This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

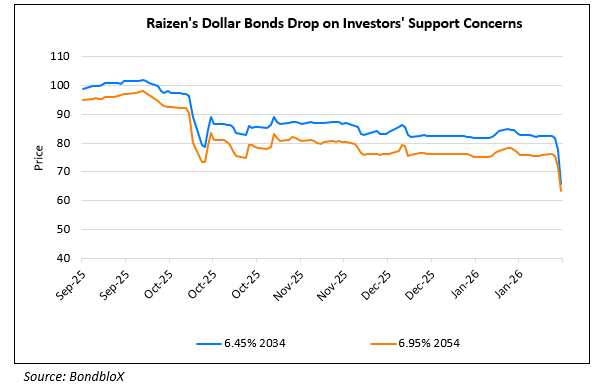

Raizen’s Dollar Bonds Drop on Potential Lack of Investors’ Support

February 5, 2026

Raizen’s dollar bonds dropped by 8–12 points across the curve amid rising fears that its two main shareholders, Cosan and Shell, may not cover an estimated $4bn funding gap. In recent meetings, Raizen and its advisers discussed early-stage restructuring scenarios, including a potential debt haircut, equity issuance, asset carve-outs and a capital injection, though no decisions have been made. Concerns intensified after Cosan redeemed bonds with cross-default clauses tied to Raizen, signaling a limited willingness to provide support. Analysts note that Raizen has been hit by high interest rates, weaker harvests and heavy investment in projects such as second-generation ethanol and sustainable aviation fuel that have yet to generate meaningful returns. They estimate that Raizen needs BRL 20–25bn ($3.8-4.8bn) in fresh capital. Shell has avoided injecting capital independently to prevent consolidating Raizen’s debt onto its balance sheet, while Cosan is constrained by its own balance-sheet pressures. Raizen now carries BRL 53.4bn ($10.2bn) in net debt and has been downgraded by S&P and Moody’s. The company is currently rated Ba1/BBB-/BBB-. Its dollar bonds have dropped by ~35% in the last six months as seen in the chart above.

For more details, click here

Go back to Latest bond Market News

Related Posts: