This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

ReNew, Westpac NZ Launch $ Bonds

January 22, 2026

The US Treasury yield curve bull flattened on Wednesday, partly reversing the bear steepening move observed earlier this week. The 10Y yield was down by 3bp while the 2Y yield was unchanged. US President Donald Trump said that he has reached a deal framework on Greenland, adding that he will not impose 10% tariffs on EU nations that were expected to take place in February. Separately, the US Treasury’s 20Y note auction saw solid demand, with a bid-to-cover ratio of 2.86x (vs. a three auction average of 2.6x).

Looking at US equity markets, the S&P and Nasdaq ended higher by ~1.2% each. US IG CDS spreads tightened by 1.3bp and HY CDS spreads were 5.5bp tighter. European equity indices ended mixed. The iTraxx Main CDS spreads were 0.7bp tighter and the Crossover CDS spreads were 3.5bp tighter. Asian equity markets have opened mixed this morning. Asia ex-Japan CDS spreads were tighter by 2.9bp.

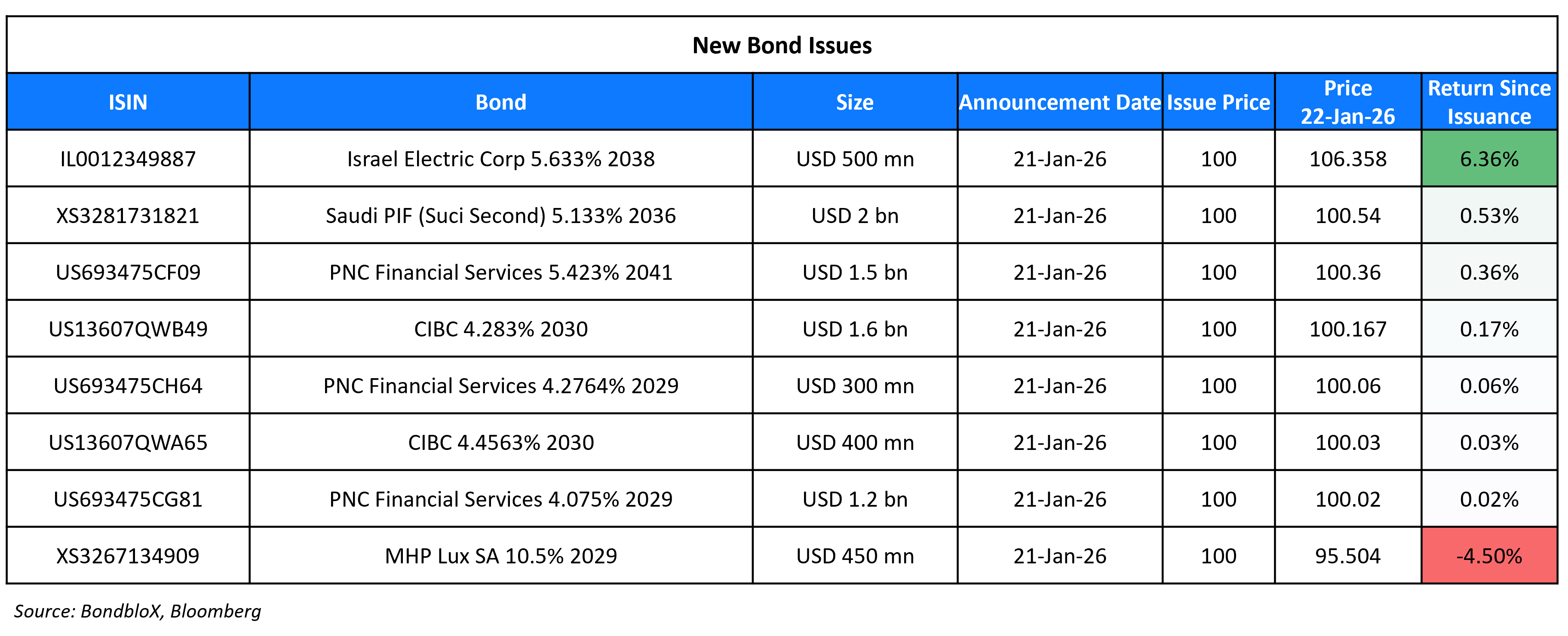

New Bond Issues

- Westpac NZ $ 3Y/5Y FRN at T+70bp/SOFR+100bp areas

- ReNew Treasury IFSC $ 5NC3 green at 6.875% area

- Panzhihua Panxi Science & Technology $ 3Y at 5.8% area

Canadian Imperial Bank of Commerce (CIBC) raised $2bn via a two-tranche offering. It raised $1.6bn via a 4NC3 bond at a yield of 4.283%, 27bp inside initial guidance of T+90bp area. It also raised $400mn via a 4NC3 FRN at a SOFR+80bp vs. initial guidance of SOFR equivalent area. The senior unsecured notes are rated A2/A-/AA-. Proceeds will be used for general corporate purposes.

Public Investment Fund (PIF) raised $2bn via a 10Y sukuk at a yield of 5.133%, 35bp inside initial guidance of T+120bp area. The senior unsecured notes are rated Aa3/A+ (Moody’s/Fitch), and received orders of over $10.9bn, ~5.4x issue size. The issuer is Suci Second Investment Co. Proceeds will be used for general corporate purposes.

PNC Financial Services Group raised $3bn via a three-tranche offering. It raised:

- $1.2bn via a 3NC2 bond at a yield of 4.075%, 27bp inside initial guidance of T+75bp area.

- $300mn via a 3NC2 FRN SOFR+62bp .vs initial guidance of SOFR equivalent area.

- $1.5bn via a 15NC10 subordinated bond at a yield of 5.423%, 28bp inside initial guidance of T+145bp area.

The senior unsecured 3NC2 bonds are rated A3/A-/A., while the subordinated 15NC10 bond is rated A3/BBB-/A. Proceeds will be used for general corporate purposes.

United Overseas Bank (Sydney Branch) raised A$2bn via a two-tranche offering. It raised A$750mn via a 5Y FRN at 3m BBSW+72bp, 5bp inside initial guidance of 3m BBSW+77bp area. It also raised A$1.25bn via a 5Y bond at a yield of 5.023%, 5bp inside initial guidance of SQ ASW+77bp. The senior unsecured notes are rated Aa1/AA-/AA-.

New Bonds Pipeline

-

Watercare Services A$ 5.5Y/10Y bonds

-

Banco BTG Pactual investor calls

Rating Changes

- Fitch Places Shriram Finance’s ‘BB+’ Ratings on Rating Watch Positive

- Frontier Communications Holdings LLC Upgraded To ‘BBB+’ And Removed From CreditWatch On Completed Acquisition

- Fitch Upgrades Frontier Communications to ‘BBB+’ Following Verizon Acquisition; Withdraws Rating

Term of the Day: Bull Flattening

Bull flattening refers to a change in the yield curve where long-term rates move down faster than short-term rates. This not only has a flattening effect on the entire yield curve but also has a net effect of interest rates moving lower and therefore bond prices moving higher, considered a bull move. On the other hand, the opposite move (interest rates move higher, bond prices move lower) is considered a bear move.

Talking Heads

On Calls Japan Bond Selloff ‘Explicit Warning’ for US – Ken Griffin, Citadel

“The bond vigilantes can come out and extract their price. What happened in Japan is a very important message to the House and to the Senate: You need to get our fiscal house in order… US has so much wealth that we can maintain this level of deficit spending for some period of time “

On Market Selloff Is Message for Trump – Bob Michele, JPMorgan

“Things are a bit chaotic and the markets do feel a bit panicked… had a fit in April and then they backed off of a lot of things and then calm ensued. We need to hear some of the same kinds of things.”

On warning of ‘economic disaster’ as Trump backs credit card rate cap – Jamie Dimon, JPMorgan

“It would remove credit from 80% of Americans, and that is their back-up credit… People crying the most will not be the credit card companies. It will be the restaurants, retailers, travel companies, the schools, the municipalities”

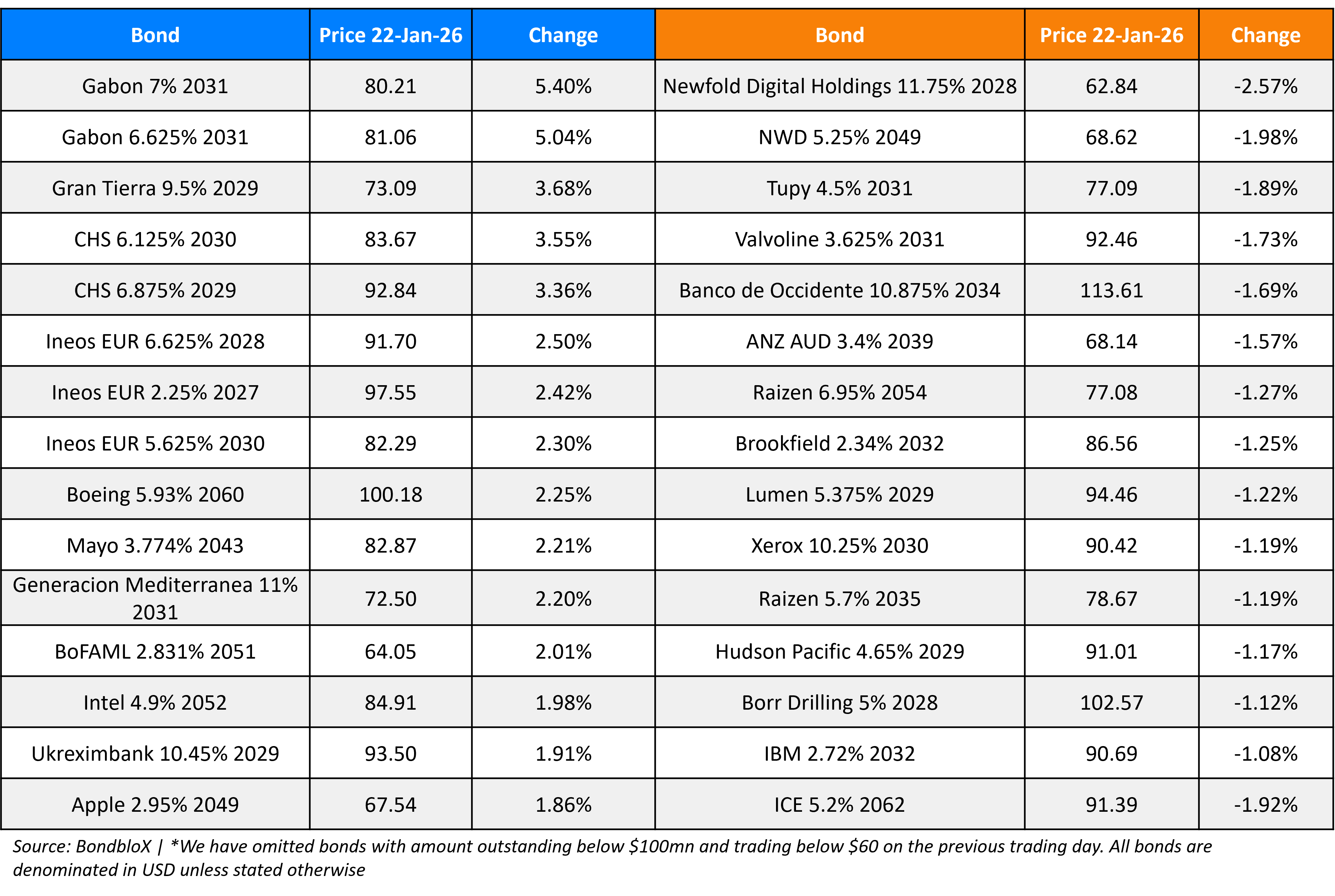

Top Gainers and Losers- 22-Jan-26*

Go back to Latest bond Market News

Related Posts: