This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

Risk-Off Sentiment Hits Markets; Binghatti, UBS, Yuexiu REIT and Others Price Bonds

February 6, 2026

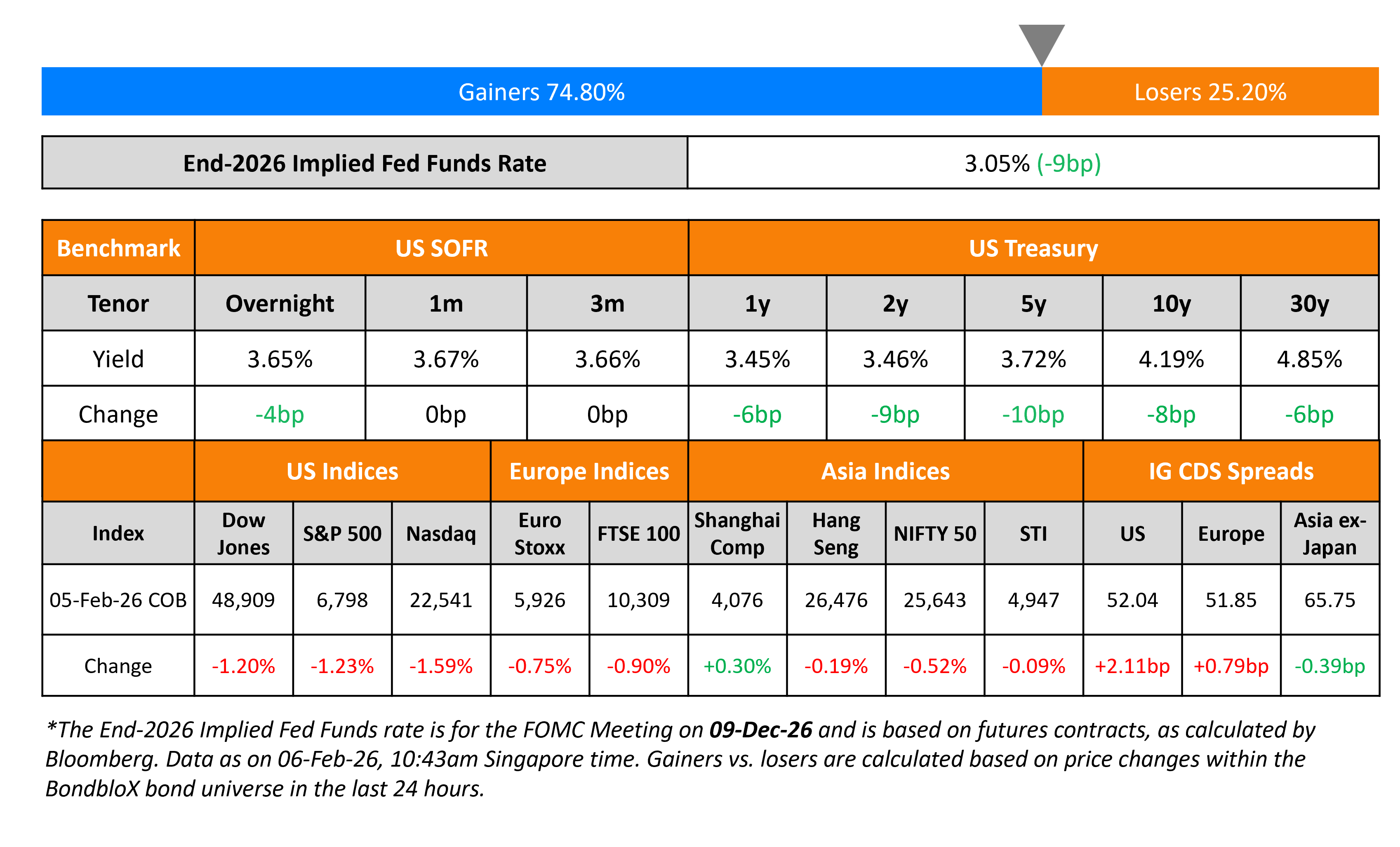

Risk-off sentiment hit the markets with US Treasury yields dropping sharply across the curve. In particular, the 2Y, 5Y and 10Y yields fell by 8-10bp. This came on the back of a sharp sell-off in tech stocks amid recent concerns over the AI-theme impacting companies and their related capital expenditures. For instance, Google announced yesterday that they will spend $175-185bn in capex for 2026 alone, doubling its $91.45bn spend in 2025. Similarly, Amazon expects to spend roughly $200bn in capex for 2026. Separately, initial jobless claims for the prior week rose by 231k, worse than expectations of a 212k print.

Looking at US equity markets, the S&P and Nasdaq closed lower by 1.2% and 1.6% respectively. US IG CDS spreads widened by 2.1bp and HY CDS spreads were 11.9bp wider. European equity indices ended lower too. The iTraxx Main CDS spreads were 0.8bp wider and the Crossover CDS spreads were 1.3bp wider. Asian equity markets have opened mixed this morning. Asia ex-Japan CDS spreads were tighter by 0.4bp.

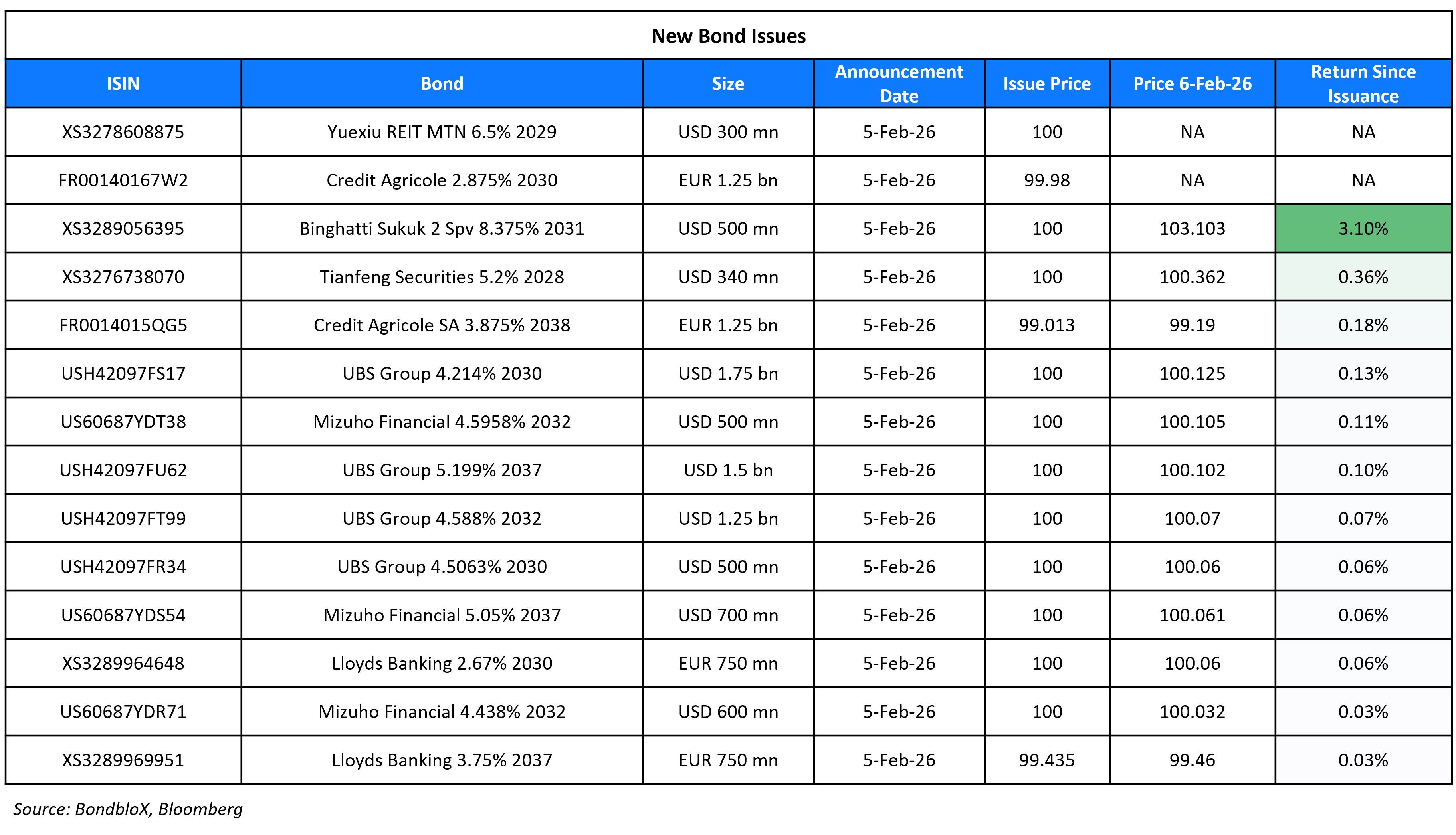

New Bond Issues

Binghatti raised $500mn via a long 5Y sukuk at a yield of 8.375%, 50bp inside initial guidance of 8.875% area. The senior unsecured note is rated BB- (Fitch), and received orders of over $2.2bn, 4.4x issue size. Proceeds will be used for general corporate purposes.

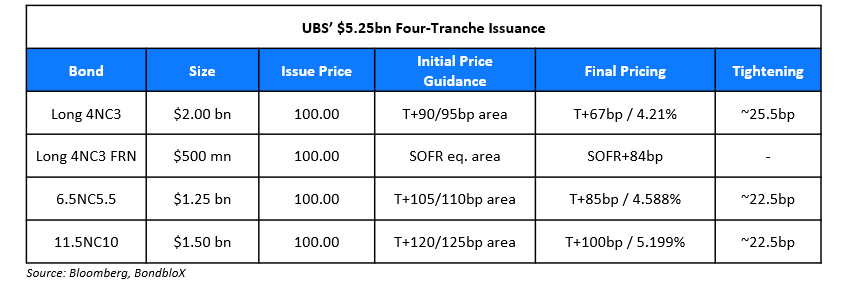

UBS raised $5.25bn via a four-trancher. Details are given in the table below:

The senior unsecured notes are rated A2/A-/A.

Yuexiu REIT raised $300mn via a 3Y bond at a yield of 6.5%, 25bp inside initial guidance of 6.75% area. The senior unsecured note is rated BBB- (Fitch). The note is guaranteed by HSBC Institutional Trust Services Asia Ltd and Yuexiu REIT. Proceeds will be used for refinancing certain debts, and an amount equivalent to the net proceeds will be used to finance or refinance eligible green assets under their green framework.

Republic of Korea raised $3bn via a two-part deal. It raised $1bn via a 3Y bond at a yield of 3.683%, 4bp inside initial guidance of T+13bp area. It also raised $2bn via a 5Y bond at a yield of 3.915%, 4bp inside initial guidance of T+16bp area. The senior unsecured notes are rated Aa2/AA/AA-. Net proceeds will become part of its Foreign Exchange Stabilization Fund.

Lloyds raised €1.5bn via a dual-tranche deal. It raised €750mn via a 4NC3 FRN at 3m Euribor+63bp, 27bp inside initial guidance of 3m Euribor+90bp area. It also raised €750mn via a 11NC10 bond at a yield of 3.819%, ~27.5bp inside initial guidance of MS+120/125bp area. Proceeds will be used to finance or refinance eligible green assets under their green framework.

Credit Agricole raised €2.5bn via a dual-tranche deal. It raised €1.25bn via a 4NC3 bond at a yield of 2.882%, ~27.5bp inside initial guidance of MS+80/85bp area. It also raised €1.25bn via a 12Y bond at a yield of 3.98%, ~32.5bp inside initial guidance of MS+130/135bp area. The senior non-preferred notes are rated A3/A-/A+. Proceeds will be used to finance or refinance eligible green assets under their green framework.

GLP Pte Ltd. raised $500mn via a tap of its 9.75% 2028s at a yield of 8.95%. Proceeds will be used for general corporate purposes, including funding its concurrent offer to purchase the group’s existing debt.

Rating Changes

- SK Hynix Upgraded To ‘BBB+’ On Memory Sales Surge, Improving Financials; Outlook Positive

- Chinese Independent Power Producers Upgraded to ‘A’ On Enhanced Role For The Government; Outlook Stable

- Fitch Upgrades PulteGroup’s IDR to ‘A-‘; Outlook Stable

- Moody’s Ratings upgrades BAE Systems to A3 from Baa1; outlook stable

- Fitch Downgrades Domtar Corporation’s IDR to ‘B+’; Outlook Stable

- Moody’s Ratings downgrades FMC to Ba1; outlook negative

- Fitch Revises the Outlook on ICICI Bank to Positive; Affirms at ‘BB+’

- Fitch Revises Outlook on Axis Bank to Positive; Affirms IDR at ‘BB+’; Upgrades VR to ‘bb+’

- Moody’s Ratings changes Indonesia’s outlook to negative from stable, affirms Baa2 rating

Term of the Day: Risk-Off

Risk-off is an indication of market sentiment wherein investors switch out from risky assets (i.e. risk-off) into safer assets on the back of increased uncertainty. This can be due to geopolitical risk, poor economic data or a crisis. Most typically, during a risk-off environment, US Treasuries and gold tend to perform better as they are considered haven assets. On the other hand, risk-on indicates positive investor sentiment wherein investors switch into risky assets (i.e. risk-on) from safer assets on improved prospects of economic growth. This can be due to improved political environment, strong economic data, strong corporate earnings, or a recovery from a crisis.

Talking Heads

On Crowded Hedge Fund Treasuries Bet Facing Risk of Rapid Unwind

George Catrambone, DWS Americas

“There’s been a long march wider in 30-year swaps spreads from last year, and that trade is coming down a little bit.. probably some deleveraging going on and unwinds”

Deutsche Bank strategists

“Fundamentally, we are uncomfortable with the fact that volatility in rates market is at a multi-year low”

Ed Al-Hussainy, Columbia Threadneedle

“Investors are getting a bit more nervous about the level of rate volatility picking up and that can hurt these swap spread widening (less negative) trades quickly”

On Warning Against Rate Cuts to Offset Structural Changes – Tiff Macklem, Bank of Canada Governor

“Monetary policy should not try to compensate for lost supply. Lowering interest rates in the face of weak economic activity risks stoking future inflation if the weakness is due to lower productive capacity rather than a cyclical downturn in demand”

On Oracle Blockbuster Bond Sale to Spur AI Borrowing Rush – John Sales, Goldman Sachs

“Everybody’s talking about record supply… the more interesting story is record demand… The market is wide open. If you’re looking at things from a spread perspective, it’s about as good as it gets. If you’re looking at things from a demand perspective, take Oracle’s order book as a case in point…”

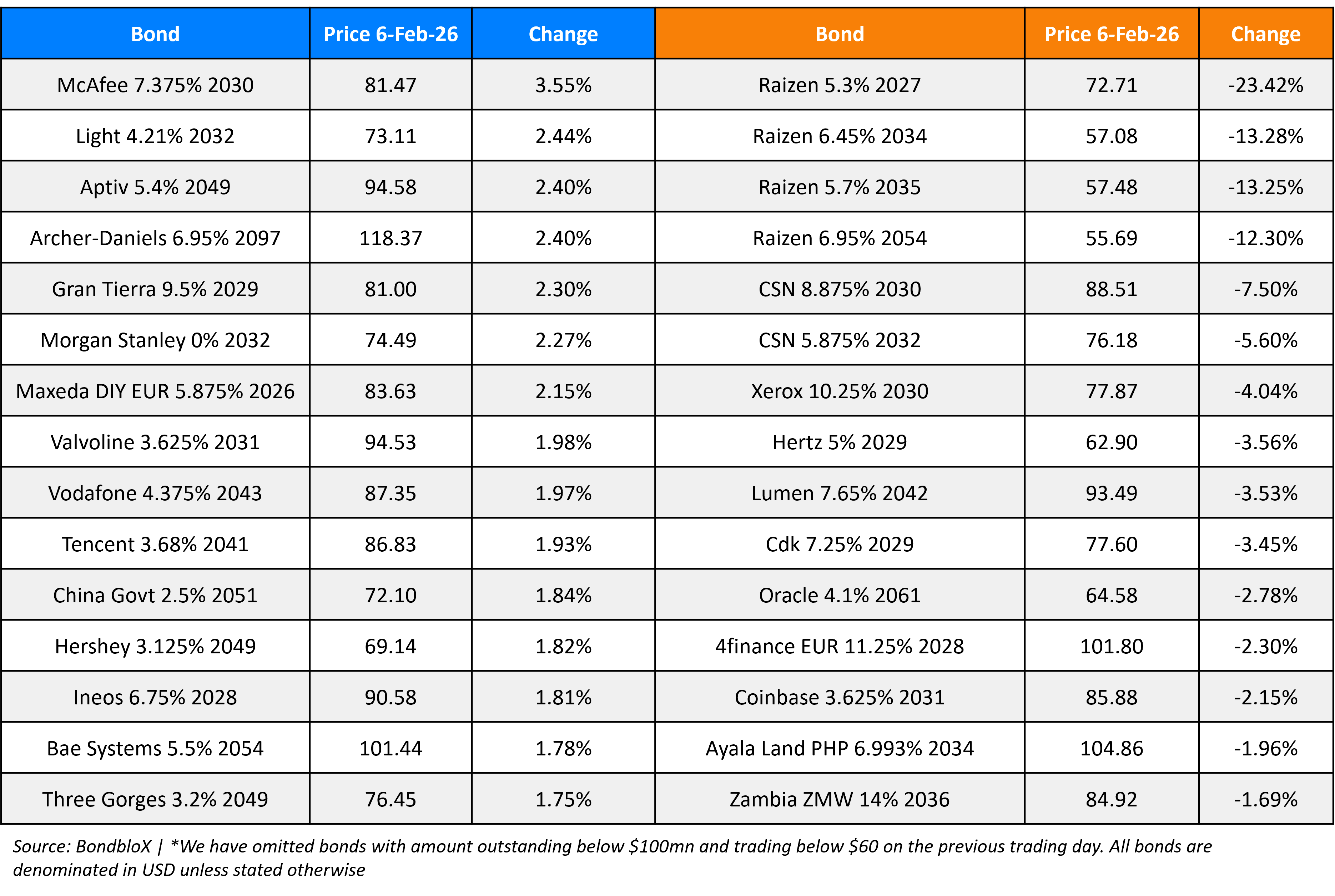

Top Gainers and Losers- 06-Feb-26*

Go back to Latest bond Market News

Related Posts: