This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

Malaysia and Pakistan Plan Return to Offshore Bond Markets After Years

January 21, 2026

Malaysia has indicated a potential return to the dollar bond primary markets after 2021, having sent a request for proposals to banks, as per sources. Malaysia, which has a $1bn sukuk due in April this year, had last raised $1.3bn in 2021. The nation is currently rated A3/A-/BBB+. As per Bloomberg, the Malaysian government is considering a dollar fundraise after spreads on dollar denominated Asian debt have tightened to a record low. The average OAS on the Bloomberg EM Asia USD Credit Index has tightened near its lowest levels at 100bp.

Malaysia’s dollar bonds were trading stable with its 2.07% sukuk due 2031 at 90.7, yielding 4.15%.

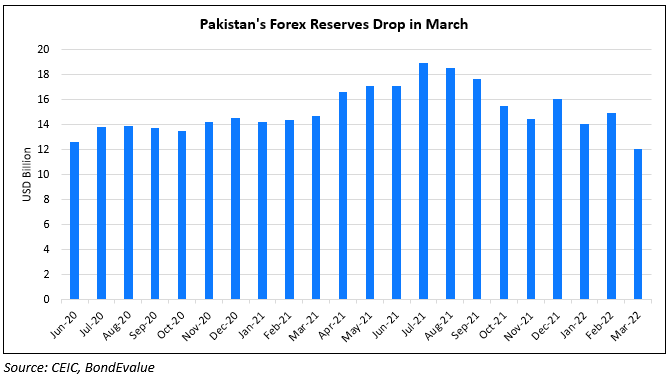

Similarly, Pakistan has also planned a return to the global bond market after four years. Their Finance Minister announced that the government will seek advisers in the coming weeks to evaluate dollar, euro, or sukuk issuances. Separately, Pakistan is also expected to launch an inaugural panda bond issuance soon. This follows a recovery from the brink of default with the nation also reducing inflation from 40% to single digits over the last few years, whilst also securing credit rating upgrades.

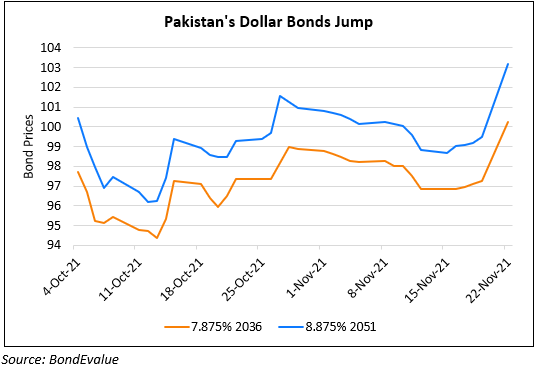

Pakistan’s dollar bonds were trading stable with its 7.375% 2031s at 99.8, yielding 7.42%

Go back to Latest bond Market News

Related Posts: