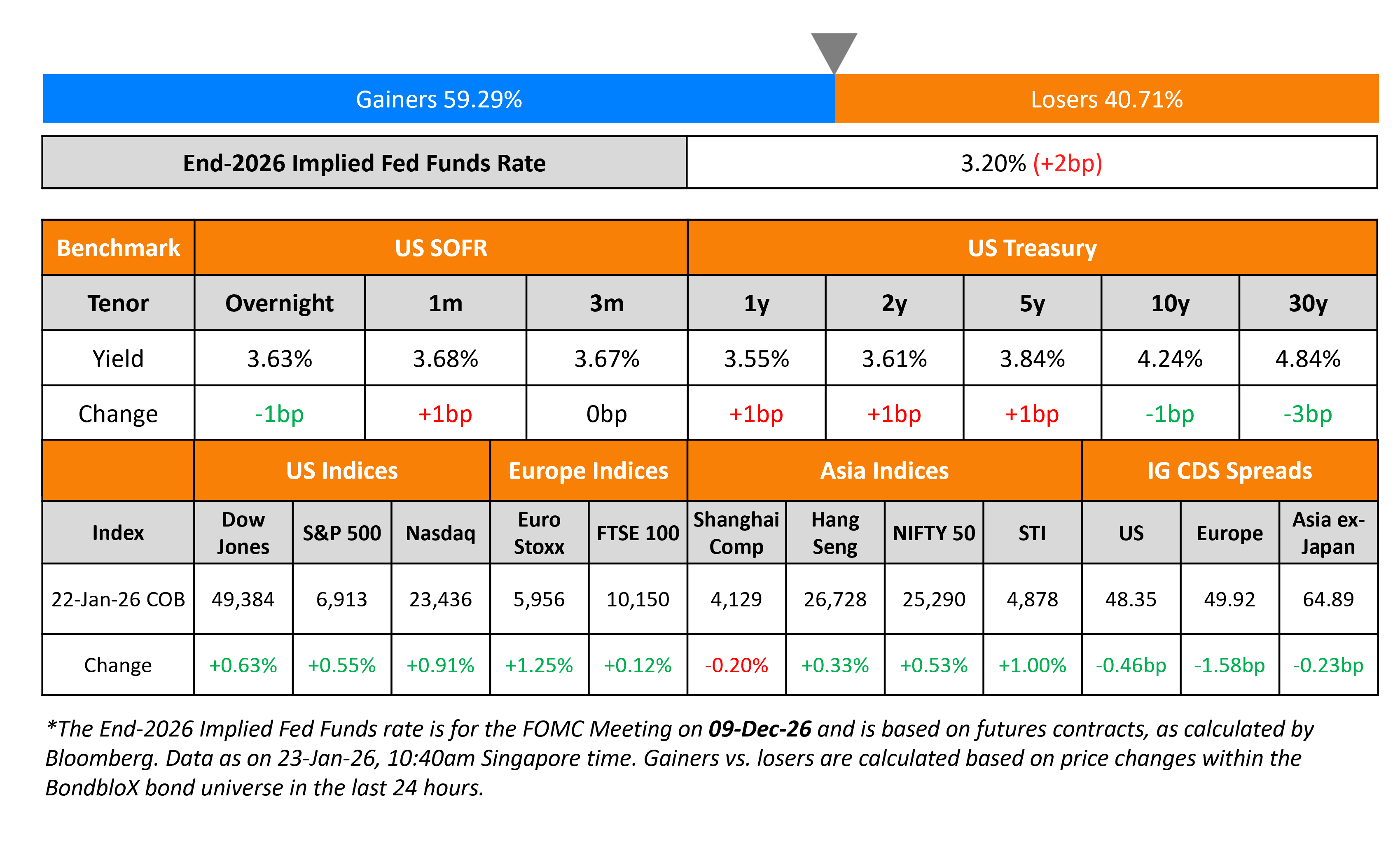

US Treasury yields were broadly stable across the curve. The final reading of US Q3 GDP came in at 4.4%, better than expectations of 4.3%, thus accelerating at its fastest pace in two years. Separately, initial jobless claims for the previous week came in at 200k, better than expectations of 209k.

Looking at US equity markets, the S&P and Nasdaq ended higher by 0.6% and 0.9% respectively. US IG CDS spreads tightened by 0.5bp and HY CDS spreads were 1.9bp tighter. European equity indices ended higher too. The iTraxx Main CDS spreads were 1.6bp tighter and the Crossover CDS spreads were 8bp tighter. The Turkish central bank cut its one-week repo rate by 100bp to 37%, less than economists’ expectations of a 150bp cut. Asian equity markets have opened higher this morning. Asia ex-Japan CDS spreads were tighter by 0.2bp.

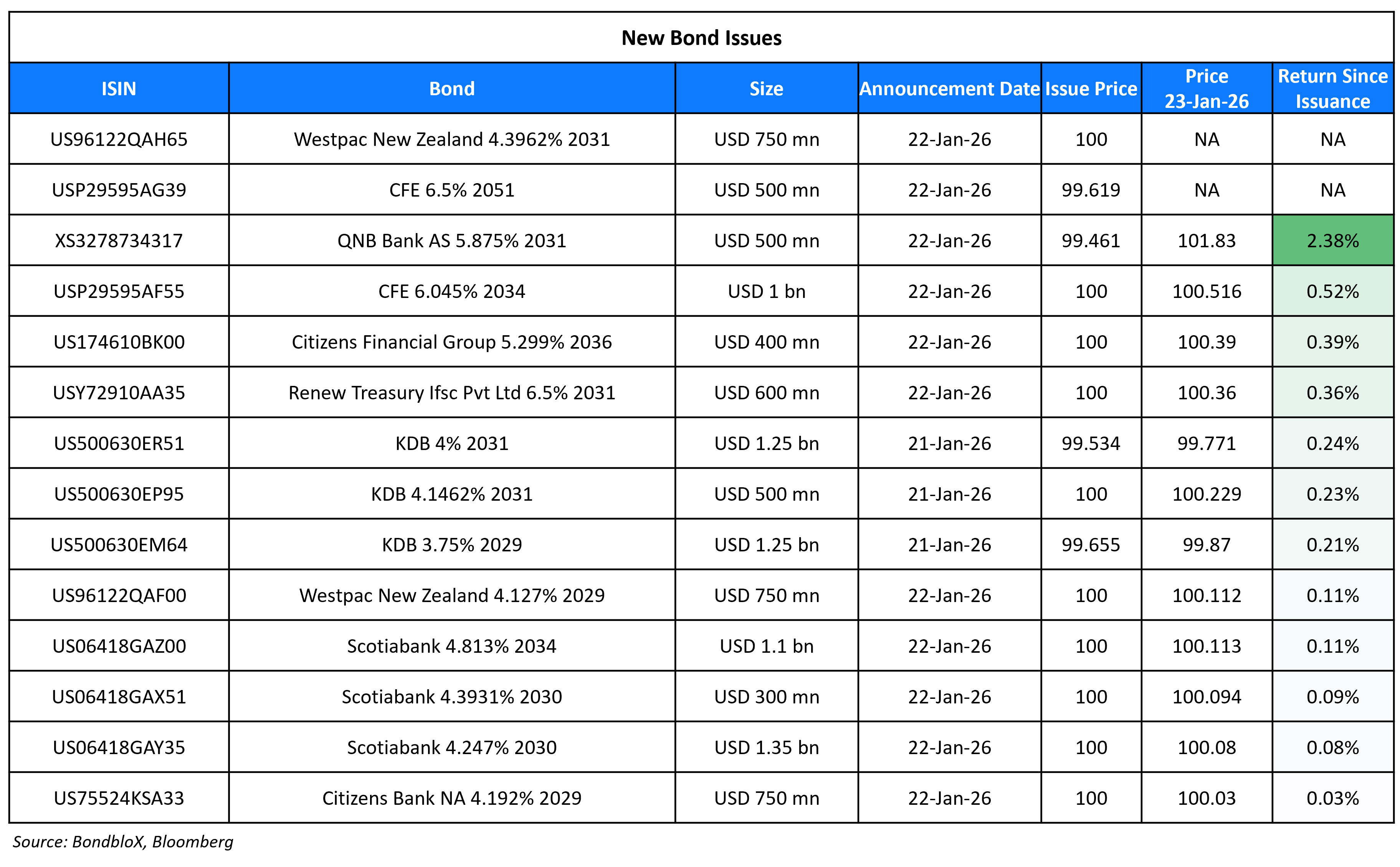

New Bond Issues

Scotiabank raised $2.75bn via a three-tranche offering. It raised:

- $1.35bn via a 4NC3 bond at a yield of 4.247%, 28bp inside initial guidance of T+85bp area.

- $300mn via a 4NC3 FRN at SOFR+73bp vs initial guidance of SOFR equivalent area.

- $1.1bn via an 8NC7 bond at a yield of 4.813%, 28bp inside initial guidance of T+105bp area.

The senior unsecured notes are rated A2/A-/AA-. Proceeds will be used for general corporate purposes.

Comision Federal de Electricidad (CFE) raised $1.5bn via a two-tranche offering. It raised $1bn via an 8Y bond at a yield of 6.045%, 40bp inside initial guidance of T+240bp area. It also raised $500mn via a 25Y bond at a yield of 6.551%, 40bp inside initial guidance of T+270bp area. The senior unsecured notes are rated Baa2/BBB/BBB-. Proceeds will be used to refinance existing debt, including the redemption of its 2027s and the repurchase of 2029s, 2045s, and 2052s under its concurrent tender offer, as well as for financing long-term infrastructure projects.

ReNew Treasury IFSC raised $600mn via a 5NC3 green bond at a yield of 6.50%, 37.5bp inside initial guidance of 6.875% area. The senior secured note is rated Ba3/BB- (Moody’s/Fitch). The bond has covenants that include (a) a 0.5x fixed asset security cover (b) a 1.0x total security cover (c) no direct security over onshore assets. Other key covenants include a net priority debt leverage ratio ≤ 6.50x, a maintenance debt-service-coverage-ratio (DSCR) ≥ 1.1x to limit incurrence of non-priority indebtedness. The note has a change of control put at 101%, if both a change of control event and a ratings decline occur. Proceeds will be used for onward lending to other entities within the ReNew Group, for repayment of existing debt, onward lending to certain Restricted Group entities, and any other purposes in accordance with its green framework.

Westpac New Zealand Ltd raised $1.5bn via a two-tranche offering. It raised $750mn via a 3Y bond at a yield of 4.127%, 25bp inside initial guidance of T+70bp area. It also raised $750mn via a 5Y FRN at SOFR+75bp, 25bp inside initial guidance of SOFR+100bp area. The senior unsecured notes are rated A1/AA-/A+ (Moody’s/S&P/Fitch).

Citizens Financial Group (CFG) raised $1.15bn via a two-tranche offering. Citizens Bank NA raised $750mn via a 3NC2 bond at a yield of 4.192%, 32bp inside initial guidance of T+90bp area. Citizens Financial Group Inc raised $400mn via a 10NC5 subordinated bond at a yield of 5.299%, 35bp inside initial guidance of T+180bp area. The 3NC2 senior unsecured note is rated A3/A-/BBB+, while the subordinated 10NC5 note is rated Baa1/BBB/BBB. Proceeds will be used for general corporate purposes.

QNB Bank AS raised $500mn via a 5Y bond at a yield of 6.0%, 50bp inside initial guidance of 6.5% area. The senior unsecured note is not rated, and received orders of ~$1.65bn, 3.3x issue size. Proceeds will be used for general corporate purposes.

YPF SA raised $550mn via a tap of its 8.25% 2034s at a yield of 8.10%, inside initial guidance of the mid-8% area. The senior unsecured note is rated B2/B-. Proceeds will be used to refinance existing debt, finance acquisitions in Argentina, and for working capital or fixed asset investments in Argentina. The notes will amortize by 30% in January 2032, 30% in January 2033 and 40% at maturity.

Korea Development Bank (KDB) raised $3bn via a three-tranche offering. It raised:

- $1.25bn via a 3Y bond at a yield of 3.873%, 2bp inside initial guidance of SOFR MS+41bp area.

- $1.25bn via a 5Y bond at a yield of 4.104%, 2bp inside initial guidance of SOFR MS+52bp area.

- $500mn via a 5Y FRN at SOFR+50bp vs. initial guidance of SOFR equivalent area.

The senior unsecured notes are rated Aa2/AA/AA- (Moody’s/S&P/Fitch). The 10Y tranche was dropped.

New Bonds Pipeline

-

Watercare Services A$ 5.5Y/10Y bonds

-

Banco BTG Pactual investor calls

Rating Changes

- Ukraine Foreign Currency Rating Raised To ‘CCC+’ From ‘SD’ On Completed GDP Warrant Restructuring; Outlook Stable

- Moody’s Ratings upgrades Blue Owl Capital Corporation’s senior unsecured rating to Baa2 from Baa3; outlook changed to stable

- Fitch Upgrades Vietnam’s Long-Term Senior Secured Debt Instruments to ‘BBB-‘; Removes UCO

- Fitch Downgrades JSC Ukrainian Railways to ‘RD’ on Uncured Coupon Non-Payment

- Moody’s Ratings revises AmeriGas Partners’ outlook to positive; affirms B1 CFR

Term of the Day: Debt Service Coverage Ratio (DSCR)

Debt Service Coverage Ratio (DSCR) is a credit metric used to understand how easily a company’s operating cashflow or EBITDA can cover its annual interest and principal obligations. The ratio shows how much profit a company makes for every dollar it uses to pay off its debts. The ratio is typically calculated as: (EBITDA)/(Principal+Interest).

Talking Heads

New chair should be “an independent person who respects the mandates… been friends with Rick for a long time. He’s the best bond guy… But inflation is not taking off. And so it’s obvious, because productivity is in the force right now, because of AI and the data centers, yeah, and so, so it looks very, very much like the 90s to me right now. And so I think that the Greenspan judgment would be appropriate now.”

On Argentina, Ecuador Riding Yield Hunt Wave as Distress Ebbs

Katrina Butt, AllianceBernstein

“Argentina and Ecuador aren’t really distressed anymore, but we like the risk-reward in those countries as policy normalizes and they regain market access”

Gorky Urquieta, Neuberger Berman

“What’s the risk Argentina spread goes back to 1,500 basis points? Or Ecuador blowing up again? Not impossible, but given they’re beyond political cycles, there’s now a runway with improving or stable-to-improving fundamentals…”

On Trump Says Fed Chair Interviews Are Done, Has Pick in Mind

“I’ll be telling you soon. I have somebody that I think will be very good but I’m not going to reveal it. It’s someone very respected, very, very well known, and will do, I think, a very good job… I’d say we’re down to three, but we’re down to two. And I probably can tell you we’re down to maybe one in my mind”

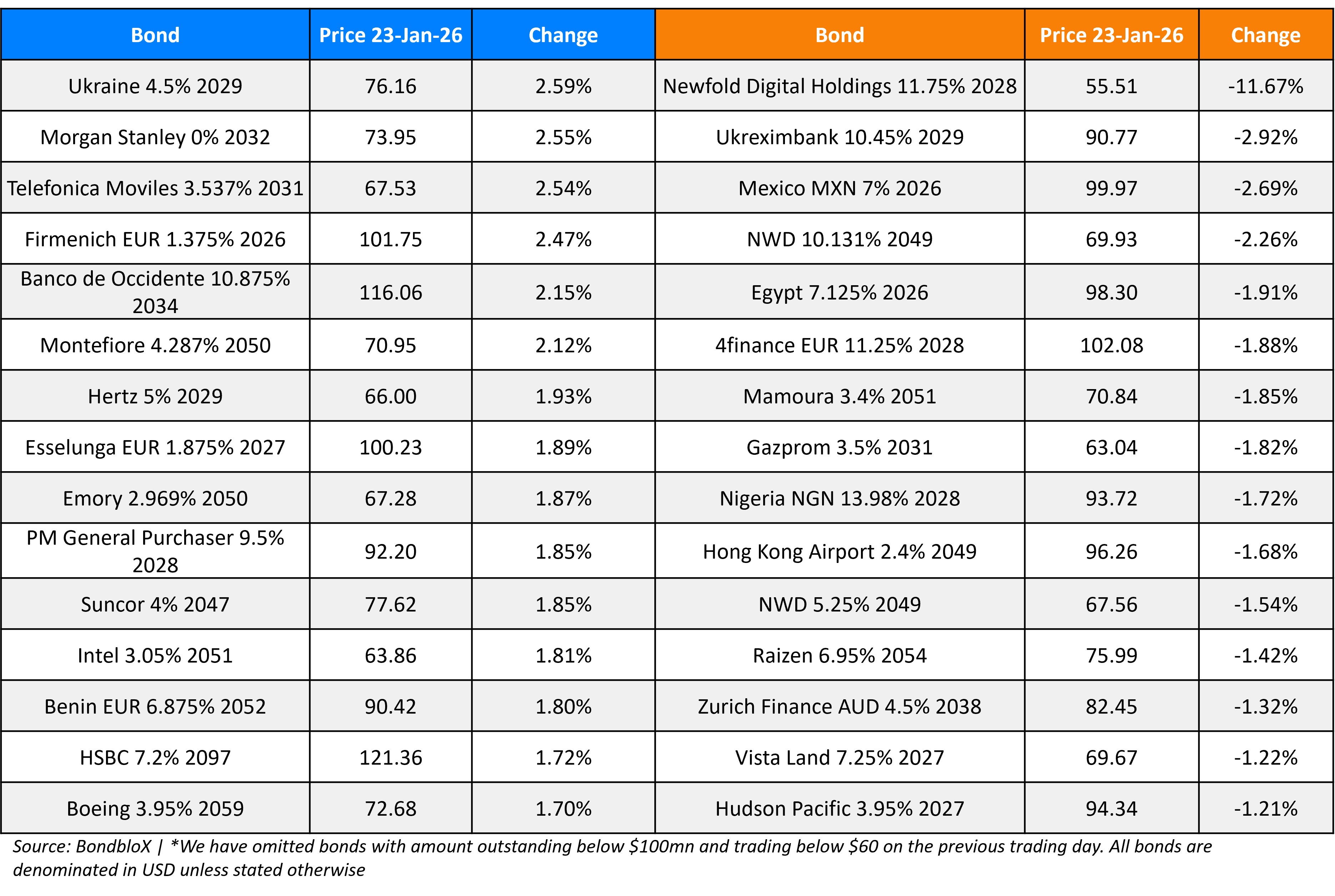

Top Gainers and Losers- 23-Jan-26*

Go back to Latest bond Market News

Related Posts: