This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

Philippines, SIA, MS, BMW, Woori Bank Price Bonds

January 21, 2026

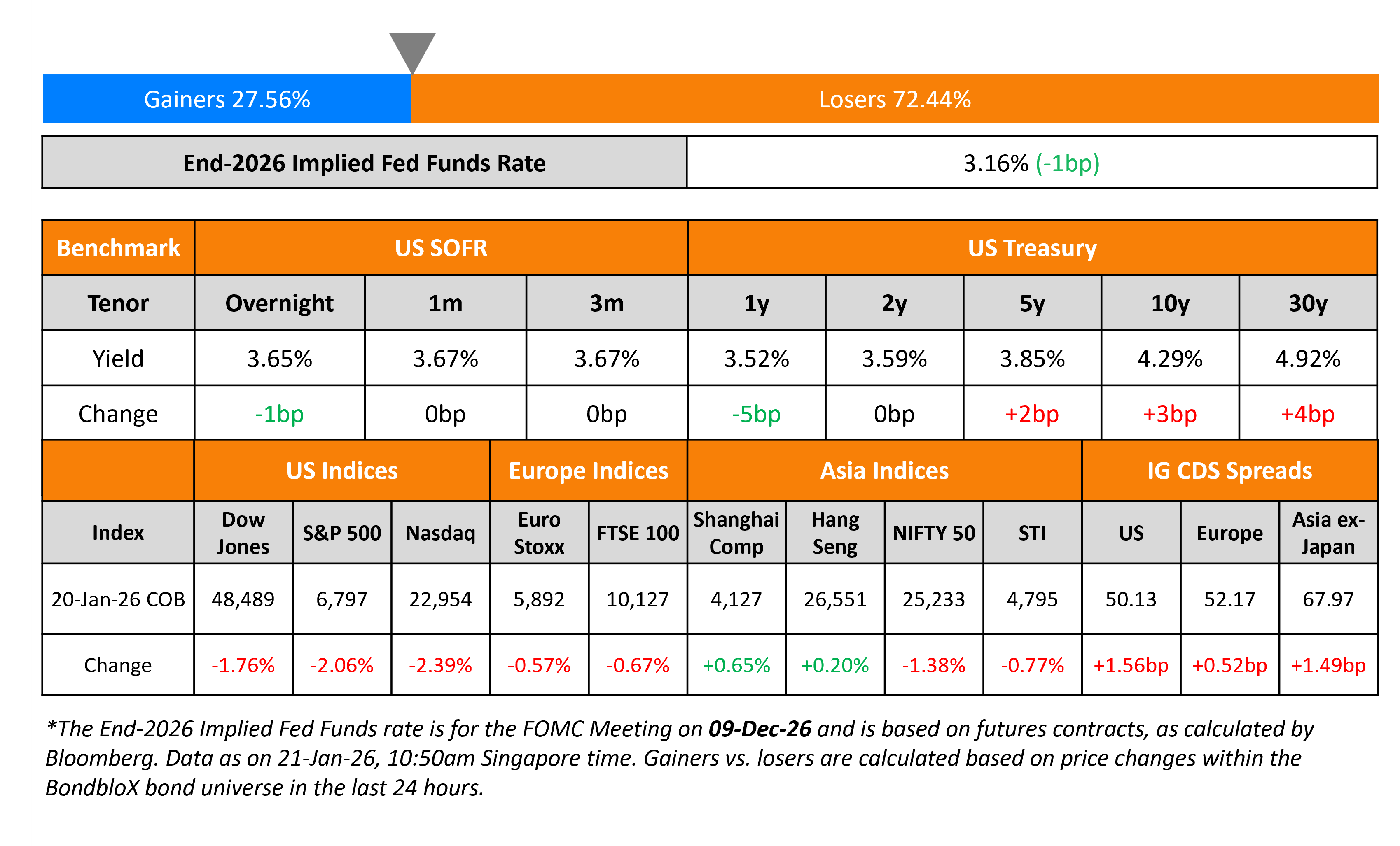

The US Treasury yield curve continued to steepen, with the 10Y higher by 3bp while the 2Y yield was unchanged. Risk sentiment deteriorated in the markets amid US President Donald Trump’s tariff threats against Europe over Greenland. Also, Japan’s bond yields surged with the 20Y JGB yield shooting higher by nearly 20bp to 3.48%. Japanese Prime Minister Sanae Takaichi officially called for a snap election on February 8, with analysts indicating fears of a reflationary policy, led by consumption tax cuts. However, this morning the JGB yields have dropped back, with the 20Y JGB now at 3.28%.

Looking at US equity markets, the S&P and Nasdaq ended sharply lower by 2.1% and 2.4% respectively. US IG and HY CDS spreads widened by 1.6bp each. European equity indices ended lower too. The iTraxx Main CDS spreads were 0.5bp wider and the Crossover CDS spreads were 1.8bp wider. Asian equity markets have opened with a negative bias this morning. Asia ex-Japan CDS spreads were wider by 1.5bp.

New Bond Issues

- MTR Corporation A$ 5Y/12Y Kangaroo bonds at ASW+70bp/ASW+100bp area

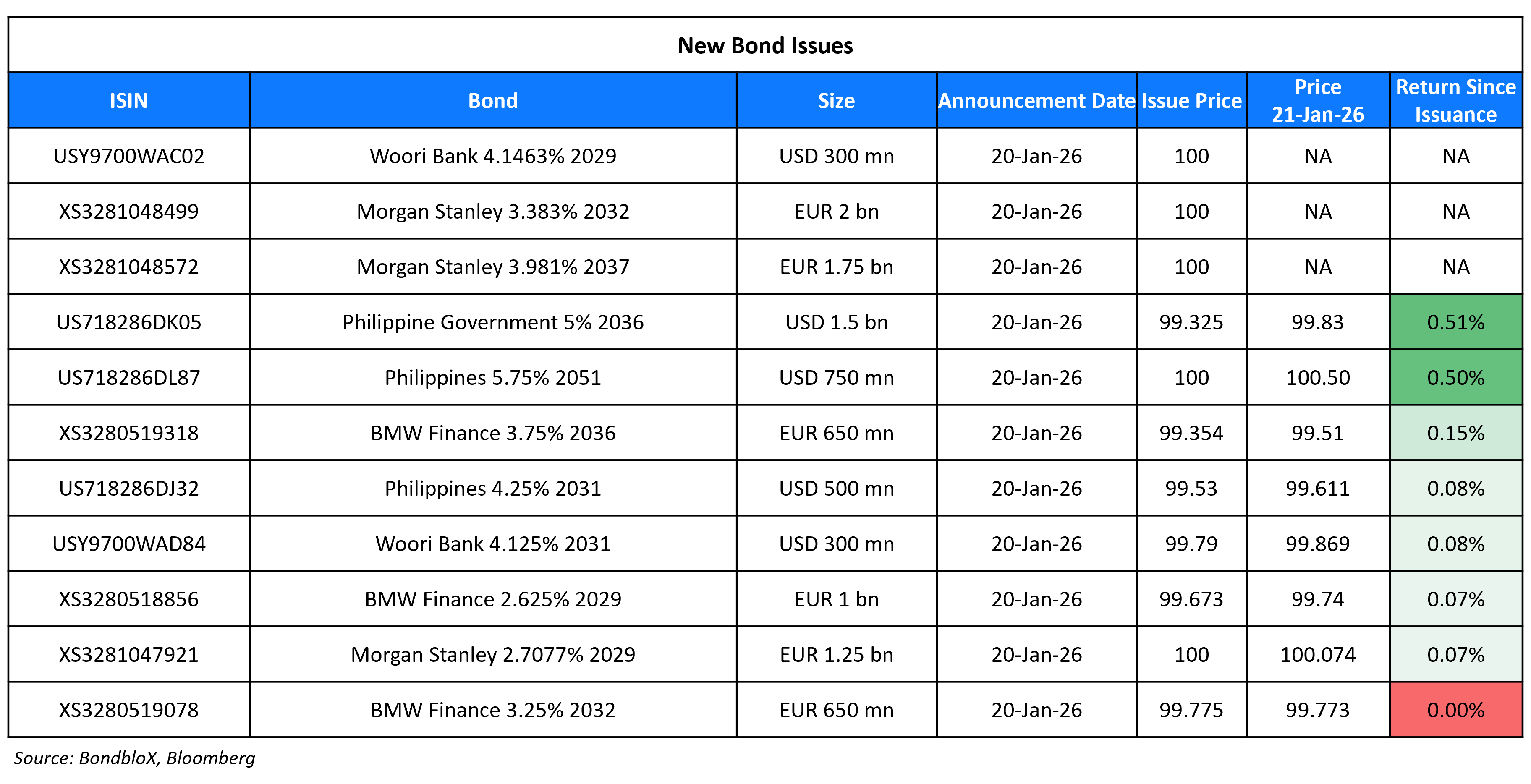

The Republic of the Philippines raised $2.75bn via a three-tranche offering. It raised:

- $500mn via a 5.5Y bond at a yield of 4.347%, 20bp inside initial guidance of T+70bp area. The new bond is priced at a new issue premium of ~8bp over its existing 7.75% 2031s that currently yield 4.27%.

- $1.5bn via a 10Y bond at a yield of 5.087%, 20bp inside initial guidance of T+100bp area.

- $750mn via a 25Y bond at a yield of 5.75%, 15bp inside initial guidance of 5.90% area.

The senior unsecured notes are rated Baa2/BBB+/BBB (Moody’s/S&P/Fitch). Proceeds will be used for general budget financing.

Singapore Airlines raised S$500mn via a 10Y bond at a yield of 2.70%, 25bp inside initial guidance of 2.95% area. The notes are unrated. Net proceeds will be used for aircraft purchases and aircraft related payments, general corporate or working capital purposes, including refinancing existing borrowings.

Morgan Stanley raised €5bn via a three-tranche offering. It raised:

- €1.25bn via a 3.75NC2.75 FRN at 3m Euribor+70bp, 20bp inside initial guidance of 3m Euribor+90bp area.

- €2bn via a 6NC5 bond at a yield of 3.383%, 25bp inside initial guidance of MS+110bp area.

- €1.75bn via an 11NC10 bond at a yield of 3.981%, 25bp inside initial guidance of MS+135bp area.

The senior unsecured notes are rated A1/A-/A+. Proceeds will be used for general corporate purposes.

BMW Finance NV raised €2.3bn via a three-tranche offering. It raised:

- €1bn via a 3Y bond at a yield of 2.74%, 35bp inside initial guidance of MS+75bp area.

- €650mn via a 6Y bond at a yield of 3.292%, ~32.5bp inside initial guidance of MS+100/105bp area.

- €650mn via a 10Y bond at a yield of 3.829%, ~32.5bp inside initial guidance of MS+125/130bp area.

The senior unsecured notes are guaranteed by Bayerische Motoren Werke AG and are rated A2/A. Proceeds will be used for general corporate purposes.

Woori Bank raised $600mn via a two-tranche offering. It raised $300mn via a 3Y FRN SOFR+48bp, 37bp inside initial guidance of SOFR+85bp area. It also raised $300mn via a 5Y bond at a yield of 4.172%, 37bp inside initial guidance of T+70bp area. The senior unsecured sustainability notes are rated A1/A+ (Moody’s/S&P). Proceeds will be used to finance and/or refinance, in whole or in part, new or existing projects in line with its sustainability framework.

New Bonds Pipeline

-

ReNew Treasury IFSC $ green bond

Rating Changes

- Moody’s Ratings upgrades NVIDIA’s senior unsecured rating to Aa1; outlook positive

- Fitch Downgrades Green Bidco S.A.U. to ‘C’ on Missed Coupon Payment; Withdraws Ratings

- Moody’s Ratings downgrades Sinclair Television’s CFR to Caa1 from B3; outlook revised to stable

- Azuria Water Solutions Inc. Upgraded To ‘B’ On Improved Scale And Service Capabilities; Outlook Stable

- Moody’s Ratings revises outlook on Yuexiu REIT to stable from negative; affirms Ba3 ratings

Term of the Day: Option Adjusted Spread (OAS)

Option Adjusted Spread (OAS) refers to a measure of the credit spread of a bond with embedded options relative to a benchmark, similar to the z-spread. The key difference between OAS and z-spread lay in the optionality. When comparing two bonds – one with an embedded option and one without – OAS is a better measure compared to z-spread as the former adjusts for/removes the impact of optionality for a like-to-like comparison. Put simply, OAS ≈ Z-Spread + Option cost.

On a technical note, the above formula is not an exact equation as the z-spread is calculated from the spot curve while the OAS is calculated from the forward curve. The OAS is less than the z-spread for callable bonds and greater than z-spread for puttable bond.

Talking Heads

On Markets Slumping as Greenland, Japan Fears Shake Up Torpid Trading

Shiyan Cao at hedge fund Winshore Capital

“It has opened up a tail risk – that people don’t want US assets. You have to put on some risk premium for political reasons”

Michael Thompson, Little Harbor Advisors

“In our opinion, today’s risk-off move is more of the systemic-type move, not idiosyncratic, which to us suggests it is a good time to begin accumulating hedge positions”

Sam Martinez, Vanguard

“Geopolitical shocks typically take time to unfold and often have their greatest market impact early on… Over time, these positions tend to moderate”

On Japanese Government Bonds Massive Selloff

Ales Koutny, Vanguard

“It’s been a perfect storm for long-dated JGBs… there are limits to how much unfunded fiscal spending a country can do”

On Warning of Risky Bet as Europe Flirts With Debt Selloff

Sergio Ermotti, CEO of UBS

“Diversifying away from America is impossible”

Michael Krautzberger, Allianz Global Investors

“If I were an adviser to some European governments, I would say you almost need to create a little bit of market volatility because Donald Trump cares about that a lot”

Anders Schelde, AkademikerPension

“There’s a strong realization across Europe that we need to be able to stand on our own feet”

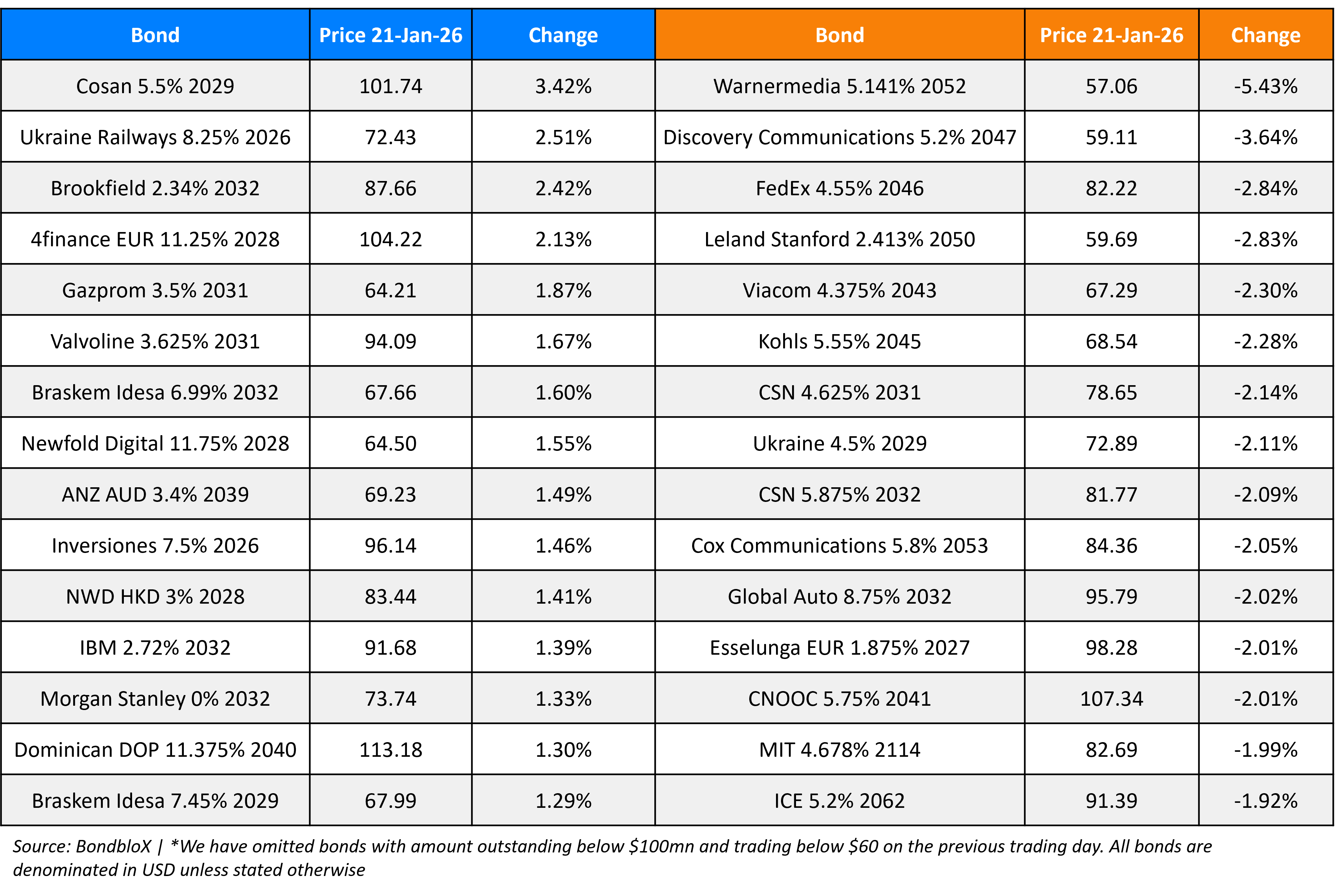

Top Gainers and Losers- 21-Jan-26*

Go back to Latest bond Market News

Related Posts: