This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

Kenya, Michaels Price $ Bonds; Weekly Jobless Claims Ease

February 20, 2026

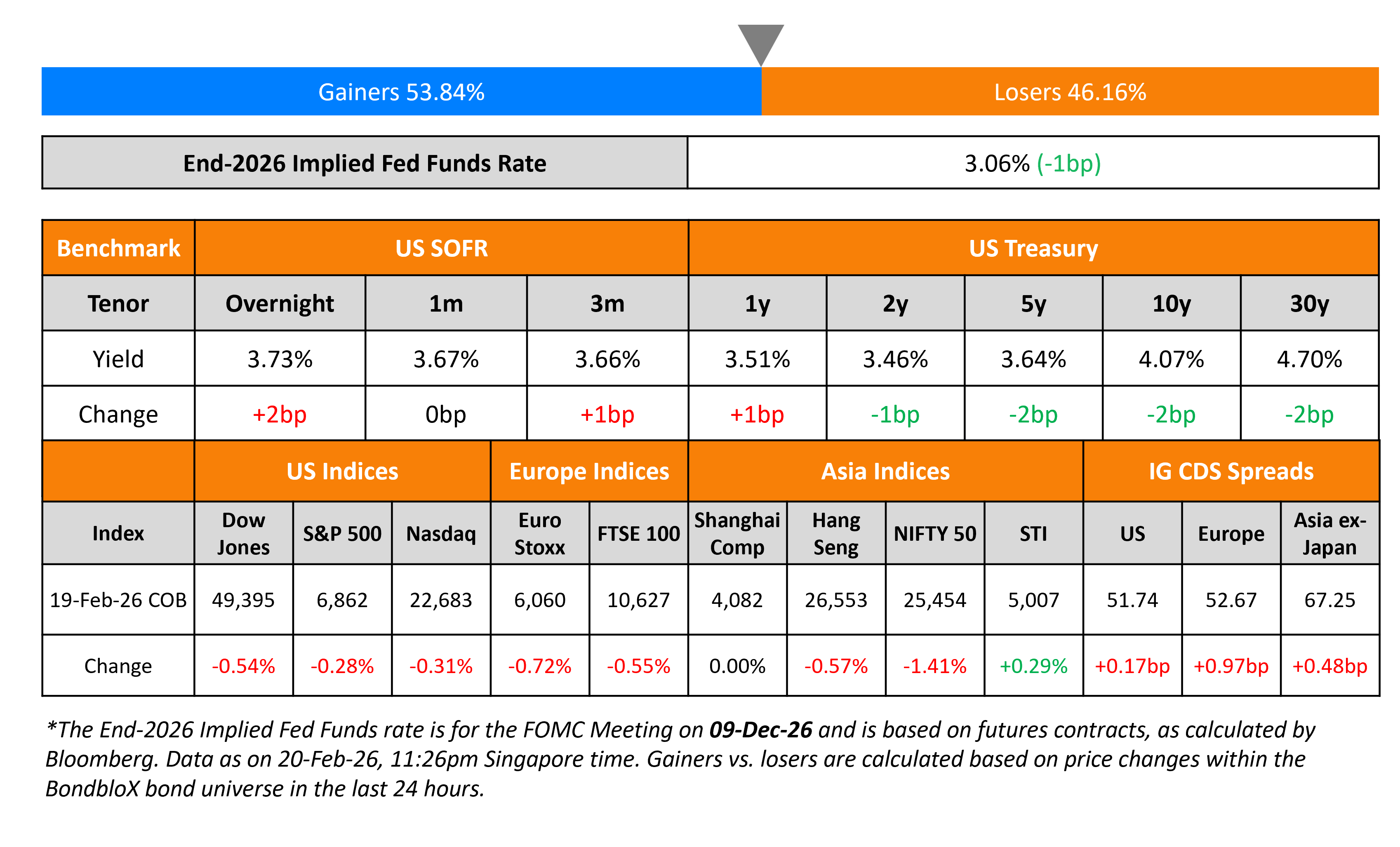

US Treasury yields were broadly stable across the curve on Thursday. Initial jobless claims for the prior week eased to 206k, better than expectations of 225k. Separately in geopolitical news, US President Donald Trump indicated that the US may or may not reach a deal with Iran over its nuclear programme over the next several days. This comes amid the US military having been deployed in the Middle East if the talks fail. On the back of this development, Brent crude prices rallied by nearly 7% over the last two trading sessions.

Looking at US equity markets, the S&P and Nasdaq ended lower by ~0.3% each. US IG CDS spreads widened by 0.2bp and HY CDS spreads were 1.4bp wider. European equity indices ended lower too. The iTraxx Main CDS spreads were 1bp wider and the Crossover CDS spreads were 4.5bp wider. Asian equity markets have opened lower this morning. Asia ex-Japan CDS spreads widened by 0.5bp. Japan’s overall CPI dropped to 1.5%, slipping below 2% for the first time since March 2022. The CPI ex-fresh food reading rose 2% YoY, its slowest pace since January 2024.

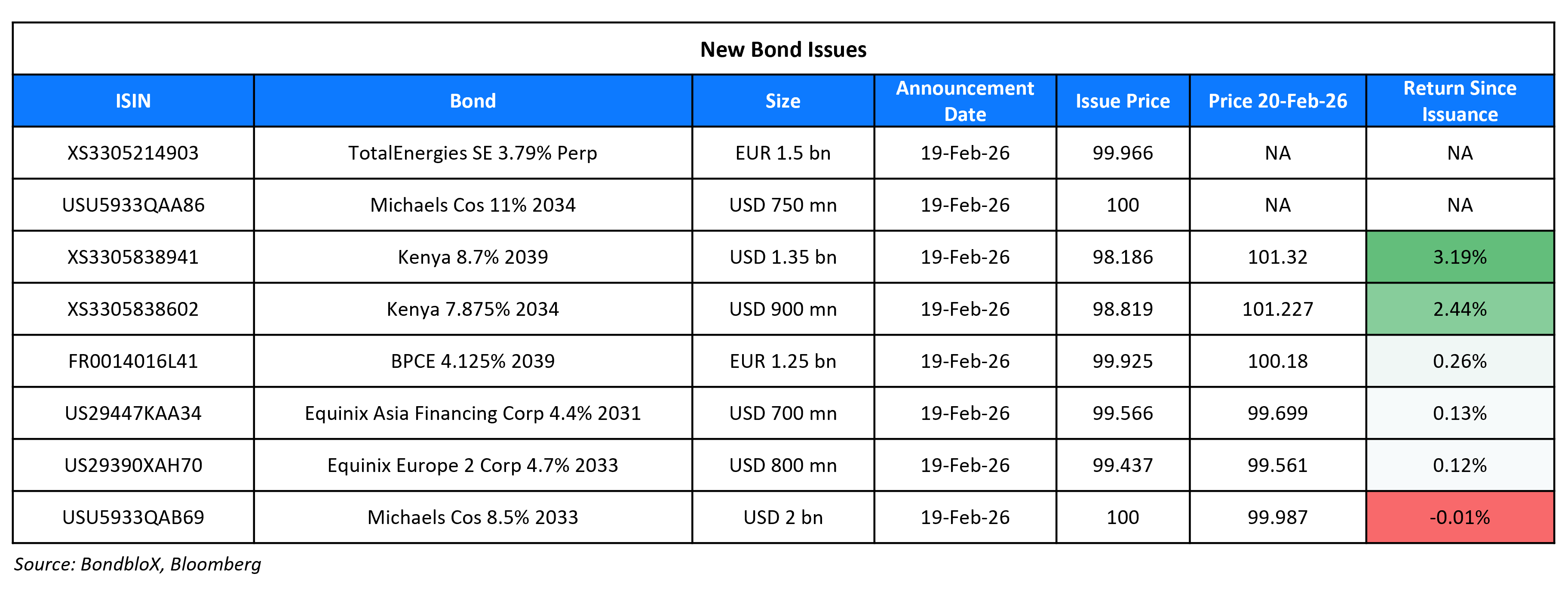

New Bond Issues

Kenya raised $2.25bn via a dual-tranche offering. It raised $900mn via a 7Y bond at a yield of 8.10%, 27.5bp inside initial guidance of 8.375% area. It also raised $1.35bn via a 12Y bond at a yield of 8.95%, 30bp inside initial guidance of 9.25% area. The senior unsecured notes are rated B/B- (S&P/Fitch), and received orders of over $4.6bn, ~2x issue size. Proceeds will be used for general budgetary purposes and to finance the repayment of the outstanding debt – this includes the purchase of its outstanding 8% amortising notes due 2032 (for up to $350mn in cash including accrued interest) and its 7.25% 2028s (for up to $150mn in cash including accrued interest). The new 7Y bond is priced at a new issue premium of 30bp over its existing 7.875% 2033s that currently yield 7.80%.

Michaels raised $2.75bn via a dual-tranche offering. It raised $2bn via a 7NC3 senior secured first lien bond at a yield of 8.5%. It also raised $750mn via an 8NC3 senior secured second lien bond at a yield of 11%. The first lien note is rated B1/B- while the second lien note is rated Caa1/CCC. Proceeds, together with borrowings under its first lien term loan facility and cash on hand are intended to fund the repurchase/repayment of its existing notes.

BPCE raised €1.25bn via a 13NC12 bond at a yield of 4.133%, ~25.5bp inside initial guidance of MS+150/155bp area. The senior non-preferred note is rated Baa1/BBB+/A. Proceeds will be used for general corporate purposes.

TotalEnergies raised €1.5bn via a PerpNC5.25 hybrid bond at a yield of 3.80%, ~51.25bp inside initial guidance of 4.25-4.375% area. The subordinated note is rated A2/A-, and received orders of over €3.5bn, 2.3x issue size. If not called by 26 May 2031, the coupon will reset to 5Y Mid-Swap plus 134.5bp. If not called by 26 May 2036, there is a coupon step-up of 25bp and if not called by 26 May 2051, there is an additional step-up of 75bp. Proceeds will be used for general corporate purposes.

New Bonds Pipeline

- CBA A$ 10NC5 FRN/fixed and/or 20Y bullet subordinated notes

Rating Changes

- Adani International Container Terminal Pvt. Ltd. Issue Rating Raised To ‘BBB’; Outlook Stable

- Ineos Group Holdings Downgraded To ‘B+’, Ineos Quattro Holdings To ‘B’ On Higher Projected Leverage; Outlook Negative

- Moody’s Ratings downgrades CSN’s ratings to B2, negative outlook

- Fitch Downgrades Alpek to ‘BB+’; Outlook Negative

- Alpek Downgraded To ‘BB+’ From ‘BBB-‘ On Sustained Business And Profitability Challenges; Outlook Negative

- Moody’s Ratings has downgraded Huntsman to Ba2 from Ba1; outlook negative

- Fitch Revises Bayer’s Outlook to Negative; Affirms IDR at ‘BBB’

- PTT Global Chemical Outlook Revised To Negative On Earnings Strain; ‘BBB-‘ Ratings Affirmed

- Rockies Express Pipeline LLC Outlook Revised To Stable From Negative On Reduced Leverage; ‘B+’ Rating Affirmed

Term of the Day: Second Lien Bond

A second lien bond is a bond with a lien that is subordinated to its senior bonds. A lien is a legal right where a creditor can claim a security interest or seize control in an asset provided by the asset’s owner. It gives a type of a legal guarantee to the lender for obligations like loan or debt repayments. Bonds typically can be either first lien, which consist of senior secured debt, or second lien, which consists of junior or subordinated debt that rank below first lien debt in the capital structure. A bondholder of a ‘first lien bond’ gets repaid before all other liens and bondholders in the event of a default. Second lien holders get repaid only after the first lien holders get paid back.

Talking Heads

On Invesco, Carmignac Betting Against US Debt, See Limited Fed Cuts

Guillame Rigeade, Carmignac

“They will cut rates, but it is not justified by the inflation outlook and growth”

Sam Lynton-Brown, BNP Paribas

“The market is pricing in a very different reaction function for the Fed once you have a new Fed chair… less convinced about that”

TS Lombard

“Increasingly likely there are no cuts”

On Buying UK Bonds Beyond Political ‘Noise’

James Ringer, Schroders

“We’re looking for a Bank of England driven move in gilts”

James Bilson, Schroders

“We’re cognizant of UK political risks, but we still think it’s an attractive place to be be long “

On Renewing Call for Cooperation to Save Global Order – Christine Lagarde, ECB President

“Despite the erosion of trust, the incentives for countries to cooperate remain strong… no country can afford to turn its back on cooperation… We can accept the drift toward a balance of power among rivals – a model that history tells us is stable only until it is not.”

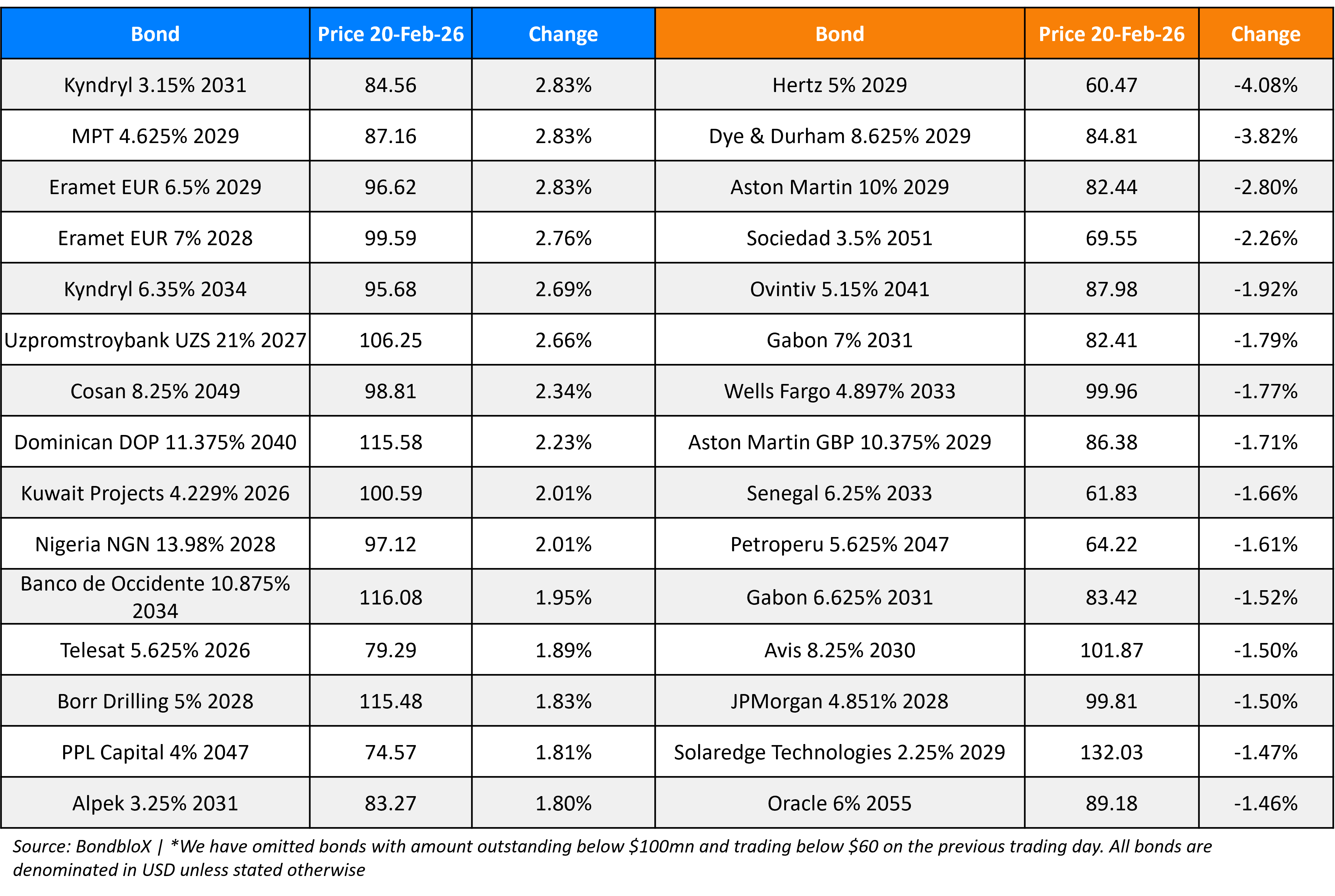

Top Gainers and Losers- 20-Feb-26*

Go back to Latest bond Market News

Related Posts: