This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

Guocoland Launches S$ 3Y; US Treasury Yields Drop

November 5, 2024

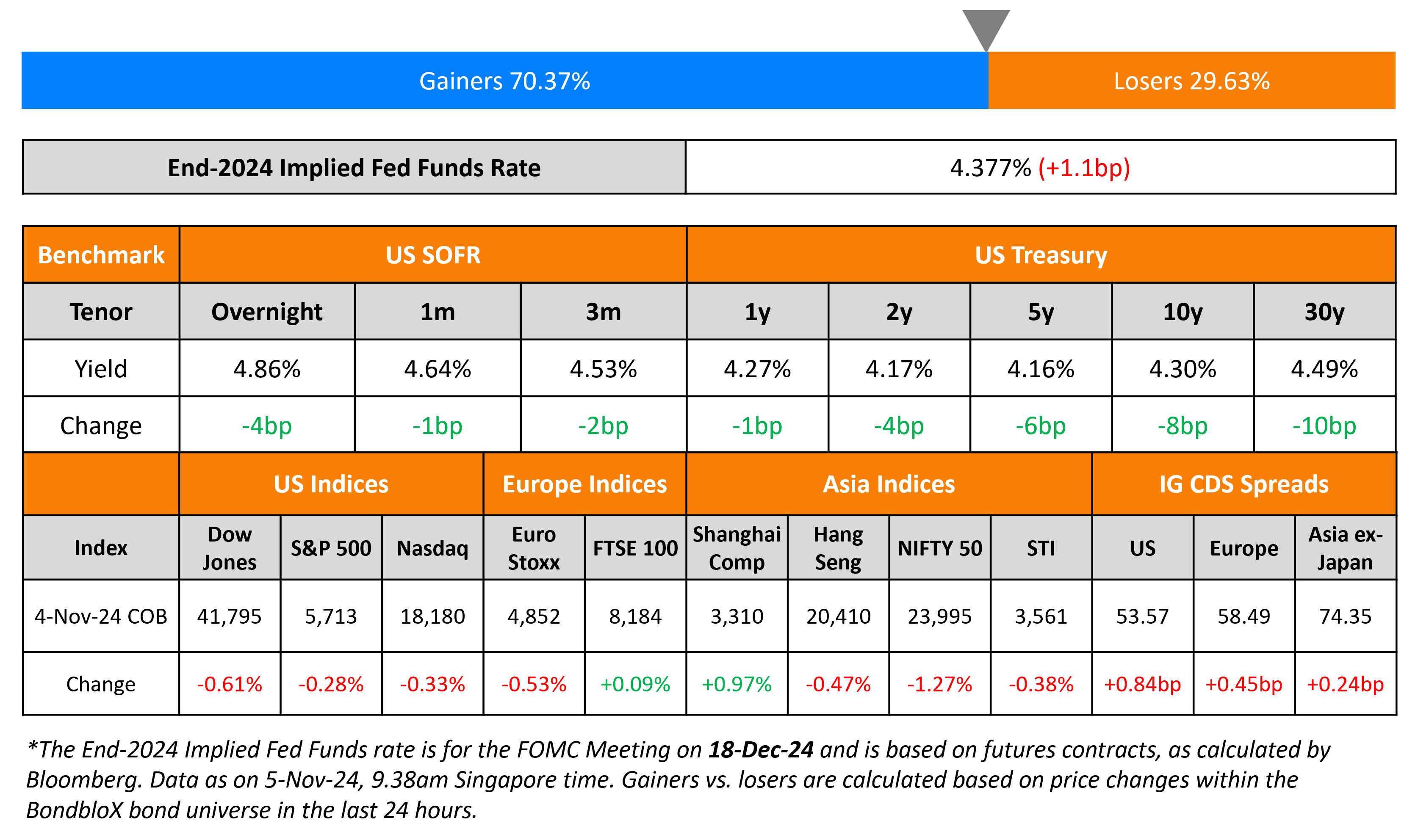

The US Treasury curve bull flattened, reversing the move following the NFP release, as long-end yields fell ~9bp. Analysts said that the move was largely due to a re-evaluation of the odds that Trump will win the election, after a Des Moines Iowa poll showed that Kamala Harris had a 3% lead in the state. Some political analysts remarked that this poll could act as a proxy as to how she would perform in the neighboring state of Wisconsin, a major swing state for the election. Separately, the US Treasury saw a solid 3Y auction with an indirect acceptance of 70.6% and a bid-to-cover ratio of 2.6x, stronger than the prior auction’s 2.45x. US IG and HY CDS spreads widened by 0.8bp and 3.6bp respectively. Looking at US equity markets, S&P and Nasdaq both closed lower by 0.3%.

European equities followed suit and closed lower across the board too. In terms of Europe’s CDS spreads, the iTraxx Main and Crossover spreads widened by 0.5bp and 2.2bp respectively. Asian equities opened broadly higher this morning. Asia ex-Japan CDS spreads widened by 0.2bp.

New Bond Issues

New Bond Pipeline

- Tata Capital hires for $ bond

-

Islamic Development Bank hires for € 5Y Sukuk bond

Rating Changes

- Moody’s Ratings upgrades State Street Corporation’s senior unsecured ratings to Aa3; outlook changed to stable

- Moody’s Ratings upgrades The Bank of New York Mellon Corporation’s senior unsecured ratings to Aa3; outlook stable

- Fitch Revises United Airlines’ Outlook to Positive; Affirms IDR at ‘BB-‘

- Fitch Affirms IIFL Finance at ‘B+’; Removes Rating Watch Negative; Outlook Stable

- Cullinan Holdco SCSp ‘B’ Ratings On CreditWatch With Negative Implications Due To Elevated Refinance Risk

Term of the Day: PMI

PMIs or Purchasing Managers’ Index are an index composed of a monthly survey of purchasing managers/supply chain managers across industries. This is a diffusion index, a statistical measure of summarizing the common tendency of a series – if there are more number of values rising than falling, the index is above 50 and the index goes below 50 if the falling values exceed those rising. For PMIs, a value below 50 indicates contraction and a value above 50 shows expansion. These surveys are taken over different areas of the supply chain business: New Orders, Employment, Inventories, Supplier Deliveries and Production covering imports, exports, prices and backlogs. In most countries, Markit publishes the PMI numbers while other organizations publish them too. Markit generally publishes the month’s PMIs in last week of the month.

Talking Heads

On Traders Selling EM Bond ETFs Ahead of US Election Volatility

Brendan McKenna, Wells Fargo

“The Fed may not be easing as quickly as markets originally expected, China stimulus has been underwhelming, and at least before this weekend, Trump had a lot of momentum… When those risks build and valuations are expensive, outflows usually follow”

On Wall Street Seeing Bond Yields Driving Stock Moves After US Poll

Mislav Matejka’s team at JPMorgan

“While equities could have a knee-jerk bounce on a Trump win, in sympathy with the 2016 template, the sustainability of the up move is likely to depend on the magnitude of the bond yields’ response”

On dollar on back foot as Trump trades unwind

Carol Kong, CBA

“The USD can therefore fall modestly by 1%‑2% this week if Vice President Harris wins and lift materially if (former) President Trump wins. Any delays and/or disputes over vote counting can also add to currency volatility this week.”

Analysts at TD Securities

“We don’t think Harris is necessarily bad for the USD over the medium term. Harris simply shifts the focus back to macro, while Trump reshapes the market narrative around politics.”

Top Gainers & Losers 05-November-24*

Go back to Latest bond Market News

Related Posts: