This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

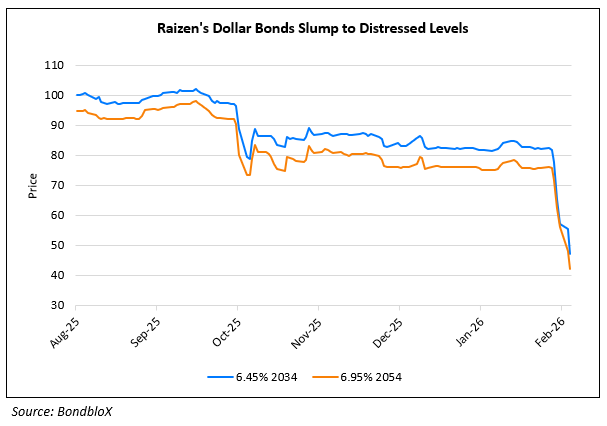

Raizen’s Dollar Bonds Slump to Distressed Levels; Downgraded to CCC+

February 10, 2026

Raizen’s dollar bonds slumped to distressed levels after the company’s credit ratings were downgraded by multiple notches by all the three rating agencies. For instance Moody’s, S&P and Fitch downgraded Raizen’s ratings to Caa1, CCC+ and CCC from Ba1, BBB- and BBB- respectively. The downgrades followed Raizen’s announcement that it hired legal advisers (Pinheiro Neto and Cleary Gottlieb) and financial adviser (Rothschild & Co) to help address mounting financial stress and strengthen its liquidity. Working with these advisers, the company has begun a preliminary review of strategic and financial alternatives as it attempts to stabilize its business. Raizen, a joint venture between Cosan and Shell, has reported a string of large losses and accumulated heavy debt. It posted a net loss of more than BRL 2.3bn ($443mn) in Q2 last year, while net debt reached about BRL 53.4bn ($10.3bn) for the six months ended September 30. A source said that the firm’s capital structure is currently unsustainable, though it still has time to pursue a turnaround. S&P cited a high likelihood of debt restructuring after expected capitalization and asset sales weakened. The company is scheduled to release its next quarterly results on February 12. Raizen’s dollar bonds have lost almost 45-50% of their value since starting of this month as seen in chart below:

Go back to Latest bond Market News

Related Posts:

Sinopec Returns to the Dollar Bond Market for a Second Time in 2017

September 13, 2017

S&P Upgrades Yanlord by One Notch to ‘BB’

March 16, 2018