This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

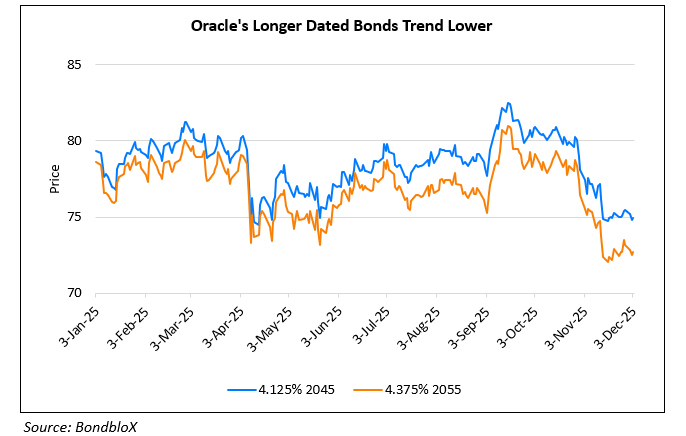

Oracle’s Bonds Slip Further On Data Centre Split with Blue Owl

December 18, 2025

Oracle’s dollar bonds slipped lower after it confirmed that its longtime partner Blue Owl Capital will not be contributing equity to a data center project in Michigan. Despite Oracle saying that the project is progressing as planned, with Blackstone in talks to supply equity and Bank of America leading a roughly $14bn debt package, the news sparked a renewed selloff in Oracle shares and pushed the cost of insuring its debt toward levels last seen during the financial crisis. The episode highlights growing scrutiny of AI infrastructure financing, much of which relies on off-balance-sheet project finance structures. While Oracle is not the borrower, its long-term lease commitments underpin these deals, adding to substantial obligations that now total nearly $250bn. Oracle has become a proxy for AI capital expenditure risk, with concerns over leverage, counterparty exposure, and political uncertainty around data center incentives.

Its 4.125% 2045s was down 0.5 points to 71.6, yielding 6.8%.

For more details, click here

Go back to Latest bond Market News

Related Posts:

Oracle’s 5Y CDS Jumps to Its Highest Level Since 2009

December 3, 2025

Oracle’s Dollar Bonds Continue to Slip

December 15, 2025