This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

Kuaishou, QNB Launch $ Bonds; HK, JPMorgan, UOB and others Price Bonds

January 15, 2026

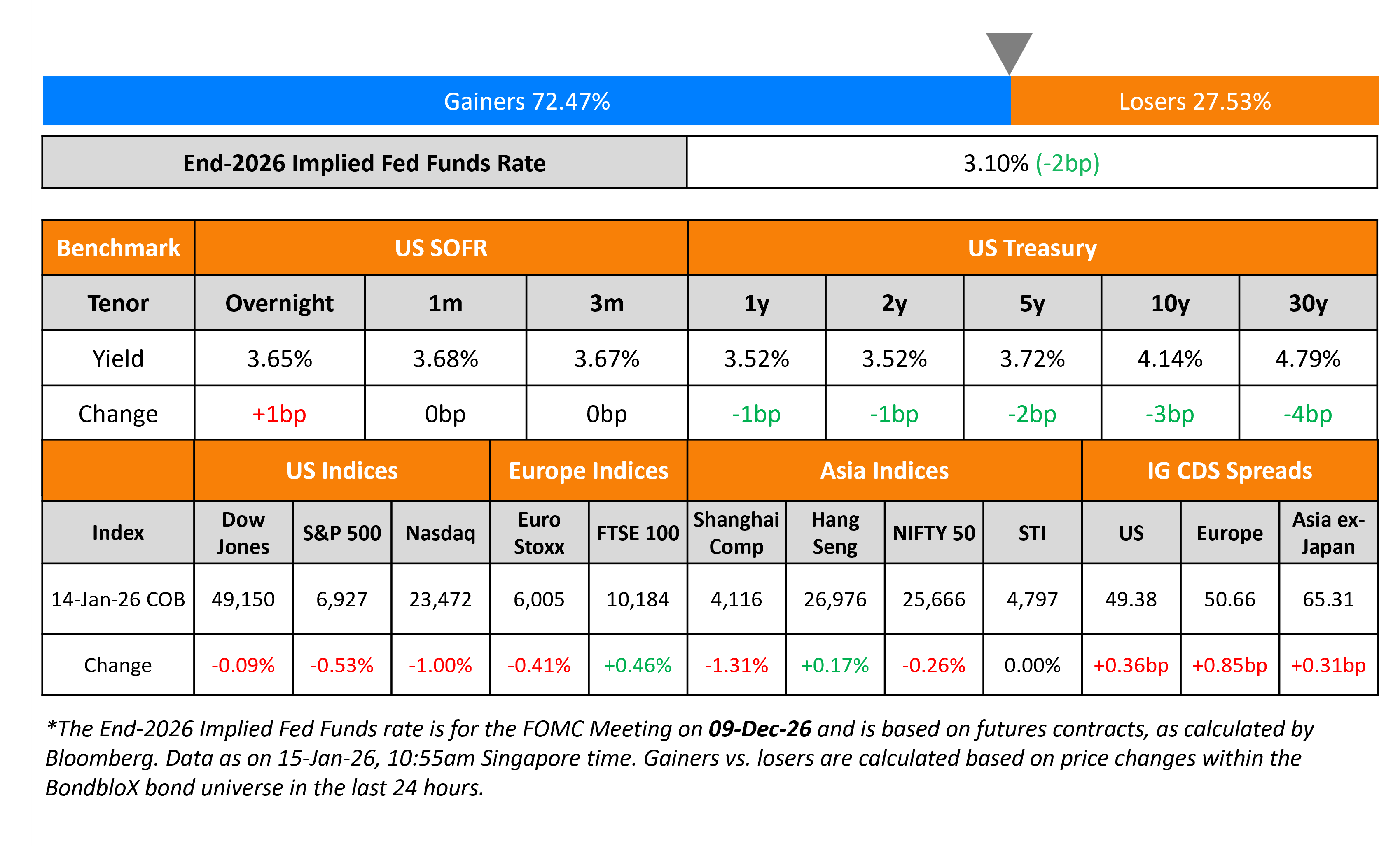

US Treasury yields eased with the 2s10s curve flattening by 2bp. Retail Sales in November grew by 0.6% MoM, better than expectations of 0.5%, with the core print growing by 0.5%, also beating expectations of 0.4%. The headline and core PPI Final Demand for November showed a 3.0% YoY increase vs. expectations of 2.7%. Separately, the Fed’s Beige Book indicated that overall economic activity increased at a slight to modest pace in eight of the twelve districts. On the labour market, it noted that employment was mostly unchanged, while on inflation, it stated that prices grew at a moderate rate.

Looking at US equity markets, the S&P and Nasdaq ended lower by 0.5% and 1% respectively. US IG CDS spreads widened by 0.4bp and HY CDS spreads were wider by 2.3bp. European equity indices ended mixed. The iTraxx Main and Crossover CDS spreads widened by 0.9bp. Asian equity markets are trading weaker this morning. Asia ex-Japan CDS spreads were wider by 0.3bp.

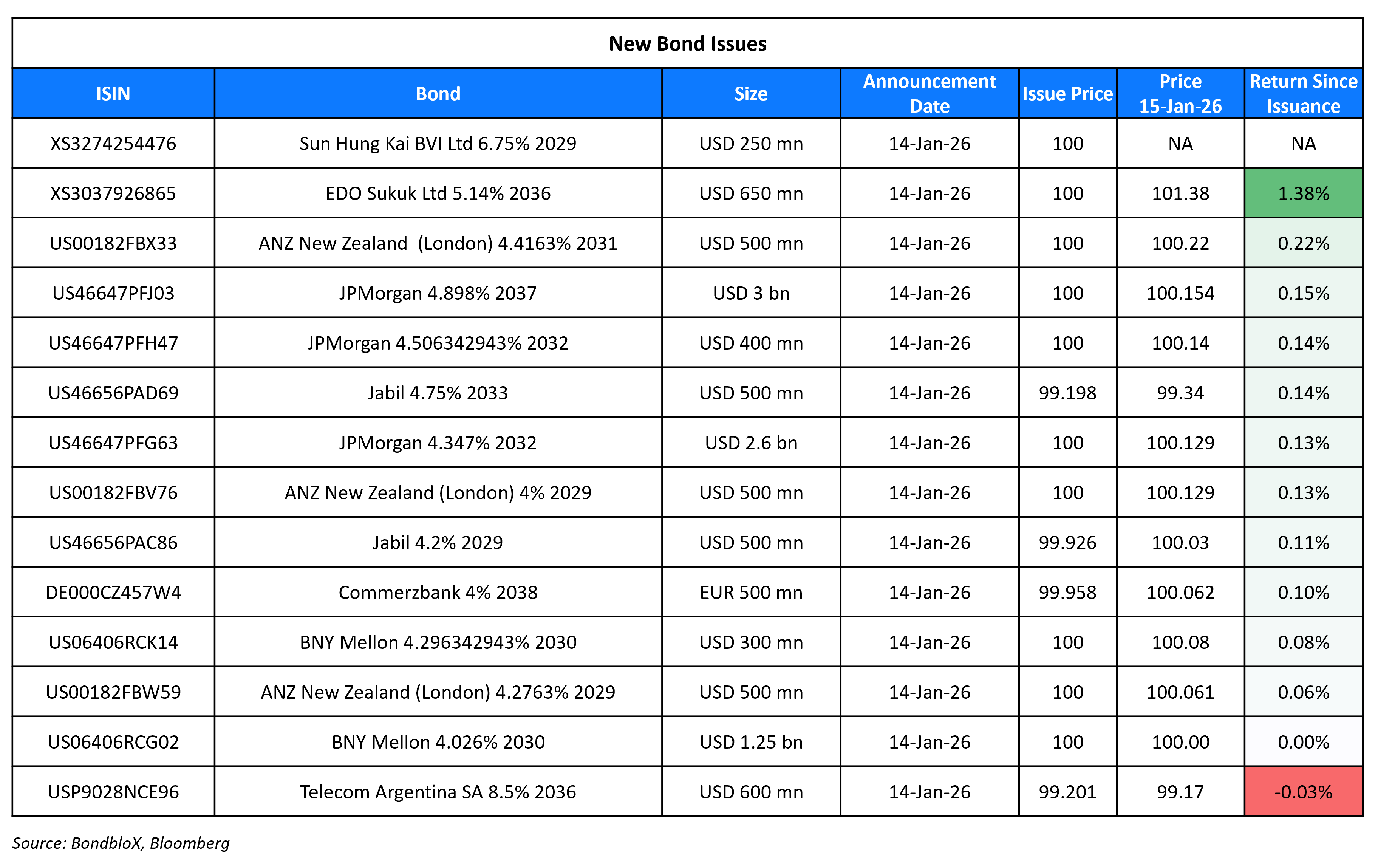

New Bond Issues

-

Kuaishou $ 5Y/10Y at T+85bp/T+100bp areas

-

Qatar National Bank $ 5Y FRN at SOFR+80bp

JPMorgan Chase & Co raised $6bn via a three-tranche offering. It raised:

- $2.6bn via a 6NC5 bond at a yield of 4.347%, 24.5bp inside initial guidance of T+87.5bp area.

- $400mn via a 6NC5 FRN at SOFR+84bp vs. initial guidance of SOFR equivalent area

- $3bn via an 11NC10 bond at a yield of 4.898%, 24bp inside initial guidance of T+100bp area.

The senior unsecured notes are rated Aa2/A-/AA- (Moody’s/S&P/Fitch). Proceeds will be used for general corporate purposes.

Sun Hung Kai & Co raised $250mn via a 3Y bond at a yield of 6.75%, inline with initial guidance. The senior unsecured notes are unrated. The notes are issued by Sun Hung Kai & Co BVI Ltd. Proceeds will be used for general corporate purposes and for refinancing existing debt.

UOB raised S$800mn via a PerpNC7 bond at a yield of 3%, inline with final guidance. The subordinated notes are rated Baa1/BBB+ (Moody’s/Fitch). If not called by 21 January 2033, the coupon will reset to the 7Y SGD OIS Swap + 94bp. The notes have a dividend stopper in place and have a partial writedown applicable upon occurrence of a loss absorption event. Proceeds will be used for general corporate purposes and to refinance existing debt.

Commerzbank raised €500mn via a 12NC7 Tier-2 green bond at a yield of 4.007%, 30bp inside initial guidance of MS+165bp area. The subordinated notes are rated Baa2/BBB-, and received orders of over €2.15bn, ~4.3x issue size. Net proceeds will be used to finance/refinance, in whole or in part, eligible new and existing green assets in accordance with its green funding framework.

Bank of New York (BNY) Mellon raised $1.55bn via a two-tranche offering. It raised $1.25bn via a 4NC3 bond at a yield of 4.026%, 28bp inside initial guidance of T+75bp area. It also raised $300mn via a 4NC3 FRN at SOFR+63bp vs. initial guidance of SOFR equivalent area. The senior unsecured notes are rated Aa3/A/AA-/AA. Proceeds will be used for general corporate purposes.

EDO Sukuk (Energy Development Oman) raised $650mn via a 10Y sukuk at a yield of 5.14%, 35bp inside initial guidance of T+135bp area. The senior unsecured notes are rated BBB-/BBB- (S&P/Fitch) and received orders of over $1.3bn, ~2x issue size.

Telecom Argentina raised $600mn via a 10Y bond at a yield of 8.625%, 37.5bp inside initial guidance of 9% area. The senior unsecured bond is rated B2. Proceeds will be used to repay/refinance existing debt, and the remainder, if any, for general corporate purposes. The notes are amortizing with two equal annual instalments of 50% each on 20 January 2035 and at maturity. The bond has a weighted average life of 9.5 years.

Jabil Inc raised $1bn via a two-tranche offering. It raised $500mn via a 3Y bond at a yield of 4.226%, 33bp inside initial guidance of T+100bp area. It also raised $500mn via a 7Y bond at a yield of 4.886%, 33bp inside initial guidance of T+130bp area. The senior unsecured notes are expected to be rated Baa3/BBB-/BBB-. Proceeds will be used for general corporate purposes, including the repayment of its 2026s at or prior to maturity.

ANZ New Zealand (London) raised $1.5bn via a three-trancher. It raised:

- $500mn via a 3Y bond at a yield of 4.0%, 30bp inside initial guidance of T+75bp area.

- $500mn via a 3Y FRN at SOFR+61bp vs. initial guidance of SOFR equivalent area

- $500mn via a 5Y FRN at SOFR+75bp vs. 30bp inside initial guidance of SOFR+105bp area

The senior unsecured notes are guaranteed by ANZ Bank New Zealand Ltd and are expected to be rated A1/AA-/A+. Proceeds will be used for general corporate purposes.

New Bonds Pipeline

- Toyota Finance Australia $ 3.25Y FRN/5Y bond

- Woori Bank $ 3Y/5Y sustainability bond

Rating Changes

- Electricite de France Upgraded To ‘BBB+’; Outlook Stable

- Allegiant Travel Co. Outlook Revised To Stable On Improving Metrics, Sun Country Acquisition; ‘B+’ Rating Affirmed

Term of the Day: Will Not Grow (WNG) Bonds

Bonds whose size is fixed and cannot be increased are called ‘Will Not Grow (WNG)’ or ‘No Grow’ bonds. Sometimes, issuers increase the final size of a deal to accommodate investor appetite. WNG bonds however have a fixed size and will not be increased. For example, green bonds often fall into this category as per the Climate Bonds Initiative (CBI). The CBI says that issuers need to show that there are enough green projects to match the amount that they intend to raise and for some, the number of suitable projects is limited. This according to them shows why green bonds tend to be smaller than vanilla bonds from the same issuer whereas for others there is more flexibility and the final size of the deal can be increased to accommodate investor appetite.

Talking Heads

On the Rally Sweeping EM to Last ‘for Years’ – Pramol Dhawan, Pimco

“This is a playbook that will last for many years. We’re not interested in taking chips off the table. Not at all… Some of the best balance sheets are in select high-quality emerging markets… can see a world where some EM yields trade inside DM.”

On Calling US Fed Autonomy ‘Incredibly Important’ – Harvey Schwartz, CEO of Carlyle Group

“Jay did a very good job of not engaging in a dialogue with the administration, regardless of the criticism he was taking… I think it’s actually brought it to a peak in terms of a discussion”

On Bessent urging ‘sound’ BOJ policy to address excess FX volatility – US Treasury Department

“Noting the inherent undesirability of excess exchange rate volatility, the Secretary also emphasized the need for sound formulation and communication of monetary policy”

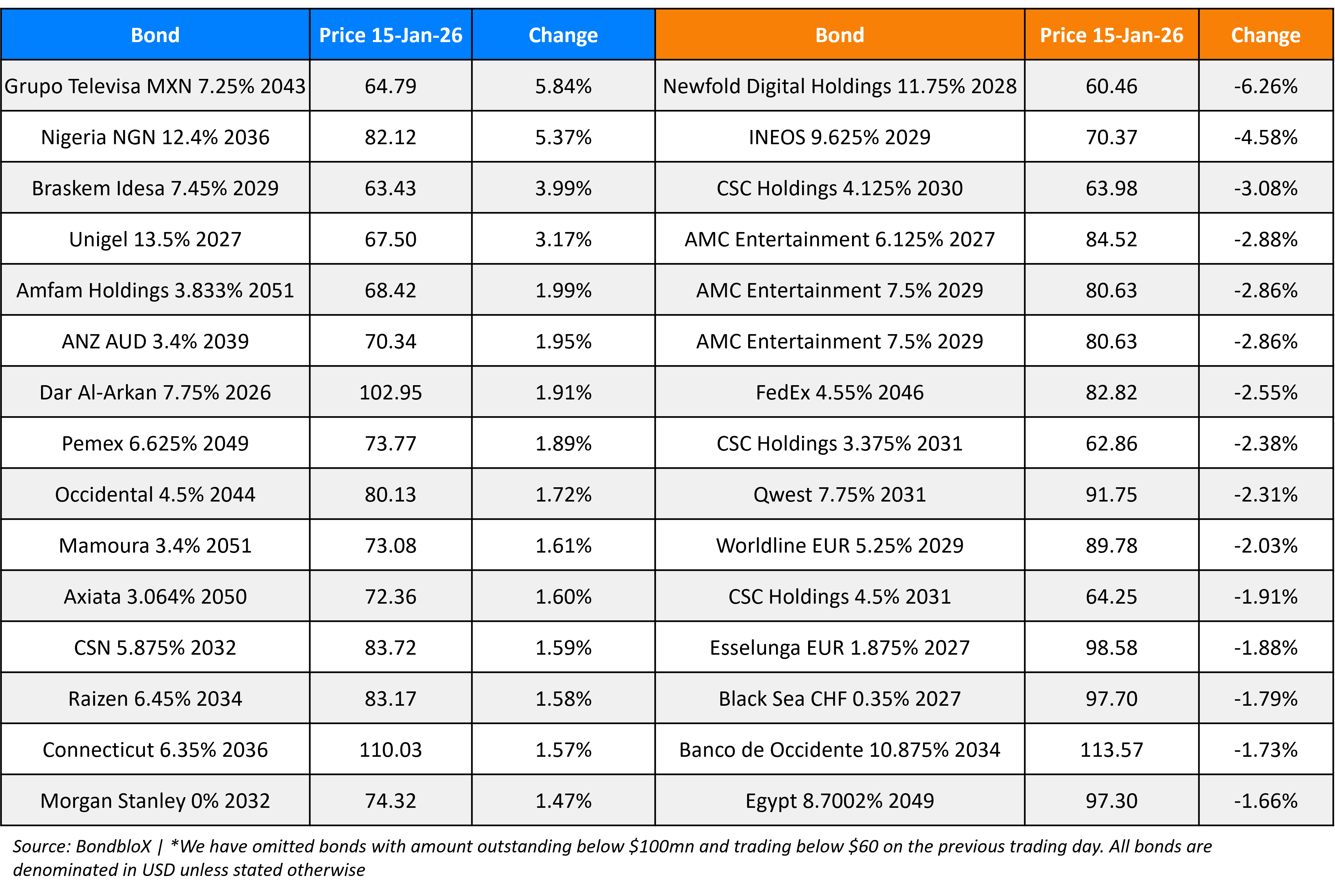

Top Gainers and Losers- 15-Jan-26*

Go back to Latest bond Market News

Related Posts: