This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

Fed’s Williams, Hammack Indicate No Rush for Further Rate Cuts

December 22, 2025

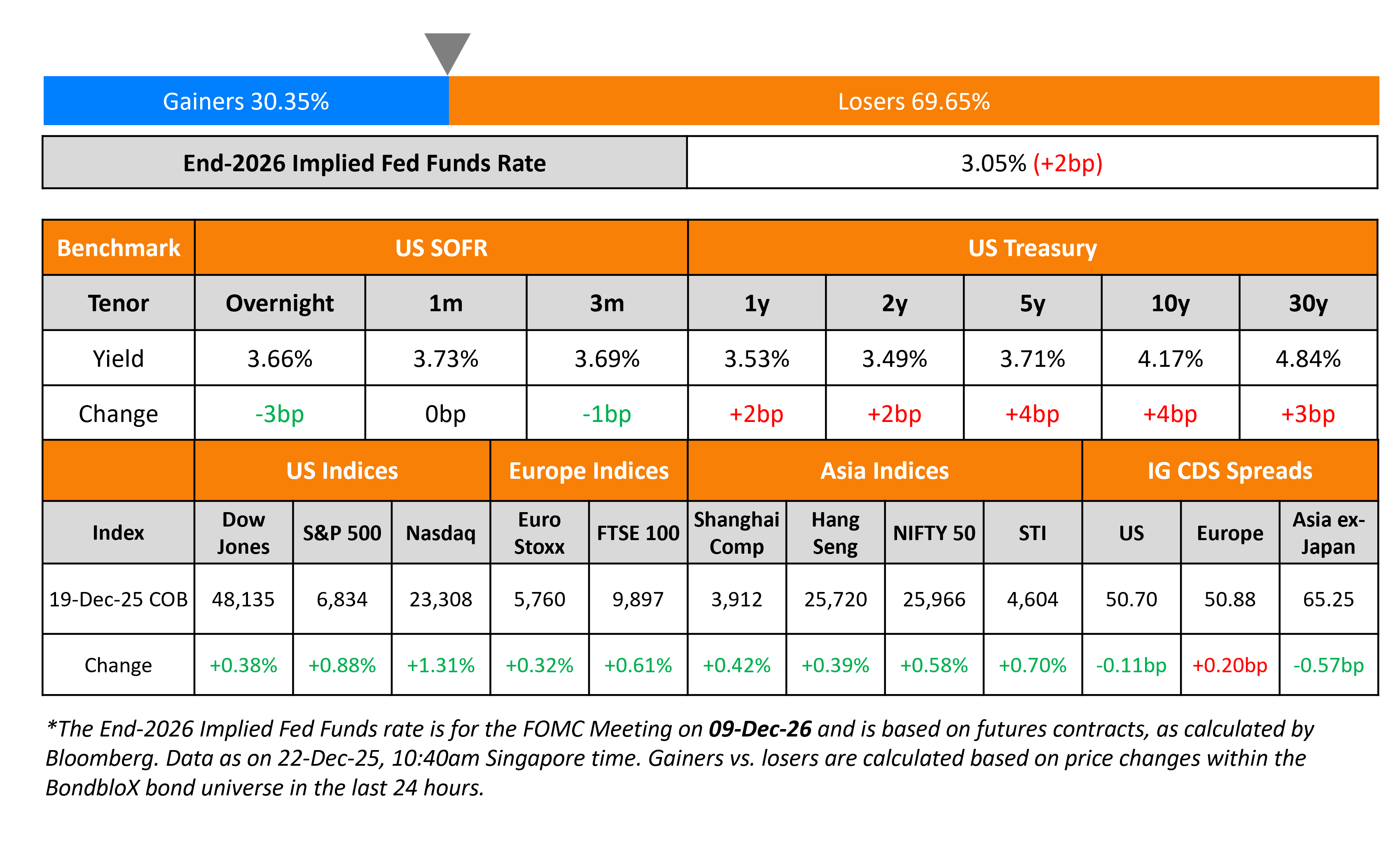

US Treasury yields rose by 2-4bp on Friday. While there were no major macro datapoints, New York Fed President John Williams and Cleveland Fed’s Beth Hammack indicated that there was no urgency for further rate cuts. Williams added that he wanted “to see inflation come down to 2% without doing undue harm to the labor market”. Hammack said that she saw no need to change rates for months ahead, adding that she was more worried about elevated inflation than the potential labor-market fragility.

Looking at US equity markets, the S&P and Nasdaq ended 0.9% and 1.3% higher respectively. US IG CDS spreads tightened by 0.1bp while HY CDS spreads tightened by 0.6bp. European equity indices ended higher too. The iTraxx Main CDS spreads widened by 0.2bp while the Crossover CDS spreads were 0.1bp wider. Asian equity markets have opened higher this morning. Asia ex-Japan CDS spreads tightened 0.6bp.

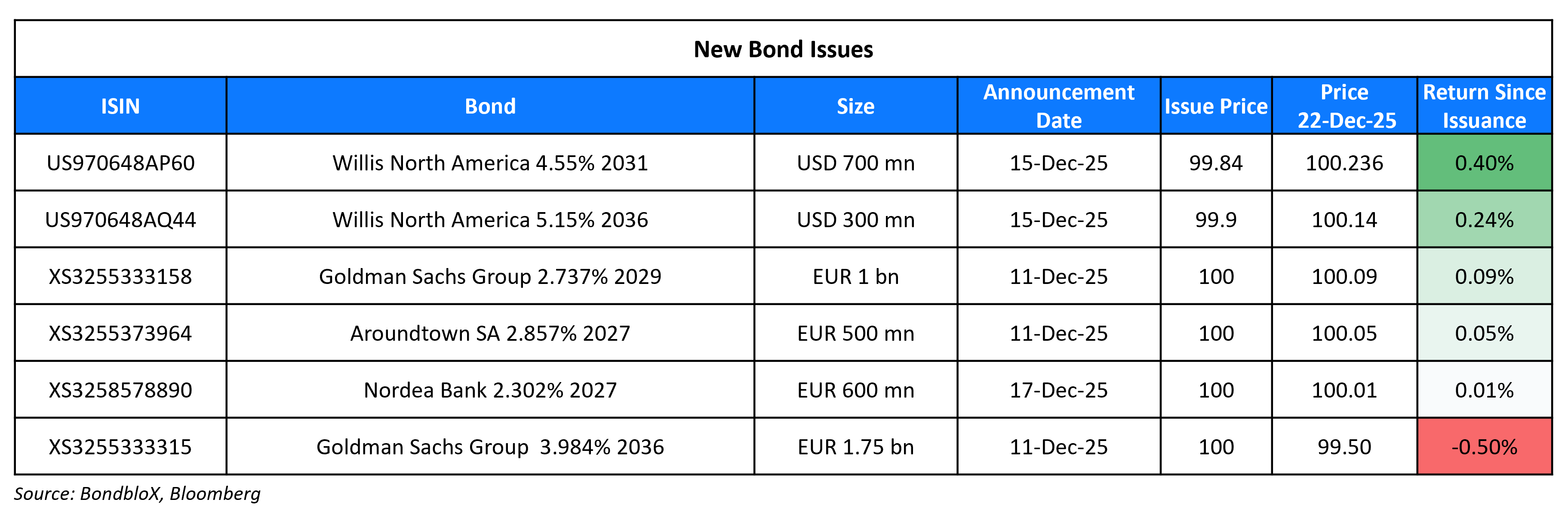

New Bond Issues

Rating Changes

- Fitch Upgrades Etihad Airways to ‘AA-‘; Outlook Stable

- Fitch Upgrades Banco BTG Pactual Chile’s SSR to ‘bb’; Affirms IDRs at ‘BBB’; Outlook Stable

- Fitch Upgrades Ero Copper’s Ratings to ‘B+’; Outlook Stable

- Moody’s Ratings upgrades Jamaica’s rating to Ba3 from B1; changes outlook to stable from positive

- Fitch Downgrades WE Soda to ‘B+’; Outlook Negative

- Fitch Downgrades Baytex ‘s Rating to ‘B+’ After Sale of U.S. Assets; Outlook Stable

- Moody’s Ratings downgrades Adler Pelzer to B3 from B2, outlook stable

- Fitch Downgrades Gabon’s LTFC IDR to ‘CCC-‘ and LTLC IDR to ‘CC’

- Fitch Revises Vedanta Resources’ Outlook to Positive; Affirms IDR at ‘B+’

- Latam Airlines Group S.A. Outlook Revised To Positive On Expected Stronger Credit Metrics; ‘BB’ Rating Affirmed

Term of the Day: Acceleration Notice

An acceleration notice is a bond clause which allows lenders to demand a borrower to immediately repay a bond if specific requirements are not met. Thus, the borrower must immediately pay unpaid principal and accumulated interest prior to the invocation of the notice. These notices are generally given when a borrower materially breaches the loan/debt agreement.

Talking Heads

On EM Bringing High Hopes for 2026 After Stellar Year

Sammy Suzuki, AllianceBernstein

“2025 was an inflection point. The question a year ago was whether emerging markets were even investable, but that’s no longer a query we receive.”

Bob Michele, JPMorgan Asset Management

“One of our best ideas is still to hang with local emerging-market debt… should get a little price appreciation, we should collect carry, and we think EM FX has a little bit more upside”

Evaluating inflation on a YoY basis is off base and it’s better to look at price pressures on a three-month moving average… instead of price pressures outstripping the Fed’s 2% target by a lot, they’re actually below target… “John (Williams) is a serious guy. He understands there’s technical difficulties in the numbers”

On ECB Needing Full Optionality – ECB Governing Council member Martins Kazaks

“Given high uncertainty, given that risks are on both sides, I think it’s still very appropriate to use the modus operandi that we have been using already for some time, which is data-dependent… with full optionality… it is counter-productive to give forward guidance in terms of the direction of the rate”

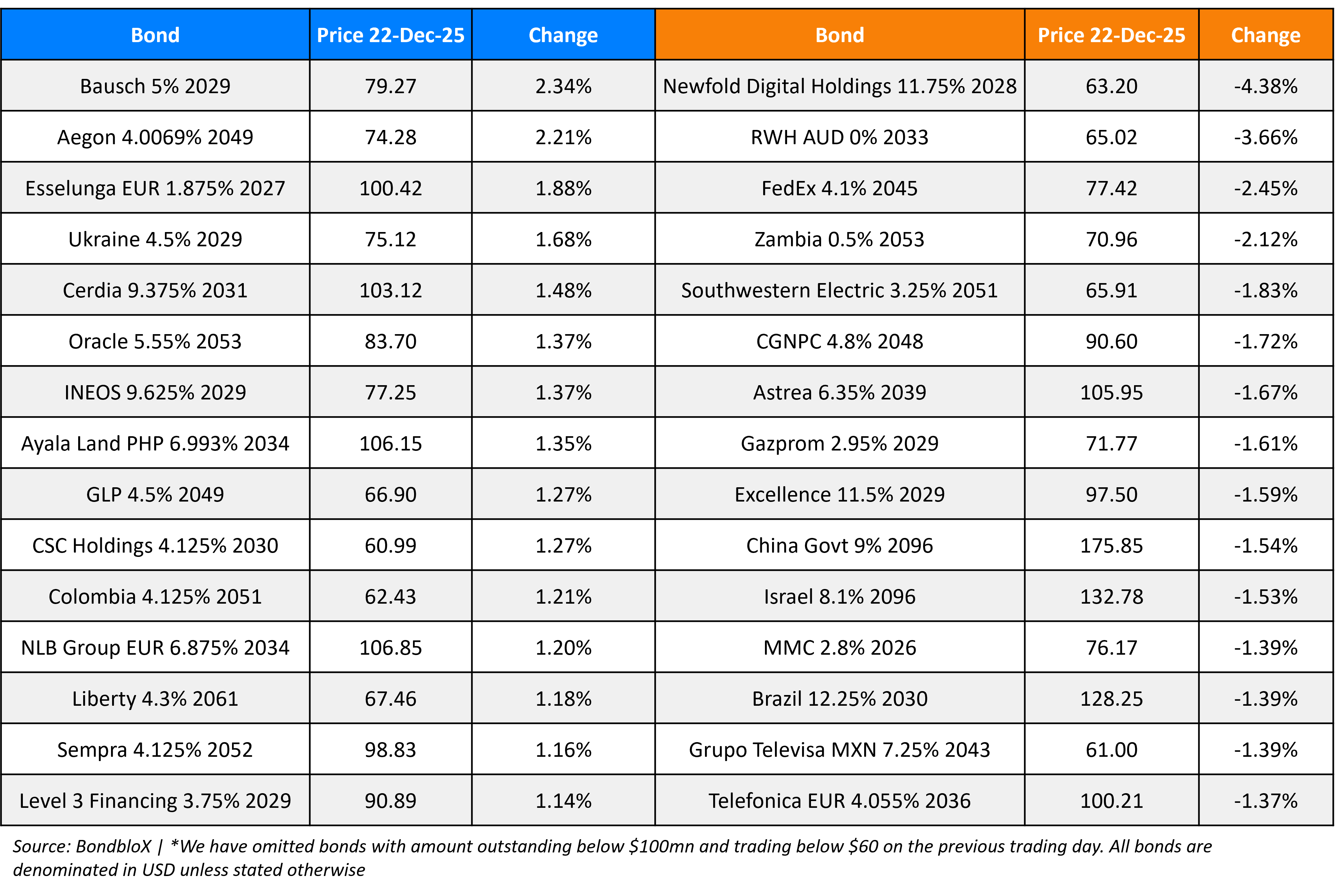

Top Gainers and Losers- 22-Dec-25*

Go back to Latest bond Market News

Related Posts: