This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

Powell Indicates No Fed Put

April 17, 2025

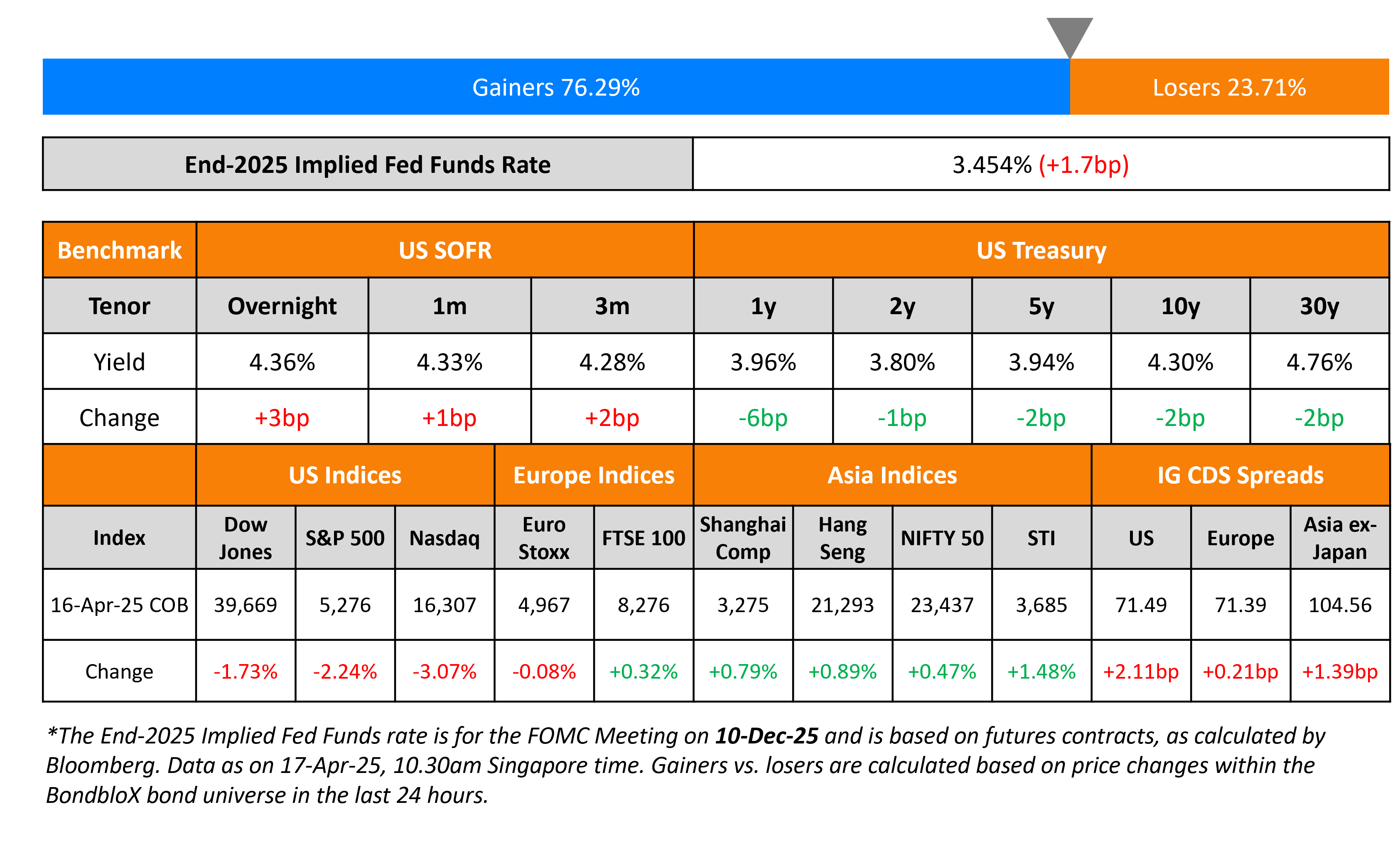

US Treasury yields were marginally lower on Wednesday, by 1-2bp. US Retail Sales rose 1.4% MoM in March, in-line with expectations and better than the prior month’s 0.2% reading. Core Retail Sales rose 0.5%, slightly better than expectations of 0.4%, but lower than the prior month’s 0.7% rise. Separately in a speech, Fed Chairman Jerome Powell indicated that the Fed was well positioned and awaiting more clarity before making any adjustments to its policy stance. Regarding a potential central bank put (Term of the Day, explained below), he said “no”, explaining that the uncertainty meant that volatility would be high and that equity markets were adjusting to that.

Following this, the S&P and Nasdaq ended sharply lower, down by 2.2% and 3.1% respectively. Looking at credit markets, US IG and HY CDS spreads widened by 2.1bp and 11.2bp respectively. European equity markets ended mixed. The iTraxx Main and Crossover CDS spreads widened by 0.2bp and 0.5bp respectively. Asian equity markets have opened in the green this morning. Asia ex-Japan CDS spreads were wider by 1.4bp. China’s 1Q2025 GDP came-in at 5.4% YoY, higher than expectations of 5.2% and in-line with the prior quarter’s 5.4%.

New Bond Issues

Rating Changes

- Province of Quebec Downgraded To ‘A+’ From ‘AA-‘ On Persistent Operating Deficits

-

Outlook On Three Egyptian Banks Revised To Stable From Positive; ‘B-/B’ Ratings Affirmed

-

Moody’s Ratings changes outlook on Helios Towers to positive from stable; affirms B1 rating

-

Fitch Revises Outlook on Swissport to Stable; Affirms at ‘BB-‘

Term of the Day: Central Bank Put

Central bank put is a term used by market analysts to denote an insurance measure taken by the central bank to mitigate market and economic volatility. It essentially denotes a central bank policy that is akin to having a put option on the equity market where the buyer is insured against the underlying falling in price. A put option gives the buyer of the option the right but not the obligation to sell the underlying instrument at a particular price known as the strike price at expiration. The term central bank put is thus a play on the term “put option”. A central bank put thereby would prevent the equity market from seeing a sharp drop, providing a backstop to the markets and sustaining prices.

Talking Heads

On Fitch seeing weakest world growth outside pandemic since 2009

“U.S. annual growth in 2025 is expected to remain positive at 1.2% but will slow to a crawl through the year to just 0.4% yoy (year-on-year) in 4Q25… China’s growth is forecast to fall below 4% this year and next while eurozone growth will remain stuck well below 1%”

On Trump’s Attack on Elite Colleges Threatening Safest Corporate Bonds

Kate Chanoux, Wellington Management

“The risk has increased since where we were a year ago… There are risks seemingly lurking around every corner in the higher ed space”

Richard Familetti, SLC Management

“This is a very high quality sector that’s underperformed probably almost exclusively because of news headlines”

On Tariff Chaos Roiling EM-Debt Tied to Oil

Chris Perryman, Pinebridge Investments

“The market is starting to think about recession scenarios and a lower oil price”

Sergey Dergachev, Union Investment Privatfonds

“We’re mostly on the sidelines and watching whether we will see some stabilization on the tariff front over the coming week before getting more active”

Top Gainers and Losers- 17-April-25*

Go back to Latest bond Market News

Related Posts: