This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

Indonesia, UniCredit, Mexico, Energy Transfer and others Price Bonds

January 13, 2026

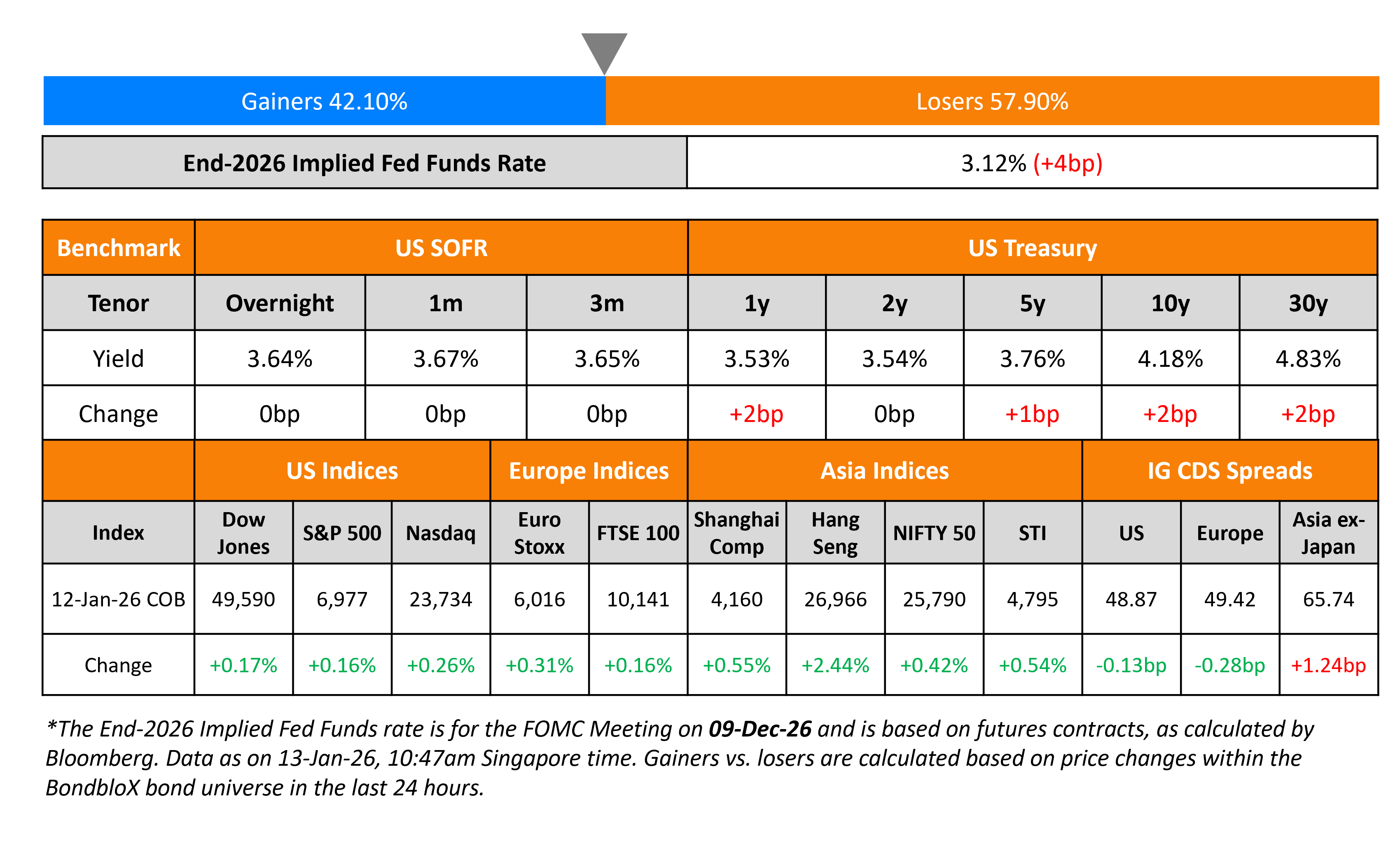

US Treasury yields inched slightly higher by 1-2bp. New York Fed President John Williams said that monetary policy is “well positioned” to support the Fed’s dual mandate. Regarding tariffs, he noted that it should have a one-time impact on prices, and expects inflation to peak to 2.75-3.00% in 1H2026 before dropping just below 2.5% for the full year. Williams further added that he expects economic growth to remain above trend.

Looking at US equity markets, the S&P and Nasdaq ended higher by 0.2-0.3%. US IG CDS spreads tightened by 0.1bp and HY CDS spreads were tighter by 0.4bp. European equity indices also ended higher. The iTraxx Main CDS spreads were 0.3bp tighter while the Crossover CDS spreads were 0.7bp tighter. Asian equity markets have opened mixed this morning. Asia ex-Japan CDS spreads were wider by 1.2bp.

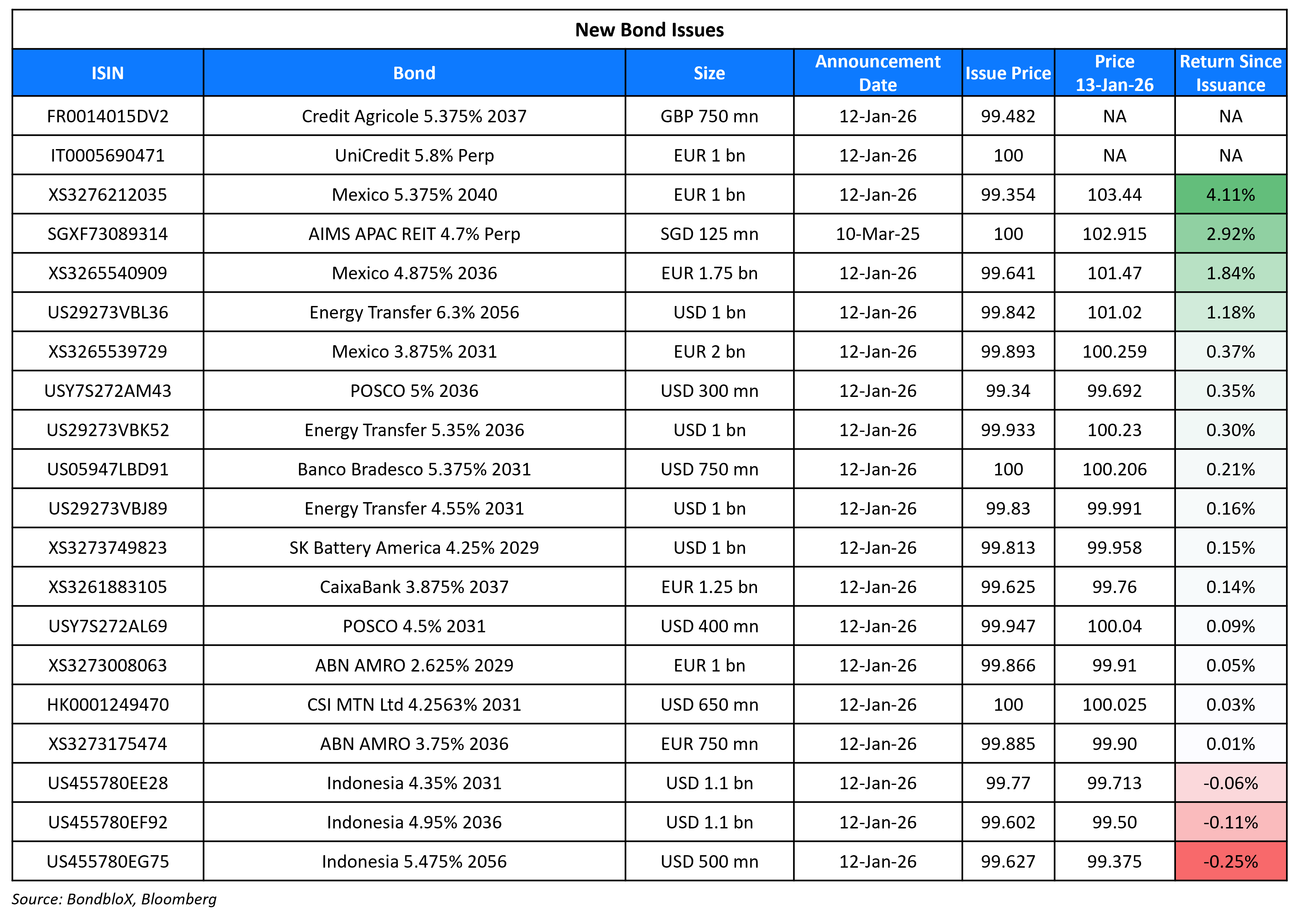

New Bond Issues

- HDB S$ 10Y at 2.471%

Indonesia raised $2.7bn via a three-tranche offering. It raised:

- $1.1bn via a long 5Y bond at a yield of 4.4%, 30bp inside initial guidance of 4.7% area. The new bond is priced roughly inline with its existing 1.85% 2031s that currently yield 4.43%.

- $1.1bn via a long 10Y bond at a yield of 5.0%, 30bp inside initial guidance of 5.3% area. The new bond is priced roughly inline with its existing 4.9% 2036s that currently yield 4.98%.

- $500mn via a long 30Y bond at a yield of 5.5%, 30bp inside initial guidance of 5.8% area.

The senior unsecured notes are rated Baa2/BBB/BBB. Proceeds will be used for general purposes of the Republic of Indonesia.

UniCredit raised €1bn via a PerpNC10 AT1 at a yield of 5.80%, 45bp inside initial guidance of 6.25% area. The junior subordinated note is rated Ba2 (Moody’s). If not called by 3 June 2036, then the coupon will reset to 5Y Mid-Swap + 301.3bp.

ABN AMRO Bank raised €1.75bn via a two-tranche offering. It raised €1bn via a 3Y senior preferred bond at a yield of 2.672%, 27bp inside initial guidance of MS+60bp area. It also raised €750mn via a 10Y senior non-preferred bond at a yield of 3.764%, 28bp inside initial guidance of MS+120bp area. The senior preferred notes are rated Aa3/A/A+ and the senior non-preferred notes are rated Baa1/BBB/A. The offering received orders of over €3.1bn, ~1.8x issue size. Proceeds will be used for general corporate purposes.

Mexico raised €4.75bn via a three-tranche offering. It raised:

- €2bn via a 5Y bond at a yield of 3.891%, 30bp inside initial guidance of MS+165bp area.

- €1.75bn via a 10Y bond at a yield of 4.914%, 20bp inside initial guidance of MS+225bp area.

- €1bn via a 14Y bond at a yield of 5.435%, 20bp inside initial guidance of MS+260bp area.

The senior unsecured sustainability bonds are rated Baa2/BBB/BBB-. Proceeds will be used for general budgetary purposes of the government, including eligible sustainable expenditures.

Energy Transfer raised $3bn via a three-tranche offering. It raised:

- $1bn via a 5Y bond at a yield of 4.589%, 27bp inside initial guidance of T+110bp area.

- $1bn via a 10Y bond at a yield of 5.359%, 27bp inside initial guidance of T+145bp area.

- $1bn via a 30Y bond at a yield of 6.312%, 27bp inside initial guidance of T+175bp area.

The senior unsecured notes are rated Baa2/BBB/BBB. Proceeds will be used to refinance existing indebtedness, including repayment of commercial paper and borrowings under its revolving credit facility, and for general corporate purposes.

AIMS APAC REIT raised S$150mn via a PerpNC5 bond at a yield of 4.1%, 30bp inside initial guidance of 4.4% area. The subordinated notes are unrated. If not called by 18 August 2030, the coupon will reset to the 5Y SGD OIS Swap + 243.7bp. There is no coupon step-up. The bond has a dividend stopper but does not have a dividend pusher. Proceeds will be used to refinance existing borrowings, finance capex and/or general working capital purposes, investments and acquisitions of investment properties, and/or refinance its existing S$250mn Perp.

SK Battery America raised $1bn via a 3Y green bond at a yield of 4.317%, 28bp inside initial guidance of T+100bp area. The senior unsecured notes are guaranteed by Kookmin Bank and are rated Aa3. Proceeds will be used to finance or refinance eligible green projects under the issuer’s green financing framework.

Credit Agricole raised £750mn via a 12NC7 Tier-2 bond at a yield of 5.469%, 20bp inside initial guidance of UKT+160bp area. The subordinated notes are rated Baa1/BBB+/A- and received orders of over £2.2bn, ~2.9x the issue size.

CaixaBank raised €1.25bn via an 11NC10 bond at a yield of 3.921%, 32bp inside initial guidance of MS+140bp area. The senior non-preferred notes are rated Baa1/BBB+/A-, and received orders of over €4.9bn, ~3.9x the issue size. Proceeds will be used for general corporate purposes.

Banco Bradesco raised $750mn via a 5Y bond at a yield of 5.375%, 32.5bp inside initial guidance of 5.70% area. The senior unsecured notes are rated Ba1/BB. Proceeds will be used for general corporate purposes.

POSCO raised $700mn via a two-tranche offering. It raised $400mn via a 5Y bond at a yield of 4.512%, 40bp inside initial guidance of T+115bp area. It also raised $300mn via a 10Y bond at a yield of 5.085%, 40bp inside initial guidance of T+130bp area. Proceeds will be used for general corporate purposes.

New Bonds Pipeline

- Sun Hung Kai & Co. $ 3Y bond

- Woori Bank US$ 3Y/5Y sustainability bond

Rating Changes

- Fitch Upgrades Albaraka Turk Katilim Bankasi A.S to ‘B+’; Outlook Stable

- Constellation Energy Generation LLC Ratings Affirmed; Outlook Stable; Calpine Corp. Upgraded To ‘BBB+’ On Merger

- Moody’s Ratings changes outlook to negative on Orsted; affirms Baa2 rating

Term of the Day: Dividend Stopper

Dividend stopper is a common covenant seen in perpetual bond structures that requires the bond issuer to not pay a dividend, if it decides to stop coupon payments on the perpetual bonds. Some contingent convertible (CoCo) perpetual bonds have a clause that allows the issuer to skip a coupon payment at their discretion, if the financial situation of the issuer is stressed. In such cases, a dividend stopper covenant is beneficial to the CoCo bondholders as it restricts the issuer from paying dividends on its equity in times when it has not paid coupon to its CoCo bondholders. This is why the presence (or absence) of a dividend stopper covenant is seen as the determining factor on whether the CoCo perpetual bonds are not (or are) subordinated to its equity.

Talking Heads

On Former Fed Chairs, Treasury Secretaries Condemning Powell Probe

Former Fed Chairs Janet Yellen, Ben Bernanke and Alan Greenspan

“This is how monetary policy is made in emerging markets with weak institutions, with highly negative consequences for inflation and the functioning of their economies more broadly. It has no place in the United States”

On ‘Sell America’ Trade Is Revived by Trump’s Latest Fed Attack

Gary Tan, Allspring Global

“Any development that raises questions about the Fed’s independence adds uncertainty around US monetary policy… likely to reinforce existing trends of diversification away from the dollar and increase interest in traditional hedges such as gold”

Ian Lyngen, BMO Capital Markets

“We remain skewed toward higher yields in the near-term”

Bhanu Baweja, UBS Investment Bank

“This is a bad time to be worrying about Fed independence for the market”

On JPMorgan forecasting 2027 Fed hike; Barclays, Goldman postponing rate cut calls

JPMorgan

“If the labor market weakens again in the coming months, or if inflation falls materially, the Fed could still ease later this year… we expect the labor market to tighten by the second quarter and the disinflation process to be quite gradual”

Goldman Sachs

“If the labor market stabilizes as we expect, the FOMC will likely shift from risk management mode to normalization mode”

BofA

“Mix of data is consistent with our view that breakeven job growth might be falling (labor supply shock) even faster than the Fed will concede”

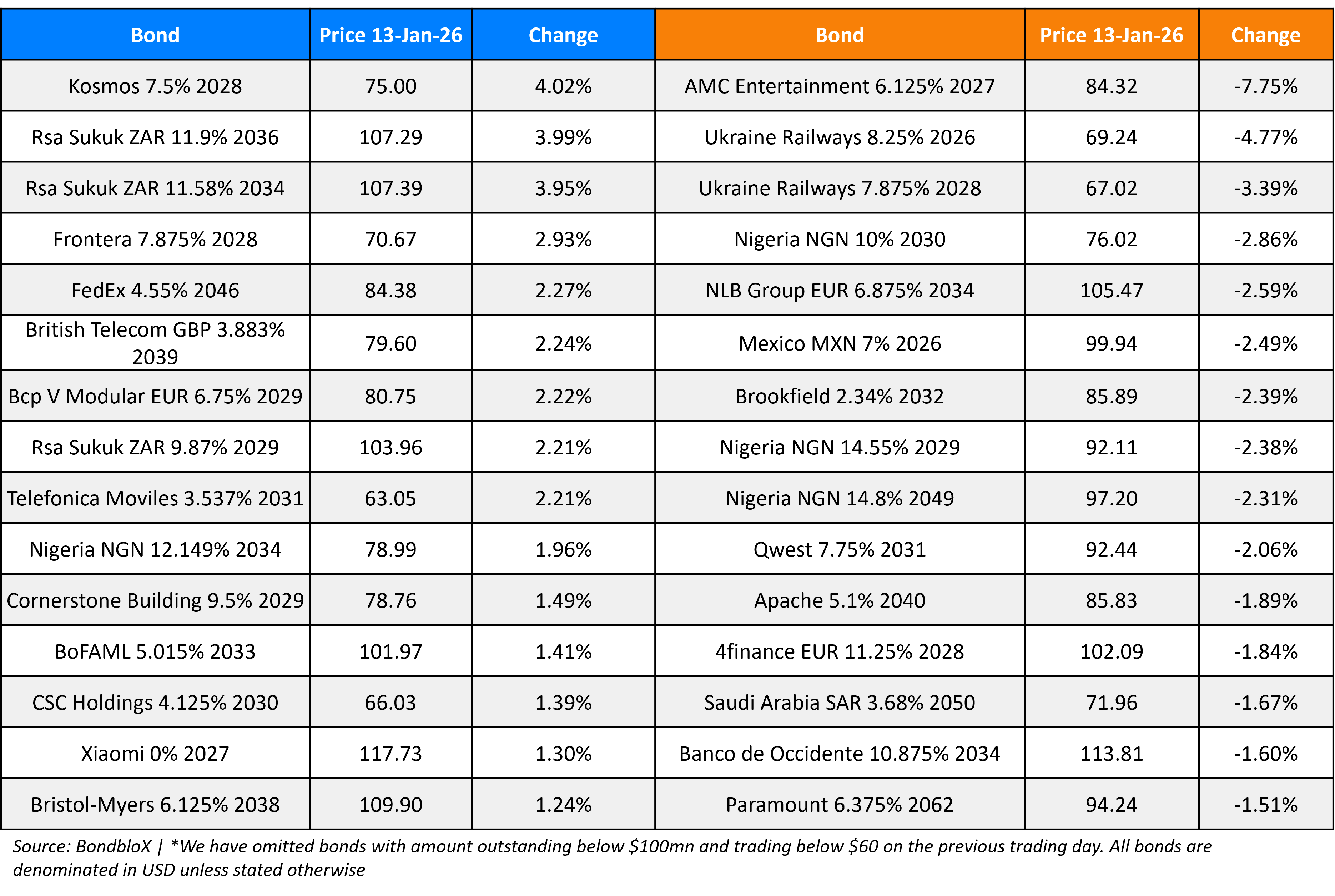

Top Gainers and Losers- 13-Jan-26*

Go back to Latest bond Market News

Related Posts: