This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

Fed’s Hammack Keeps Option Open for June Rate Cut

April 25, 2025

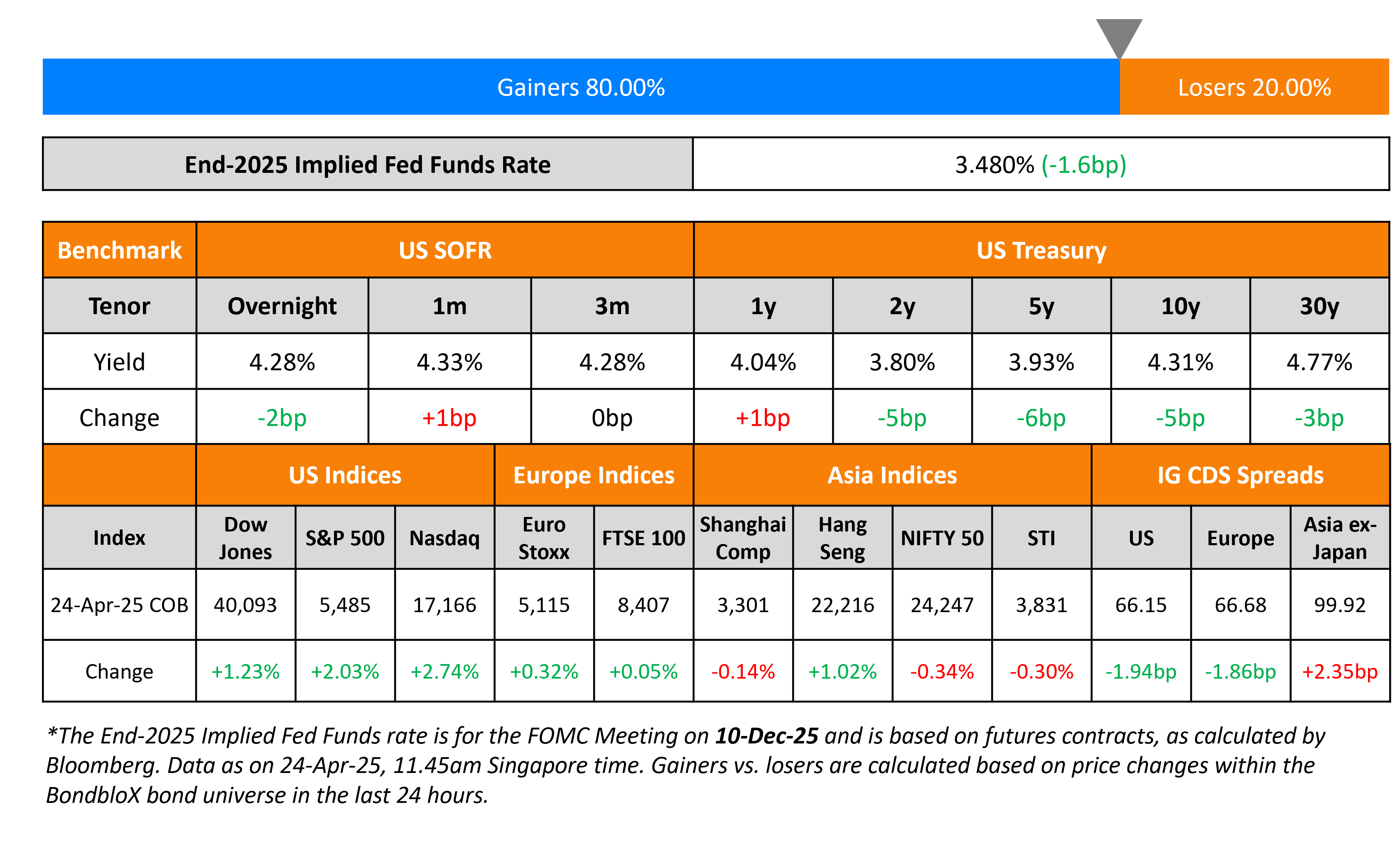

US Treasury yields fell across the curve by 5-6bp after Cleveland Fed President Beth Hammack kept the option open for a potential June rate cute. She noted that the Fed could take the action in June if there is “clear and convincing data” assisting policymakers in knowing the right move. Separately, preliminary Durable Goods Orders for March in the US rose sharply by 9.2% vs. expectations of 2%, due to a one-off spike in transportation orders led by aircraft bookings. For instance, Boeing said that it had received 192 aircraft orders in March, significantly higher than the 13 orders seen in February. Core Durable Goods Orders (ex-transportation) came-in at 0%, softer than expectations of 0.3%.

The S&P and Nasdaq extended their rally, up by 2% and 2.7% respectively. Looking at credit markets, US IG and HY CDS spreads tightened by 1.9bp and 10.5bp respectively. European equity markets ended higher. The iTraxx Main spreads were 1.9bp tighter while Crossover CDS spreads tightened 7.2bp. Asian equity markets have opened broadly higher this morning. Asia ex-Japan CDS spreads were wider by 2.4bp.

New Bond Issues

Rating Changes

-

Moody’s Ratings upgrades Odea Bank A.S.’s long-term deposit ratings to B1 from B3; outlook remains positive

-

Zoetis Inc. Upgraded To ‘BBB+’ On Strengthening Business Position; Outlook Stable

-

Kronos Worldwide Inc. Ratings Raised To ‘B’ On Improved Performance And Credit Metrics; Outlook Stable

-

Moody’s Ratings affirms Eldorado Gold’s B1 CFR; outlook changed to positive

-

Fitch Revises JetBlue’s Outlook to Negative; Affirms IDR and EETC ratings

Term of the Day: Danish Compromise

Danish Compromise is a regulatory provision in the European Union’s Capital Requirements Regulation (CRR), used to reduce the burden for banks of owning an insurer. Here, banks are allowed to hold capital against insurance holdings on a risk-weighted basis, instead of deducting them in full from their capital. The idea here is that the insurance sector’s tight regulation requirements remove the need for a full capital deduction. The European Banking Authority in 2023 issued a regulatory clarification on acquisitions that banks make through their insurance business – they allowed goodwill booked on the purchase to be risk-weighted rather than deducted from capital. This is because, during the purchase of asset management companies, a large goodwill arises from the valuation of the client base, which makes it expensive for banks, as per EY.

Talking Heads

On ‘Tremendous’ Opportunity in Treasuries on Fed Cuts – JPMorgan

“US rates are priced to be above 3%, above their neutral rate – over the next few years and that’s where I think there’s tremendous opportunity… We are looking at less bad news, less uncertainty coming in the near-term… growth and inflation – That’s really what is going to determine what happens next”

On Best Over for US Stocks, Expect to See More Losses – Christopher Wood, Jefferies

“The dollar has begun a long-term weakening trend, and that’s going to reduce the US stock market capitalization as percentage of the world… It’s not just a question of the US going down. It’s a question of Europe, China and India going up… It’s not just a question of the US going down. It’s a question of Europe, China and India going up”

On Seeing Credit Market Risks Rising as Trade War Rages on – BlackRock

“We’re likely to see spreads widen from here as we see further deterioration in risk assets and in overall credit quality… don’t think you’ll see a massive uptick in defaults… Value in our opinion is a bit more attractive in high-yield bonds or leveraged loans “

Top Gainers and Losers- 25-April-25*

Go back to Latest bond Market News

Related Posts: