This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

Market Sees Flurry of New Deals Launch Including StanChart, CAS, Clifford

January 6, 2026

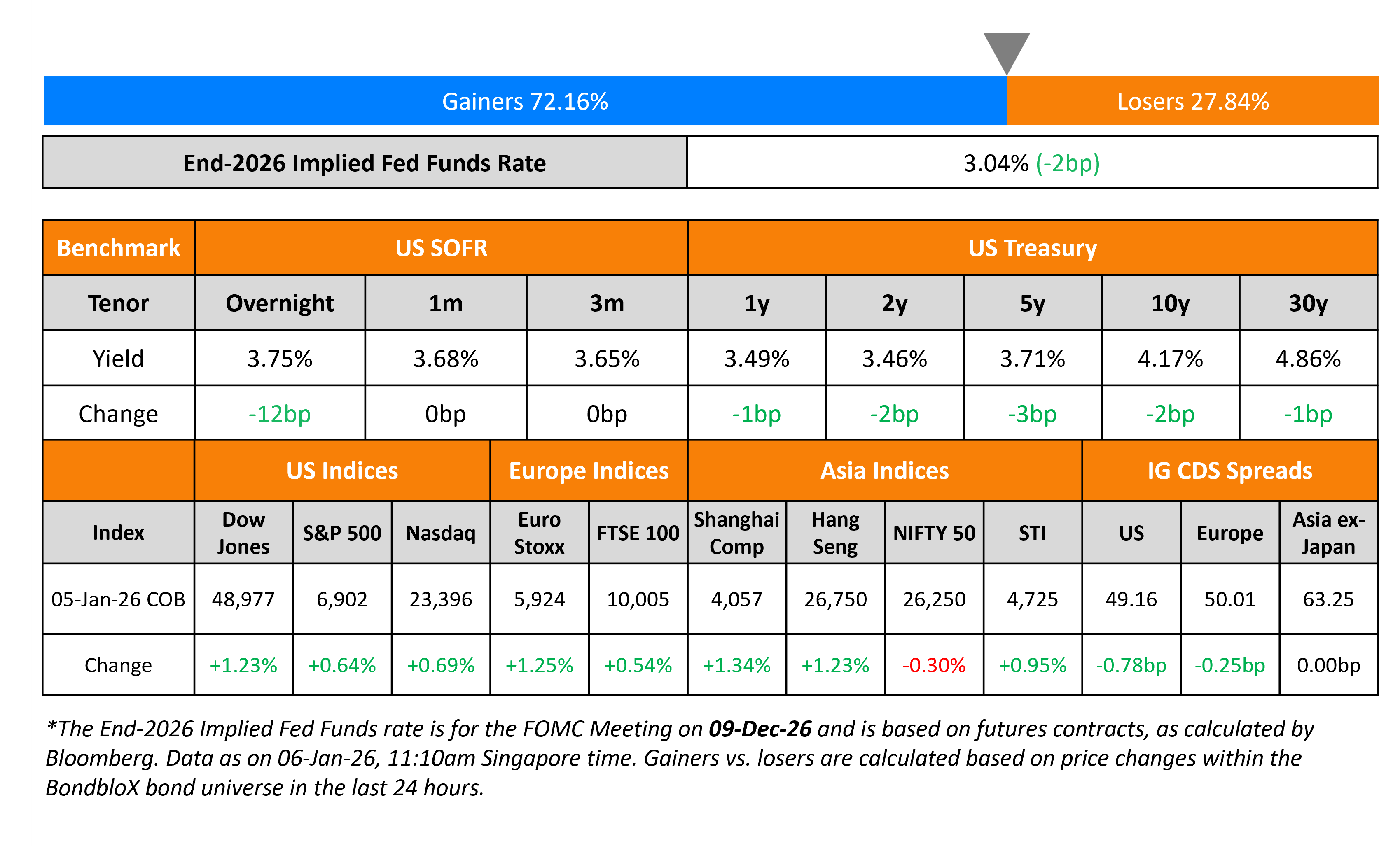

US Treasury yields were lower by 2-3bp across the curve. The ISM Manufacturing Index contracted for the 10th consecutive month in December, and at its weakest pace in over 14 months. The reading came in at 47.9 vs. expectations of 48.3. The sub-indices saw production stay modestly positive while new orders, employment, and inventories remained in contraction territory. Input prices (the Prices Paid reading) stayed nearly unchanged. Meanwhile, Minneapolis Fed President Neil Kashkari said that interest rates may be close to a neutral level for the US economy now.

Looking at US equity markets, the S&P and Nasdaq rallied by 0.6-0.7%. US IG CDS spreads tightened by 0.8bp while HY CDS spreads were tighter by 4.1bp. European equity indices ended higher too. The iTraxx Main CDS spreads were 0.3bp tighter and the Crossover CDS spreads were 1.6bp tighter. Asian equity markets have opened with a positive bias this morning. Asia ex-Japan CDS spreads were unchanged.

New Bond Issues

- Standard Chartered S$ PerpNC5.5 AT1 at 4.7% area

- CAS Holding $ PerpNC5.25 at 6.625% area

- KEXIM $ 3Y/3Y FRN/5Y/5Y FRN at T+50bp/SOFR eq./T+53bp/T+57bp areas

- Clifford Capital $ 3Y/5Y at T+62/T+65bp areas

- AgBank of China (NY) $ 5Y FRN at SOFR+105bp area

- Swire Properties $ green bond at T+90bp area

- Far East Horizon $ 3Y at T+215bp area

- Resona Bank $ 5Y at T+90bp area

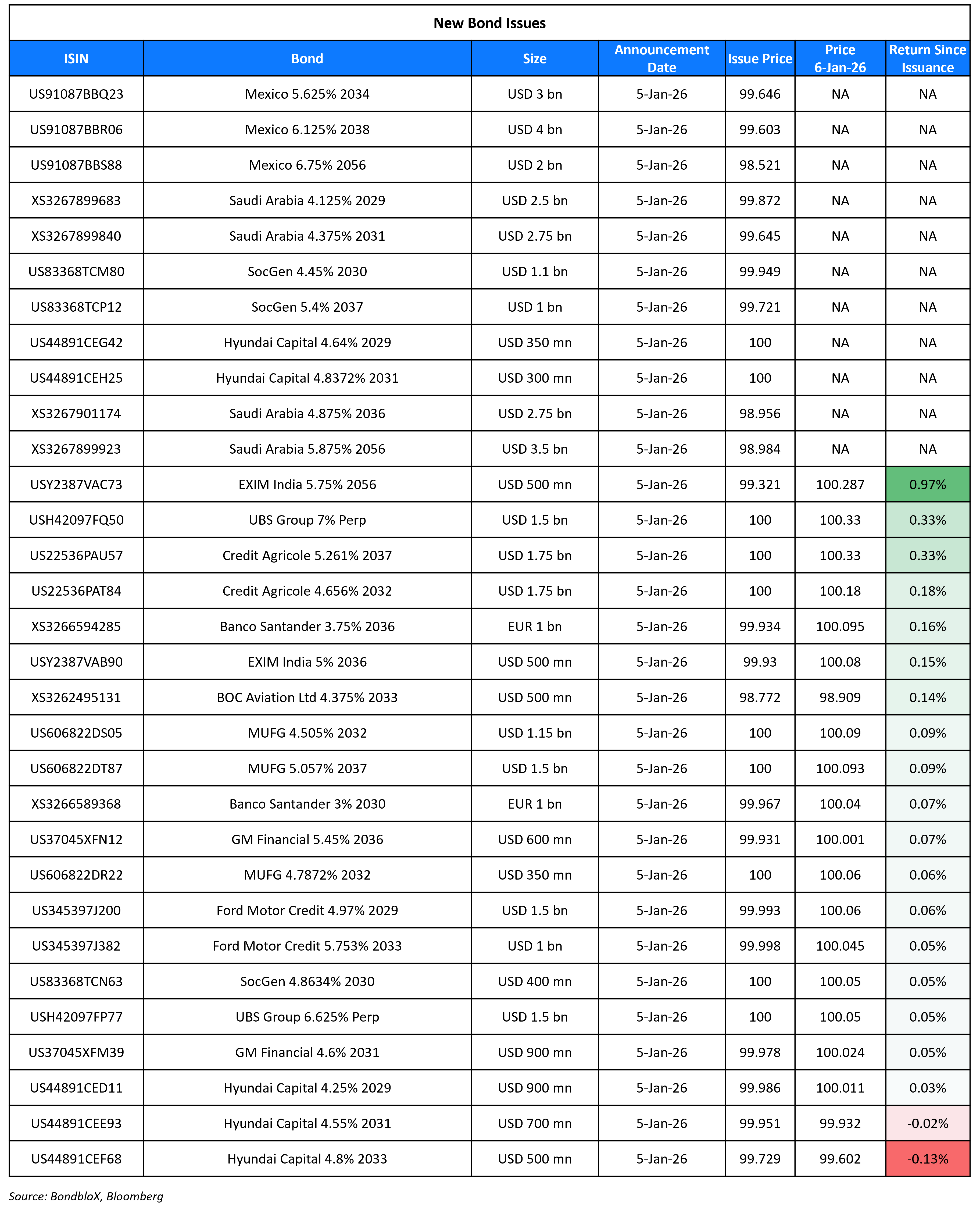

EXIM India raised $1bn via a two-tranche offering. It raised $500mn via a 10Y bond at a yield of 5.009%, 30bp inside initial guidance of T+115bp area. It also raised $500mn via a 30Y bond at a yield of 5.798%, 45bp inside initial guidance of T+140bp area. Proceeds will be used to fund credit lines, loans for overseas investments and joint ventures, import of capital goods by export-oriented units, concessional financing schemes and eligible foreign currency loans.

Ford Motor Credit raised $2.5bn via a two-tranche offering. It raised $1.5bn via a 3Y bond at a yield of 4.975%, 35bp inside initial guidance of T+180bp area. It also raised $1bn via a 7Y bond at a yield of 5.755%, 32bp inside initial guidance of T+215bp area. The senior unsecured notes are rated Ba1/BBB-/BBB-. Proceeds will be used for general corporate purposes.

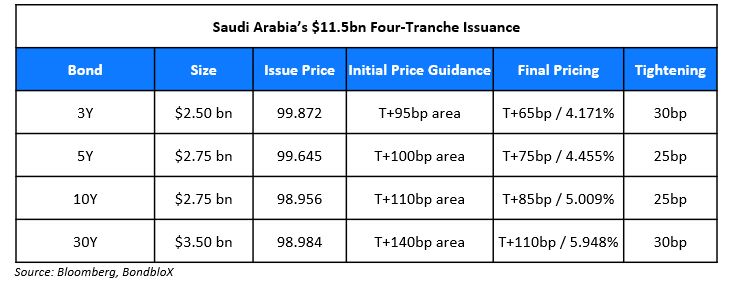

Saudi Arabia raised $11.5bn via a four-trancher.

The notes are rated A+, and received combined orders of ~$28bn, 2.4x issue size. Proceeds will be used for domestic general budgetary purposes.

Mexico raised $9bn via a three-trancher. It raised:

- $3bn via an 8Y bond at a yield of 5.679%, 30bp inside initial guidance of T+205bp area

- $4bn via a 12Y bond at a yield of 6.171%, 35bp inside initial guidance of T+235bp area

- $2bn via a 30Y bond at a yield of 6.866%, 25bp inside initial guidance of T+225bp area

The notes are rated Baa2/BBB/BBB-. Proceeds will be used for general purposes.

Societe Generale raised $2.5bn via a three-trancher. It raised:

- $400mn via a 4.25NC3.25 FRN at SOFR+109.6bp vs. initial guidance of SOFR equivalent area

- $1.1bn via a 4.25NC3.25 bond at a yield of 4.469%, 25bp inside initial guidance of T+120bp area

- $1bn via an 11.25NC10.25 bond at a yield of 5.437%, 27bp inside initial guidance of T+155bp area

The senior non-preferred notes are rated Baa2/BBB/A-.

General Motors Financial raised $1.5bn via a two-tranche offering. It raised $900mn via a 5Y bond at a yield of 4.605%, 30bp inside initial guidance of T+120bp area. It also raised $600mn via a 10Y bond at a yield of 5.459%, 35bp inside initial guidance of T+165bp area. The senior unsecured notes are rated Baa2/BBB/BBB. Proceeds will be used for general corporate purposes.

Banco Santander raised €2bn via a two-tranche offering. It raised €1bn via a 4Y bond at a yield of 3.009%, 28bp inside initial guidance of the MS+80bp area. It also raised €1bn via a 10Y bond at a yield of 3.758%, 28bp inside initial guidance of MS+110bp area. The senior preferred notes are rated A1/A+/A+ and received combined orders of €4.5bn, 2.3x issue size.

BOC Aviation raised $500mn via a 7Y bond at a yield of 4.582%, 30bp inside initial guidance of T+95bp area. The senior unsecured note is rated A-/A- by S&P and Fitch. Proceeds will be used for new capital expenditure, general corporate purposes and/or refinancing of existing borrowings.

Mitsubishi UFJ Financial Group raised $3bn via a three-trancher. It raised:

- $1.15bn via a 6NC5 bond at a yield of 4.505%, around 25-30bp inside initial guidance of T+105/110bp area

- $350mn via a 6NC5 FRN at SOFR+102bp vs. initial guidance of SOFR equivalent area

- $1.5bn via an 11NC10 bond at a yield of 5.057%, 30bp inside initial guidance of T+120bp area

The SEC-registered senior unsecured notes are unrated. Proceeds will be used to fund the operations of MUFG Bank Ltd. through loans intended to qualify as internal TLAC debt.

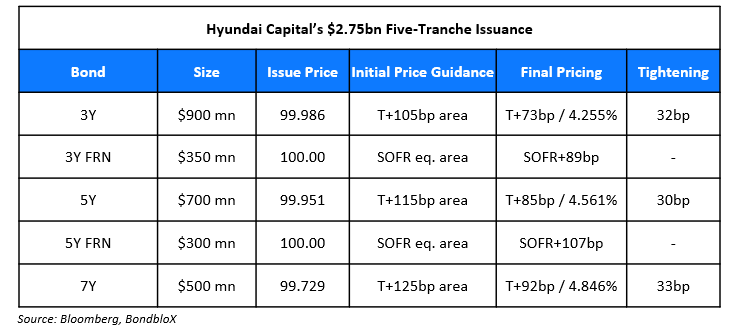

Hyundai Capital raised $2.75bn via a five-trancher.

The senior unsecured notes are rated A3/A-/A-. Proceeds will be used for general corporate purposes.

Level 3 Financing raised $650mn via a tap of its 8.5% 2036s at a yield of 8.237%. The senior unsecured note is rated Caa1/B-. Proceeds, if necessary with cash in hand or other available liquidity, will be used to fund the purchase of any existing second lien notes under its tender offer. The deal was upsized from the initial $600mn size.

Rating Changes

- Level 3 Financing Inc. Senior Unsecured Note Rating Raised To ‘B-‘ From ‘CCC’ On Second-Lien Note Repayment

- Fitch Upgrades VTR to ‘B+’; Outlook Stable

- Fitch Upgrades SK Mohawk Holdings, SCS to ‘B-‘; Outlook Stable

- Moody’s Ratings upgrades Callaway’s CFR to Ba3; outlook is positive

New Bonds Pipeline

- SK Battery America $ 3Y green bond

- Thai Oil $ Perp

- SJM Holdings $ bond

Term of the Day

Sovereign Risk Premium

Sovereign risk premium refers to the additional implied spread that a country’s sovereign bonds offer vs. a benchmark for a particular currency. Put differently, it is the incremental return (or yield) that investors demand from a country to buy its sovereign bonds vs. the benchmark.

Talking Heads

On SF Fed Research Suggesting that Tariffs May Lower Inflation

“Our analysis of historical data highlights a possibility that the large tariff increase of 2025 could put upward pressure on unemployment while putting downward pressure on inflation”

On Warning of Growing ‘Fiscal Dominance’ Threat to US Economy – Janet Yellen, Fmr. US Treasury Secy

“The preconditions for fiscal dominance are clearly strengthening… I doubt Americans will end up on the fiscal dominance course, but I definitely think the dangers are real and should be monitored”

On Hedge Fund Canaima Seeing Likely Venezuela Debt Revamp in 2026

“With the removal of Maduro, it’s opening up a way for US companies — as President Trump mentioned this weekend — to come into the country and create the cash flow for a potential restructuring… If this happens (restructuring), there will clearly be a path for a restructuring as early as this year… The big bet here is that Venezuela will go back into the Western financial system… There will be a lot of instruments that could be given to investors to pay for the time spent and to repay them”

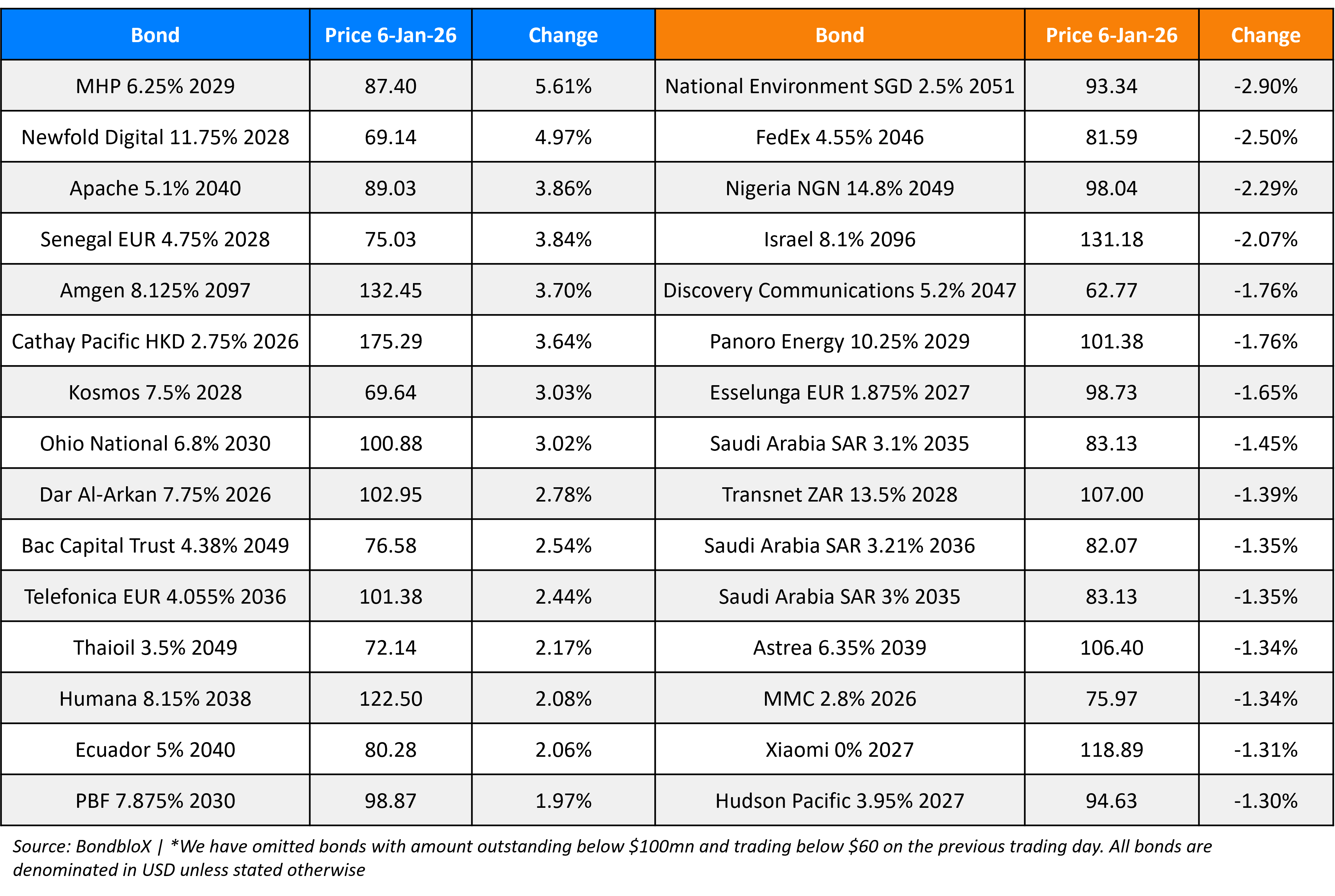

Top Gainers and Losers- 06-Jan-26*

Go back to Latest bond Market News

Related Posts: