This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

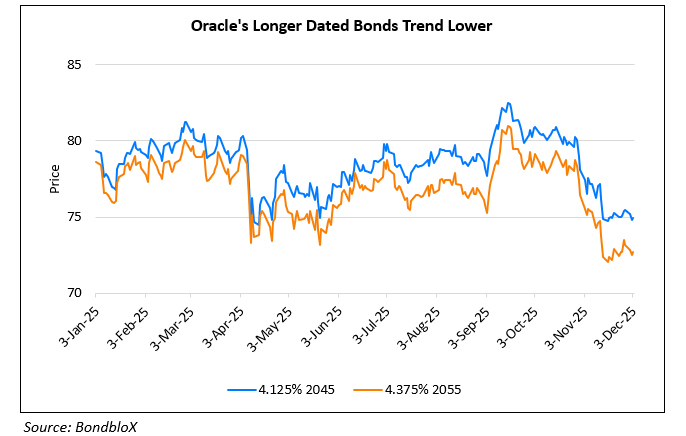

Oracle’s Dollar Bonds Continue to Slip

December 15, 2025

Oracle’s dollar bonds dropped by 0.5-1.5 points across the curve as delays in data-center timelines intensified concerns about the profitability and scale of its AI investments. The latest sell-off followed reports that certain OpenAI-linked data-center projects have been pushed to 2028, though Oracle maintains all contractual milestones remain on track. At the same time, Oracle’s 5Y credit default swaps (CDS) surged to 151.3bp, to their highest levels since 2009, reflecting mounting market anxiety over the company’s heavy borrowing, ballooning debt load, and uncertain AI returns. Analysts warn that rapid advances in chip efficiency could leave Oracle with overbuilt infrastructure, making its massive capex commitments a growing credit risk. Banks financing data-center construction are actively hedging via CDS, and hedge funds have also increased protection buying. Despite the pressure, Oracle’s leadership says it remains committed to preserving its investment-grade rating and may ultimately borrow less than current market expectations. The $18bn bond package sold in September has already generated roughly $1.35bn in paper losses for investors, with spreads on the 2035s notes widening to 187bp over Treasuries, as per Bloomberg.

For more details, click here

Go back to Latest bond Market News

Related Posts: