This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

November’s NFP and Unemployment Come in Higher

December 17, 2025

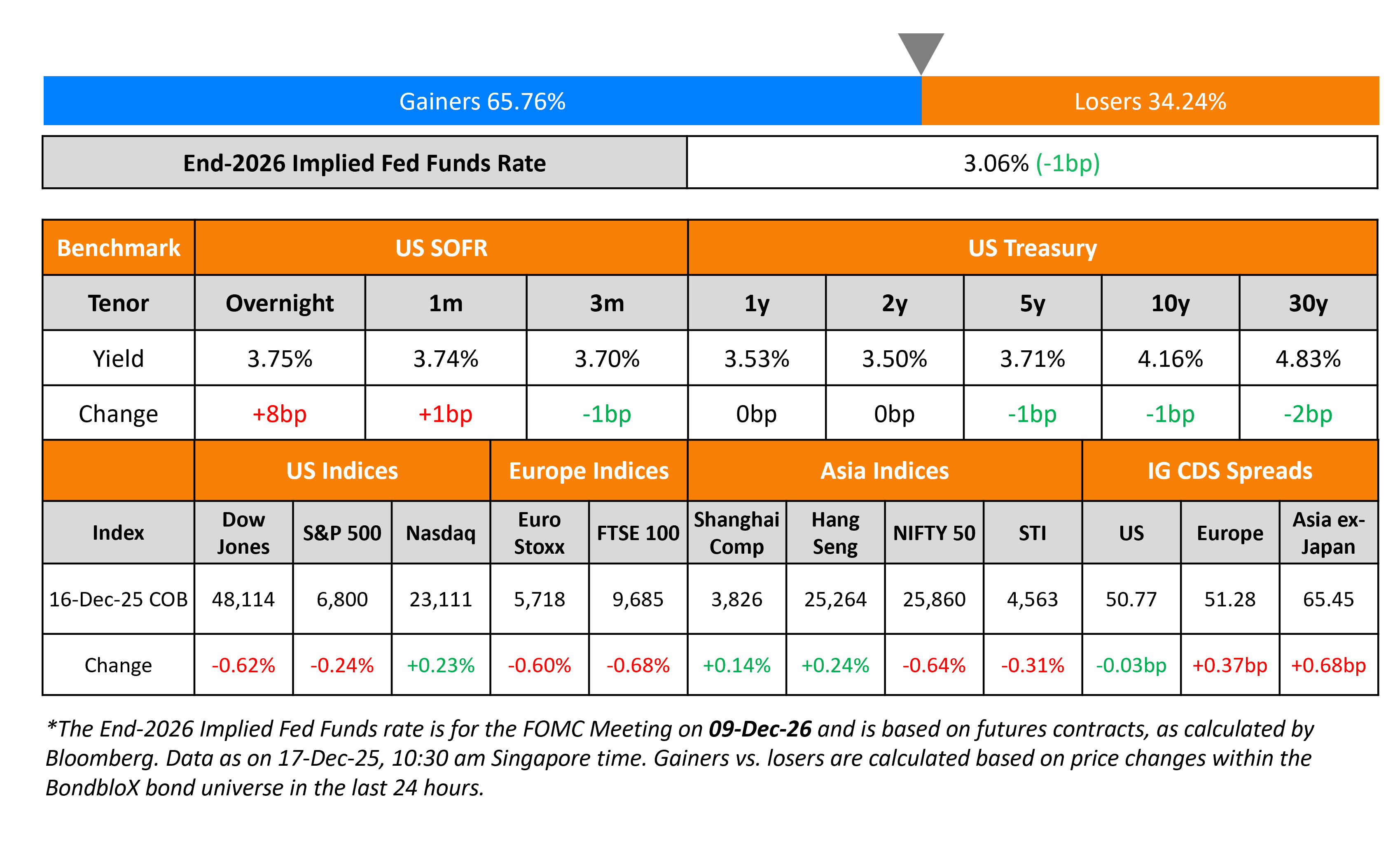

US NFP for November came in at 64k, higher than expectations of 50k and October’s print of -105k. Average Hourly Earnings YoY rose by 3.5%, lower than the surveyed 3.7% and October’s print of 3.7%. The Unemployment Rate came in at a four-year high of 4.6%, worse than expectations of 4.5%. However, this came on the back of a change in the methodology by the Bureau of Labor Statistics after the 43-day government shutdown prevented the collection of data from households. The longer-end of the US Treasury yield curve eased slightly by 1-2bp while the short-end was stable. Regarding Fed speakers, Atlanta Fed Raphael Bostic said that policymakers should remain focused on addressing inflation, with elevated price pressures expected to persist through most of next year. He also revealed that he favored keeping rates unchanged through 2026, citing economic tailwinds that could keep upward pressure on inflation.

Looking at US equity markets, the S&P ended 0.2% lower while Nasdaq ended 0.2% higher. US IG CDS spreads were flat while HY CDS spreads widened by 1.3bp. European equity indices ended lower. The iTraxx Main CDS spreads widened by 0.4bp while the Crossover CDS spreads were 1.7bp wider. Asian equity markets have opened higher this morning. Asia ex-Japan CDS spreads widened 0.7bp.

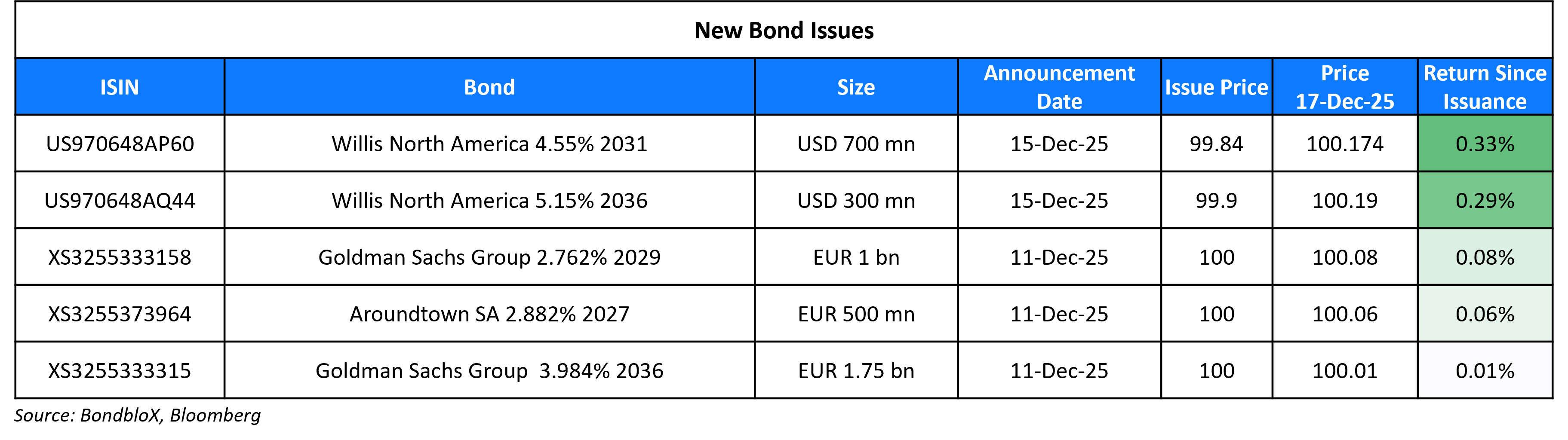

New Bond Issues

Rating Changes

- Fitch Upgrades Nama Electricity Distribution Company to ‘BBB-‘; Outlook Stable

- Grifols Upgraded To ‘BB-‘ On Strong Operating Performance; Outlook Stable

- Fitch Downgrades Colombia to ‘BB’; Outlook Stable

- Spain-Based Banco de Sabadell Outlook Revised To Positive On Potential For Higher ALAC Buffer; ‘A-/A-2’ Ratings Affirmed

- Fitch Revises Cosan’s Outlook to Negative; Affirms IDRs at ‘BB’

- Fitch Revises KIPCO’s Outlook to Stable; Affirms IDR at ‘BB-‘

- Blackstone Mortgage Trust Inc. Outlook Revised To Stable From Negative On Improving Asset Quality; ‘B+’ Rating Affirmed

Term of the Day

Non-Farm Payrolls (NFP)

Non-Farm Payrolls (NFP) is a key data point that is released by the US Bureau of Labor Statistics (BLS) usually on the first Friday of every month. NFP measures net changes in employment excluding agricultural, local government, private household and not-for-profit sectors over the past month and is a key economic indicator in the United States. A high reading of the NFP is considered a positive sign for the US economy while a negative reading is considered a sign of a slowdown in the US jobs market. The NFP indicator is closely watched by traders, especially as it is one of the first monthly economic indicators to be released, and because of the direct relationship between job creation and economic growth.

Talking Heads

On Yield Curve Trade Firing Up

Kevin Flanagan – WisdomTree.

“You’ve got the 2-year anchored in by the Fed and rate-cut expectations while the back end of the curve is responding to broader issues, an economy that is not teetering on a recession and has sticky inflation. That leaves the 10-year yield locked in a 4% to 4.5% range.”

On Private Credit Pressures Fuelling Further Defaults in 2026

Michael Dimler – Morningstar DBRS

“We’re seeing margin compression. Instead of it going away, it’s actually getting worse. It’s just really a matter of when does the credit cycle turn.”

On China HK Stocks Extending Lag on Tech Rotation

Hao Hong – Lotus Asset Management Ltd

“The signal to boost consumption and poor retail sales all argue for better performance in the non-tech sectors. People are looking for value and consumption related themes, and the non-tech’s relative performance will last at least another quarter.”

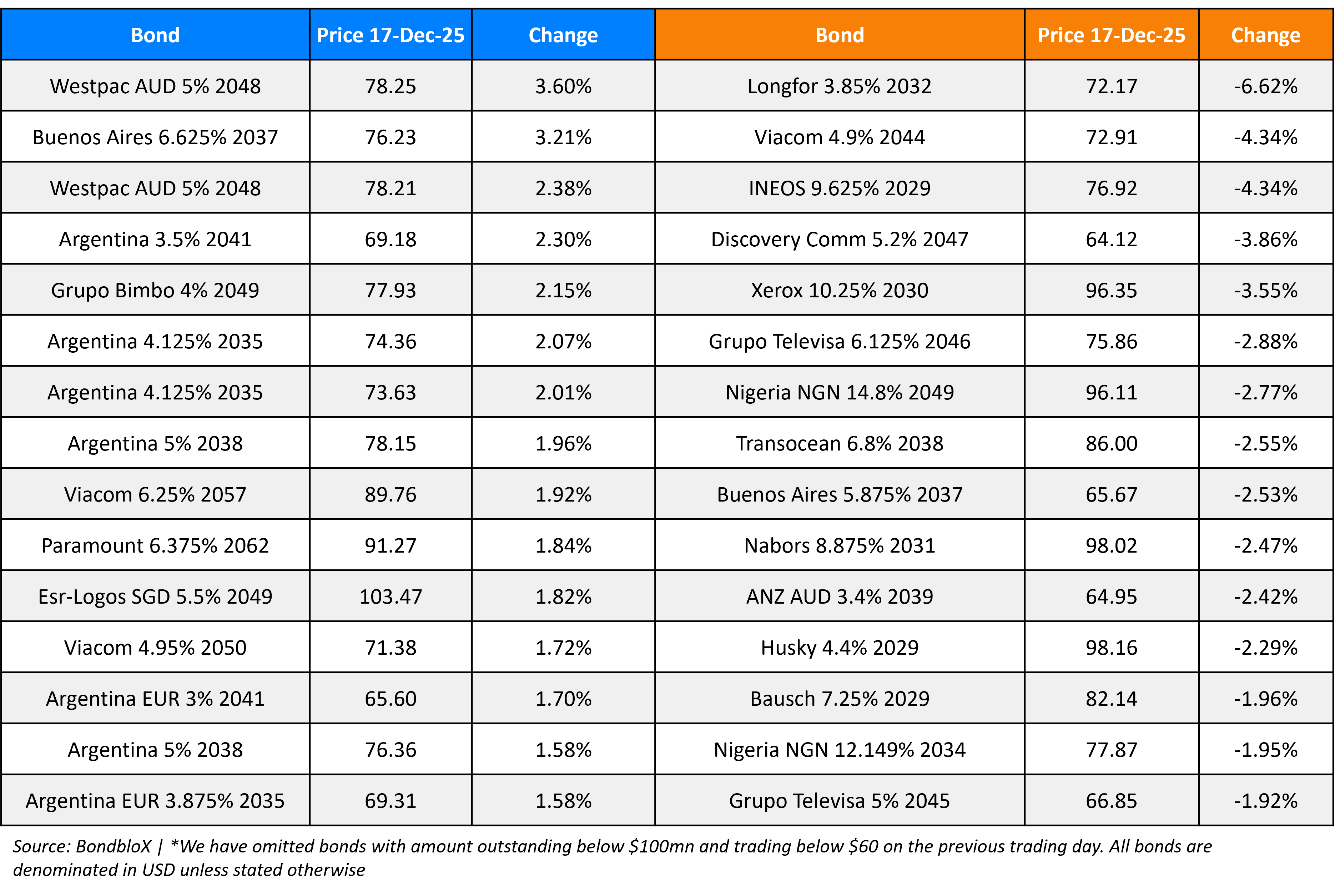

Top Gainers and Losers- 17-Dec-25*

Go back to Latest bond Market News

Related Posts: