This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

Ghana’s Bondholders Agree to Restructure 2026 Dollar Bond

January 9, 2026

Ghana and a group of bondholders have reached an agreement in principle to restructure a defaulted 2026 dollar bond. The restructuring terms were agreed after two years of negotiations between Ghana and an adhoc committee representing its bondholders. While creditors had previously rejected Ghana’s two prior proposals, the breakthrough came after the government shared the terms set by the official creditor committee. According to a statement made by the Government of Ghana, the deal will see holders of Saderea DAC’s (a special-purpose infrastructure funding vehicle) 12.5% bonds swap into sovereign bonds due in 2035 and 2037, receiving $986 and $330 respectively worth of the securities per $1,000 of Saderea’s principal. According to reports, a government spokesperson declined to comment on the agreement with the committee.

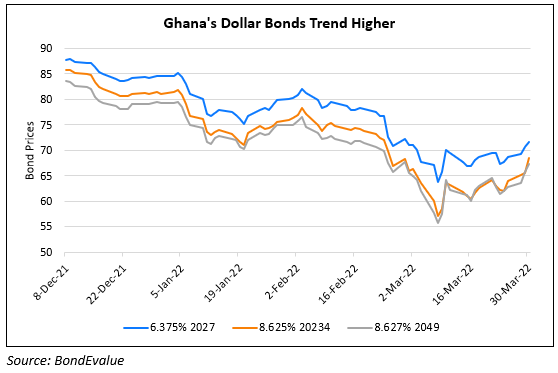

Ghana’s dollar bonds have traded 2 points lower this week with its 5% 2035s at 89.2, yielding 7.6%.

For more details, click here

Go back to Latest bond Market News

Related Posts:

Ghana Downgraded to B- by Fitch

January 17, 2022

Ghana Downgraded to Caa1 by Moody’s

February 7, 2022