This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

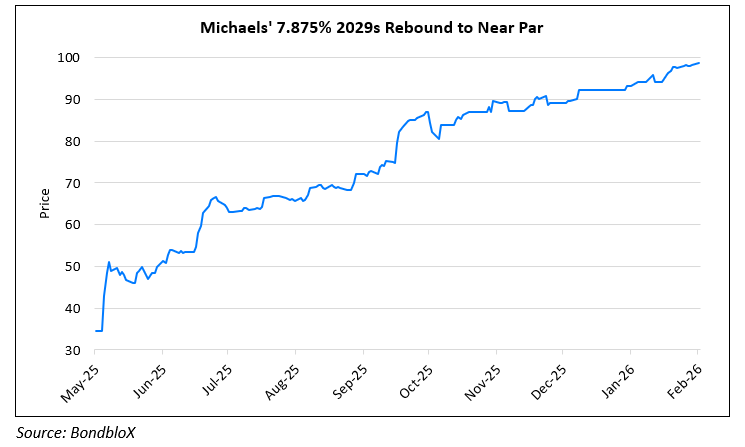

Michael’s Bonds Make a Comeback, Rise to Near Par

February 9, 2026

Michaels, the arts-and-crafts retailer backed by Apollo Global Management has staged a sharp turnaround since April, reporting consistently strong performance. The company expects Q4 same-store sales growth of about 7.9-8.2%, with projected revenue of roughly $1.77bn and earnings of $318–328mn. Earlier concerns which included tariff pressures and potential liability-management actions, have faded as the company’s credit profile has improved. Michaels expects that Q4 ended with about $65–70mn cash and an undrawn asset-based revolver. The retailer has also benefited from market share opportunities created by the liquidations of competitors Joann and Party City. Improved operating results have lifted Michaels’ bonds from distressed levels (about 34 cents on the dollar last May) back to near par, prompting investors to anticipate a refinancing of several billion dollars of debt.

For more details, click here

Go back to Latest bond Market News

Related Posts: