This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

NFP Beats Expectations; DRC Prices Debut $ Bond;

February 12, 2026

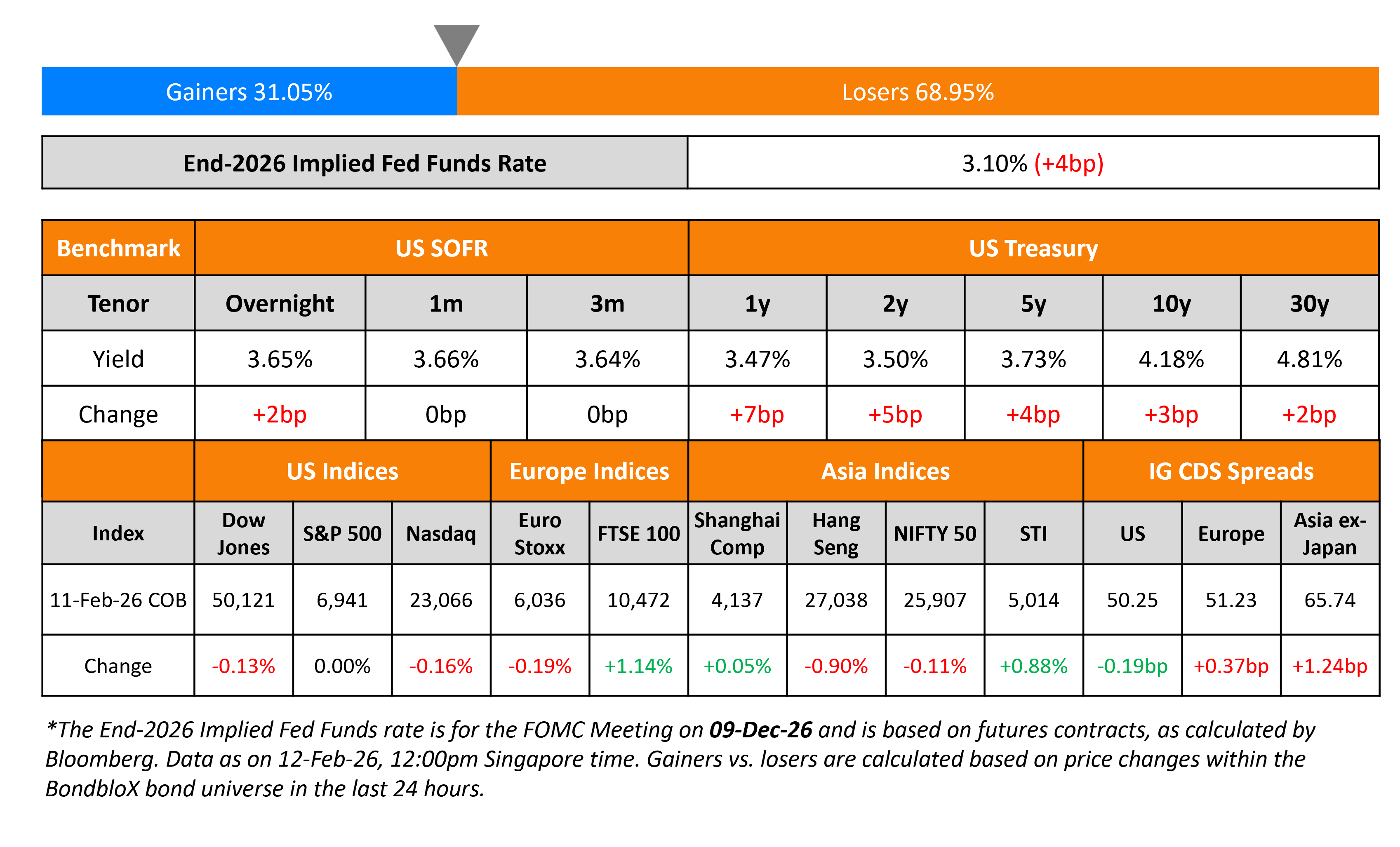

US Treasury yields jumped higher across the curve, with the 2s10s curve bear flattening yesterday. This came on the back of strong jobs data and a weak 10Y Treasury auction. NFP for January showed a sharp jump, coming in at 130k, beating expectations of 65k and the prior month’s 48k print. The Unemployment Rate fell to 4.3% vs. expectations of 4.4%. Average Hourly Earnings (AHE) YoY rose by 3.7%, in-line with expectations. The was followed by a weak 10Y US Treasury auction that saw a bid-to-cover ratio of 2.4x vs. a six-month average of 2.5x, whilst also tailing by 1.4bp.

Looking at US equity markets, the S&P ended flat while the Nasdaq closed 0.2% lower. US IG CDS spreads tightened by 0.2bp and HY CDS spreads were 0.3bp tighter. European equity indices ended mixed. The iTraxx Main CDS spreads were 0.4bp wider and the Crossover CDS spreads were 1.6bp wider. Asian equity markets have opened mixed this morning. Asia ex-Japan CDS spreads were wider by 1.2bp.

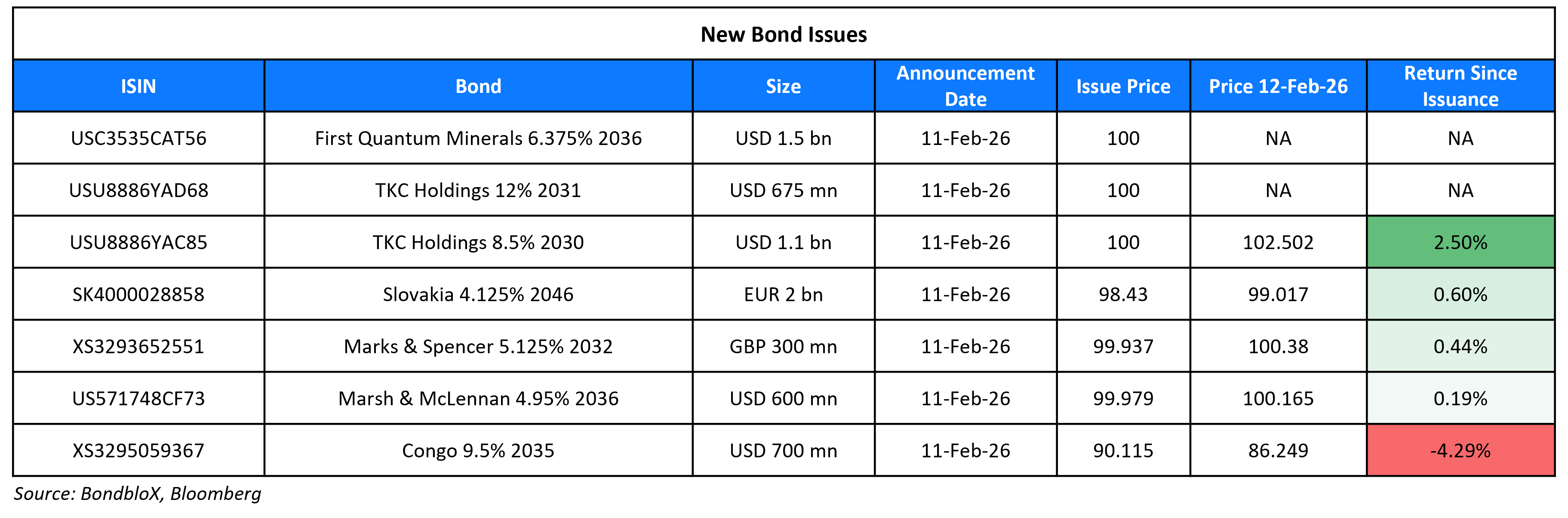

New Bond Issues

The Democratic Republic of Congo raised $700mn via a 7Y debut bond at a yield of 11.625%, 37.5bp inside initial guidance of 12.00% area. The senior unsecured note is rated CCC+/CCC+ (S&P/Fitch), and received orders of over $2bn, 2.9x issue size. Proceeds will be used to fund the tender offer for its 2032s and for refinancing domestic market debt lines.

New Bonds Pipeline

- IMB Bank A$ 10NC5 Tier-2 bond

- Mashreqbank $500mn PerpNC5.5 AT1 bond

Rating Changes

- Moody’s Ratings upgrades Royal Caribbean Cruises Ltd.’s senior unsecured rating to Baa2; outlook stable

- Fitch Downgrades Borr Drilling to ‘B-‘; Off Rating Watch Negative; Outlook Stable

- Moody’s Ratings considers Gran Tierra’s exchange transaction a distressed exchange; downgrades ratings to Caa2, outlook negative

- Empresas CMPC S.A. Downgraded To ‘BBB-‘ From ‘BBB’ On Slower-Than-Expected Deleveraging, Outlook Stable

- Moody’s Ratings affirms Intrum’s ratings, changes outlook to positive from stable

- Fitch Places Valaris on Rating Watch Negative Following Announced Acquisition by Transocean

Term of the Day: First Lien

A first lien bond is a bond with a lien that is senior to its subordinated bonds. A lien is a legal right where a creditor can claim a security interest or seize control of an asset provided by the asset’s owner. It gives a type of legal guarantee to the lender for obligations like loans or debt repayments. Bonds typically can be either first lien, which consist of senior secured debt, or second lien, which consists of junior or subordinated debt that rank below first lien debt in the capital structure. A bondholder of a ‘first lien bond’ gets repaid before all other liens’ holders in the event of a default. Second lien holders get repaid only after the first lien holders get paid back.

Talking Heads

On Software selloff disrupting some M&A and IPO deals – US bankers

Vincenzo La Ruffa, Aquiline Capital Partners

“Some people can’t afford to sell on the way down”

Wally Cheng, Morgan Stanley

“Everything’s down and there really hasn’t been a very thoughtful, detail‑oriented approach to sorting through who winners and losers are”

Robert Smith, Vista Equity Partners

“We feel the volatility in public software markets is being driven primarily by sentiment and uncertainty, not by fundamental performance”

On Oil Industry’s Weakest Links Seeking Relief From Bondholders

Egor Fedorov, ING

“Lower oil prices have had an impact on cash flows and raised concerns”

Dilawer Farazi, Loomis Sayles

“With the bulk of its production in Colombia, smaller, mature fields and more vulnerable to lower oil prices”

Ashley Kelty, Panmure Liberum

“The Jubilee and TEN fields will never generate enough free cash flow, even at higher prices, to cover $1.3 billion of debt”

On There’s Still a Variety of Reasons to Cut Rates – Stephen Miran, Fed Governor

“A variety of reasons why I want to see lower interest rates, and while today’s jobs data made me feel really good about the economy, I think the truth is that pushing out the supply side of the economy still allows for monetary policies to accommodate that”

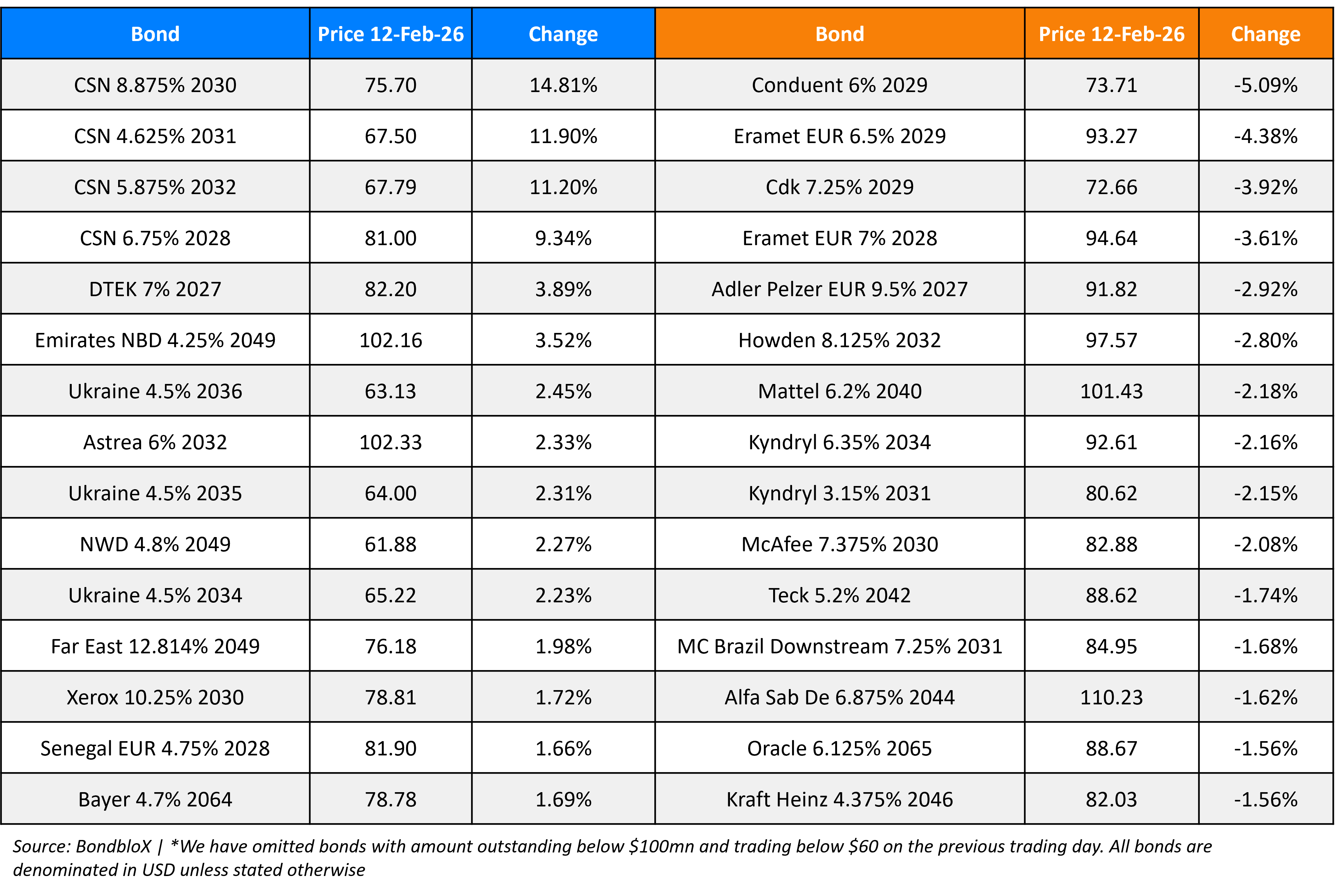

Top Gainers and Losers- 12-Feb-26*

Go back to Latest bond Market News

Related Posts: