This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

Goldman, Mashreq, Great Wall Price $ Bonds

April 16, 2025

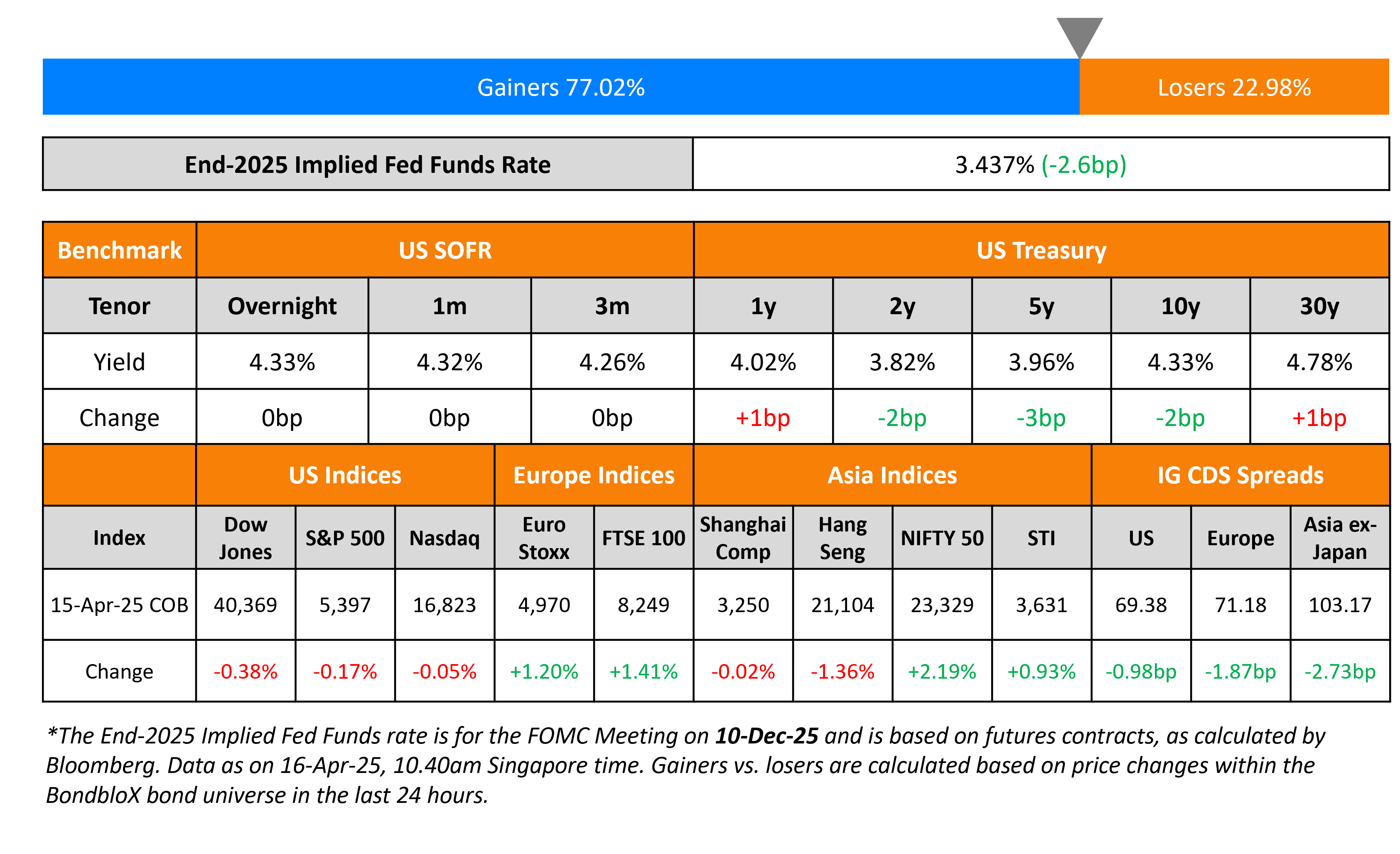

The US Treasury curve held stable on Tuesday after several volatile sessions. US Deputy Treasury Secretary Michael Faulkender’s noted that officials are discussing easing supplementary lending requirements to lower the costs of trading treasuries for banks.

Looking at US equity markets, the S&P and Nasdaq ended marginally lower, by 0.1-0.2%. Looking at credit markets, US IG and HY CDS spreads tightened by 1bp and 2.2bp respectively. European equity markets ended higher. The iTraxx Main and Crossover CDS spreads tightened by 1.9bp and 6.7bp respectively. Asian equity markets have opened in the red this morning. Asia ex-Japan CDS spreads were tighter by 2.7bp.

New Bond Issues

Wells Fargo raised $8bn via a four-trancher.

The senior unsecured notes are rated A1/BBB+/A+.

Colombia raised $3.8bn via a two-trancher. It raised $1.9bn via a 5Y bond at a yield of 7.5%, 37.5bp inside initial guidance of 7.875% area. It also raised $1.9bn via a 10Y bond at a yield of 8.75%, 25bp inside initial guidance of 9% area. The notes are rated Baa2/BB+/BB+. Proceeds will be used in part, for liability management transactions, which may include the purchase of all or a portion of its older bonds under its tender offer and/or for general budgetary purposes.

Goldman Sachs raised $6bn via a three-trancher. It raised:

- $2.5bn via a 3NC2 bond at a yield of 4.937%, 20bp inside initial guidance of T+130bp area.

- $500mn via a 3NC2 FRN at SOFR+129bp vs. initial guidance of SOFR equivalent area

- $3bn via a 6NC5 bond at a yield of 5.218%, 20bp inside initial guidance of T+145bp area.

The senior unsecured notes are rated A2/BBB+/A. Proceeds will be used for general corporate purposes.

China Great Wall raised $450mn via a 3Y bond at a yield of 5.297%, 50bp inside initial guidance of T+195bp area. The senior guaranteed note is rated BBB- by Fitch. Proceeds will be used to replace offshore debt due in April 2025.

Mashreq Bank raised $500mn via a 5Y sukuk at a yield of 5.035%, 35bp inside initial guidance of T+140bp area. The senior unsecured note is rated A by S&P.

Rating Changes

- Moody’s Ratings upgrades Damac’s rating to Ba1; outlook stable

- China Hongqiao Upgraded To ‘BB’ On Leverage And Liquidity Improvements; Outlook Stable

- Italian Utility Terna Ratings Raised To ‘A-‘ Following Sovereign Upgrade; Outlook Stable

- Moody’s Ratings downgrades Vestel to Caa1; outlook negative

- Fitch Downgrades New Fortress Energy’s IDR to ‘B-‘; Maintains Rating Watch Negative

- Conuma Resources Ltd. Downgraded To ‘SD’ Following Distressed Restructuring Transaction; Senior Notes Downgraded To ‘D’

- Moody’s Ratings changes Iliad’s outlook to positive and affirms all the ratings

Term of the Day: Portfolio Trading

Portfolio trading is a mechanism in which dealers move large baskets of bonds in a single trade often using ETFs, hence pricing and transacting an entire portfolio at one shot. The benefit of portfolio trading it to move large buckets of risk with ease by executing fewer, larger trades to reduce market impact, cost and reducing the time taken to execute on portfolios. As ICE notes, it is an “all or none” execution style.

Talking Heads

On Corporate-Bond Trading Costs Surging during Market Tumult – Torsten Slok, Apollo Global

“Liquidity in on-the-run bonds has improved, but off-the-run paper has become virtually untradeable and effectively a buy-and-hold investment”

On Portfolio Trading Holding Strong Amid Tariff Turmoil – Barclays

“We believe this resilience speaks of the maturation of the technology in the last five years… market participants increasingly rely on portfolio trading to manage large baskets during uncertain times and to enhance execution efficiency… ability to source liquidity on an all-or-none basis with a single dealer throughout the day is crucial, especially during volatile periods”

On Seeing More Room for Rally In India Bonds Amid Global Selloff – Aditya Bagree, Citi India

“Everything points toward Indian yields having room to come down further… expect some steepening in the curve because short-term yields can fall further with rate cuts and adequate system liquidity”

Top Gainers and Losers- 16-April-25*

Go back to Latest bond Market News

Related Posts: