This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

Fitch Upgrades Bolivia to CCC

January 19, 2026

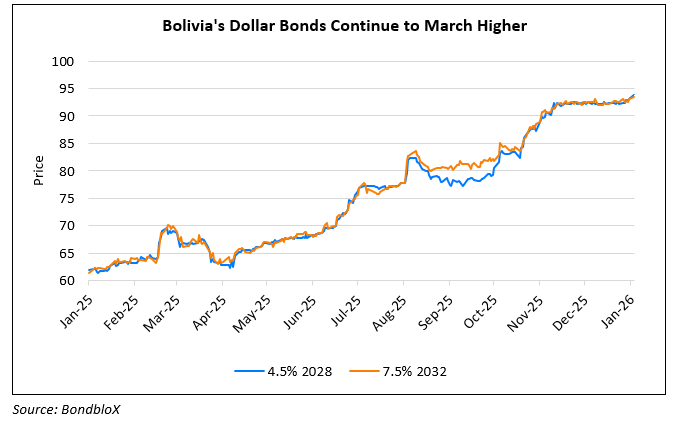

Bolivia was upgraded by a notch to CCC from CCC- by Fitch.The upgrade reflects reduced political constraints on external financing following the October 2025 election victory of Rodrigo Paz and a more reform-friendly Congress, enabling approval of new funding. International reserves have improved, with liquid reserves rising to $523mn as of 9 January 2026, supported by a loan disbursement, while total reserves including gold reached $3.8bn. Fitch highlighted bold economic reforms, notably the elimination of fuel subsidies, alongside plans for foreign exchange flexibility, trade liberalization, and investment incentives. These steps should help reduce the fiscal deficit, support reserve accumulation, and improve debt-servicing capacity, despite ongoing social tensions and protests. Bolivia’s low external commercial debt burden, manageable near-term maturities (including a $388mn eurobond payment in March 2026), and expected fresh external financing in 2026 also underpin the rating action. However, near-term risks remain high given narrow external liquidity and large deficits (estimated 12.6% of GDP in 2025). Bolivia’s dollar bonds rose by 0.4- 0.6 points across the curve, continuing their uptrend since last year where they gained by almost 50%.

Go back to Latest bond Market News

Related Posts:

Credit rating boost for Ireland & Portugal: EU inches towards recovery

September 20, 2017

China Refutes S&P Downgrade Action

September 26, 2017

Mongolia’s Credit Ratings Upgraded to B3 by Moody’s

January 19, 2018