This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

Indonesia, SK Battery, POSCO and Others Launch Bonds

January 12, 2026

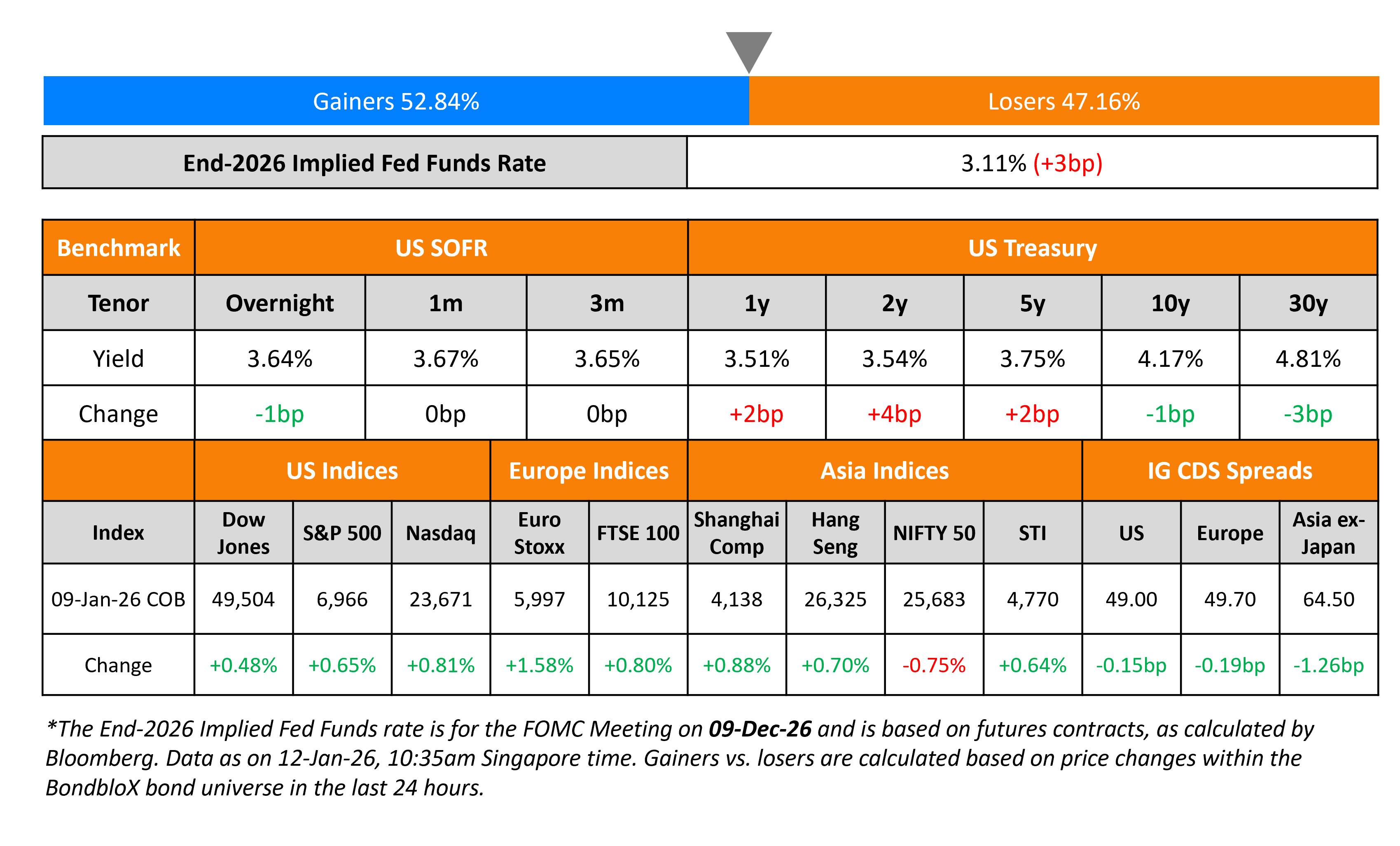

The US Treasury curve flattened with short-end yields moving higher by 2-4bp while long-end yields eased slightly. The December NFP print came in at 50k, below estimates of 70k. November’s print was revised lower to 56k from 64k. However, the Unemployment Rate eased to 4.4% from 4.5%. Also, the Average Hourly Earnings (AHE) reading rose by 3.8% YoY, coming in stronger than expectations and the prior month’s revised print of 3.6%. Following the jobs data, Richmond Fed President Thomas Barkin said that the report reflected modest jobs growth and a continued low-hiring environment. Separately, Fed Chairman Jerome Powell is under federal criminal investigation related to the $2.5bn renovation to the Fed’s headquarters. Powell said that the probe was a result of the Fed “setting interest rates based on our best assessment of what will serve the public, rather than following the preferences of” the US President.

Looking at US equity markets, the S&P and the Nasdaq ended higher by 0.7-0.8%. US IG CDS spreads tightened by 0.2bp while HY CDS spreads were tighter by 0.7bp. European equity indices also ended higher. The iTraxx Main CDS spreads were 0.2bp tighter while the Crossover CDS spreads were 1.7bp tighter. Asian equity markets have opened with a positive bias this morning. Asia ex-Japan CDS spreads were tighter by 1.3bp.

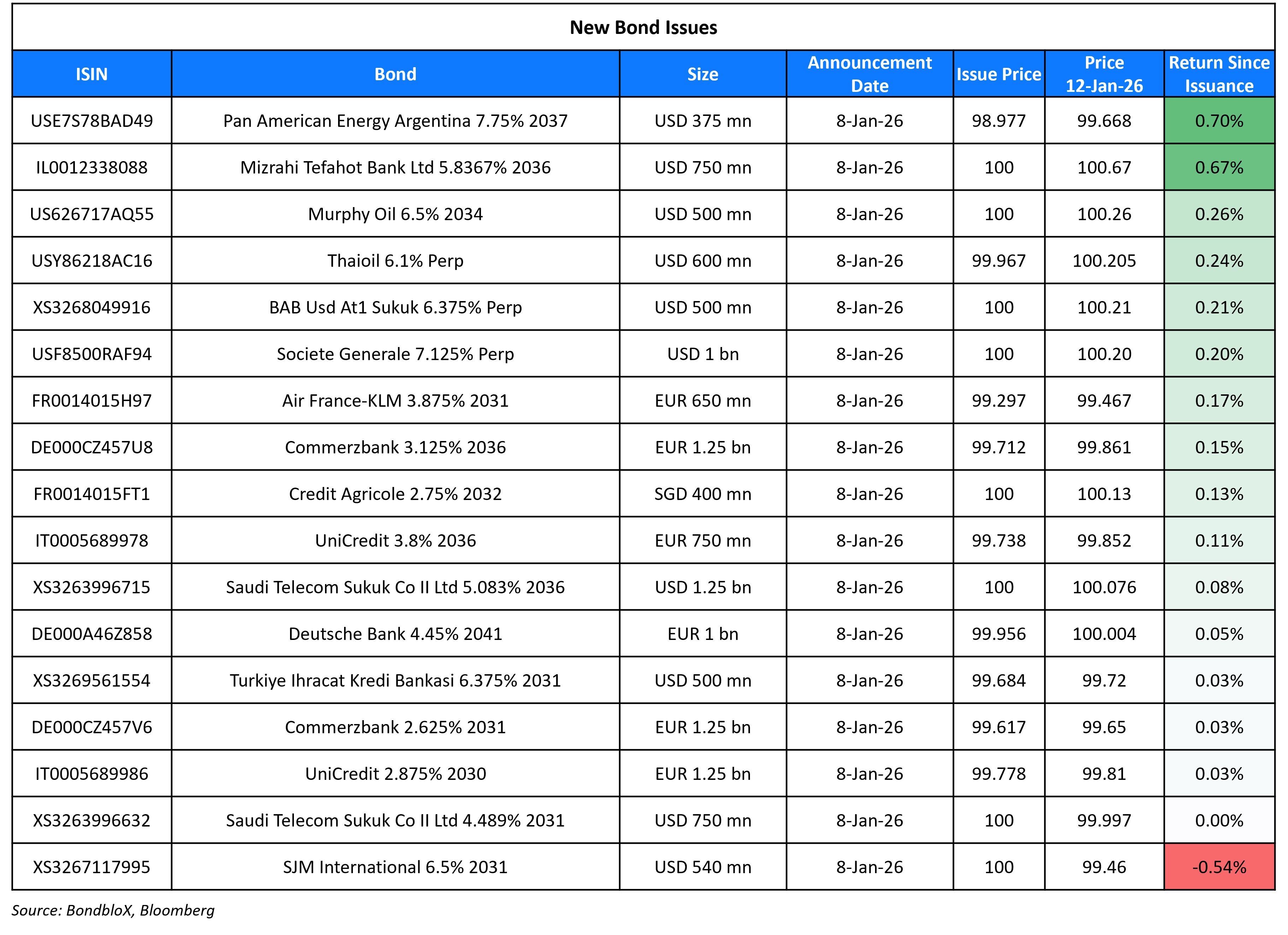

New Bond Issues

- Republic of Indonesia $ long 5Y/10Y/30Y at 4.7%/5.3%/5.8% areas

- AIMS APAC REIT S$ PerpNC5 at 4.4% area

- Citic Securities $ 5Y FRN at SOFR+115bp area

- POSCO $ 5Y/10Y at T+115/T+130bp areas

- SK Battery America $ 3Y at T+100bp area

New Bonds Pipeline

- Hyundai Capital Services € 3Y bond

Rating Changes

- Fitch Upgrades Turkiye Finans Katilim Bankasi’s Viability Rating to ‘b+’, Affirms IDRs at ‘BB -‘

- Fitch Upgrades Kuveyt Turk Katilim Bankasi’s Viability Rating to ‘bb-‘; Affirms IDRs at ‘BB-‘

- Fitch Upgrades Calpine’s IDR to ‘BBB’; Outlook Stable

- Moody’s Ratings changes Shriram Finance’s outlook to positive from stable; affirms Ba1 rating

Term of the Day: SOFR

Secured Overnight Financing Rate (SOFR) is a broad measure of the cost of borrowing cash overnight collateralized by Treasury securities. SOFR is calculated as a volume-weighted median of three rates – tri-party repo data collected from BNY Mellon, General Collateral Financing (GCF) Repo transaction data and data on bilateral Treasury repo transactions cleared through FICC’s DVP service, which are obtained from DTCC Solutions LLC. SOFR was selected as the representative rate for use in USD derivatives, and was suggested as an alternative to LIBOR.

Talking Heads

On Wall Street’s Risk-On Fever Showing No Signs of Abating in New Year

Julie Biel, Kayne Anderson Rudnick

“It really doesn’t work to be overly defensive. There’s too much sugar coming into the economy.”

Michael O’Rourke, JonesTrading

“You have Intel up 10% and registering new highs because the CEO met with the president. On a daily basis stocks are rising 10% to 20% on tertiary news developments or the recycling of themes…”

Sameer Samana, Wells Fargo Investment Institute

“We are still a little skeptical on going too far down the market-cap stack”

On More Bonds Teetering on the Brink of Junk

Nathaniel Rosenbaum, JPMorgan

“As companies continue to refinance debt, the pressure on their balance sheets from rising interest expense is growing. That, in turn, does put a little bit more ratings pressure on weaker credits.”

Zachary Griffiths, CreditSights

“If you look underneath the hood there are underlying signs of weakening in credit profiles”

David Delvecchio, PGIM Fixed Income

“We are avoiding issuers that may be stressing their balance sheets to fund significant capex plans or engage in M&A”

On Magnificent 7’s Stock Market Dominance Shows Signs of Cracking

Jack Janasiewicz, Natixis Investment Managers

“This isn’t a one-size-fits-all market. If you’re just buying the group, the losers could offset the winners”

David Lefkowitz, UBS Global Wealth Management

“We’re already seeing a broadening of earnings growth and we think that’s going to continue. Tech is not the only game in town.”

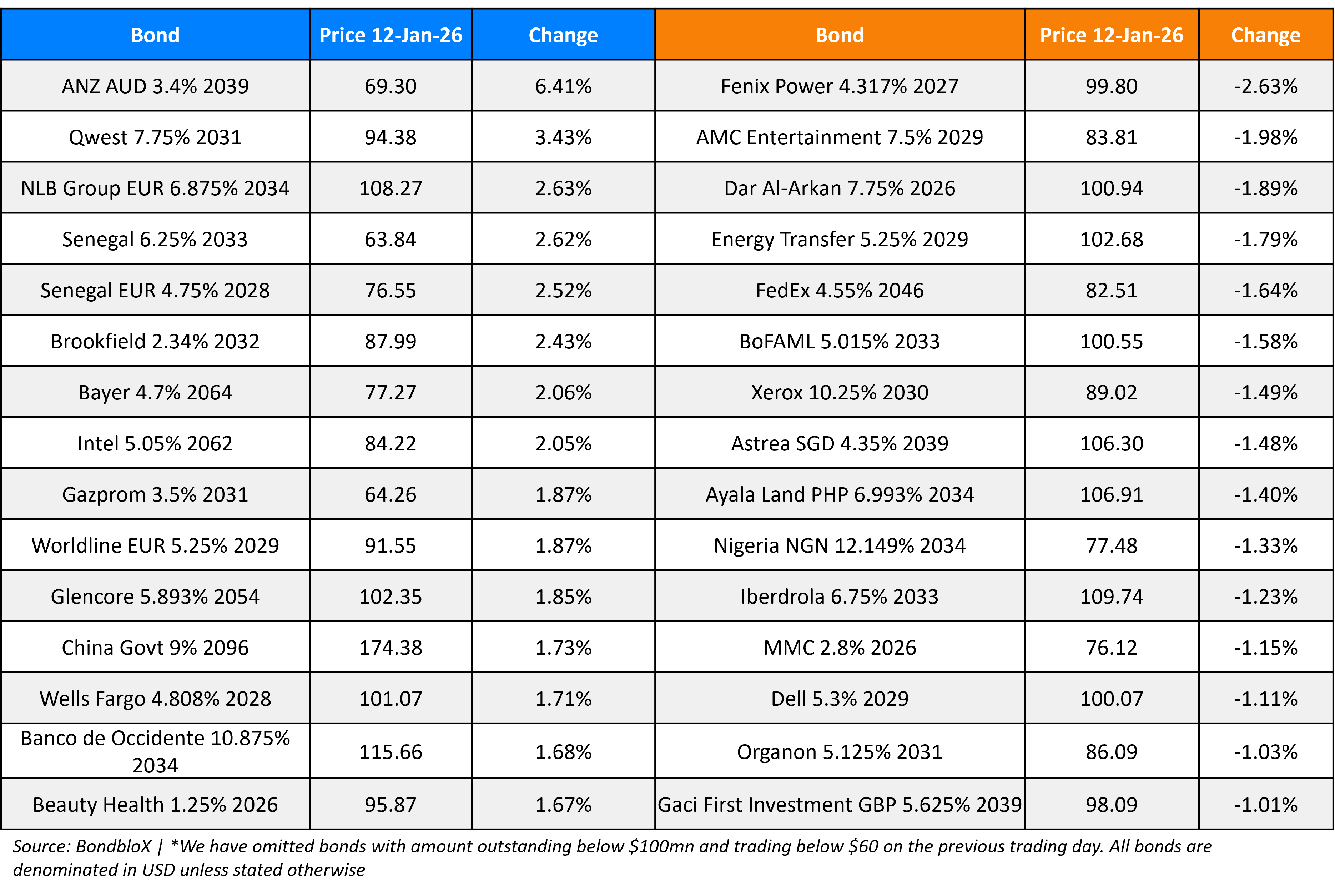

Top Gainers and Losers- 12-Jan-26*

Go back to Latest bond Market News

Related Posts: