This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

Goldman, MS, Saudi National Bank, Wells Fargo and others Price $ Bonds

January 16, 2026

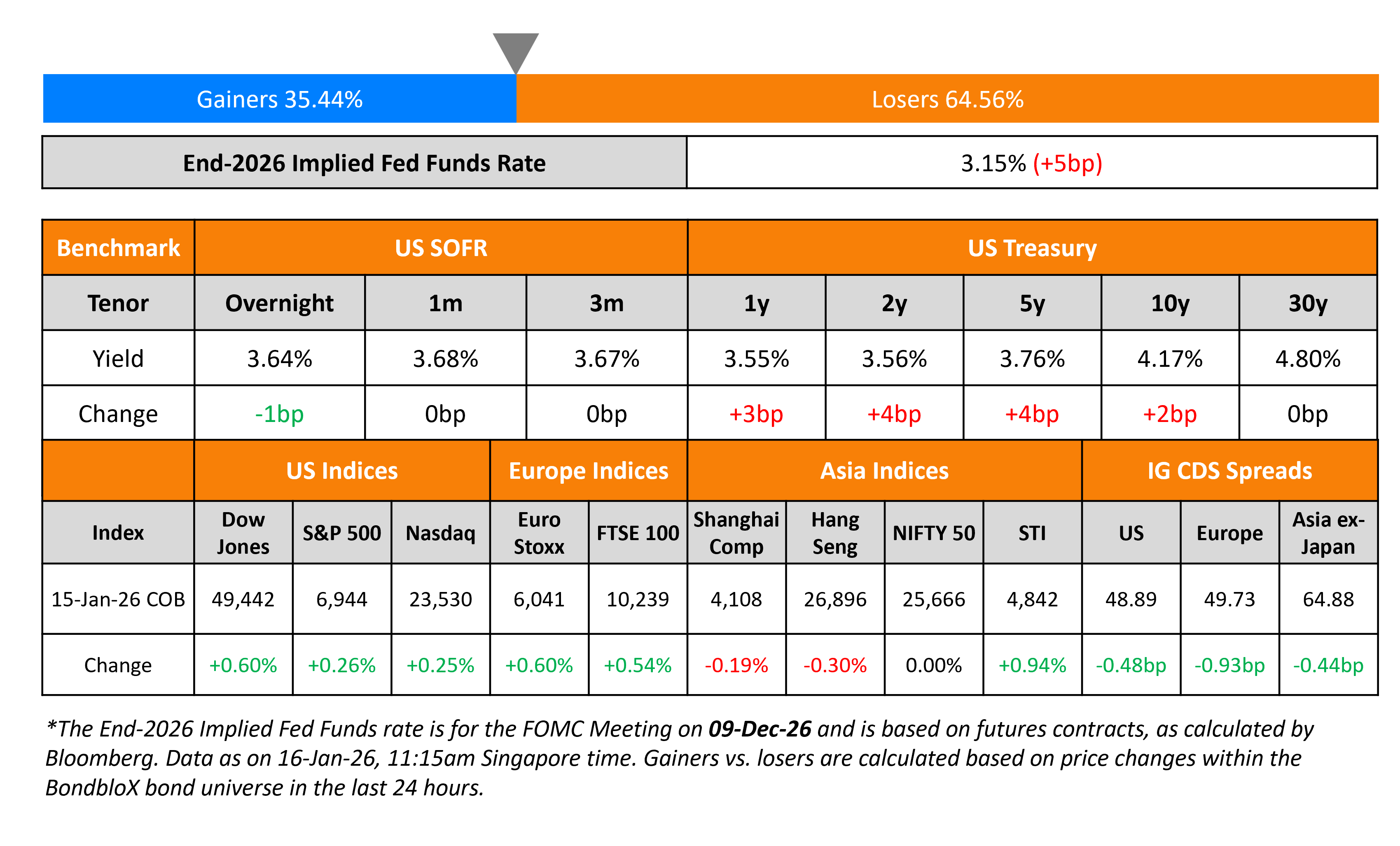

US Treasury yields rose, led by short-end – the 2Y rose by 4bp while the 10Y rose by 2bp. Economic data was positive — initial jobless claims for the prior week came in at 198k, better than expectations of 215k. Separately, the Empire Manufacturing Index for December came in at 7.7, much better than expectations of 1. Similarly the Philadelphia Fed Business Outlook print for December came in at 12.6, beating expectations of -1.4.

Looking at US equity markets, the S&P and Nasdaq ended higher by 0.3% each. US IG CDS spreads tightened by 0.5bp and HY CDS spreads were tighter by 22bp. European equity indices also ended higher. The iTraxx Main CDS spreads were 0.9bp tighter and the Crossover CDS spreads were 3.2bp tighter. Asian equity markets are trading weaker this morning. Asia ex-Japan CDS spreads tightened by 0.4bp.

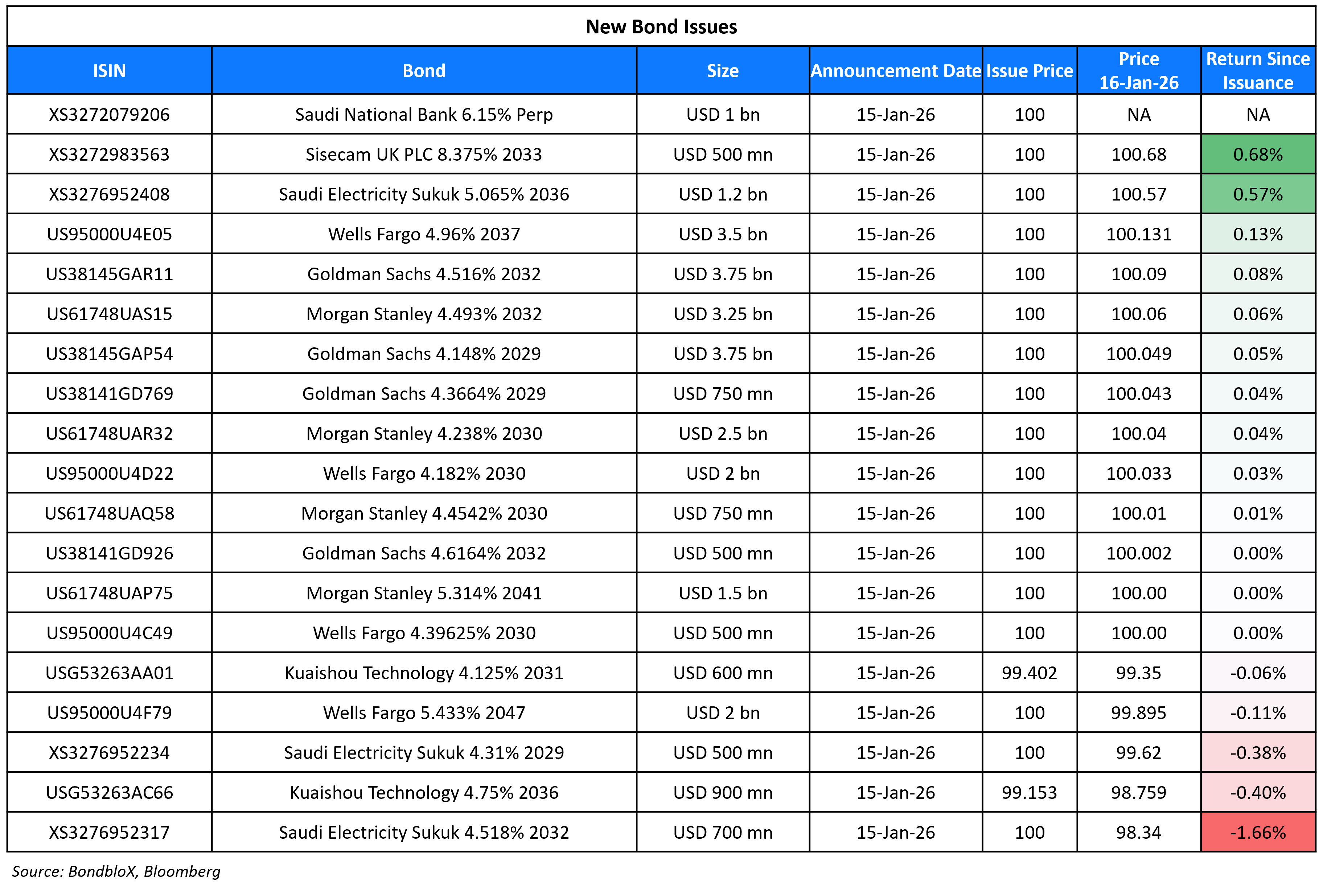

New Bond Issues

Saudi National Bank raised $1bn via a PerpNC5.5 AT1 at a yield of 6.15%, 47.5bp inside initial guidance of 6.625%. The junior subordinated note is unrated. If not called by 22 July 2031, then the coupon will reset to US 5Y Treasury yield + 234.3bp. The bond offers a yield pick-up of 12bp compared to its peer Al Rajhi’s 6.15% Perp, currently yielding 6.03%.

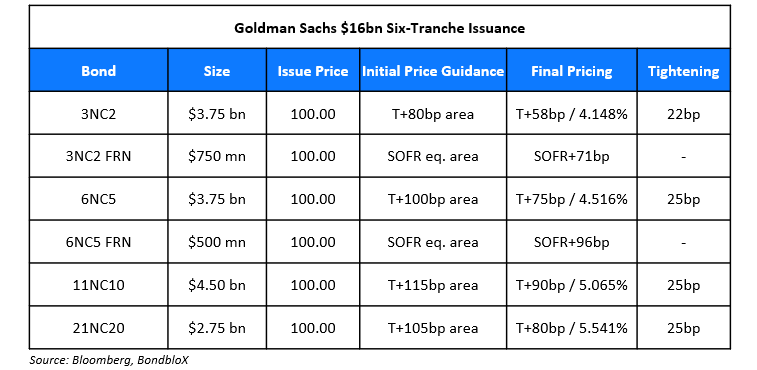

Goldman Sachs raised $16bn via a six-trancher:

The senior unsecured notes are rated A2/BBB+/A. Proceeds will be used for general corporate purposes.

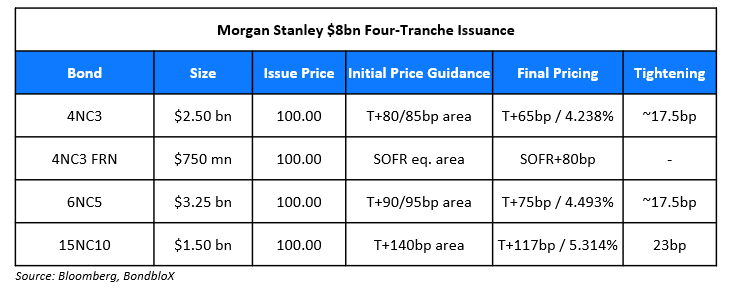

Morgan Stanley raised $8bn via a four-part deal.

Proceeds will be used for general corporate purposes.

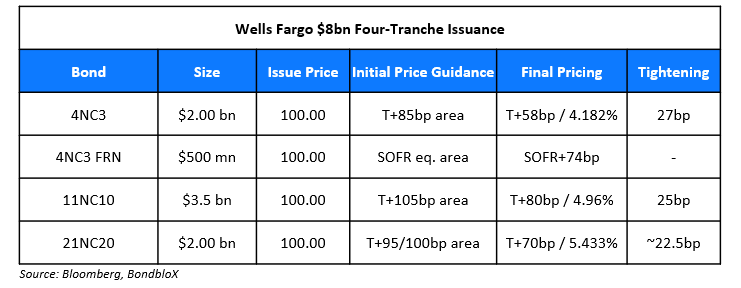

Wells Fargo raised $8bn via a four-part deal.

The senior unsecured notes are rated A1/BBB+/A+. Proceeds will be used for general corporate purposes.

Saudi Electricity raised $2.4bn via a three-tranche sukuk offering. It raised:

- $500mn via a 3Y bond at a yield of 4.31%, 35bp inside initial guidance of T+105bp area.

- $700mn via a 6Y bond at a yield of 4.518%, 40bp inside initial guidance of T+115bp area.

- $1.2bn via a 10Y bond at a yield of 5.065%, 35bp inside initial guidance of T+125bp area.

The senior unsecured notes are rated Aa3/A+ and received orders of over $6.2bn, ~2.6x issue size. Proceeds will be used for general corporate purposes.

Sisecam UK PLC raised $500mn via a 7NC3 bond at a yield of 8.375%, 37.5bp inside initial guidance of 8.750% area. The senior unsecured notes are rated B2/B (Moody’s/Fitch) and received orders of over $1.5bn, ~3x issue size. Proceeds will be used to redeem $372mn of its $700mn 6.95% 2026s, repay $91mn in short-term loans, repay a $24mn TRY-denominated bond maturing in March 2026, and cover issuance expenses.

Kuaishou Technology raised $1.5bn via a two-tranche offering. It raised $600mn via a 5Y bond at a yield of 4.259%, 35bp inside initial guidance of T+85bp area. It also raised $900mn via a 10Y bond at a yield of 4.858%, 30bp inside initial guidance of T+100bp area. The senior unsecured notes are rated A3/A-/A- (Moody’s/S&P/Fitch). Proceeds will be used for general corporate purposes.

Japan Bank for International Cooperation (JBIC) raised $1.5bn via a two-tranche offering. It raised $500mn via a 5Y green bond at a yield of 3.969%, 3bp inside initial guidance of SOFR MS+47bp area. It also raised $1bn via a 10Y bond at a yield of 4.437%, 2bp inside initial guidance of SOFR MS+62bp area. The notes are rated A1/A+, and received total orders of over $5.2bn, ~3.5x issue size. Proceeds from the 5Y tranche will be used for existing or future eligible projects in accordance with its framework, while proceeds from the 10Y tranche will be used for ordinary operations.

New Bonds Pipeline

- Toyota Finance Australia $ 3.25Y FRN/5Y bond

- Woori Bank $ 3Y/5Y sustainability bond

Rating Changes

- Shriram Finance Rating Raised To ‘BBB-/A-3’ On MUFG Investment; Outlook Stable

- Fitch Upgrades Abanca to ‘BBB+’; Outlook Stable

- Fitch Upgrades Unicaja to ‘BBB+’; Outlook Stable

- Fitch Downgrades JSC Ukrainian Railways to ‘C’ on Missed Coupon Payment

- Fitch Downgrades Newfold to ‘RD’ on DDE; Upgrades to ‘B-‘; Assigns Stable Outlook

- Delta Air Lines Inc. Outlook Revised To Positive On Expected Deleveraging; ‘BBB-‘ Rating Affirmed

- Moody’s Ratings revises Adani Ports’ outlook to stable; Affirms Baa3 ratings

Term of the Day: Rising Star

Rising stars are companies that have recently seen credit rating upgrades that pull its rating to investment grade category from its previous junk or high yield category. They are termed as rising stars as their financial and/or operational metrics show an improving trend. The opposite of rising stars are fallen angels, which are issuers that have been recently downgraded to junk category from its previous investment grade rating category.

Talking Heads

On Fed Facing ‘Trilemma’ of How Big Its Balance Sheet Should Be

Burcu Duygan-Bump and R. Jay Kahn

“Central banks face a ‘balance sheet trilemma’ in that they can achieve only two… underlying tension between these goals is due to the financial sector’s demand for reserves and the frequency of sudden changes in liquidity demand and supply”

On ‘Absolutely, Positively No Chance’ on Fed Chair Job – Jamie Dimon, JPMorgan

“Chairman of the Fed, I’d put in the absolutely, positively no chance, no way, no how, for any reason… Everyone I know, including the president of the United States, says we need an independent Fed board… If you chip away too much — in my view, this is my opinion — it will drive rates higher, not lower”

On Tough Enough to Win Arguments at the Fed – Kevin Hassett, NEC Director

“I am tough enough to win an argument… Anybody who’s come to this White House and taken every question.. is tough enough to go into a hostile room and help people understand why they’re right or they’re wrong… he’s got a bunch of really great, experienced candidates”

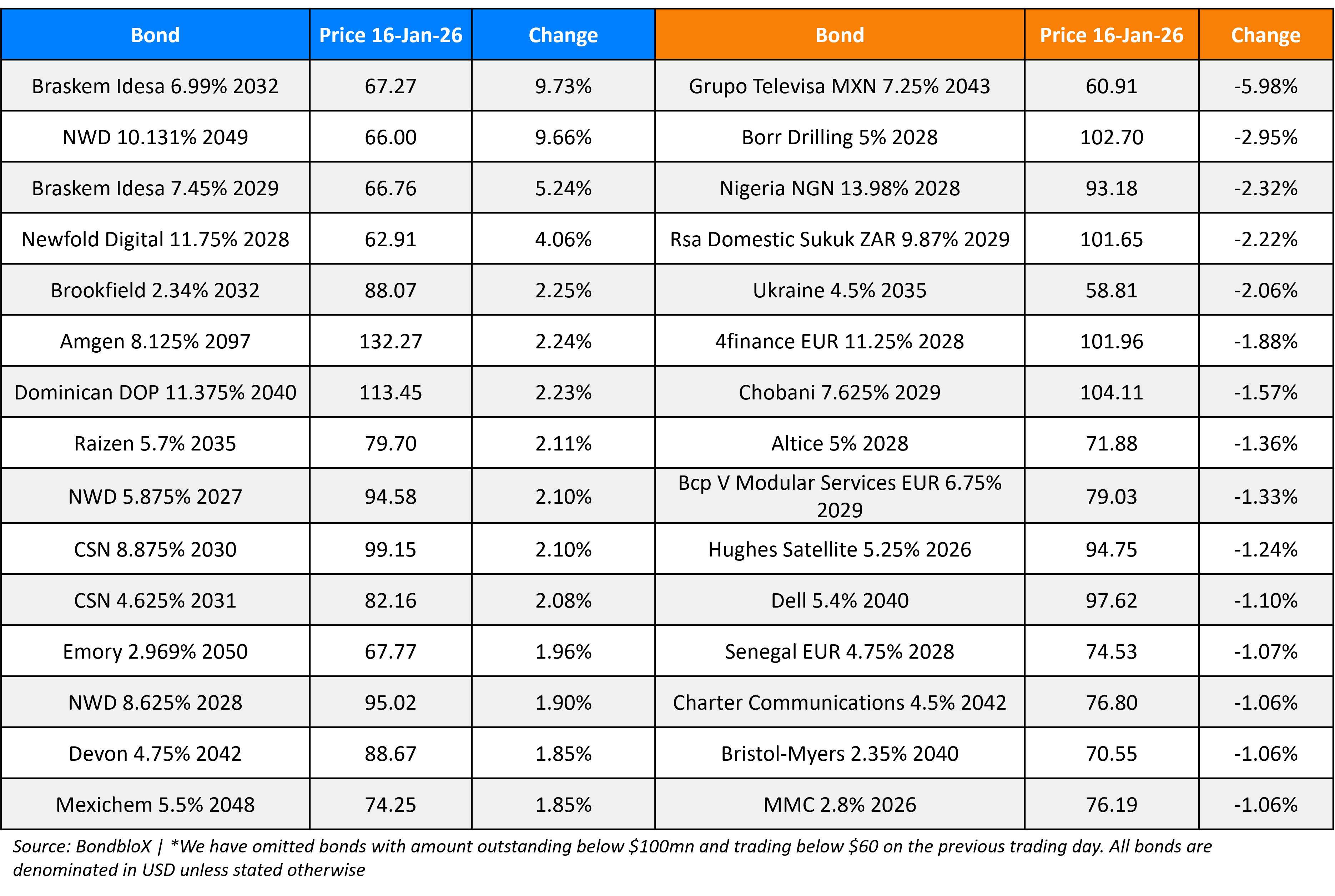

Top Gainers and Losers- 16-Jan-26*

Go back to Latest bond Market News

Related Posts: