This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

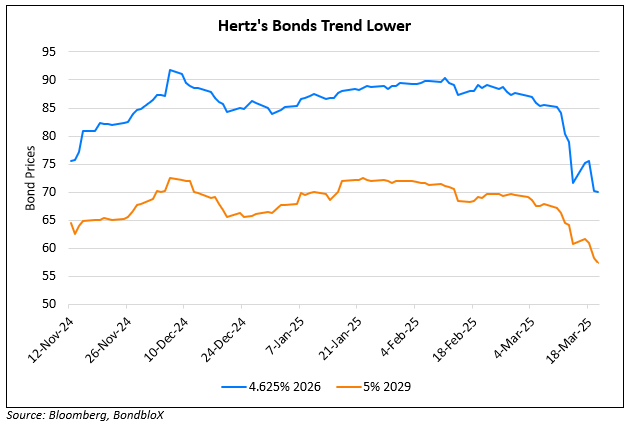

Hertz Aims to Raise ~$500mn to Strengthen Balance Sheet

April 25, 2025

Hertz is seeking to raise around $500mn in secured debt to strengthen its balance sheet, in a latest update from the news earlier this week. The company is also exploring options like raising equity through an at-the-market offering. Hertz has hired investment bank Ducera Partners to help secure financing for a litigation settlement with bondholders and to extend its revolving credit facility due next year. The company is also negotiating a settlement for a $300mn payout related to its 2020 bankruptcy proceedings. The car rental company’s total debt stands at over $6bn.

Hertz’s 4.625% 2026s were up 0.6 points to trade at 86.24 cents on the dollar, yielding 14.6%.

For more details, click here

Go back to Latest bond Market News

Related Posts:

Hertz Downgraded to B by S&P; Raises

June 21, 2024

Hertz Bondholders Raise Concerns Over Repayment Ability

December 9, 2024