This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

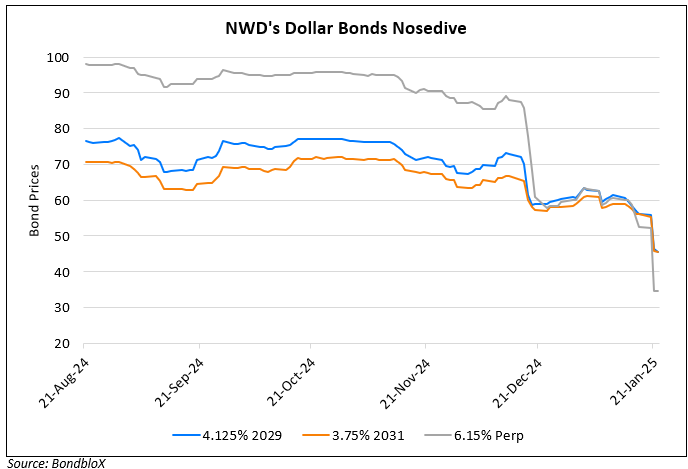

NWD Posts $852mn Loss; Vanke to Repay Local Bond

March 3, 2025

New World Development (NWD) reported a loss of HKD 6.63bn ($852mn) for 1H2024, a sharp decline from a profit of HKD 502mn ($65mn) last year, driven by writedowns on residential and commercial properties. CEO Echo Huang emphasized the company’s focus on reducing debt and plans to sell HKD 26bn ($3.3bn) in assets, including residential and commercial properties, within the current financial year. Revenues fell 1.62% to HKD 16.79bn ($2.2bn), and core operating profit dropped 18% to HKD 4.4bn ($570mn). No interim dividend was declared. Consolidated net debt rose slightly to HKD 124.6bn ($16bn). NWD’s dollar bonds have however, rallied across the curve. For instance, its 6.15% Perp was up 1.9 points to trade at 57.1 cents on the dollar.

Separately, amid concerns about large local debts in the Chinese property sector, China Vanke said that it will repay a local bond. As per a statement to the Shenzhen stock exchange, it will repay an RMB 890mn ($122mn) 3.14% onshore bond, with the notes set to be delisted on March 4. Vanke’s dollar bonds are among the top gainers this morning, up by over 1.5 points. Its 3.795% 2027s were up 1.8 points to 72.3, yielding 17.4%.

Go back to Latest bond Market News

Related Posts: