This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

ING, Turkey, BofA, Lloyds, DB Price Bonds

February 4, 2026

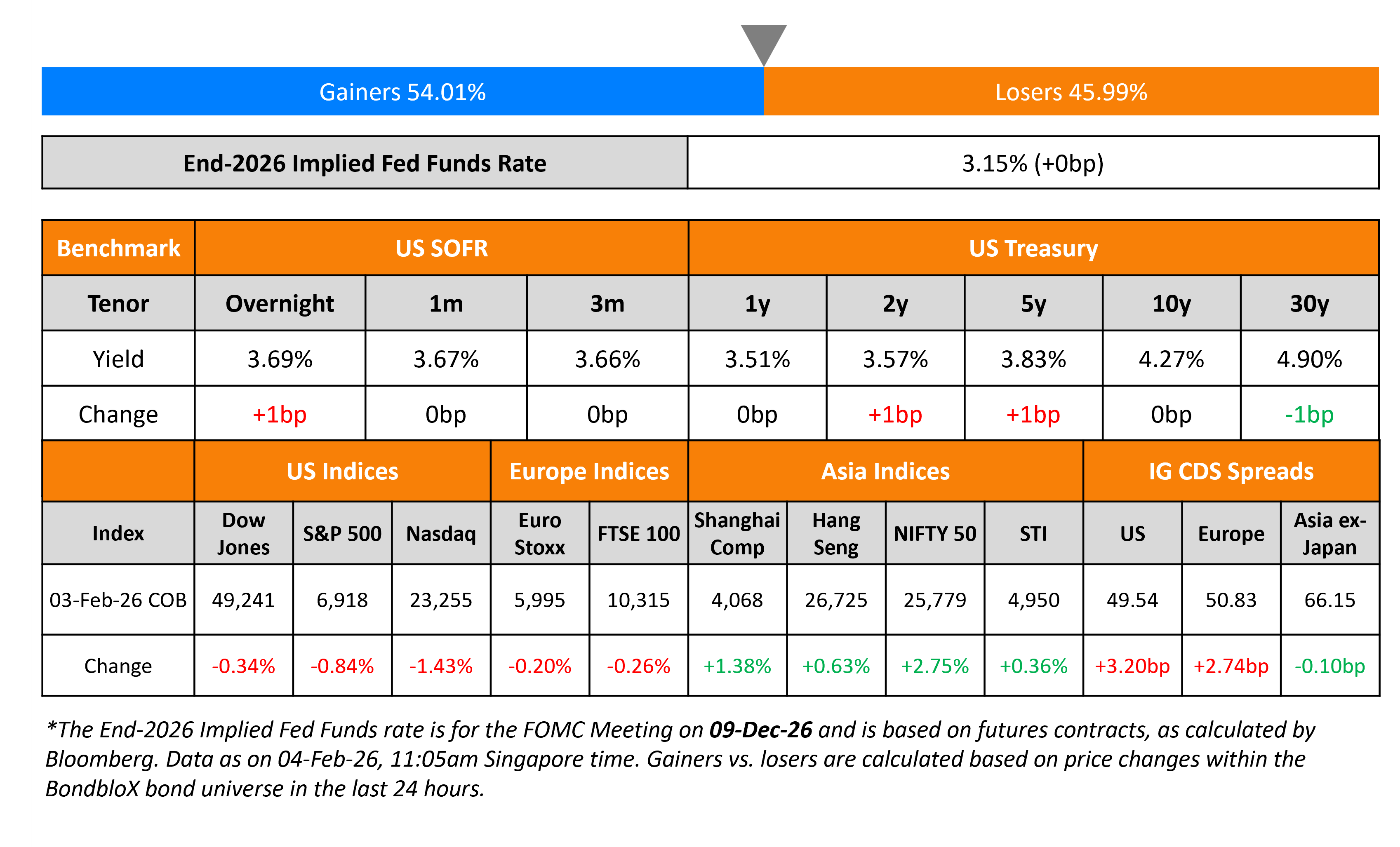

US Treasury yields were stable across the curve yesterday. US President Donald Trump signed a $1.2tn budget to end the partial government shutdown that began on Saturday. JOLTS Job Openings data for the month of December was not released due to ongoing government shutdown. Separately, Richmond’s Fed President Tom Barkin said that the rising productivity is helping US businesses ease cost pressures and support the inflation fight, but its durability remains uncertain. He expects the economy to stay resilient into 2026, supported by policy stimulus and steady demand.

Looking at US equity markets, the S&P and Nasdaq ended lower by 0.8% and 1.4% respectively. US IG CDS spreads widened by 3.2bp while HY CDS spreads were 5bp wider. European equity indices ended lower too. The iTraxx Main CDS spreads were 2.7bp wider while the Crossover CDS spreads widened by 1.8bp. Asian equity markets have opened mixed this morning. Asia ex-Japan CDS spreads tightened by 0.1bp.

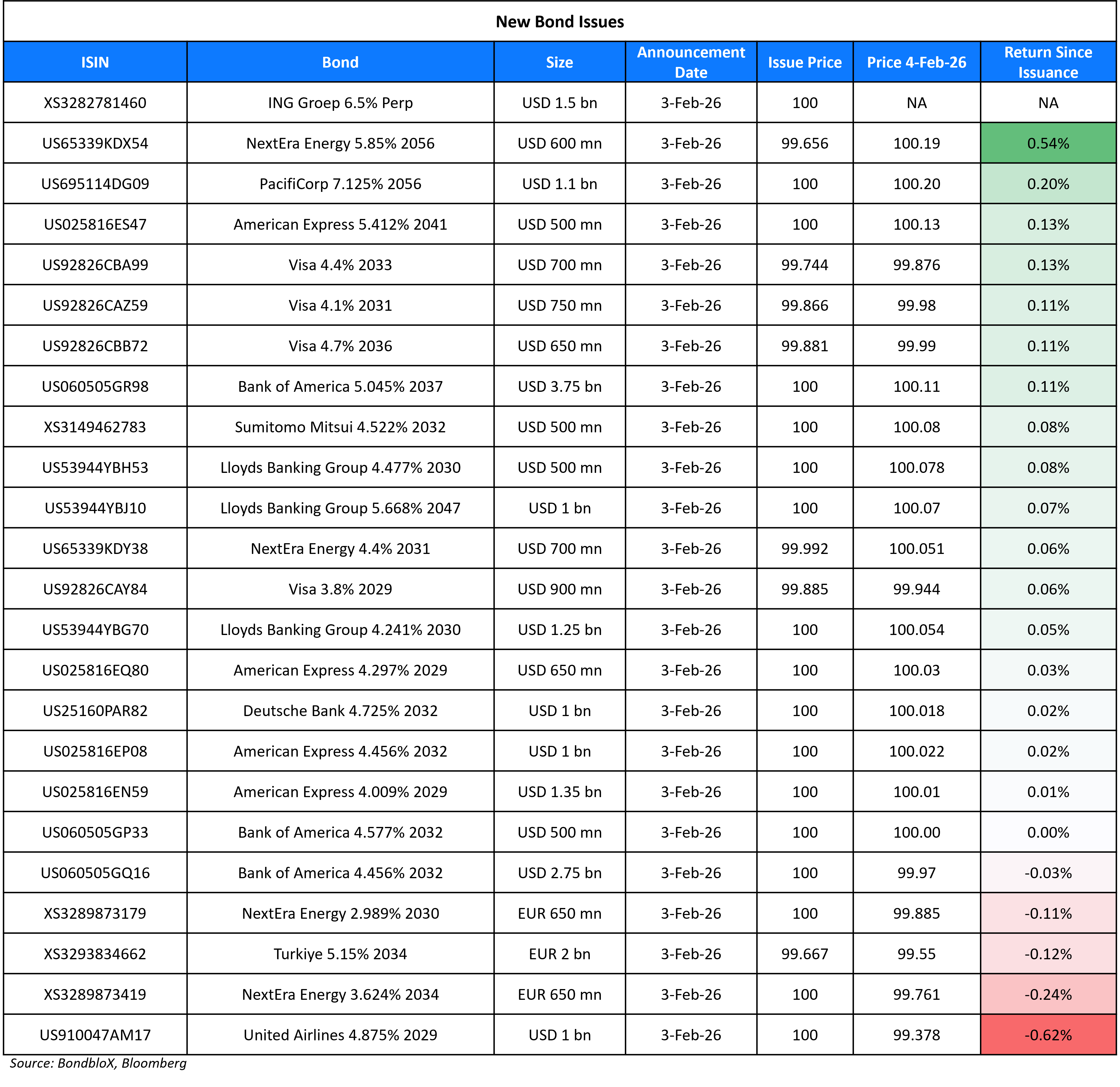

New Bond Issues

- Westpac A$ 5Y and/or 15NC10 Tier-2 at 3mBBSW +75bp and/or S/Q ASW +145bp area

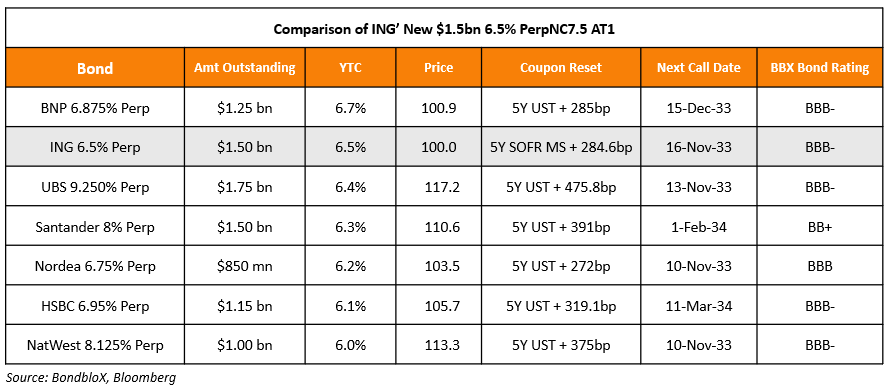

ING Groep raised $1.5bn via a PerpNC7.5 AT1 at a yield of 6.5%, 50bp inside initial guidance of 7% area. The junior subordinated note is rated BBB-/BBB (S&P/Fitch). If not called by 16 November 2033, the coupon will reset to the 5Y SOFR MS + 284.6bp. Proceeds will be used for general corporate purposes and to strengthen the capital base of the issuer. Below table gives the comparison of the ING Perp with its peers.

Turkiye raised €2bn via an 8Y bond at a yield of 5.2%, 30bp inside initial guidance of 5.5% area. The senior unsecured note is rated Ba3/BB- (Moody’s/Fitch). Proceeds will be used for general budgetary purposes.

BofA raised $7bn via a three-tranche deal. It raised:

- $2.75bn via a 6NC5 bond at a yield of 4.456%, 22bp inside initial guidance of T+85bp area

- $500mn via a 6NC5 FRN at SOFR+87bp vs. initial guidance of SOFR equivalent area

- $3.75bn via a 11NC10 bond at a yield of 5.045%, 22bp inside initial guidance of T+100bp area

The senior unsecured notes are rated A1/A-/AA-. Proceeds will be used for general corporate purposes.

Deutsche Bank NY raised $1bn via a 6NC5 bond at a yield of 4.725%, 30bp inside initial guidance of T+120bp area. The senior non-preferred note is rated Baa1/BBB/A-. Proceeds will be used for general corporate purposes.

Lloyds raised $2.75bn via a three-trancher. It raised:

- $1.25bn via a 4NC3 bond at a yield of 4.241%, ~27.5bp inside initial guidance of T+85/90bp area

- $500mn via a 4NC3 FRN at SOFR+77bp vs. initial guidance of SOFR equivalent area

- $1bn via a 21NC20 bond at a yield of 5.668%, ~25.5bp inside initial guidance of T+105/110bp area

The senior unsecured notes are rated A3/A-/A+. Proceeds will be used for general corporate purposes.

United Airlines raised $1bn via a 3Y bond at a yield of 4.875% vs. initial guidance of 4.875-5.00% area. The senior unsecured note is rated Ba2/BB+/BB+. Proceeds will be used for general corporate purposes, including repaying existing debt.

PacifiCorp raised $1.1bn via a 30.5NC5.25 bond at a yield of 7.125%, 37.5bp inside initial guidance of 7.50% area. The junior subordinated note is rated Baa3/BB. Proceeds will be used for general corporate purposes and to fund capital expenditures.

NextEra Energy Capital raised $1.3bn via a two-part deal. It raised $700mn via a 5Y bond at a yield of 4.401%, 28bp inside initial guidance of T+85bp area. It also raised $600mn via a 30Y bond at a yield of 5.874%, 28bp inside initial guidance of T+125bp area. The senior unsecured notes are rated Baa1/A-/A-. Proceeds will be used to fund investments in energy and power projects and for other general corporate purposes, including the repayment of a portion of its outstanding commercial paper obligations.

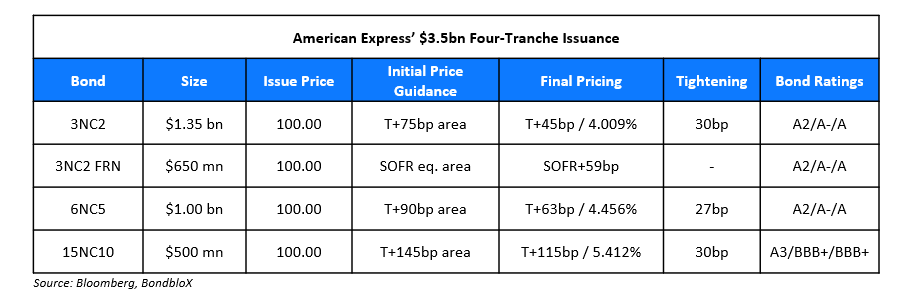

American Express raised $3.5bn via a four-trancher.

The senior unsecured notes are rated A2/A-/A, while the 15NC10 subordinated note is rated A3/BBB+/BBB+. Proceeds will be used for general corporate purposes.

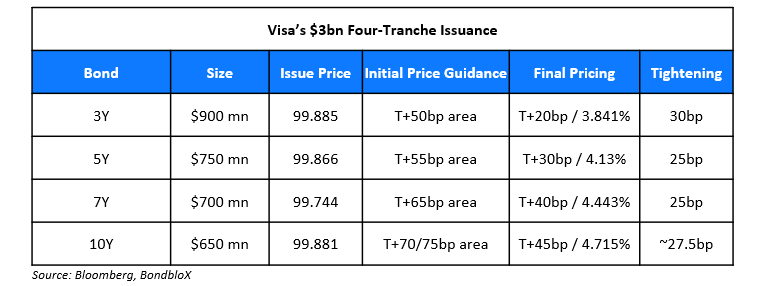

Visa raised $3bn via a four-trancher. It raised:

The senior unsecured notes are rated Aa3/AA-. Proceeds will be used for general corporate purposes, including refinancing existing debt.

New Bonds Pipeline

- Binghatti hires for $ long 5Y bond

Rating Changes

- Civitas Resources Inc. Upgraded To ‘BB’, Removed From CreditWatch On Acquisition By SM Energy; Rating Withdrawn

- Fitch Downgrades CSN’s IDRs to ‘BB-‘; Places on RWN; Removes from Under Criteria Observation

- Oi S.A. Issuer Credit Rating Lowered To ‘D’ From ‘SD’ Following Missed Interest Payment

- Delphi, IN Waterworks Revenue Bond Rating Lowered To ‘BBB+’ From ‘A-‘ On Weakened Liquidity

- Far East Horizon Placed On CreditWatch Negative Following Subsidiary’s Profit Warning

- Fitch Places Devon Energy on Rating Watch Positive Following Coterra Merger Announcement

- Coterra Energy Inc. Ratings Placed On CreditWatch Positive Following Merger Announcement

Term of the Day: Bolt-on Acquisition

A bolt-on acquisition is a transaction where a larger company acquires a smaller company, to complement and enhance its operations by expanding into new/existing markets and increase market share. They are considered to be an efficient alternative to building capabilities from the scratch or pursuing larger, more complex acquisitions.

Talking Heads

On investors ramping up bets on steeper yield curve under Warsh-led Fed

Eric Kuby, North Star Investment Management Corp

“The main outcome of shrinking the balance sheet would be to have a yield curve that is more normally positively sloped as it was historically before all the intervention following the financial crisis”

Jim Barnes, Bryn Mawr Trust

“It’s a tough policy to administer. You have one policy that you’re using in a dovish fashion like cutting rates, and then you have another policy that you’re using that leads to higher rates, like shrinking the balance sheet”

Benjamin Connard, Carnegie Investment Counsel

“He’s changed his tune recently, and a cynic may say only to secure the nomination. … Rates are set by the majority, so Warsh alone cannot cut them”

On Smaller Fed Balance Sheet Requires More Active Fed – Mizuho

Reserves are “pretty much at their limit, consistent with orderly functioning of the fed funds market. If they shrink the balance sheet that becomes a problem.”

On Fed Needs to Cut Rates by More Than a Point This Year – Stephen Miran, Fmr. Fed Governor

“I’m probably looking for a little bit more than a point of interest-rate cuts over the course of the year… When I look at underlying inflation, I don’t really see a lot of very strong price pressures in the economy. I think we’re keeping rates too high”

Top Gainers and Losers- 04-Feb-26*

Go back to Latest bond Market News

Related Posts:.png)