This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

Royal Caribbean, Akbank, Mashreqbank and others Price Bonds

February 13, 2026

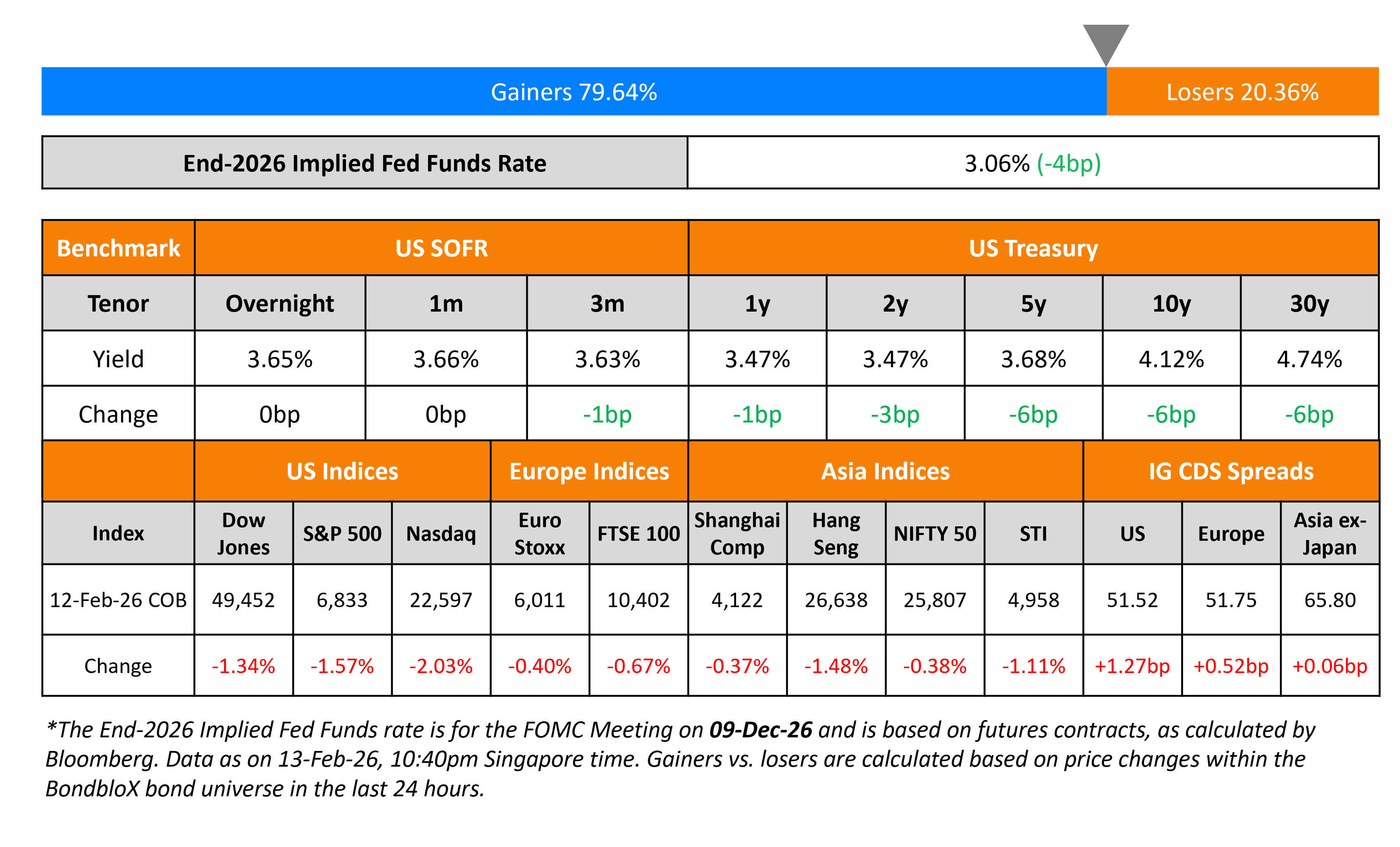

US Treasury yields dropped across the curve as risk-off sentiment impacted the markets, led by a drop in tech stocks. The 2Y yield fell by 3bp while the 10Y was down 6bp. On the data front, initial jobless claims for the prior week rose to 227k, worse than expectations of 223k. Separately, the US 30Y Treasury bond’s auction was well received with strong demand. Its bid-to-cover ratio was at 2.66x, and the auction stopped through by 2.1bp as compared to the 10Y note auction that saw weak demand a day earlier. The US CPI and Core CPI data will be released later today.

Looking at US equity markets, the S&P and Nasdaq closed 1.6% and 2.0% lower respectively. US IG CDS spreads widened by 1.3bp and HY CDS spreads were 5.7bp wider. European equity indices ended lower too. The iTraxx Main CDS spreads were 0.5bp wider and the Crossover CDS spreads were 2.8bp wider. Asian equity markets have opened lower this morning. Asia ex-Japan CDS spreads were wider by 0.1bp.

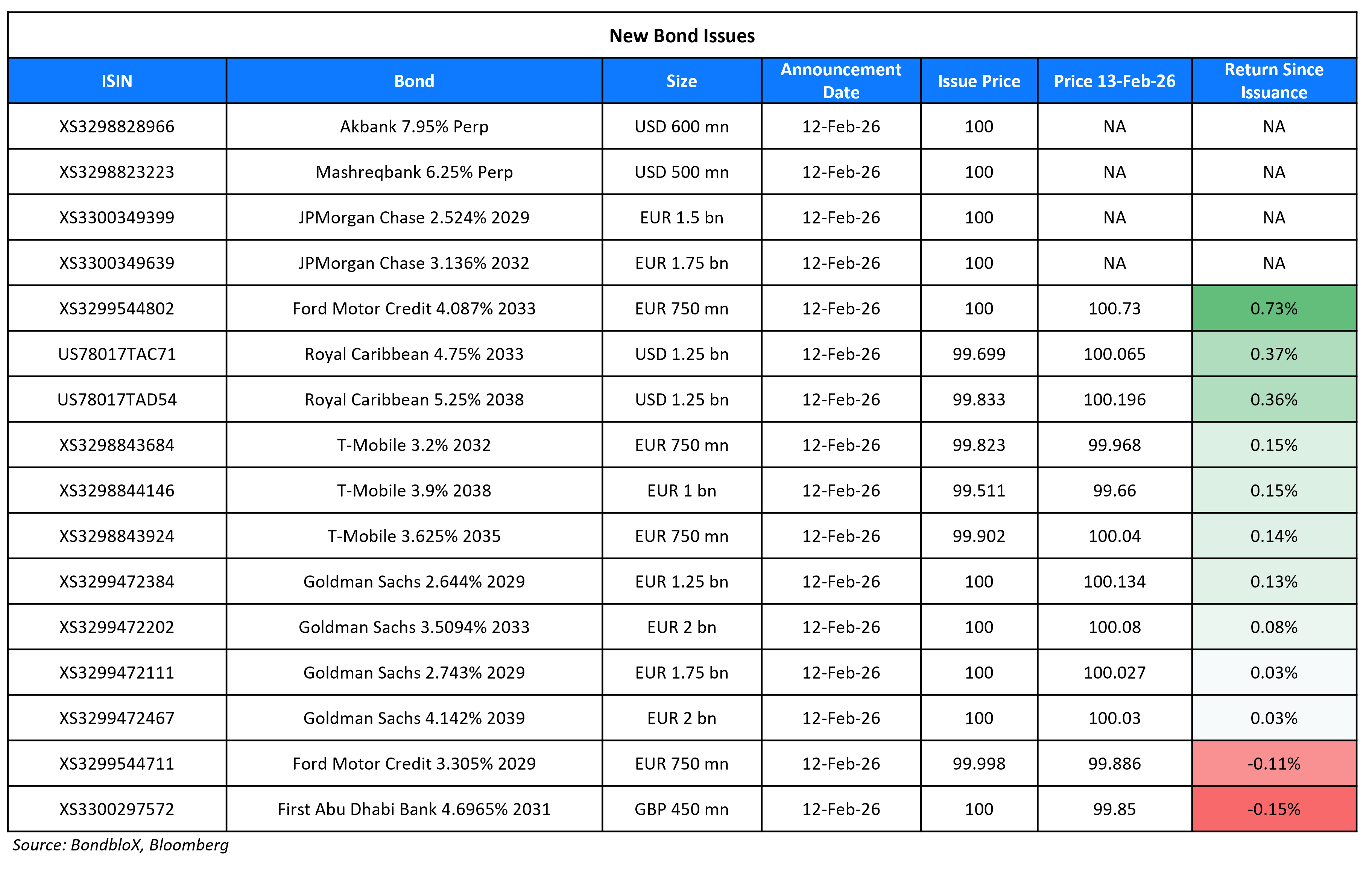

New Bond Issues

Royal Caribbean Cruises raised $2.5bn via a two-trancher. It raised $1.25bn via a 7Y bond at a yield of 4.797%, 33bp inside initial guidance of T+125bp area. It also raised $1.25bn via a 12Y bond at a yield of 5.269%, 33bp inside initial guidance of T+150bp area. The senior unsecured notes are rated Baa2/BBB/BBB. Proceeds will be used to refinance its 2026s. Any remaining net proceeds will be used to repay existing debt, which may include term loans.

AkBank raised $600mn via a PerpNC5.5 AT1 bond at a yield of 7.95%, 55bp inside initial guidance of 8.50% area. The junior subordinated note is rated B- (Fitch), and received orders of over $2.7bn, 4.5x issue size. If not called by 19 August 2031, the coupon will be reset to the US 5Y Treasury yield plus 422.1bp. The note offers a yield pick-up of 37bp over Vakif Katilim Bankasi’s 8.375% Perp that currently yields 7.58%. It also offers a yield pick-up of 32bp over IS Bank’s 9.125% Perp that currently yields 7.63%.

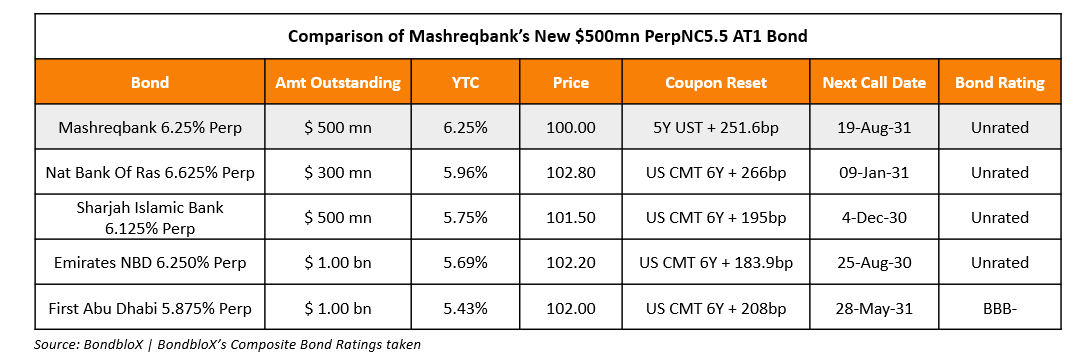

Mashreqbank raised $500mn via a PerpNC5.5 bond at a yield of 6.25%, ~56.25bp inside initial guidance of 6.75-6.875% area. The junior subordinated note is unrated, and received orders of over $1.35bn, 2.7x issue size. If not called by 19 August 2031, the coupon will be reset to the US 5Y Treasury yield plus 251.6bp. The note has a dividend stopper and will be partially written down upon a Non-Viability Event ocurring. The table below compares the new issuance with its UAE peers.

Ford Motor Credit raised €1.5bn via a two-trancher. It raised €750mn via a long 3Y bond at a yield of 3.309%, ~32.5bp inside initial guidance of MS+130/135bp area. It also raised €750mn via a 7Y bond at a yield of 4.087%, ~34.5bp inside initial guidance of MS+180/185bp area. The senior unsecured notes are rated Ba1/BBB-/BBB-.

JPMorgan raised €3.25bn via a two-trancher. It raised €1.5bn via a 3NC2 FRN at 3m Euribor+53bp, 27bp inside initial guidance of 3m Euribor+80bp area. It also raised €1.75bn via a 6NC5 bond at a yield of 3.136%, 27bp inside initial guidance of MS+95bp area. The senior unsecured notes are rated A1/A/AA-,and received orders of over €6.8bn, 2.1x issue size.

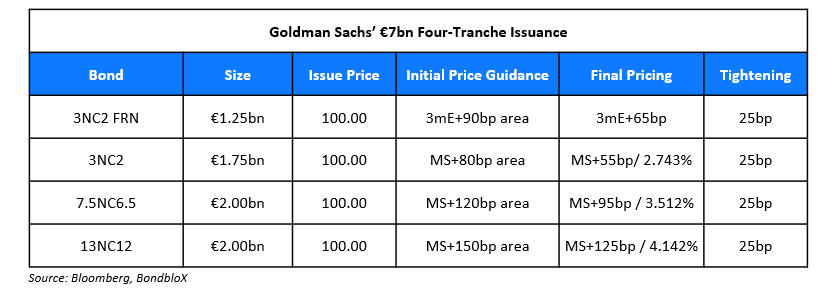

Goldman Sachs raised €7bn via a four-part offering.

The senior unsecured notes are rated A2/BBB+/A. Proceeds will be used for general corporate purposes.

T-Mobile raised €2.5bn via a three-trancher. It raised:

- €750mn via a 6Y bond at 3.233%, ~32.5bp inside initial guidance of MS+100/105bp area.

- €750mn via a 9Y bond at a yield of 3.638%, ~32.5bp inside initial guidance of MS+120/125bp area.

- €1bn via a 12Y bond at a yield of 3.952%, ~37.5bp inside initial guidance of MS+140/145bp area.

The senior unsecured notes are rated Baa1/BBB/BBB+. Proceeds will be used for general corporate purposes including share repurchases, dividends and for refinancing existing debts on an ongoing basis.

FAB raised £450mn via a 5.5Y bond at a yield of 4.702%, 15bp inside initial guidance of UKT+90bp area. The senior unsecured note is rated Aa3/AA-/AA-.

Rating Changes

- Vertiv Group Corp. Upgraded To ‘BBB-‘ On Continued Strong Credit Measures, Outlook Stable

- Moody’s Ratings upgrades CSG’s backed senior secured rating to Baa3 from Ba1; outlook stable

- Moody’s Ratings downgrades Indika Energy to B1; outlook stable

- Cosan Outlook Revised To Negative On Adverse Effects Of Joint Venture’s Potential Debt Restructuring; Ratings Affirmed

- Kraft Heinz Co. Outlook Revised To Negative From Stable On Continued Profit Declines; ‘BBB’ Rating Affirmed

- Fitch Revises Mersin’s Notes Outlook to Positive; Affirms at ‘BB-‘

- Coty Inc. Outlook Revised To Negative On Operating Weakness; ‘BB+’ Rating Affirmed

Term of the Day: Non-Viability Trigger Event

This is an event when the regulators/relevant authorities determine that the company under consideration may be non-viable or may not remain a going concern unless measures are taken to revive its operations given financial difficulties. Once the regulators determine that the company would be non-viable, it would trigger an action where for example, the company would have a right to irrevocably write-off (partly or fully) the outstanding principal of the bonds and make this portion non-payable henceforth. It could also include accrued and unpaid interest/dividends being unpayable. Thus, in this case, the regulator determines that without a write-off, the issuer would become non-viable and without a public sector injection of capital or other equivalent support, the issuer would become non-viable.

Talking Heads

On Investors Pouring Another $4bn Into US High-Grade Bond Funds

Ayako Yoshioka, Wealth Enhancement Group

“We don’t see any catalysts to be bearish but there’s little room for bullishness given where spreads are”

Christian Hoffmann, Thornburg Investment Management

“The spreads for the hyperscalers have widened within the indices, and supply is being impacted in a meaningful way by AI”

On Betting on Deeper Fed Cuts as One of ‘Best Trades’ – David Einhorn, Greenlight Capital

“I think one of the best trades out there right now is betting on more cuts this year than expected… by the time we get to the end of the year, it’s going to be substantially more than two cuts… He’s not being brought on to hold the rates at a steady rate.”

On Warsh Fed-Treasury Pact to Have Minimal Market Impact – BofA

“Other accord steps are unlikely to matter much… We think rates market impact of a new ‘accord’ is minimal”

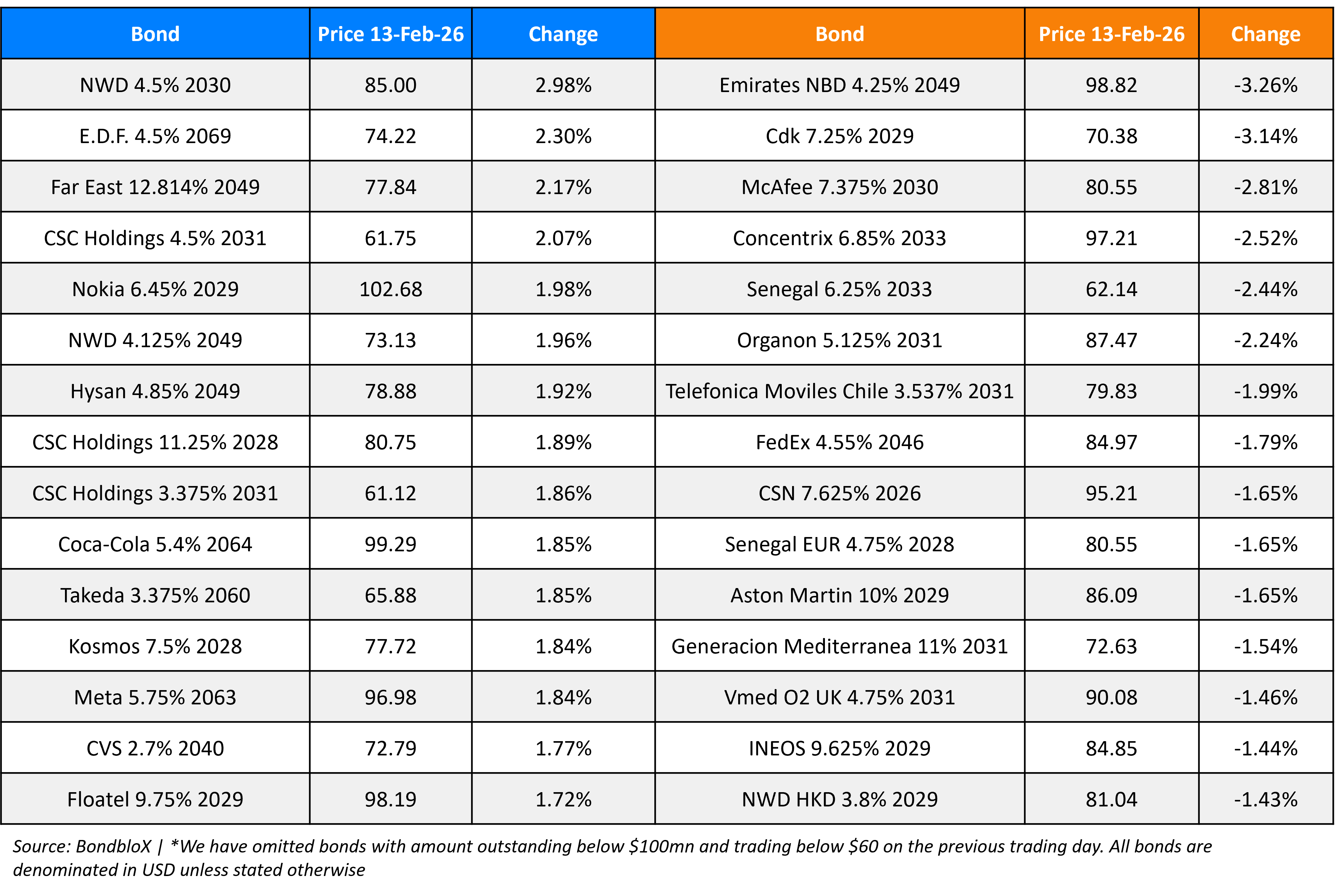

Top Gainers and Losers- 13-Feb-26*

Go back to Latest bond Market News

Related Posts: